Crypto Analysis. Crypto Price Chart for October 4.

We make up a crypto markets overview containing the detailed technical analysis on Bitcoin and top altcoins. The market analysis is performed on the Daily timeframe.

Key topics

- Bitcoin (BTC/USDT)

- Ethereum (ETH/USDT)

- Binance Coin (BNB/USDT)

- Polkadot (DOT/USDT)

- Ripple (XRP/USDT)

- Bottom Line

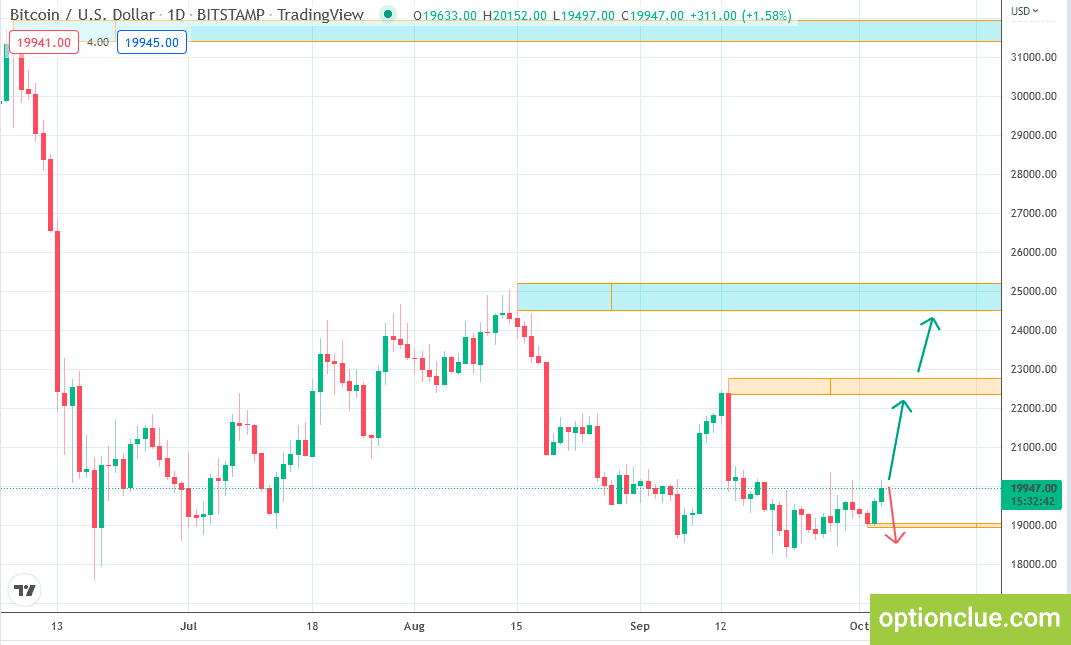

Bitcoin (BTC/USDT)

The market is in the uptrend on the Daily timeframe. The price has been in a narrow price range for the last few days.

The pullback buying opportunity was formed on October 3.

The first target in the upward movement is the resistance level formed on September 11 – 13 with the borders of $22,355 – $22,780.

In case of successful development of the trend, a more distant target will be on the highs of August 12 – 15, where the next resistance is located with the borders of $24,500 – $25,210.

Long positions will remain relevant until the market is above the nearest support level on the Daily timeframe. The borders of this support are $18,930 – $19,055.

Bitcoin / U.S. Dollar. Daily price chart. Technical analysis.

