Selling Cash-Secured Puts. Main Insights into CSP strategy.

Contents

- The nature of cash-secured puts

- Important notes about CSP

- How to correctly start the cash-secured put?

- Management when running the CSP

- Insights into cash-secured puts

The Nature of Cash-Secured Puts

In this article we will discuss one of the most popular options strategies called the cash-secured put.

The cash-secured put strategy is also one of the stages of another popular strategy called the options wheel strategy or covered strangle.

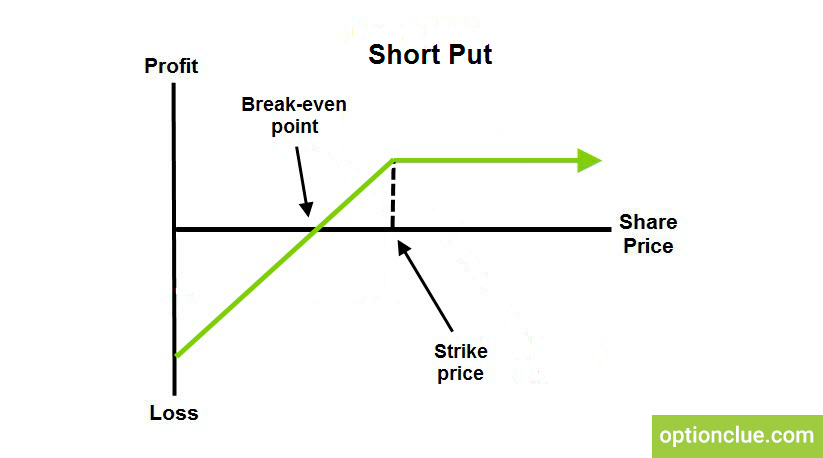

The cash-secured put (CSP for short) is a neutral to bullish strategy just like the naked put or the short put, it is a similar concept.

The reason why we are saying neutral is that you can make a maximum profit if the underlying does not move, you still have directional risk but it does not have to move to make maximum profit.

The maximum profit you will receive on this trade is the credit you get, your maximum loss technically is undefined which would be underlying at zero, your breakeven point is your strike price minus the credit you receive.

If the underlying goes up, it has a positive effect on the short put.

If the underlying goes down let us consider 2 scenarios: when implied volatility (IV) goes up, it is not a good thing for a short put, and on the contrary, when IV is high and goes down it is a good thing because one can close the position with significant profit and start considering opening a new one.

Important Notes about CSP

Let us consider a few notes about CSP:

- CSP can become a staple strategy when running more complex strategies.

- We use it to acquire stock or just collect some money while we are looking to acquire stock because you can buy the stock outright if you want or you can sell puts to collect premiums and wait until you are assigned this same stock you want to buy but be paid to do it along the way.

- Typically you would turn the cash-secured put once assigned into a covered call. That is generally the strategy there.

- If you want to be assigned the stock you generally would select a more aggressive delta, so something like a .4, .45, or something like that if you want to be assigned. If you are kind of like you do not mind being assigned but you want to collect credit and hopefully not use as much buying power that is when you would hang around a thirty delta.

- For every trade when selling, allocate first, figure out your outlay and be prepared to scale.

- You should generally look somewhere between zero to sixty days to expiration – it all depends on what you are looking for. The less your days to expiration, the greater your return on capital, the greater the decay you are going to experience, but the more gamma risk you are going to see which is the variance in your P&L. So that is the trade-off.

How to Correctly Start the Cash-Secured Put?

Let us run through some kind of general mechanics to help people get started:

- Always start with a scan. Remember with the cash secured-put you are preparing to acquire stock. So, whatever you typically would do to prepare to acquire stock – your fundamental analysis, technical analysis, maybe support and resistance levels analysis – do that.

- The next step is to create a shortlist of things that pass your scan criteria. That is when you should screen them. According to that, you can figure out which one you want to trade.

- Then we need to allocate the position. However much money we are going to afford the position in total.

- Then we also want to make sure that we include our scaling criteria. When the position is down 10%, 15%, you should always reevaluate the position, which is extremely important.

Management When Running the CSP

Let us consider how to manage the cash-secured put. This is another pretty easy one because we do not mind being assigned.

- Setting a profit target. If the option hits a specific price, where do we want to take it off? If you really do not mind owning the underlying you could pick a high-profit target, about 80% or something like that. If you 50/50 do not mind owning it, it is not necessarily trying to make an 80% profit target, 50-60% will be good in this case. With 80% you are going to take that off fewer times than with the value of 50-60%. So, that is how we manage those two based on our disposition.

- Loss target setting – this is easy because we are just essentially waiting to be assigned. So, if it goes below our short strike typically we are just going to wait.

- Now we do have to reevaluate that because it is important. If the underlying falls below your short strike for some sort of catastrophic reason that has changed your assumption in the underlying you need to reevaluate and maybe this is time to either take a loss or roll the position out and actually apply management techniques if changes are a little bit not positive for you to own it right no.

Insights into Cash-Secured Puts

Despite the fact that selling CSP is a fairly simple options strategy, in which many traders receive income, to maximize the benefits of its use one should take into account the following factors:

- Diversification. Trading dozens of stocks takes too much energy and time to monitor. To prevent it, you should choose up to 10 assets to trade preferably from different sectors and volatility. That allows you to trade stable and have enough funds available for effective management.

- Rolling. The opportunity arises if the stock is below your strike price. But what strikes to choose when rolling? One approach is to keep the strike the same but sometimes it is possible to roll down if the credit still exceeds our weekly goal.

Let us take an example. We wrote Apr 29 AAA 98 put option but it went in-the-money. We closed them for 95 cents and wrote 97 puts again for $1.50. We could write the new 98 puts for around $1.75 but we wanted to increase the odds while still collecting credit. As we believe in the stock, we do not mind rolling anyway. The stock would end up OTM on May 5. In hindsight, we should have kept the same strike but we made out with a good profit. - Risk tolerance. Since each person is unique, everyone has a different risk tolerance. And that is reflected in traders’ actions when managing their position, whether they roll or decide to be assigned depending on current underlying prices and days to expiration left. So, and you when starting the cash-secured put should take it into account and do all the best to avoid discomfort when trading and managing the options position.