Good examples of bad risk-management

In the previous article we discussed the reasons for the extreme importance of using risk management rules in trading. These are the axioms that are desirable to learn before the first trade is made in the financial markets.

While continuing to develop this topic, we will analyze several examples of bad risk management when the risk management rules are ignored and the predictable consequences are bound to follow.

Contents

- Flip side of the coin

- Example 1. Probability of profit is 99.3%

- Bad risk management characteristics

- Example 2. Consequences of ignoring risk management rules

- Example 3. Mistakes in risk management

- Summary

Flip side of the coin

If you use risk management rules and are looking for trades in which a risk-reward ratio is 1:2 or less, then your capital can grow even in periods when there are more losing trades than profitable ones.

If trading is carried out with a risk-reward ratio of 1:1 or higher, then it will be much more difficult to trade because in this case you assume the obligation to trade profitably more often than at a loss, which as you may agree, is not the best idea.

We will analyze examples of trading with an extremely high risk-reward ratio. Such risk management options are common in trade practices of new traders, as well as in situations where martingale or averaging strategies are applied.

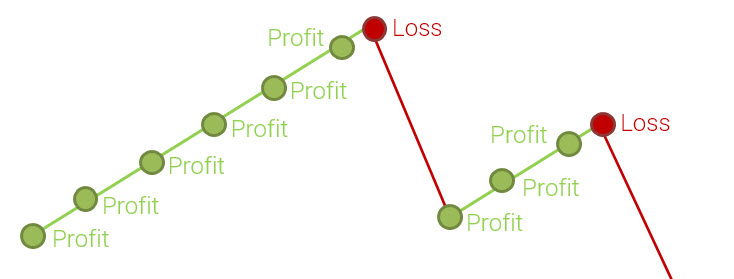

If you look at the trade history of traders who perform operations in the financial markets, focusing on similar methods of risk management, then most often you’ll see a yield curve similar to that is shown in Fig. 1.

Fig. 1. Bad risk management. The risk-reward ratio is equal to 5:1. The account grows slowly, but «declines» fast and deep when making a losing trade.

The lower the profit per trade and the higher the risk, the more profitable trades will be closed (the reason is statistics, but not professionalism). Therefore, at first on the trader’s account appear a lot of profitable trades and the yield curve tends to the vertical.

Why are the profitable trades being closed regularly in this case? The price changes every second and if the profit per trade is minimal and the risks are incommensurably large, then due to constant fluctuations in prices many profitable trades will be fixed on the account.

At the same time, as soon as a losing trade appears, the entire positive result of the previous periods can be destroyed and a trader is forced to waste his time again in order to restore the trading account bit by bit, hoping that there will be no more losing trades. For this reason, trading with ignored risk management rules exhausts emotionally.

Let me remind you that the higher reward-risk ratio is, the faster trading capital grows. The reverse is equally true: the smaller reward-risk ratio is, the faster the capital is lost and it is more difficult to restore it.

In the most high-risk trading strategies such as martingale and averaging the number of profitable trades can approach 100%, most often in this case one or two loss-making trades completely destroy the trading account.

Quote from «The New Market Wizards»

— If you were starting out as a trader today, knowing what you know now, what would you do differently than the first time around?

— I started out by worrying about the system I was going to use to trade. The second factor I worked on was risk management and volatility control. The third area I focused on was the psychology of trading. If I had it to do over again, I would reverse the process completely. I think investment psychology is by far the most important element, followed by risk control, with the least important consideration being the question of where you buy and sell.Tom Basso — an American hedge fund manager, founder of Trendstat Capital Management Inc.

Trading with a high risk-reward ratio is very cunning since on the trading account for a long time can appear only profitable trades. As a consequence, it’s impossible to assess the real risks included in this trading style.

For this reason, trading with a reward-risk ratio of less than 1:1 is common among beginners as it generates deceptively attractive historical yield curves (and the number of profitable trades).