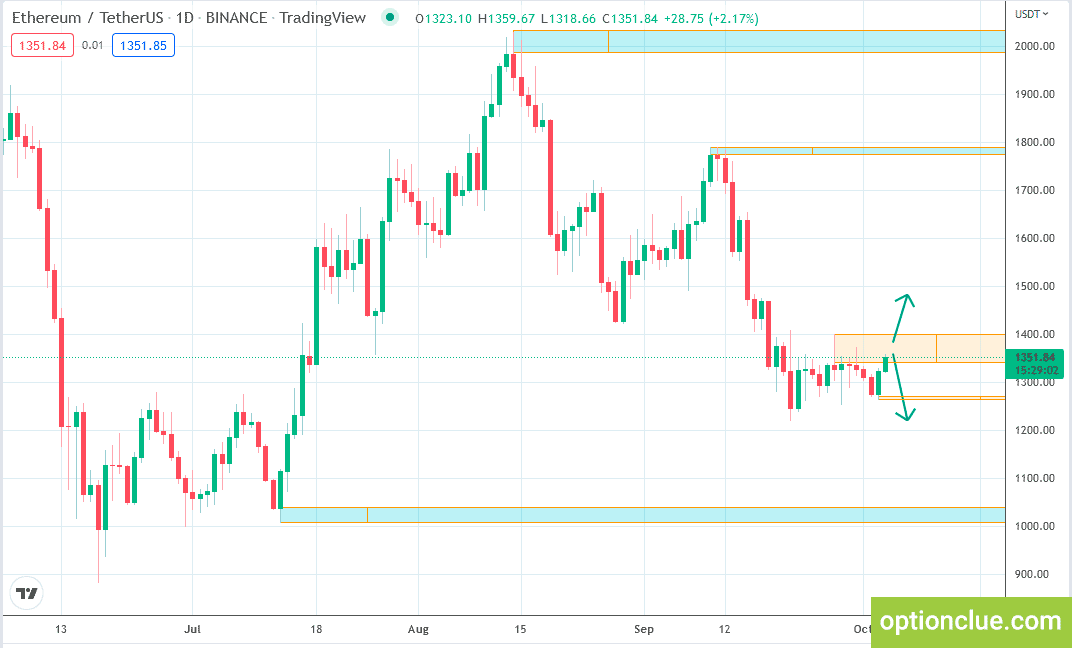

Ethereum (ETH/USDT)

Ethereum is trading sideways at the moment. The upper border of this price range is the resistance level formed on September 26 – October 1. The borders of this resistance are $1,340 – $1,400. The nearest support was formed on October 1 – 3. Its borders are $1,263 – $1,271.

This price range is likely to be broken through soon. The price is in the resistance zone now.

After the bullish candle on the Daily timeframe is closed above the resistance level the market will reverse and the uptrend will start. The first target in this case is the resistance level formed on September 9 – 12 with the borders of $1,774 – $1,789.

When breaking through the support, the trend will continue and we should look for selling opportunities. In this case the target will be around the support level with the borders of $1,006 – $1,041.

Ethereum / U.S. Dollar. Daily price chart. Technical analysis.

