The second property of horizontal support and resistance levels

In this article we will talk about the second property of horizontal support and resistance levels, which sounds in the following way: the market is more likely to bounce off the horizontal level than it will break it through.

We will discuss why this happens. We will also analyze the true reasons of the main market participants while trading near the levels and we will take the examples.

Contents

- Trading. The essence of the second property of levels

- EURAUD. Examples of the second property of support and resistance levels implementation. Flats

- EURAUD. Examples of the second property implementation. Short-term correction

- EURUSD. Examples of the second property implementation in the FOREX market. Pullback

Trading. The essence of the second property of levels

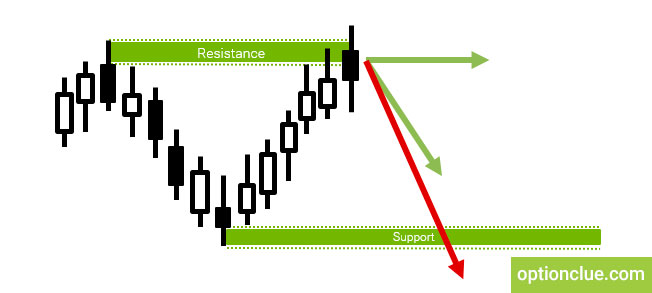

When the price comes to the important support or resistance level, a correction or the market reversal can start or a temporary movement slowdown can take place.

This property of levels is especially important when analyzing large timeframes. If the market enters such resistance or support zone a sideways trend can form on smaller timeframes.

The properties of levels work for the simple reason that most traders believe that they have to work.

Thus, the demand and supply balance will change around the levels that can cause a change in the price movement direction. There are always several groups of traders in the market that tend to act around the levels in a particular way.

EURAUD. Examples of the second property of support and resistance levels implementation. Flats

Let’s take as an example of the EURAUD currency pair what can occur in the market when the price comes to one of the important levels.

Flats can be formed around such levels or triangles on the current and, especially, smaller timeframes.

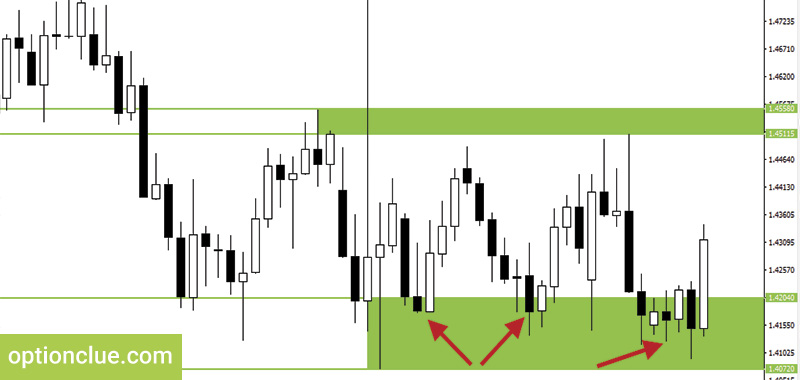

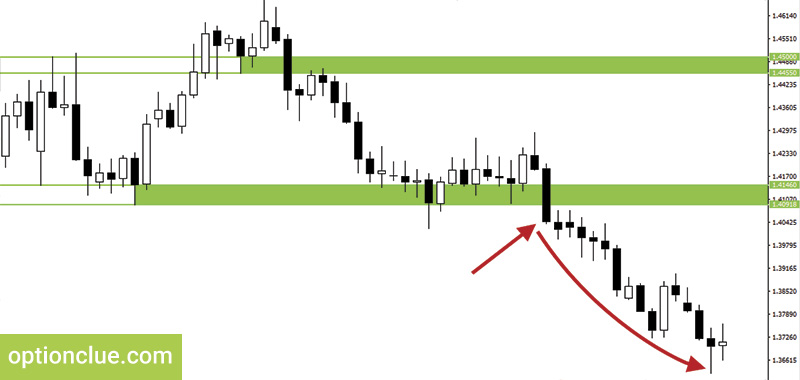

Since October 2016 a bear trend was evolving in the market, price lows and support levels were successively being broken through and the market was falling rapidly for several weeks. However, afterwards the price, having formed the next support level, returned to it for several times but could not overcome it. We’ll see it in the following example.

As I mentioned in the previous articles, support levels are plotted from the borders of the bodies to the borders of the candle shadows. The first horizontal support level on the current chart has the following borders: 1.4182 and 1.4204. The price was falling for a long time and then after the next bull candle formation the market began to pull back.

This candle managed to overlap the previous one and for that reason we can plot a level at this point. After that the price began to correct, a new resistance level (with borders: 1.4558 and 1.4511) was formed and then the market began to fall again (Figure 2).

