Short Straddle Options Strategy. How to Sell Stock Options?

Contents

- Why to sell put and call options? Introduction to short straddle.

- The nature of straddle write

- Short straddle adjustment

- Conclusions on selling straddle performance

Why to Sell Put and Call Options? Introduction to Short Straddle

In this article we will discuss the options strategy called straddle write or short straddle. This strategy is gaining popularity as many option traders realize what potential lies behind selling options contracts.

Straddle write is an options strategy designed for those who simultaneously sell put and call options. Its short name is fully identical to its long counterpart.

By selling them at the same strike price, their writer sells (or writes) a straddle, thereby forming a short straddle. If we sell calls and puts that have different strike prices, we form a short strangle.

Let us consider selling a straddle in more detail. When running the strategy, the seller does not want prices to move anywhere as opposed to the buyer of this strategy. The best friends of the strategy are decreasing volatility and time. Actually, if we assume that on the opposite side of the straddle seller there are holders that buy not particular option contracts, but the strategy as a whole, then this would be an ordinary market battle.

But unlike the stand-off between bulls and bears in the futures or stock market, the struggle here is not that one party looks up and the other down, but that buyers expect a strong price impulse in any direction, and sellers do not, or they hope to see the market in a certain price range, that is often called a sideways trend, or simply a flat.

The Nature of Straddle Write

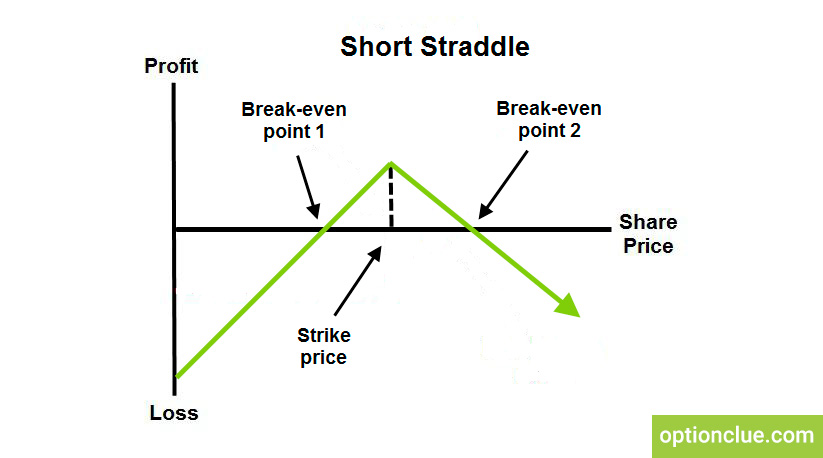

At-the-money (ATM) options, for your information, create the straddle. Below you can see its profit/loss curve.

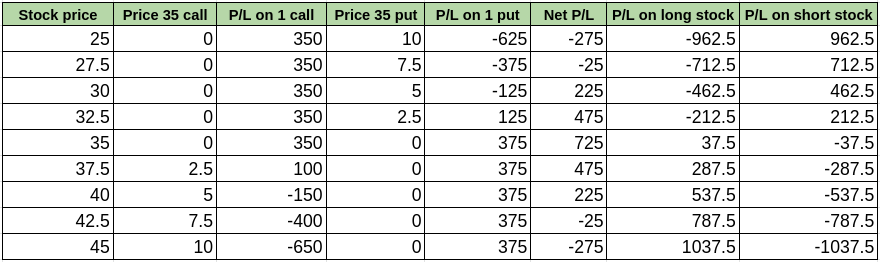

Let us take an example. Let us say we want XYZ stock price to remain in a narrow price range for some time. To make some money we start to run the short straddle made up of writing a put option for $3.75 and a call option for $3.50. Their strike prices are $35. Options will expire in 133 days.

The table below demonstrates the possible outcomes of this strategy at expiration. The last two columns show gains and losses if you are long/short on 100 stocks.

