How to Sell a Put Option? Difference in Selling Naked and Covered Puts.

What is the difference between selling a naked put and selling a covered put?

Selling a certain put option, also called “selling a naked put”, is completely different from selling a covered put in terms of strategic perspective, capital and margin requirements, and equity of the trading account. In other words, even though both option strategies involve selling put options, they are actually completely different in nature, composition and requirements.

Short put is also a neutral to bullish position when maximum profit is going to be your credit received while maximum loss is going to be undefined and realized when the underlying asset goes to zero. The breakeven point is short strike minus the credit received. When the underlying goes up that helps our position, when the underlying goes down that is not good for our position. From the implied volatility perspective, when IV goes up that is not good for our position, when it goes down, that is good for our position.

Contents

- Margin

- Requirements for a trading account

- Main Differences between Selling Naked and Covered Puts

- Conclusions on Selling a Covered Put and a Naked Put

Margin

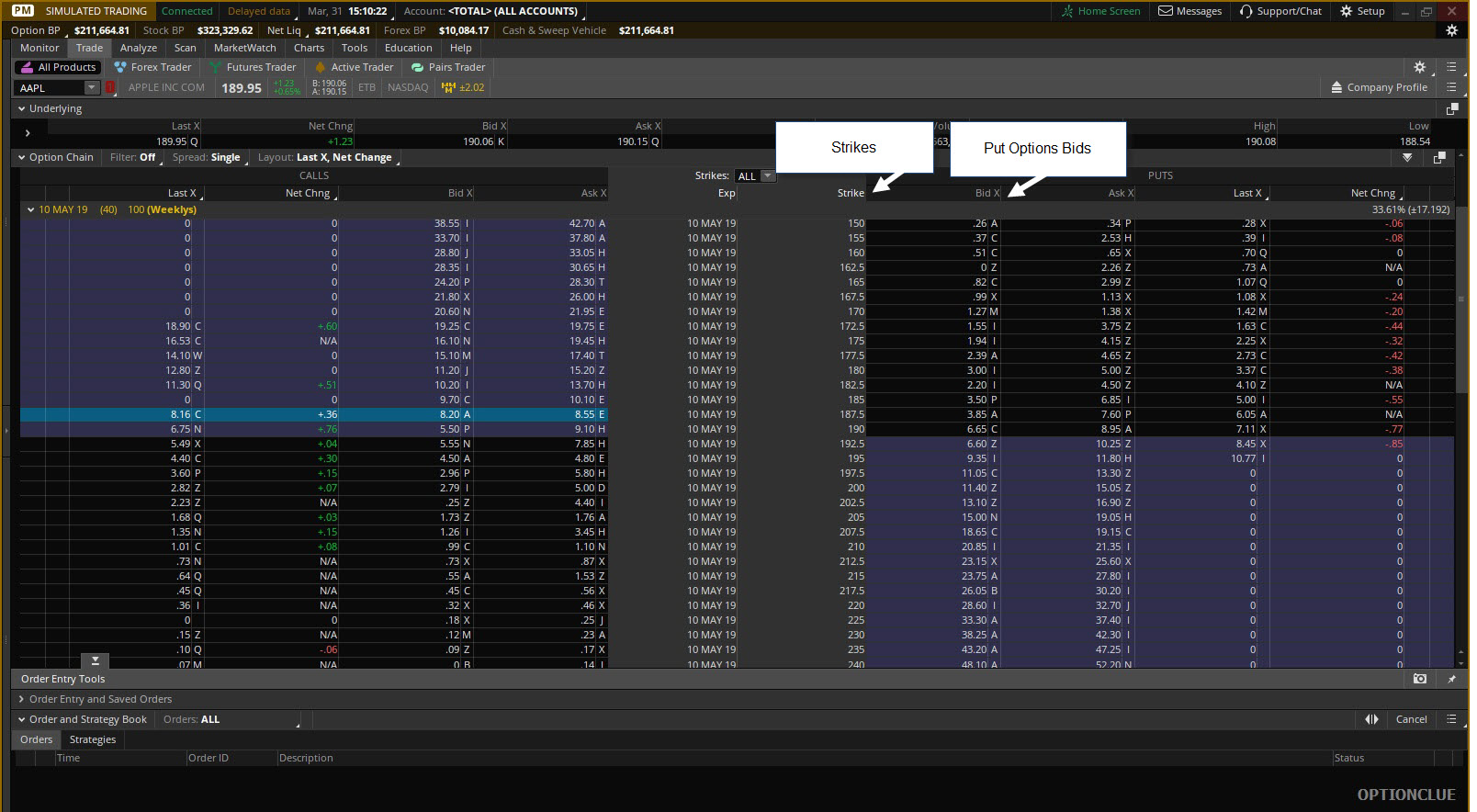

Basically, a naked put option is created by simply selling (writing) a put option using a specific «sell to open» order.

A covered put option involves selling a put option on existing short positions in the stock so that your short position in the put option is “covered” if the option is assigned (when the buyer of your put options decides to exercise these options).

Since selling a naked put is provided without any assets covering it, option brokers require the so-called “cash collateral”, that is, cash available in your trading account. It is usually a percentage of the amount required to buy the underlying stocks if the option is exercised.

However, this collateral is not required when selling a covered put option, as a short position in the underlying stocks “covers” the short put. However, even though no cash collateral is required to sell the covered put, there are margin requirements to maintain a short position in the stock.

Let us take some examples to sort this out. Suppose, AAPL is trading at $374.94 and the December 370$ put costs $11.20.

An example of selling a naked put

You sold one December 370 put option at $11.20.

Required margin is $8,124.80 (according to the margin requirements of optionsxpress broker).

Money earned from selling put options is $1,120.

The amount required to sell a naked put is $ 7,004.80 ($8,124.80 – $1,120).

So, this is when we typically have larger positions, when we are trading on margin, having some leverage, under those kinds of things we do not want to be assigned, I always give a bare minimum, I think that a good minimum is to be able to sell 3 puts. It does not mean that you would ever sell 3 if you could. I would never sell all 3 at once, I would probably sell only 1, but by picking something that you can sell at least three, will give you room down the road to scale in if the position goes against you.

