Is it possible to lose money following risk and money management rules?

In the previous articles of the cycle «Axioms of Trading» we began to examine the benefits that can be obtained using money and risk management rules.

To calculate the optimal position size it is necessary to determine the profit potential and risk per trade as a percentage of trading capital. This approach smoothes the yield curve when the account falls into the streak of bad luck and allows you to maximize profit if the market goes in the right direction during several trades.

Using risk management rules it becomes not easy to lose money in the financial markets. Risk-management and money-management are reliable defenders of any trading account.

In this article we will continue to discuss money management rules. Also we will discuss the principles, the use of which will make the loss of a trading account a difficult task.

Is it possible to lose money in the market?

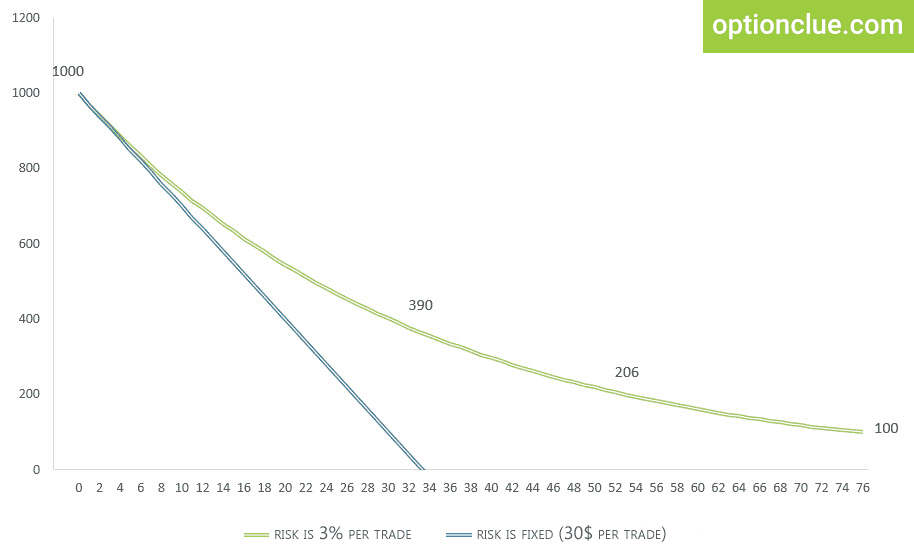

Figure 1 presents the condition model of a trading account in case of a series of unprofitable trades. Sooner or later each trader comes across this situation. In the first case (blue chart) the risk is fixed in the account currency and it is $30. In the second case (green chart) the risk is determined as a share of capital and it is equal to 3% per trade.

Fig. 1. Stress test. Green chart. The risk is determined as a share of capital (3%). Blue chart. The risk is fixed in the account currency ($30).

In this model of stress testing traders get 30 losing trades in a row. Such statistics is close to fantasy rather than objective reality. Nevertheless, it serves the main purpose of our experiment, that is to demonstrate visually the gap between different methods of money management. The calculation of risk per trade as a percentage of trading capital has a better effect on trade statistics than more simple methods discussed in the previous article.

Is it possible to crash a trading account? Yes, if a trader determines the position size fixing risk per trade in the account currency. When risk per trade is $30, you will need to make 34 unprofitable operations in a row. At the same time a trader who determines risk per trade as a share of trading capital has 39% of the starting amount left.

$200 or 20% of the starting amount is left after the 53rd trade. Approximately $100 will be left in the account after the 75th losing trade in a row. Even in case of a strong desire it will be difficult to make such number of negative trades in a row.

It is known that the probability of co-occurrence of two independent events is equal to the multiplication of the probabilities of these events.

P{AB} — probability of co-occurrence of A and B events,

A — probability of occurrence of A event,

B — probability of occurrence of B event.

Thus, even in case 60% of all trades are negative, the probability of 33 losing trades in a row is the following in percentage:

The probability of 53 losing trades in a row is:

Morality is simple. Following money management rules, you will have to make enormous efforts in order to destroy a trading account. A trader is more likely to be bored with trading than a trading account will be destroyed.

Try to do it yourself. Open a test account (demo account) and try to destroy it, following risk and money management rules. Risk per trade must be calculated as a share of capital (for example 3%), stop loss must be twice less than take profit (stop-loss size must correspond to real trading). Even if stop loss and take profit are placed at spontaneous points without the use of resistance and support levels and the trade will be open according to absurd principles (for example, «heads or tails»), you are more likely to get bored with this activity than the account will be destroyed.

