In this category you can find articles related to the use of COT in trading.

Commodity Futures Trading Commission (CFTC) is the U.S. independent federal agency, established to monitor the implementation of the Law on Commodity Exchanges.

The Commission’s stated aim is to protect market participants and their clients from fraud and abuse when trading commodity and financial futures and options, and also encourage a competitive and financially significant futures and options market. The oversight and regulation carried out by the Commission enables the markets to effectively play their role in the economy – to provide tools for determining the price and mechanisms for price risk compensation.

Any individual or legal entity is obliged to send daily reports on its transactions made on commodity exchanges if the volume of these trades is or exceeds a certain level established by CFTC. For example, for S&P500 index futures, this reporting level is 1000 contracts; for major currencies futures it’s 400 contracts.

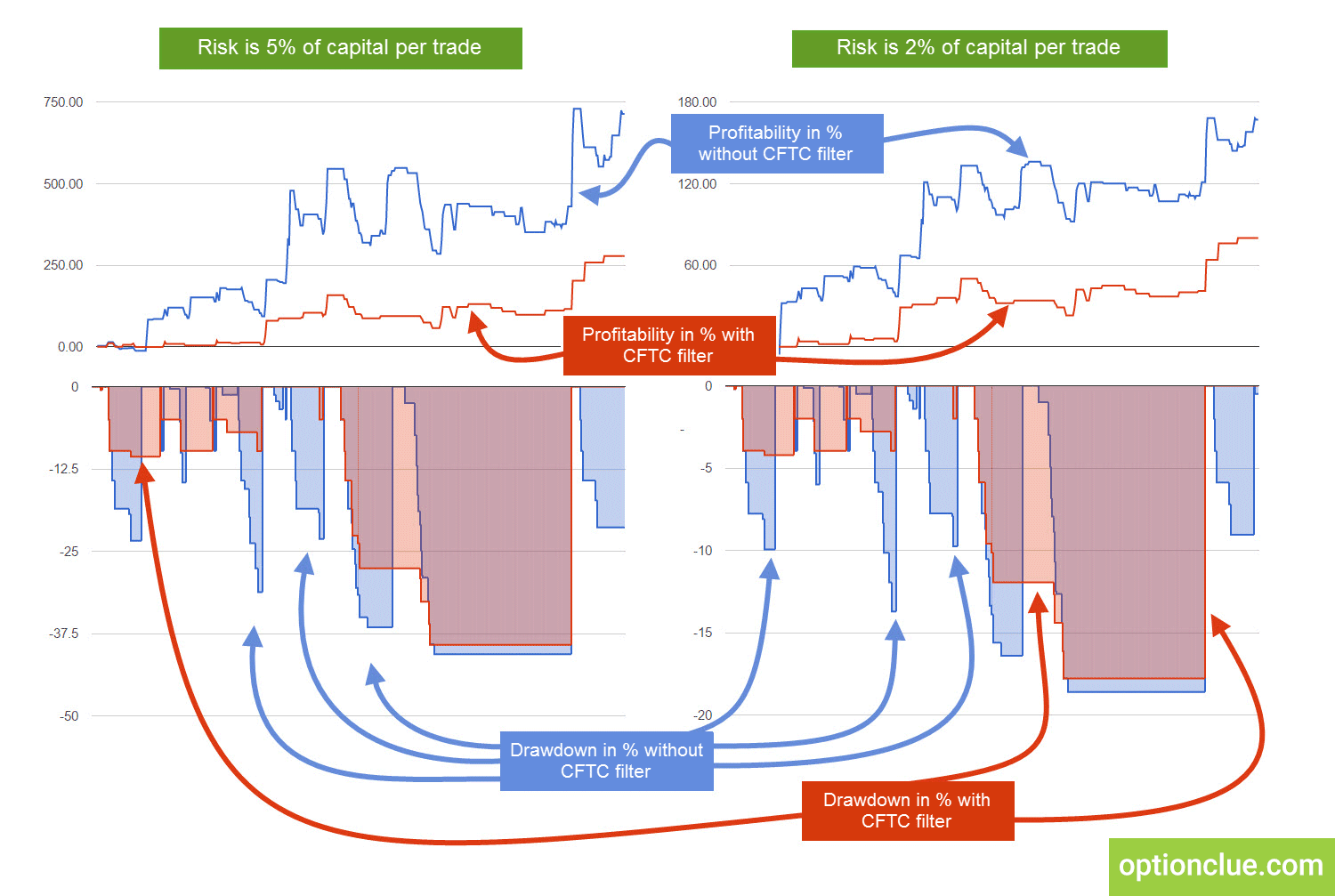

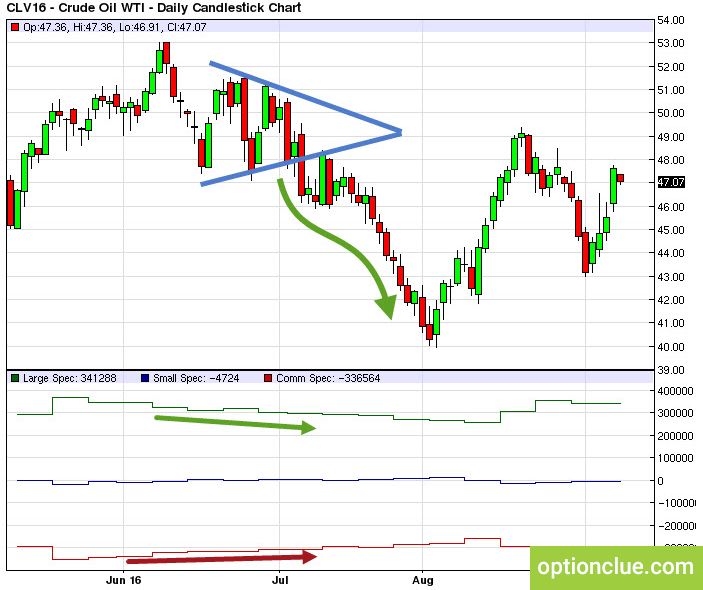

Information available in COT reports can significantly improve the quality of your trades, help you figure out large traders’ actions and better understand the principles of price movement. In medium- and long-term trading, when positions are held for weeks or months, it’s important to understand the direction in which large players hold their positions, whether they increase, or, on the contrary, gradually reduce them.

In other categories of our site you can find information that will also make your trading more efficient: trading risk management, money management rules, risk per trade in trading, support and resistance levels and other interesting facts about trade. In addition, you can find trading education video.