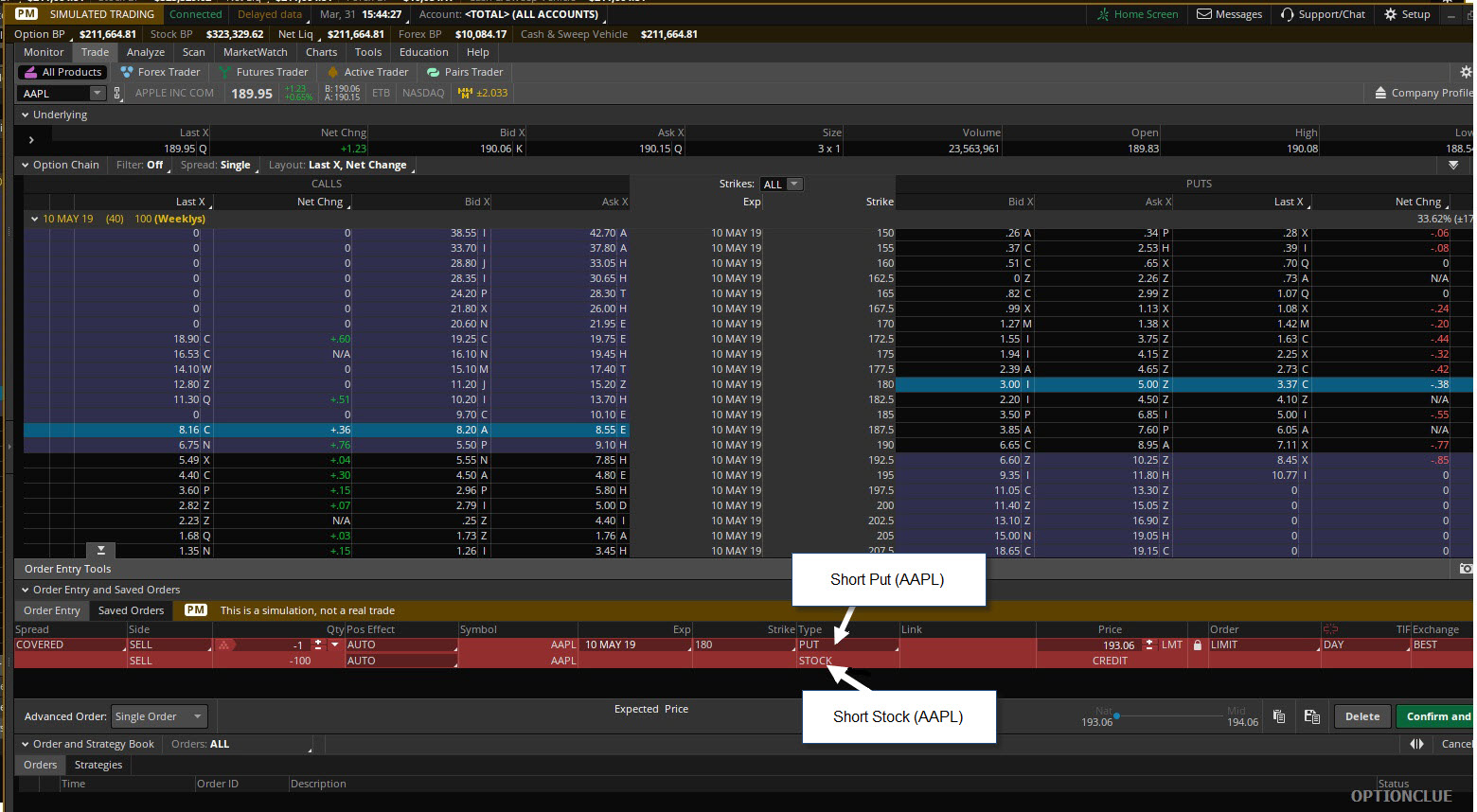

Example of Selling a Covered Put

Suppose, you sold 100 AAPL shares (you opened a short position) and then sold 1 December 370 put on these shares at $11.20.

Margin for shorting 100 AAPL stocks, trading at $ 374.94 per share, is $37,484.05 (as required by optionsxpress).

Money made from selling the put option is $1,120.

The total amount of funds required to sell the covered put is $ 36,364.05 ($ 37,484.05 – $ 1,120).

Requirements for a Trading Account

In addition to differences in nature and margin, selling a naked put and a covered put also requires different “trading levels”. A trading level is about limiting the types of option strategies available to you, that a broker imposes according to your experience and risk assessment of your trading account. Generally, a level 5 is required to sell naked puts, due to the higher risk of default, while selling a covered put usually requires only a Level 2 account, as there is no default risk in case an option is exercised.

In our example, let us say that by the expiration in December, AAPL stock price has fallen to $110.

Risk of selling a naked put

Suppose you sold one December 370 put option at $11.20.

You got losses in the amount of $ 26,000 : ($370 – $110) x 100.

In this case, you may not have enough money to cover that loss, and this may result in the risk of non-payment for a broker.

Risk of selling a covered put

Suppose, you sold 100 AAPL shares and then wrote 1 December 370 put on these shares at $11.20.

If the option is exercised, the put option buyer will simply take your 100 AAPL shares short position, so there is no risk of default.