How often do traders act when the market reaches a support level? Realizing that the price can bounce off this level, traders who opened sell positions earlier at higher prices, understand that the market can start to correct and they begin to fix their profitable positions.

Thus, the number of new sellers near the support level decreases, but the number of buyers increases that can cause the opposite price movement and the market can start correcting.

Let’s come back to the example. For a few days the market actively tested this level, the price pierced it through several times. Traders who expected the price to decline further opened short positions around the level, using pending stop orders. This trading principle is discussed in our other articles. Pending stop orders triggering can provoke the formation of long shadows below the level (Figure 3).

However, there was no fact of the candle closing below the support. But the level has changed a little bit as it has become wider. Its borders are: 1.4072 and 1.4204. Afterwards, the price tested a new level.

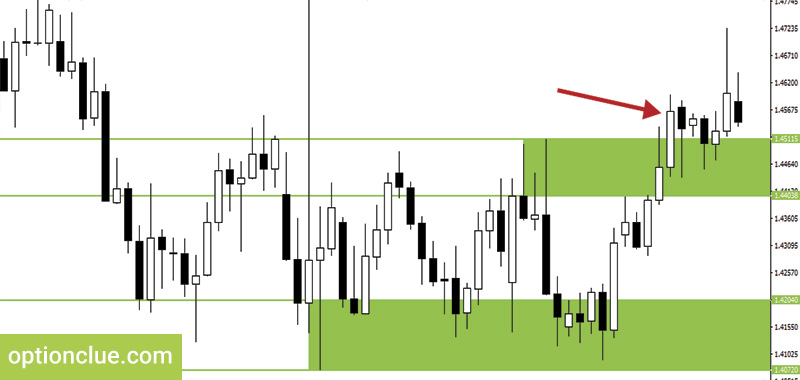

The market started rising again. Then the price touches the support level again and bounces off it. The market turns into a sideways trend, in which, as you know, it’s not worth trading (Figure 4).

It is more difficult to forecast the direction of price exit from a flat, rather than just to trade a trend. Therefore, many traders closed their positions around this level and the price after almost 40-days being at one point began to reverse.

A new resistance level was formed and its upper border was 1.4511. Having broken through this level, the market moved up and then was rising for several days (Figure 5).

We have considered one of the ways of the second property of horizontal levels realization. When the price comes to the support or resistance level, touches it and then transforms into a flat that is the market condition when one isn’t recommended to trade.

EURAUD. Examples of the second property implementation. Short-term correction

The next way of the price reaction to horizontal levels is a short-term correction. Let’s analyze why this happens. If the market has a stable trend, supported by the largest market participants, for example, banks or investment funds, the price can break through the level and move towards the following targets. In such cases while achieving resistance or support, a small correction is often observed in the market. It is caused by the liquidation of previously open positions around the horizontal level.

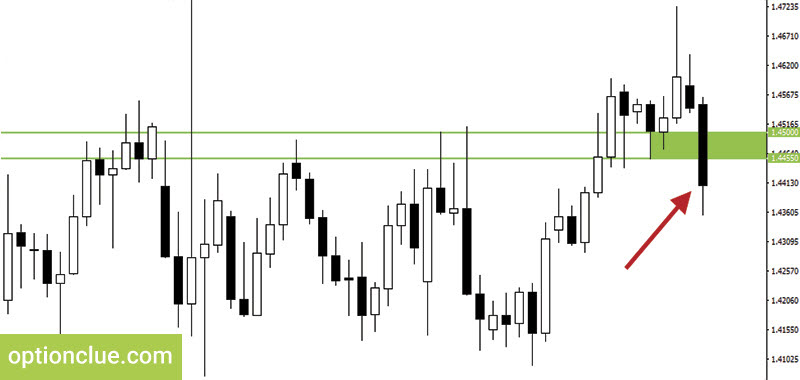

Let’s take a small example. The market has formed a support level, the lower border of which is at 1.4449 and the upper border is about at 1.4500. Let’s paint it out to understand the way the market will react to it in the future.

On January the 3rd, there was a fact of the level breakout down. Respectively, in terms of the technical analysis, after the bear candle closing sell positions became relevant (Figure 6).

I’d like to note that the primary targets often coincide with the nearest support levels. Candles of the 14th, 15th and 16th December formed this level. The level is plotted along the bodies and the shadows of the candles at the point where we can see a clear visual price reversal. The lower border of the level is 1.4091, the upper border is 1.4146. This is the support level and the first target for bearish entering the market (Figure 7).

