How to Sell Puts? Risks and Insights into Selling Put Options Strategy.

Contents

- The nature of writing put options

- Buying stocks vs selling put strategy performance

- Conclusions on selling a put option

The Nature of Writing Put Options

In this article we will discuss the option strategy of selling a put option.

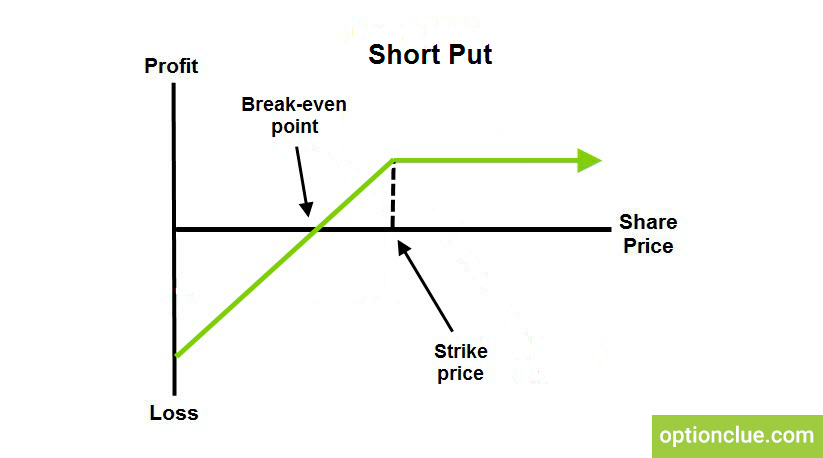

Writing or selling a put option is the opposite of buying a put, and the profit and loss payoff is very similar to that of an uncovered call strategy. The strategy of selling a put can also be called a ‘naked put’. Just like selling a call, selling a put generates limited gains with potentially unlimited losses. This is well illustrated by the profit/loss curve of a short put.

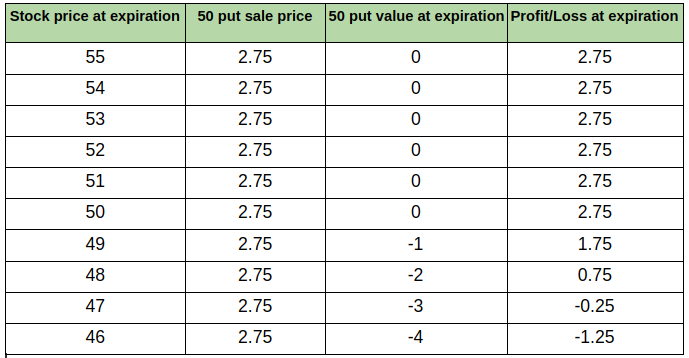

Let us take an example. Suppose we are waiting for a medium-term neutral-to-bullish price action of ABC stock, which is trading at $51.5 at the moment. To make a profit we decided to sell the put option with 95 days till expiration for $2.75 with the strike price of $50.

The table below clearly shows the potential gains and losses that can be obtained by selling a put option on the expiration date. Our break-even point with a $50 strike and $2.75 premium is $47,25.

Writing Put option. Profit / Loss table

A short put, in terms of risk and reward, as well as transactions with it, is closely related to a short call option. With regard to put option contracts, it is also common practice to sell out-of-the-money options trading with a small premium in the hope that the statistics will not fail and prices will not fall by 15-20% in a short time.

Even though the stock market is almost constantly rising, this is where sharp price drops occur. Stocks tend to fall much faster than they go up. Even though put options are much better at maintaining time value than call options, premiums on out-of-the-money options, in case they expire soon, are insufficient to cover the risk accepted.

Anyway, pragmatic investors are not really interested in such operations. A short put option can also be transformed into a less risky strategy of cash-secured put, which requires cash to be maintained in the account when selling puts, so that a trader has enough funds to buy the underlying stock if it is assigned.

Selling put options that have a fairly good premium is often considered as an option to enter the market to have a long position in the future. That’s what they say, although the price of the underlying asset has bottomed, it can remain at the low price levels for some time. The fear of being late if prices go up and uncertainty about that prices may fluctuate in a price range for a while or even fall, usually prompts to sell a put option, which is used as an alternative to a long position.

Further developments suggest two scenarios:

- the option will expire worthless for holders, which will bring the option seller a limited profit

- the option will be exercised and thus it is required to go long on the underlying asset (stock or futures)

In both scenarios, an investor would rather get some time to think over, and at the same time not miss profitable opportunities. In most cases, this approach is successful. Moreover, the likelihood of getting a good position increases sharply if the options are sold when volatility is high. In such cases, traders are likely to use at-the-money options or even options that are slightly in-the-money.

Buying Stocks vs Selling Put Strategy Performance

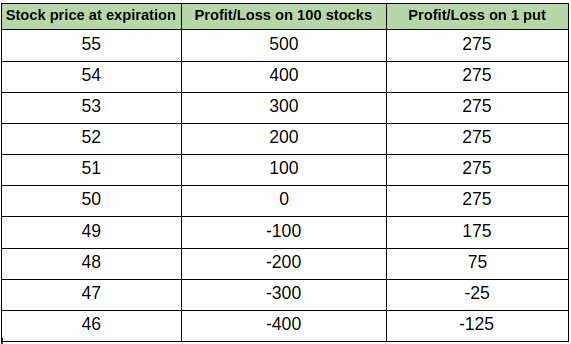

To assess the attractiveness of using a short put instead of a long position on the underlying asset, let us refer to the table below, which shows the gains and losses when buying 100 shares of ABC stock at $50 compared with selling 1 ABC 50 put option with 95 days till expiration for $2.75.

Long Stock vs Short Put. Profit / Loss table

The calculations are more than impressive since they demonstrate the benefits of using a put option. The impression will get bigger if we turn to the stock price chart again. You know, when it comes to short-term trades, it is much easier to work with the underlying asset. However, the option looks great in case of positional trading. You should also remember that the margin requirements for options trading are 2.5 times less than when using stocks. Actually, we can either buy 200 shares or sell 5 option contracts for the same amount.

Based on the data in the table, it is easy to calculate that with a share price of $54, the profit from buying 200 securities will be $800, whereas the profit from selling an uncovered put option will be $1375. The benefit with this outcome increases by 4.5 times when trading options, not stocks. When the stock is traded at the other price levels, the results will be different, but still in favor of options. The price of this magnificence is determined by the need to hold the position for the entire period up to the expiration date of options contracts.

Sometimes options positions are in favor given the assumption that there are currently no funds, but the portfolio manager knows that after a while they will definitely appear. In this case, he has a reason to sell put options with those series that their expiration coincides with the period when the needed funds may appear. For these purposes, often are used options that are in-the-money and even deep-in-the-money.

Conclusions on Selling a Put Option

In general, selling a put option is one of the most popular options strategies as it generates a stable cash flow when collecting a premium. So, when the price of an underlying asset has been in a certain market condition and can start rising in the near-term (e.g. when the price is around the nearest support level) and the expected premium to be collected is rather high, experienced options traders can run an uncovered put strategy. Uncovered short puts are frequently described as “naked short puts”, since option writers typically want to avoid a long stock position. As a result, sellers may close their puts which are in-the-money as expiration approaches. They can be closed with a “buy to close” order.

A less risky options trading strategy, which also involves selling a put option, is a cash-secured put, which implies the obligation for a trader to own a stock if the option is assigned. This strategy if started can be further transformed into a covered strangle options strategy.