Traders who follow these principles are often found in trust management services with small capitals. Due to ignoring the rules of money and risk management, they unconsciously destroy their funds and investors’ capital (in the Forex market such risk management principles are often used in pamm-accounts, trading signals and copying trades services).

The smaller the profit in each trade and the higher the risk, then the higher the share of profitable trades will be. In such cases a misleading visibility of the vertical growth of the trading account is created, when almost 100% of transactions on the trading account are profitable.

The number of such transactions misleads a trader or investor as there can be more than one hundred of them. The euphoria passes quickly after the first unprofitable trade is made, which, as a rule, crashes the trading account or creates so deep drawdown that makes trading on this account senseless.

We will analyze in detail what happens to the trading account in case of total disregard of risk management rules.

Related content

Example 1. Probability of profit is 99.3%

Suppose the risk per trade is $500 and the profit per trade is $2. Thus, the risk-reward ratio is 250:1. Losing trades are very rare. Is such trading noteworthy?

A huge number of profitable trades will be formed on the trader’s account. But the reason for this will be not in extreme professionalism, but in probability theory: the higher the risk and the lower the profit per trade, the higher the probability of Take Profit triggering.

What does this trading look like? Imagine that you open a position and as soon as the market moves 1-2 points in the desired direction the position is closed. At the same time, if the price moves against you, the trade is «outsat» and is closed only if the loss becomes crucial (sometimes a trader, as losses increase, is averaged in the direction of the entry, in other words, he opens more and more new positions).

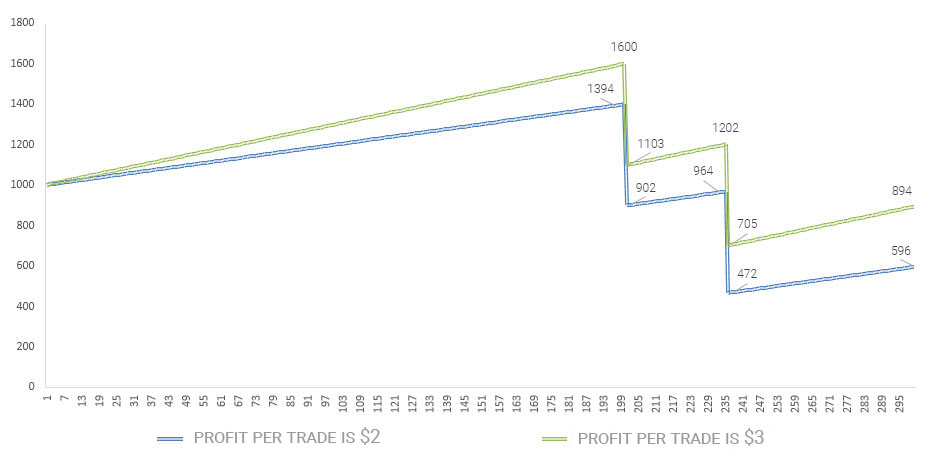

Fig. 2. Bad risk management. The probability of profit is 99.3%. The risk per trade is $500, the profit per trade is $2 (blue chart) and $3 (green chart). The account grows very slowly, but quickly and deeply declines when making unprofitable transactions.

As a rule, in case of «oversitting», a trader claims that he knows where the market has to «go». This is a classic pattern of behavior that precedes the rapid destruction of the trading capital.

Even if the profit in this case is close to 100%, the result is predictable.

In the model shown in Fig. 2 the probability of profit is 99.3% (!), the profit per trade is $2 (blue chart), the risk per trade is $500.

Expected Value is:

If the probability of profit is equal to 99.3%, the profit per trade is 3$ (green chart) and the risk per trade is $500, then the expected value is:

Both cases generate a negative expected value. This means that such trading approach does not make sense because during a fairly long time interval, on average, a trader will lose in each trade $1.51 and $0.52 respectively.

