Risk management methods

On this page you can find articles on risk and money management. Any trading strategy that can benefit much in the long-term cannot do without following risk and money management rules. To become a successful trader one should include these points in the trading plan.

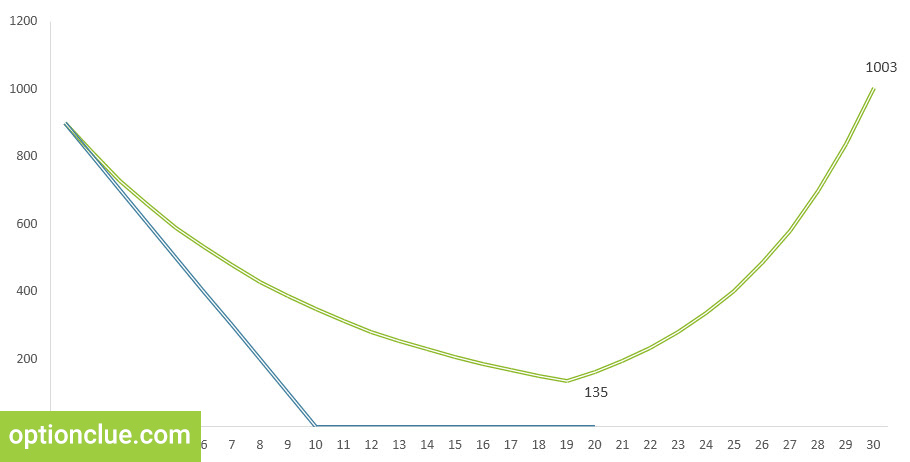

There’s no trading without drawdowns, but applying risk management rules aims to reduce temporary drawdowns and increase the stability of a trading account and finally results in substantial reward in the long term.

Risk management implies identifying market exit points and you can determine if the trade is qualitative in terms of risk and profit potential. Advantages of risk and money management applications are evident when it comes to hundreds of trades that is in the long-term.

After reading these articles you’ll find out the difference between fixed risk per trade and dynamic risk per trade and we will discuss what risk-reward ratio is needed for profitable trade statistics even after several losing trades.

Sometimes there are situations when you see a clear trading signal but risk and money management rules don’t allow to open a position. Many traders have some doubts about what to do in this case. The use of options as an alternative to trading with a stop loss provides an opportunity to trade. And you’ll find this information on this page.

Principles of setting targets when entering the market along with position sizing and risk and money management methods provide the basis for clear and effective trading.