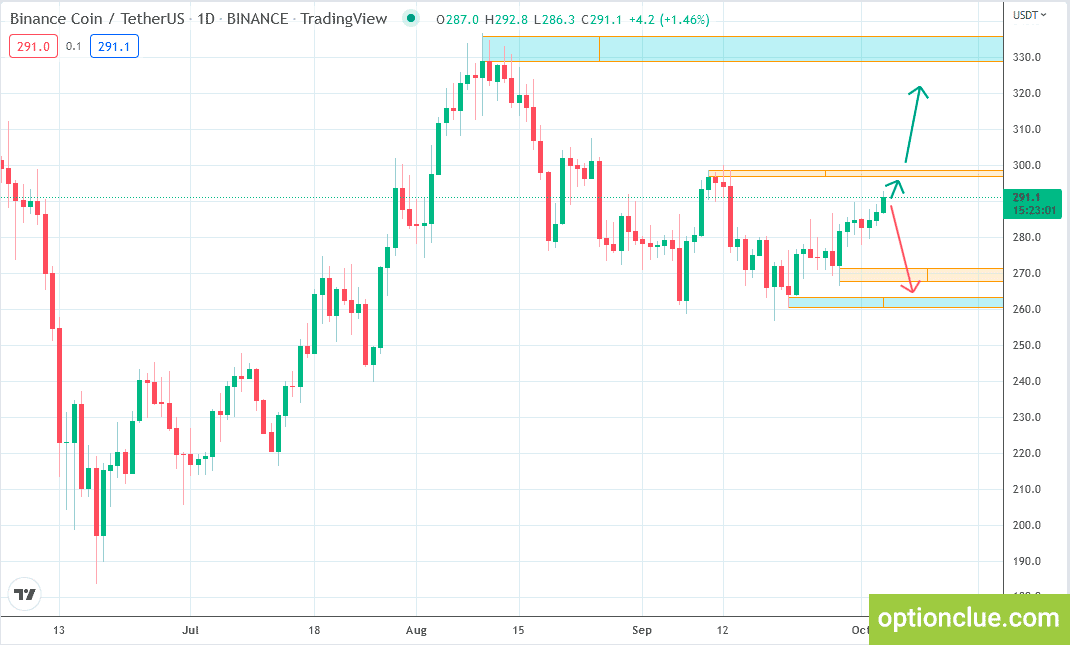

Binance Coin (BNB/USDT)

The market is in the uptrend on the Daily timeframe and the impulse wave develops. The price is approaching the first target. It is the resistance level formed on September 9 – 12 with the borders of $296.5 – $298.5.

The correction is likely to start after reaching the resistance. A pullback buying opportunity will appear after the correction is formed on the Daily timeframe.

If the market is closed above this resistance successfully, the price is likely to move forward to the target #2 – it is the resistance level with the borders of $336 – $328.5 formed on August 10 – 14.

Long positions will remain relevant until the market is above the nearest support level on the Daily timeframe. The borders of this support are $272.5 – $266.5.

BNB / U.S. Dollar. Daily price chart. Technical analysis.

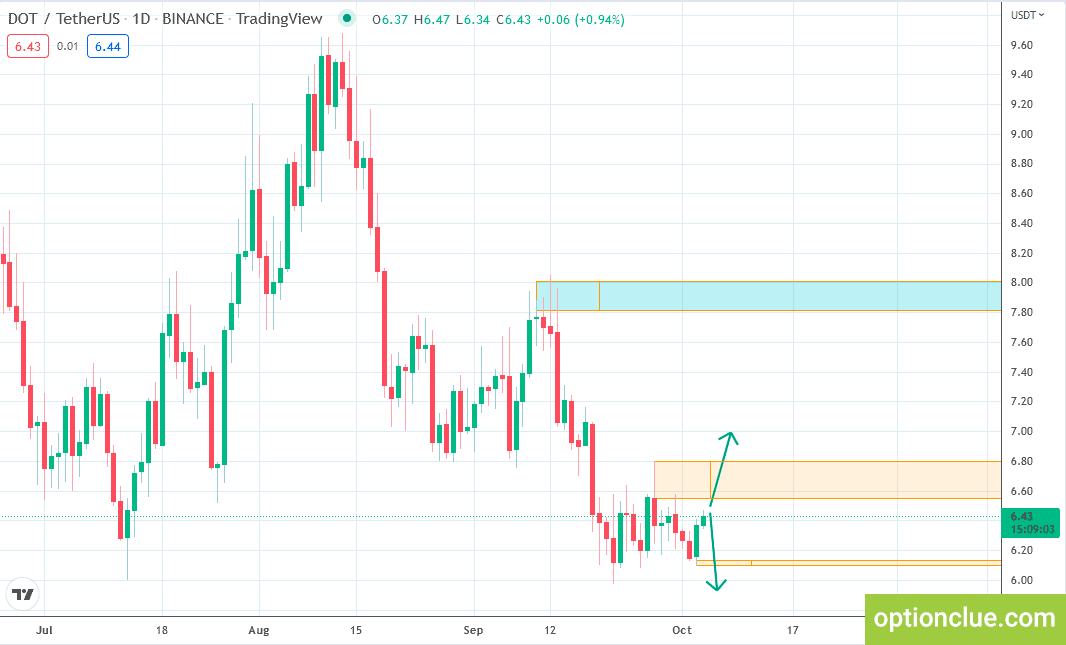

Polkadot (DOT/USDT)

Polkadot is in the flat formation now. The upper border of this price range is the resistance level formed on September 26 – 30. The borders of this resistance are $6.55 – $6.80. The nearest support was formed on October 1 – 3. Its borders are $6.09 – $6.13.

