On this page you’ll find valuable information on the option wheel strategy.

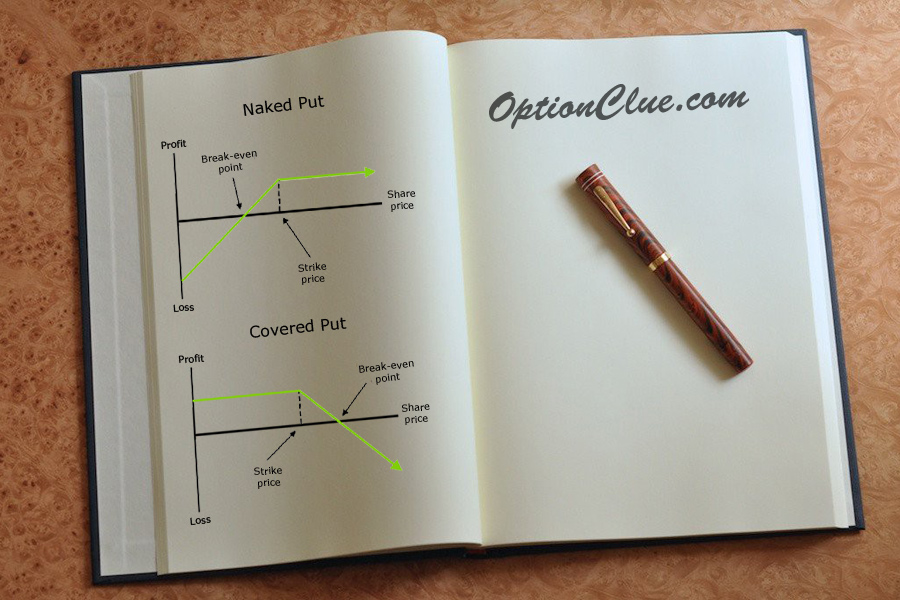

For many of you, this name of the strategy may seem somewhat strange. But there is nothing strange here if you understand how it is created. It’s formed by selling options, namely starting with cash-secured puts and ending with covered call strategy.

Iterating the cycle of selling stock options, we find ourselves in the so-called wheel, from which the name of the strategy comes. Another name for the strategy is covered strangle.

Traders tend to trade wheels when they want to own the stock or don’t mind assignment. In this case guaranteed profit made from CSP is the additional earnings to such assignment.

One more advantage of wheel options lies in the fact that selling covered calls generate additional cash to the trader’s account. Owning a high-liquid dividend stock results in extra bonus.

Option wheel strategy gets even easier with 5Greeks scanner.