Selling a straddle is a fairly aggressive strategy, as it is clear that one should nip in the bud the idea of holding options before we get the exercise notifications. This means a seller should focus on an early exit from the strategy, by closing in advance positions of at least one of two option types used in the trade.

Naturally, we should get rid of ITM options (puts or calls). It is clear that all this in the future will not result in a very rosy picture. However, sometimes this strategy can be very profitable, especially when high volatility is prevailing in the market.

A short straddle implies a limited profit and sufficient losses which can become unlimited. The right time to form it is when volatility is at high levels, and when we have reason to believe it is likely to decrease very shortly. Long-term fluctuations in a narrow price range can make an option writer happy.

The maximum profit here equals the net premium (put premium + call premium). It can be reached at expiration provided these options expire worthless and the stock price closes at the strike price level.

Breakeven points at expiration are calculated as the straddle strike price ± (put premium + call premium).

In this regard, it is easy to understand what criteria one should follow when choosing to use a strategy. They are here directly related to the expectation of the stock price move.

Short Straddle Adjustment

Those who use this strategy sometimes combine it with buying or selling the underlying. But they forget that any of these configurations can be represented differently. For instance, in the case of a long stock and a short straddle, it can be decomposed into a covered call and a naked put strategy. Thus, a covered call is equivalent to an uncovered put.

One wonders whether it would be better to sell 2 uncovered puts. The argument for this way of running this strategy (adding a short or long position on the underlying asset to a straddle) is largely based on the need to determine the appropriate risk management method. It is important since risk inevitably arises when selling options. The issue is more complex because if one is strictly focused on the expiration date of the options contracts, then one of them must be exercised. Actually, this view captures the core of the problem not quite accurately, which will be discussed below.