This flat is likely to be broken through soon. The price is close to the resistance zone now.

After the bullish candle on the Daily timeframe is closed above the resistance level the market will reverse and the uptrend will start. The first target in this case is the resistance level formed on September 9 – 12 with the borders of $7.81 – $8.01.

When breaking through the support, the trend will continue and we should look for selling opportunities.

DOT / U.S. Dollar. Daily price chart. Technical analysis.

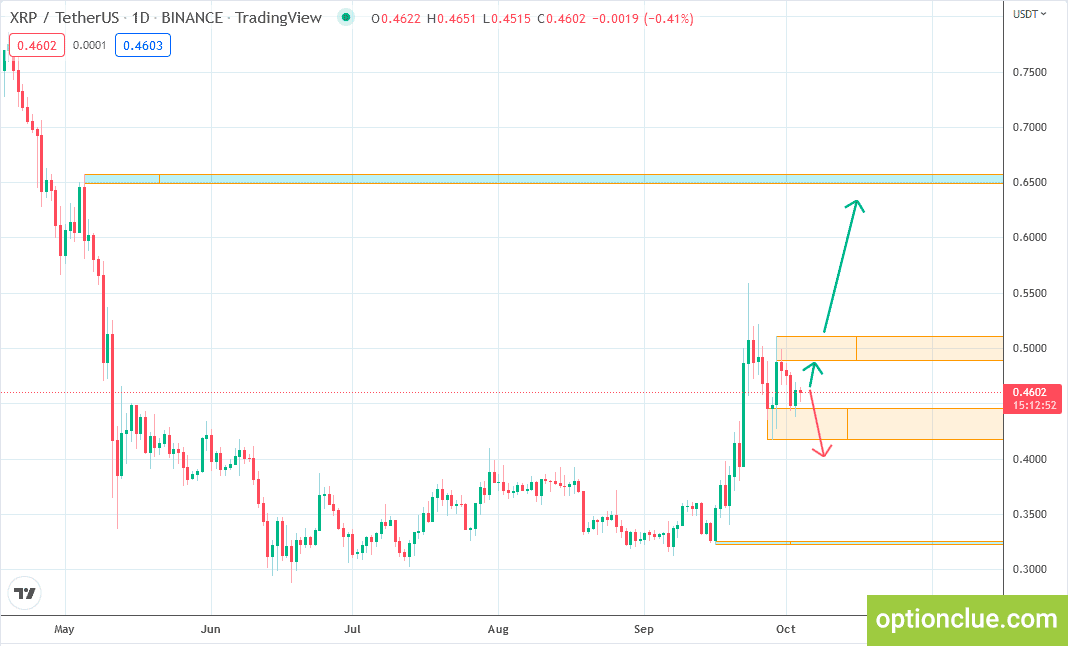

Ripple (XRP/USDT)

The market is in the uptrend on the Daily price chart.

The price is around the support level now. The correction came to an end on October 3 and the pullback buying opportunity was formed.

The movement in recent days has formed a new support level with the borders of $0.4457 – $0.4168.

The nearest target for the upward movement is the resistance level with the borders of $0.4882 – $0.5109 formed on September 29 – October 1.

If the market is closed above this resistance successfully, the price is likely to move forward to the target #2 – it is the resistance level with the borders of $0.6485 – $0.6572 formed on May 4 – 5.

Long positions will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of September 27 – 29.

Ripple / U.S. Dollar. Daily price chart. Technical analysis.

Bottom Line

In terms of medium-term trading, the token with the correction close to completion on the Daily timeframe and with potentially the most promising risk-reward ratio is Bitcoin.

In the near future, many tokens, for example Ethereum, will provide excellent opportunities to enter the market with a huge reward / risk ratio.

We used support and resistance levels for the analysis in this market overview.

FYI. We are building an indicator that will automatically plot key levels on all timeframes on all popular tokens..

Subscribe to our Telegram channel, dedicated to cryptocurrencies.

Subscribe to our Telegram channel, dedicated to cryptocurrencies.