So, I would like to add some points for the naked put position management. If it goes against you can always reevaluate, typically not going to exit the market, but strive to roll your position (the best time for it is when the stock price equals our short strike). This will enable you to make extra credit and wait for favorable developments in the market. If you pick a product that you trust, you believe the companies are strong in the medium and long term (either S&p 500 company or index ETFs) you will finally succeed in this process.

Main Differences between Selling Naked and Covered Puts

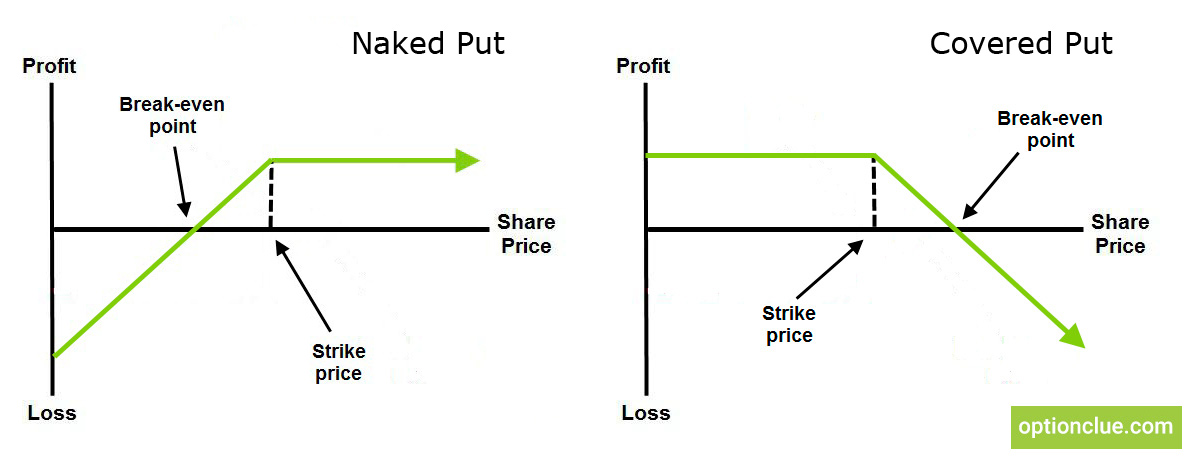

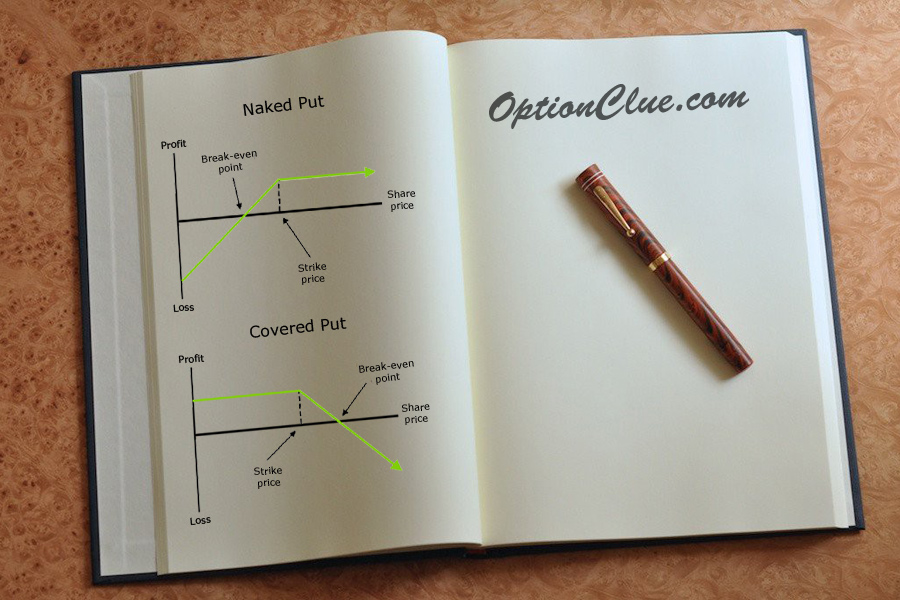

Finally, selling a covered put and selling a naked put are option strategies with completely different perspectives. Actually, selling a naked put is a bullish option strategy, while selling a covered put is a bearish option strategy.