The market is falling and when the price reaches this level the aggressive bearish movement is gradually slowing down. After the first touch the price bounced off the level. Then the second, third touch occurs, bears try to push the price down below the level in the candle of January the 19th. However, this does not happen. A correction starts which lasts for about two weeks (Figure 8).

This is the example of realization of the second property of horizontal levels when the price begins to correct when the support is reached.

The market reacts to the levels in this way because, firstly, some traders close the previously open sell positions, and secondly, other traders open pullback positions at such levels on smaller timeframes or place buy limit pending orders to catch minor movements against the main trend.

Such actions affect the change in the balance between buyers and sellers and cause the price movements you see on the chart.

The price was in correction for a while, but the trend did not change, as the resistance levels were not updated. Each new maximum was lower or equal to the previous one, the trend continued.

On February the 2nd there was a support level breakout, which coincided with the level plotted in accordance with price movements in December. There is a market reversal from the bottom-up and the bull candle closing forms the support level.

The price overcame it and moved lower, that is, not always a market reversal around the levels can take place or a flat is formed. If the trend is strong enough, it can continue despite reaching the level (Figure 9).

In this case the pullback from the level will be insignificant and it can be visible only on smaller timeframes.

The primary targets often coincide with the levels you see on the chart. Therefore, I recommend at least in part to fix the positions around important levels. Otherwise, there is a probability that you will have to outsit a correction, which often begins around the horizontal levels.

EURUSD. Examples of the second property implementation in the FOREX market. Pullback

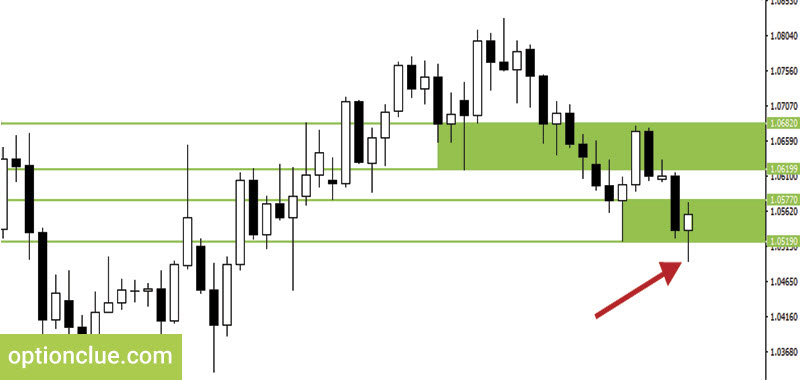

Let’s analyze one more example. It’s the EURUSD currency pair, the Daily time frame. After a long-term bull trend the support level was formed, the lower border of which was 1.0619, the upper border was 1.0682.

The market broke through this level on February the 13th. The bear candle was closed below its lower border. As a result, the bear trend developed after its closing (Figure 10).

Since then the price continues to fall, but after this the correction starts, which lasts for two days. During the correction a new support level is formed, the lower border of which is 1.0519 and the upper border is 1.0577. This level is plotted on the grounds of two bear and two bull candles.

After the completion of the bull correction the trend remains bearish and a downward movement arises again. The market is declining for three days and the price cannot overcome the support minimums. The market cannot settle around the level and the buyers push the price up. As a result, the candle is closed within the borders of the level (Figure 11).

After that the market is fluctuating for 3 days almost on the same point and the support is updated. The lower border of the new horizontal level is at 1.0494 and the upper one is 1.0534. After the correction has been completed, the price is testing a new support level but cannot overcome it and the euro starts rising again.

The resistance level has also been updated by this moment. Its upper border was formed after the correction and continuation of the impulse wave completion and this range is from 1.0631 to 1.0587. This level, as the previously support one, is being tested during two days that is on March the 3d and the 4th, but the price cannot overcome it. Once again, there is a realization of the second property of horizontal levels (Figure 12).

As we can see from the examples considered above, the market often reacts to important levels. It can move away from them, stop or correct temporarily.

Around important levels some traders fix previously open positions, other traders open positions against the main trend. Anyway, it is important to understand that the market can start to correct near the important price levels. Therefore, around the nearest levels, you can fix the positions in part and use the levels as targets when entering the market or look for market entry points on a small timeframe when the price starts to bounce off the larger level.

Traders often make the process of plotting horizontal support and resistance levels much more difficult than it needs to be. Some of them tend to complicate this task by plotting unnecessary levels confusing them in determining further price movements in directed trading. After getting the Levels indicator you won’t have any difficulty in this due to the simplicity of its use. It can help not only identify price zones where the market movement can slow down or price reversal is likely to occur but also find entry signals that appear during a deep market correction or calculate stop-loss and take-profit.

Good luck in trading!