Covered Strangle vs Covered Call Strategy

Contents

- Why choose the covered strangle rather than the covered call writing?

- Conclusions on covered strangle and writing covered calls performance

Why Choose the Covered Strangle Rather than the Covered Call Writing?

In this article we will take a quick look at the covered strangle options strategy and consider its main differences and advantages over covered calls.

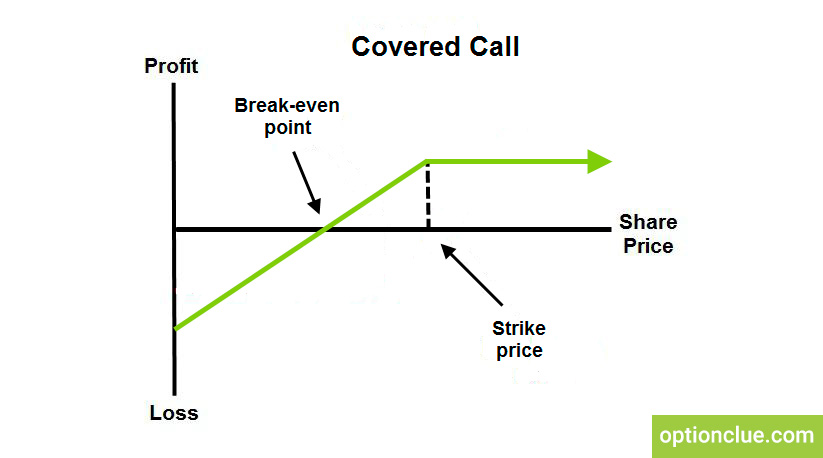

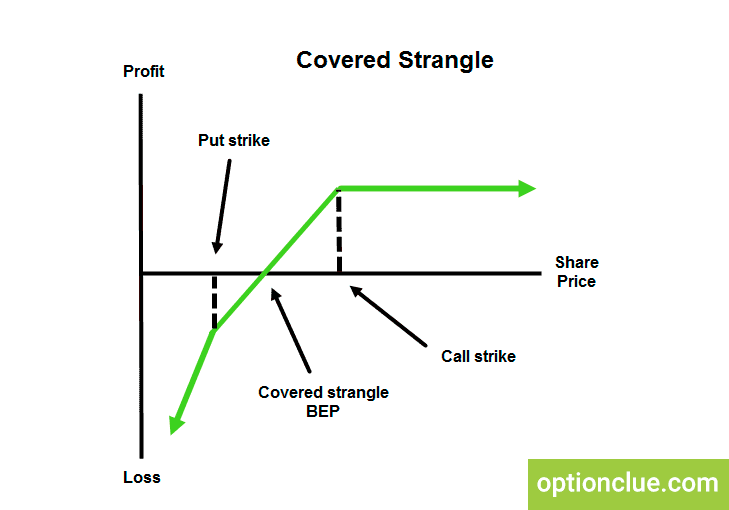

The very first bullet under the strategy is this is a bullish or neutral to bullish trade like just a covered call is and the difference from a covered call is that it is a covered call and a cash-secured put traded at the same time.

You had better take 200 share at risk rather than 100, and because you get 2 credits instead of one, then depending upon what happens to the stock price which we are going to go through, up, down or sideways, there can be some advantages to this over a covered call and in certain situations, there are disadvantages of this to a covered call, as with any other strategy.

Many people do start covered calls with a cash-secured put and many do not.

Let us assume that you do, and then in the first step you would sell a put. And if the stock goes up, your put expires worthless and then you would go on and if you are still interested in that particular stock index, you would sell another put and then another put as long as the stock continued to go up.

At that level, the covered strangle is exactly like what you might do with a covered call if you did it starting with a cash-secured put.

The other scenario is the stock does not go up but the stock goes down. If the stock goes down, your put is assigned and now you have got a hundred shares of stock. Now after you have the stock, you are going to sell a covered call. You are going to have a covered call but you are also going to sell a put.

Now you have 2 credits on this hundred shares of stock in a sense that you have got at this point and again one of two things happens:

- Either the stock goes up

- Or the stock goes down or it obviously can stay sideways

But, if the stock goes up then just like you would with a covered call you are going to get your stocks called away but your put is going to expire worthless.

At this point, the advantage that you would have over a covered call is you will have collected three premiums instead of two because with the covered stock you would have got your first one by selling the put and you would have got your second one by selling a call, but with the covered strangle you have got a third premium by selling the put.

If this is where you got to, obviously you would be ahead with the strangle over the covered call.

Now the other thing that could happen when you put this strangle on is this the stock goes down. In this case, you are going to get assigned another hundred shares of stock.

Your call is going to expire worthless. At this point, you are now going to have two hundred shares of stock instead of a hundred. And the big difference versus a covered call is you have to be willing to have two hundred shares instead of one hundred shares or four hundred instead of two hundred and so on, it just depends on how big your trades are. Moreover, once you get two hundred shares of stock, you are just going to sell 2 covered calls instead of one. Now you are going to do step # 3 – you are doing the same thing with a covered call, but with two hundred shares instead of a hundred.

And again, you have the stock that can either go up or go down. And if it goes up, you are 200 shares get called away, and you are going to be back to zero. But at this point, you have collected 5 premiums. The reason you have got 5 premiums is because you got your initial 1 credit from the put, then you got 2 from selling a call and the put – that gave you 3, and then you sold 2 more because you had two hundred shares. That gave you 5 credits at this point and now you are back to zero in terms of the stock.

Alternatively, at this point, we are just in a covered call situation. If the stock price goes down, then your calls just expire worthless and you are still left with 200 shares of stock. And your cost basis is going to be based on these 5 premiums and at this point, you would just sell another two covered calls and then continue this process over and over.

That is just a really quick explanation.

Conclusions on Covered Strangle and Writing Covered Calls Performance

Again back over to the strategy, this is a bullish or neutral strategy and you need to be willing to purchase 200 shares and once you get them you need to be willing to let them be called away and theoretically, the concept is you want to sell your shares at a higher price than you have got today. That is why you are putting a call and a put on here is to lower your basis but you are also willing to buy more shares if the stock price falls.

The concept is you want to get a more stable or smaller standard deviation. It is probably a better way than you did it with 200 shares of stock with two covered calls or just simply two cash-secured puts of the same ticker. It is because if the stock market is bullish, the two covered calls win and if the stock goes down this covered strangle wins. Moreover, it really depends on how bullish you are, how bearish you are, or how risk-averse you are. Because if you are somewhat risk-averse or you are not bullish enough to go for it, then this actually comes out ahead of the two covered calls but that is fundamentally why you would consider doing this.