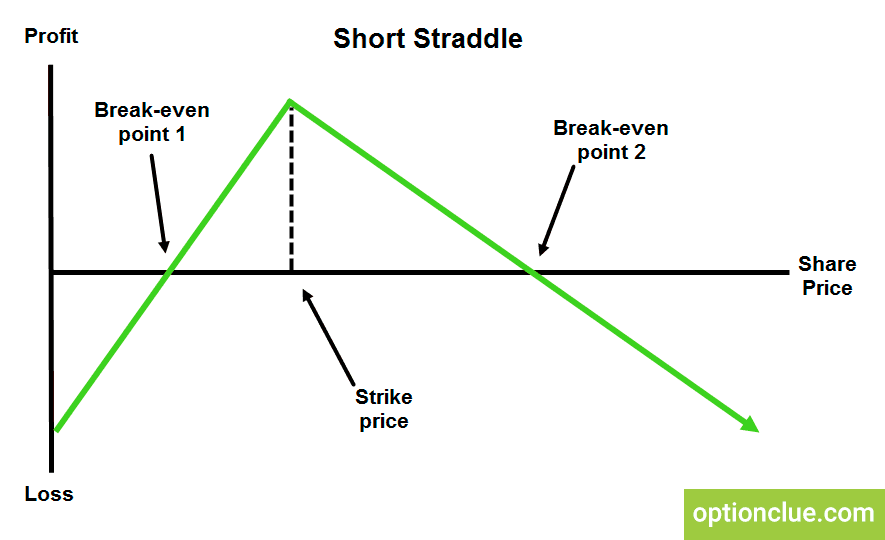

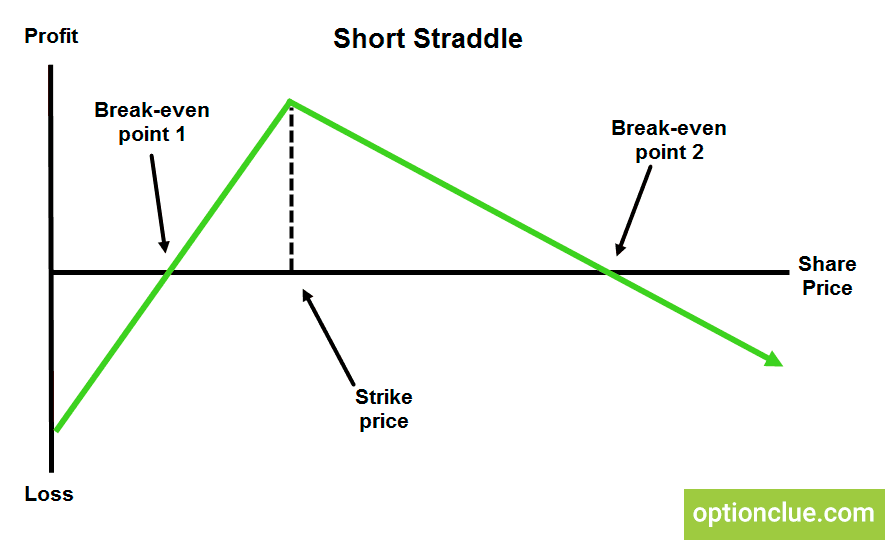

As you can see the short straddle curve is not symmetric. This suggests that it might be more promising to use an unequal number of put and call options sold. This idea can be justified if, for example, the market is assumed to be in a price range, and at the same time it tends to slightly go up. The strategy that consists of 2 short puts and 1 short call is somewhat different from the standard short straddle that can be shown on the image below.

It can be assumed that a strategy formed by a different number of options of one type will be somewhat skewed. It all depends on the market sentiment expectations, which can be realized using different ratios between the sold call and put options. For example, if you write three put options and one call option with the strike prices of $35, you get a strategy that is even more bullish than it is shown in the figure above.

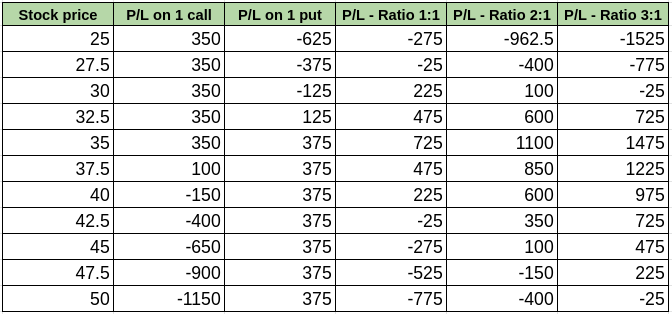

The table below simultaneously shows all three options of ratios between the short put and the short call options – 1:1, 2:1, and 3:1, so that it is easy to see the prospects of the alternatives according to the expectations of the emerging market movements.

In our example, we sell the 133 call for $3.5 and 133 put option for $3.75. Our stock is traded at $34.625, and our strikes are $35.

Obviously, the more put options are sold, the more profit is on the upside and the more risk on the downside. A straddle formed by additional short calls will act similarly. This strategy will become increasingly bearish as the number of short calls increases. To objectively assess the strategy, it is enough to know the delta of the options construction.

Conclusions on Selling Straddle Performance

Let us summarize all above mentioned. The prospect of using this promising strategy largely depends on the current market sentiment, its volatility, options premiums as well as a trader’s accuracy of building support and resistance levels, and the chance to see the price in a given price range until expiration.

That is, selling a straddle is fairly good to benefit from market movements that are limited by a price range. Since the market is in this state more than half of the time, it is clear how profitable this strategy can be. Its additional advantage is that the margin requirements are determined by one of the legs.

Moreover, another leg continues to make a profit and it can be reached without the need to deposit funds to operate with margin.

Since this strategy can lead to big losses when the price is rapidly moving, it is not recommended for beginners. However, a short straddle, along with other strategies based on selling options, such as selling cash-secured puts (CSP), covered calls (CC), or the options wheel, are currently very popular. The main thing is to figure out the features of these option strategies and know how to manage them if needed.