The main problem is that, in case of using this approach in trading, the real risks are hidden. Before the default of the account, dozens (or hundreds) of profitable trades will be formed, the yield curve will be close to the vertical, which may mislead both a trader who tests the trading strategy using historical data and an investor who trusts his funds, focusing on the yield curve.

As a result, after a plenty of profitable trades there will be 1-2 losing ones that will destroy not only the previous profitable results, but also the capital which was under management.

The number of profitable trades by itself does not say anything about the quality of the trading system. It is necessary to understand the average risk-reward ratio in each trade, preferably the average frequency of profitable and unprofitable trades. The risk-reward ratio in each trade is much more important than the number of profitable or loss-making trades.

Quote from «The New Market Wizards»

The trader who gets wiped out by a sudden, large, adverse price move is not simply unlucky. Such events occur often enough so they must be planned for.

Jack D. Schwager — an author, fund manager

If you see yield curves where a significant part of the capital is lost in one trade when the yield curve grows slowly, but falls quickly, it means that a trader in each trade makes a small profit, but risks a large amount of funds. Risk management is ignored and the long-term result of such trading approach is likely to be negative. This attitude to risks and profits most often isn’t noteworthy.

Related content

Bad risk management characteristics

In the trading system with ignoring risk management rules:

- the capital decreases quickly and deeply when making unprofitable trades;

- the account grows slowly when profitable trades are closed;

- the share of profitable trades in the long term can tend to be 100%;

- a trader will usually focus on the share of profitable trades (this is important only partly) rather than profitability (which is important) or the risk-reward ratio (and this is the most important);

- risk management (the importance of a low risk-reward ratio) is often ridiculed;

- responsibility is delegated (the Fed official is responsible, the US unemployment rate or the company’s cash flow statistics can be responsible as well, etc.)

In the trading system using risk management rules:

- when getting unprofitable trades, the capital decreases slowly, moderately and predictably;

- the account grows rapidly when profitable trades are closed;

- the number of profitable and loss-making trades will fluctuate, sometimes the number of losing trades will be higher than the number of profitable ones;

- as a rule, a trader will focus on the returns and risk-reward ratio, but not on the share of profitable trades.

Trading with extremely high risk-reward ratios in most cases has nothing to do with professional trading.

Let’s take some more examples.

Example 2. Consequences of ignoring risk management rules

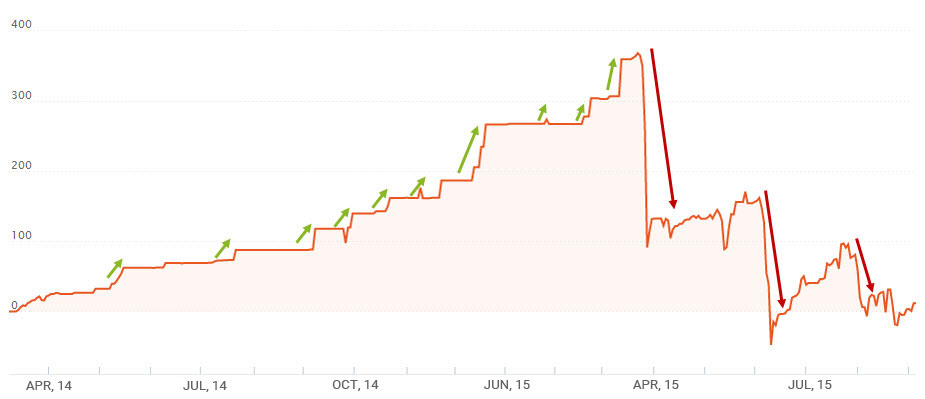

On the slide you can see the yield graph of a trader (the real example) who was managing about $52,000. The yield at the highest point was 363%.

Fig. 3. The example of profitability of a trading account with an extremely high risk-reward ratio. A few loss-making trades is enough to destroy the statistics and capital of investors who joined during the yield growth.