Anyway we need to be very mindful of binary events, things that can drastically influence the price of an option:

- Earnings reports

- Different kind of announcements for different companies

As you can see from the graph above, selling a covered put is a bearish option strategy that gives limited profits when the stock price decreases and unlimited losses when the stock price goes up. Selling a naked put is a bullish option strategy, with limited profit potential when the stock price rises and the risk of unlimited losses when the stock price declines.

Note that selling a naked put and selling a covered put strategies make profits in the opposite directions. Thus, both strategies are completely different and cannot be used as an alternative.

The big difference between these strategies lies in shorting the stock, in the case of selling a covered put. When selling a naked put, until the price of the underlying asset (for example, a stock) is above the strike price of the put option, the option writer receives the entire premium as a profit, no matter how high the stock price rises. That provides limited profit at the top when selling a naked put.

In this example, until the AAPL price remains above the strike price ($370) of the put option, you will keep the entire premium of $11.20 as your profit, no matter how high the AAPL price is at expiration. In this situation profit cannot be higher than $ 11.20 per share ($ 1,120 per 100 shares) as you sold the put options at that price.

However, if the stock price falls, then the price of put options sold will rise as the stock price falls, resulting in unlimited losses since you will have to buy back put options at a higher price than you sold them.

As you can see from the second example, the more the AAPL stock price declines, the higher the price of December 370 put and the higher your losses, since you will now have to buy back the put options at a new higher price in order to close the option position.