The destruction of a trading account is the choice that a trader makes when he decides whether to apply risk and money management rules or not.

When using risk and money management rules statistics safeguards a trading account. Even if the market moves in the unfavorable direction several times in a row profitable trades will periodically occur. With 3% risk per trade each profitable position will yield 6% of profit. This greatly complicates the task of destroying the trading account.

Suppose that capital is $2000. One profitable trade yields 6% which is equal to $120 in this case. To lose this money you need to make at least more than two losing trades.

The quote from «MARKET WIZARDS»

— What other advice would you have for traders?

— The most important advice is to never let a loser get out of hand. You want to be sure that you can be wrong twenty or thirty times in a row and still have money in your account. When I trade, I’ll risk perhaps 5 to 10 percent of the money in my account.Randy McKay is trader

At the first you should not make more than one trade a day. If a trader performs one trade a day, then it is necessary to be wrong every day during six weeks to get 30 losing trades in a row.

During all the time I communicate with traders and study financial markets I have never faced such situation. But even if someone manages to do this, the account will still have about 39% of the seed investment amount.

Related content

Super aggressive money-management

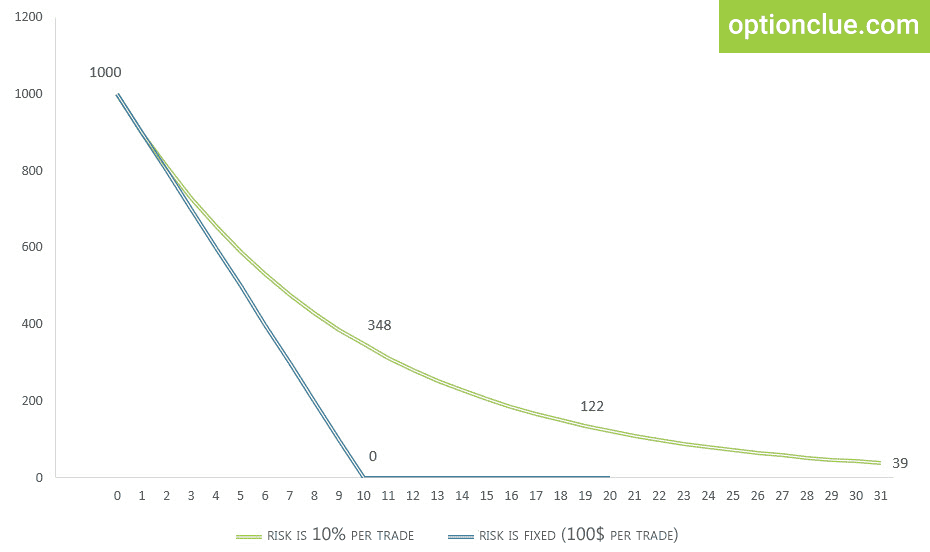

Let’s take an example associated with extremely aggressive trading when risk per trade is 10% of capital. I do not recommend to use such high values, however, even if you apply high levels of risk, it will not be easy to destroy a trading account. After ten losing trades in a row the account will have about 35% of the seed amount, after twenty trades – 12%, after thirty ones – 4% of the seed amount.

Fig. 2. Stress test. Green chart. The risk is determined as a share of capital (10%). Blue chart. The risk is fixed in the account currency ($100).

Do not forget that in case of meeting risk management rules each profitable trade will generate plus 20% of the trading account. Even in case of an extremely high risk per trade it will not be easy to lose money.

Summary

The examples given above are the regular illustrations of the unconditional importance of risk management and money management. If a trader determines risk per trade as a fixed amount of capital, his trading account becomes less resistant to drawdowns. In the examples described above such trader would lose all funds at least once, whereas his colleague who determines risk per trade as a percentage of funds would continue to trade as before.

These examples clearly reflect the fact that regardless of super aggressive or ultra-conservative trading risk and money management rules are the axiom of trading. Dynamic risk per trade allows you to defend your trading account from excessive drawdowns during the most difficult periods. If you use this concept, it will be very difficult to lose money in the market even if the market entry and the targets determination occur with the help of obviously absurd principles.

Grail in trading is following money and risk management rules. Search for the most appropriate trading strategy for you is important, but it is of secondary importance in comparison with using risk management and money management.

Good luck in trading!

Additional materials

- How to calculate the optimal position size when trading with stop loss

- Option or stop-loss? Position size calculation when trading options

- Good examples of bad risk-management