Up to the maximum on the yield chart, the account existed approximately 10 months. You may notice that the yield curve resembles the examples we considered earlier: the graph is growing slowly and most of the trades are profitable. The trader in each trade earns not much and the yield gradually moves up.

The real risks laid in such trading concept are not visible until the very last moment. The profitable trades mask this «time bomb».

This chart supplements the mentioned earlier idea: a trader who does not follow risk management rules and trades with negative expected value quickly destroys his capital and investors’ funds.

Please note, post factum you can see that the account growth in each transaction is insignificant in comparison with the periods of falling yield, that is, the trader earned little in each trade, but lost a lot when the market moved against him.

This is a classic disregard of risk management rules which for centuries leads to the same result – the destruction of the trading account.

Example 3. Mistakes in risk management

Let’s analyze one more real example. A trader’s yield chart is shown on Fig. 4. He had about 3.5 million rubles (about $50,000 at the time of trading) at the peak of capitalization.

According to the yield graph, it is clear that the trader didn’t hide the principles of risk management: each new trade slightly exceeded the previous maximum on the yield graph while the drawdowns were incomparably higher even during the active growth of the trading account. This indicates the insignificant profitability potential per trade and extremely high risks. Such yield graph is common in high-risk strategies that are based on using martingale and/or averaging.

Fig. 4. The example of profitability of a trading account with an extremely high risk-reward ratio. A few loss-making trades is enough to destroy the statistics (and the capital of investors that joined during the yield growth).

The trader traded for several months, then lost most of the trading account after 1-2 trades. Afterwards, he began to risk even more, rose capital to a small plus and then destroyed his trading account. Bad risk management forces you to create profitability bit by bit, hoping and believing that there will not be any unprofitable trade.

Quote from «The Black Swan: The Impact of the Highly Improbable»

Those who believe in the unconditional benefits of past experience should consider this pearl of wisdom allegedly voiced by a famous ship’s captain: “But in all my experience, I have never been in any accident. . . of any sort worth speaking about. I have seen but one vessel in distress in all my years at sea. I never saw a wreck and never have been wrecked nor was I ever in any predicament that threatened to end in disaster of any sort,” – E. J . Smith, 1907, Captain, RMS Titanic. Captain Smith’s ship sank in 1912 in what became the most talked about shipwreck in history.

Nassim Nicholas Taleb — a trader, essayist and statistician

If you follow money and risk management rules, then it’ll be difficult to lose money in the market. Ignoring these principles maximizes the probability of your trading account falling into the average sample, according to which 95% of traders lose money in the financial markets.

In my experience many traders are ready to lose accounts one after the other stubbornly not recognizing the fact that they lose money due to ignoring money and risk management rules.

Summary

The vast majority of traders lose money in the market. The vast majority of traders do not follow money and risk management rules in their trading practices. The first tendency is a direct consequence of the second one.

The ability to ignore trades with a reward-risk ratio of less than 2:1 can become your powerful competitive advantage since most traders are not able to follow this principle.

It is impossible to predict the number of unprofitable transactions in the future period, but it is quite real to protect your trading account from the uncertainty of the future. To do this, it is sufficient to follow money management and risk management rules. That does not guarantee any profit, but it gives the opportunity for the capital to increase even if there are more losing trades than profitable ones.

It is an individual matter of how much money a trader has to lose to understand this principle depends on every individual case. I have never met traders for whom this value would have been 0$. Sometimes traders leave this business without realizing that they do not have to make more than 50% of profitable trades to make their capital grow.

I’d like to note that we can still meet successful traders who trade with a reward-risk ratio less than 2:1. But these cases are single, and having studied all the alternatives these people made an informed choice. In most cases such rule is true: if a trader does not follow money and risk management rules, he loses money. Applying risk management rules a trader gets the opportunity to be wrong more often than to be right. If the average losing trade is larger than the average profitable one, a trader is obliged to be right more often than to be wrong. Why to assume such obligation?

Additional materials

- Formula for calculating the position size

- Option or stop-loss? Position size calculation when trading options