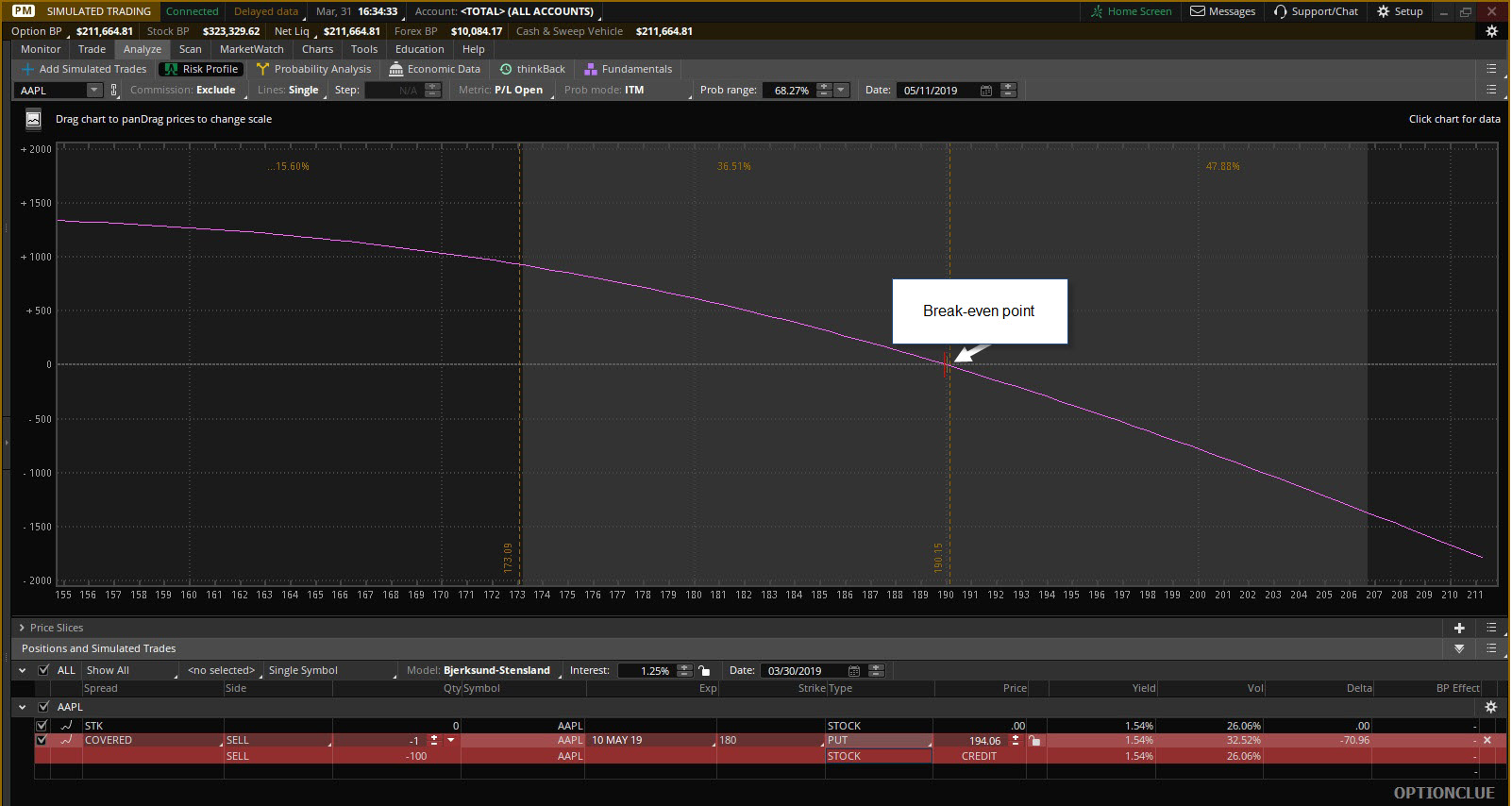

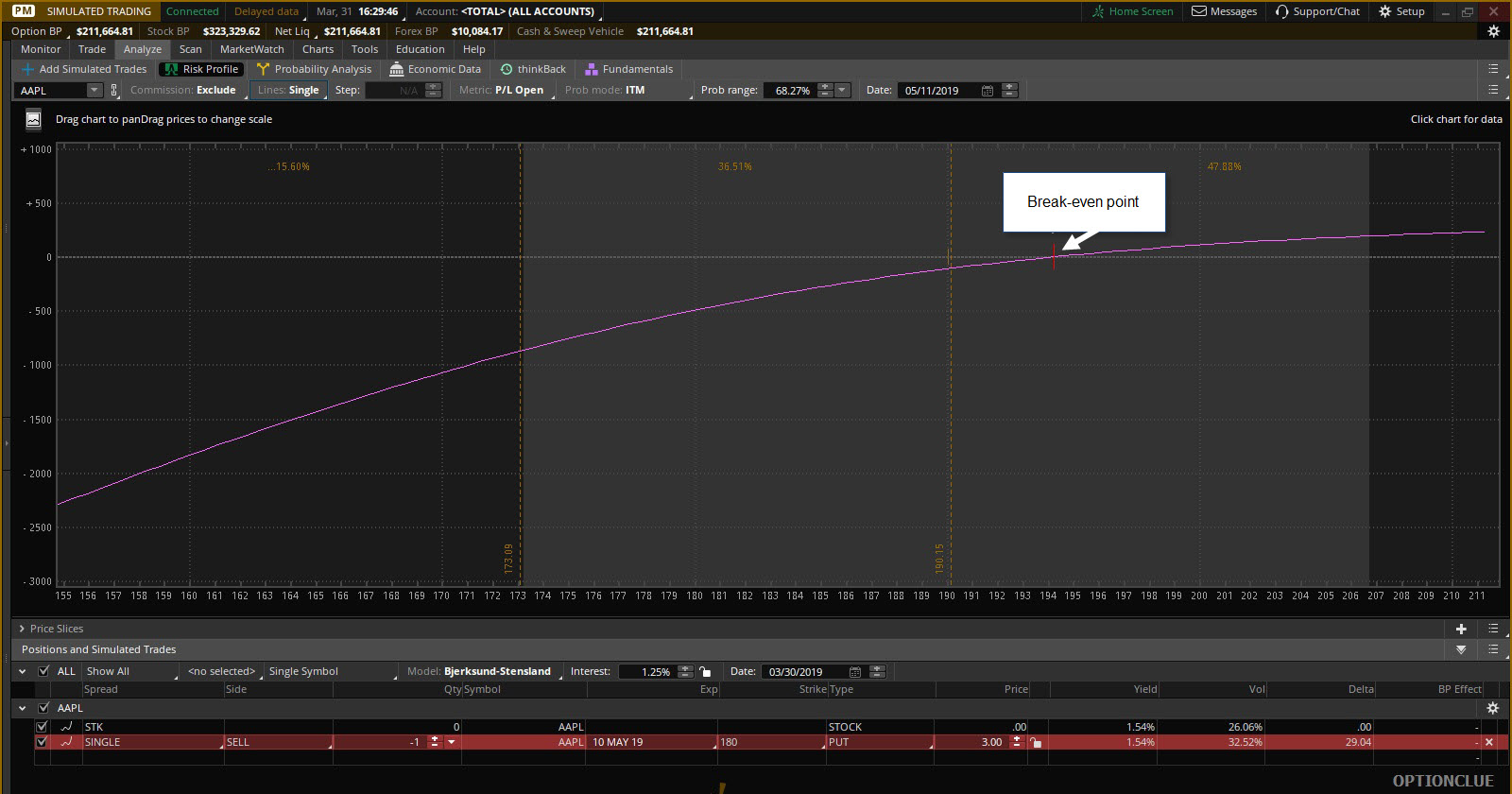

Figure 4. Change in P/L of a short position on a naked put option (AAPL) depending on the stock price

However, when you add a short stock position to the short uncovered put, resulting in a covered put, a decline in the stock price will lead to gains on the short position, offsetting the losses on the put options.

Actually, a short stock position would profit by the stock price decreasing to the strike price of the put options, that is, even before the subsequent decline results in an increase in the price of put options, fully offsetting the losses on the put options sold. This provides a net limited profit when selling a covered put (and not a loss) when the stock price goes down.

In our example, when AAPL price declines to $ 110, the short stock position will generate a profit of $ 264 per share ($ 374.94 – $ 110), while after selling the put option, the loss will be $ 260 per share ($ 370 – 110 $). This will provide a net profit of $ 16.14 per share ($ 264.94 – $ 260 + $ 11.20), instead of a loss in case just selling put options, without a short stock position.

However, if the stock price rises, then selling a covered put would have unlimited risks due to the short position in the stocks, this risk is not offset by anything.

In this example, if the AAPL price rises to $ 400 by the expiration of the covered put option, the short stock position would generate a loss of $ 25.06 per share ($ 400 – $ 374.94), while selling the put option would profit only $ 11.20 per share, no matter how high the AAPL price rises. This would end up with a net loss of $ 13.86 per share ($ 25.06 – $ 11.20), instead of a $ 11.20 profit (in case of selling the put option, without a short position in the stock).

Now you see that adding a short stock position to selling an uncovered put completely changes the reward / risk ratio of the option position. Actually, selling out-of-the-money put options is an individual high-risk option strategy, while selling a covered put is used primarily as a hedging strategy for a short stock position.

Conclusions on Selling a Covered Put and a Naked Put

So, let us summarize. Even though selling both uncovered and covered puts is based on selling (writing) put options, they are completely different in terms of strategy, composition and trading account requirements. Also, they should not be considered as alternatives to each other, since both option strategies have completely different goals.

Cash secured put as part of our management strategy implies to allow assignment. Unlike the cash secured put, when selling a naked put we do not want to be assigned, that is not the case here.