Best Strategies to Trade Options. Writing Covered Calls for Income.

Choosing of assets for trading can take a long time, especially when it comes to options trading. Keeping this in mind, we’ve created the options screener that saves your time and helps find new trading ideas based on a simple principle – buying cheap options or selling expensive ones.

In this article we’ll discuss one of the most popular options strategies called covered call. We will analyze the features of its application in certain market conditions and we will take examples. This material can be valuable for beginners since it contains simple examples of stocks and options trading.

Contents

The Nature of Covered Calls

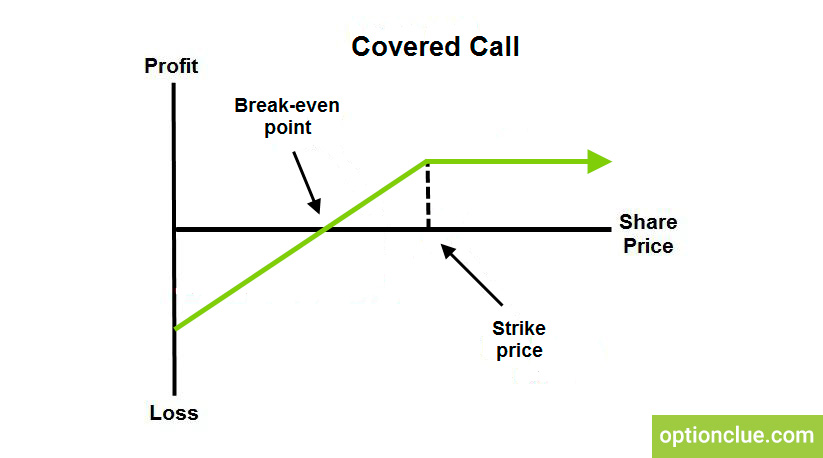

A covered call is an option strategy that can help investors earn additional income on securities like stocks or ETFs that they already own (Figure 1).

You can sell (write) covered calls to generate additional income, increase your cash flow and reduce your market risks. A covered call involves selling a call option above the stock’s current price (OTM or ATM) to collect a premium. One call option is equal to a hundred shares.

If the stock’s price rises above the strike price the option is exercised, you are obligated to sell the stock at the strike price. As long as the price of your stock doesn’t decline more than the value of the premium received you make money.

Covered Call Example

Let’s go through a real-life example of top option stocks – for example, Apple stock. We buy a hundred shares of Apple for $155.3 per share. We pay for it $15,530 (100*$155.3).

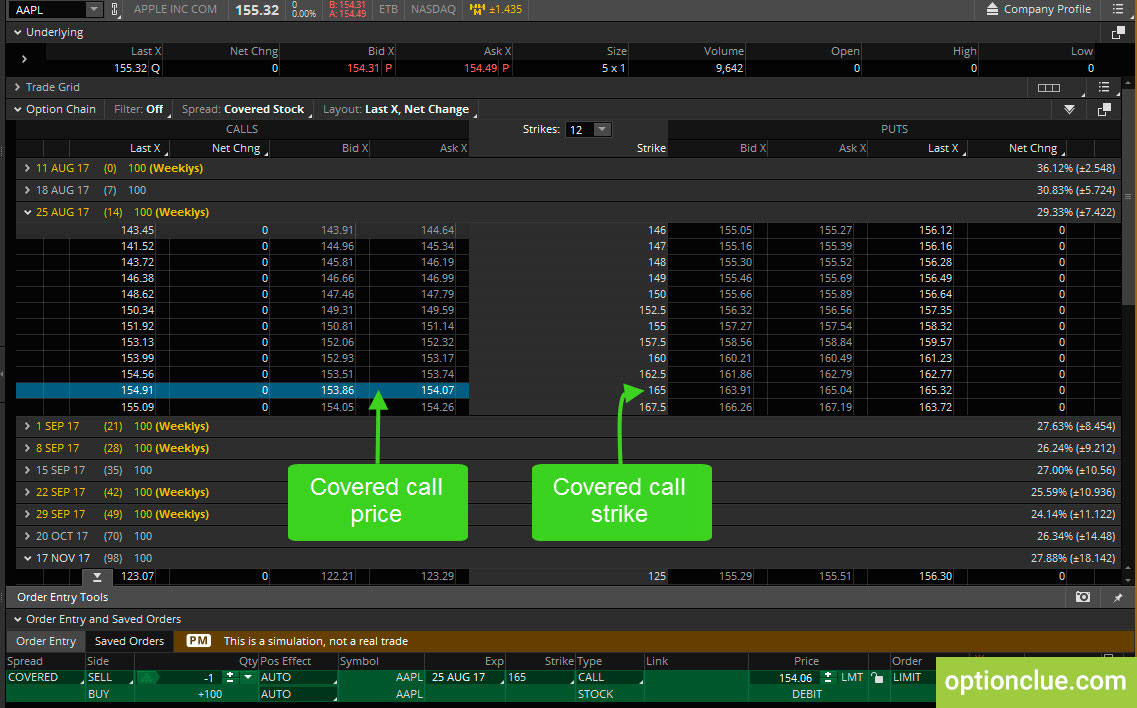

After analyzing the Apple stock price movement and the Daily trend, sometime after the stocks purchase we don’t think the stock price will rise much in the near future. Therefore besides buying stocks, we decide to sell 25 AUG 165 call option for $154 (Figure 2).

Now let’s calculate the total rate of return.

The numerator is $154, it’s the amount of premium we get for selling 165 call option, this value is for 14 days. All rate of returns are calculated according to 12 months. That’s why it’s necessary to multiply our final value 26 (365/14) times. The denominator is $15,530 (the total price for buying 100 shares). So the possible yearly rate of return, in this case, is 25.7% (154/15530*26).

In addition, Apple pays us a dividend of, for instance, 4.5%. We add these two values together and it is 30.2%.

You should be aware that nothing stays the same, there is always movement going on in the markets, there is always volatility. Stocks just like the market can go three ways: up, down and sideways, that is within a narrow price range.

As long as the shares don’t rise above $165 dollars the option will expire worthless and we keep this stock. If Apple goes up or sideways we can achieve our 30.2% return.

But if the stock does move higher than $165 the option would likely be exercised and we would be forced to sell our shares. However, we still make a $9.7 ($165-$155.3) profit per share in addition to the option premium.

If the market goes down, we’ll get less than our 30.2% since we lose money on the stock but any losses could be partially offset by the option premium. Moreover, as the stock goes down far enough we’ll probably have a negative return.

If you wrote that same $154 covered call every 2 weeks for 12 months and the stock stays below the strike price of the covered call, the premium you would earn overtime would help pay less for the stock (26*$154=$4,004) and generate additional positive cash flow.

Selling covered call stock options helps to mitigate risks but it cannot eliminate them. However, when trading stocks and best option trading strategy you have the opportunity to make more as you could see.

Valuable information on what options to buy now you can find after seeing option alerts.