General Principles of Forming and Managing Option Strategies. LEAPS Options.

Contents

- Main issues when forming an option strategy.

- Reward/Risk analysis when running options strategies.

- Benefit-generating parameters in options strategies

- Options strategies management. Risk assessment.

- LEAPS Options.

Main Issues when Forming an Option Strategy

In this article, we will discuss general principles of forming options strategies and managing them. We will also examine benefit-generating parameters when running options and explore the differences of LEAPS options.

General principles of forming and managing positions require a predetermined and clearly defined goal. It is not necessarily complicated and with a set of intricate conditions. When it comes to the need to develop a concept and a certain philosophy, we emphasize that all this can be done in an extremely simple and understandable way. In the investment management area, there is no fundamental difference between solving complex and very simple problems, which most people solve every day and quite successfully, allowing them to consider themselves competent specialists in this area. You will see this as soon as we look at the simplest strategies.

The formation of an option strategy or another combination, which includes a set of strategies or the possibility of partition into them, is due to the following main issues solution:

- What tasks are assigned?

- What did the market analysis of a particular stock lead to?

- What are the features of the identified options?

Usually, when choosing options, traders are guided by the analysis that evaluates the reward/risk ratio from different perspectives, depending on the underlying price, time, volatility, etc. Different curves can also be taken into account, not just the one that shows the winnings. For example, by delta, gamma, etc.

Reward/Risk Analysis when Running Options Strategies

Ultimately, the choice is based on reward/risk criteria. Particular features and differences depend largely on how a person or a company (where eventually decisions are also made by individuals) assesses the risk and how well they are aware of where to look for it. This is especially relevant for options trading, where in many cases the risk can exist and even begin to appear in some way, but it is not always easy to identify it. And often the opposite happens: the risk is overestimated, and the imaginary risk is assessed as real.

Naturally, setting the problem is always the first step. It is certainly the most important step under any circumstances and in achieving any goals. The need for analysis after setting the problem is clear and logically follows from the need to process the data that is available or obtained after selecting.

Position management directly follows from the task and determines how it will be implemented. That is, which strategy will be used, which risks are taken into account, and which are ignored or simply forgotten.

Success in trading depends on how well the analysis was carried out, how correctly the strategy or combination (which is based, largely, on the market development prediction) was built.

Benefit-generating Parameters in Options Strategies

The complexity of management, as well as the availability of adjusting positions as the situation develops till the combination completely changes directly depends on the performance of preliminary actions: defining goals (setting the task), analyzing and identifying possible benefits or losses by various parameters.

The position management efficiency is directly related to how time and price changes over time are interpreted. This is the cornerstone of options trading. When dealing with securities or futures, time is often ignored, or has too general focus, which, at best, is described in imprecise formulations: “a little more”, “a little less”, “some time”. When trading with these traditional assets, time usually occurs at the moment of summing up the results, final or intermediate.

In the options market, things look completely different. Many strategies initially focus on the time factor as one of the main sources of income. Time is a component of any model that allows evaluating an option premium.

We can assume that other variables included in the initial parameters of the option model also make it possible to use them as the main elements on which the strategy is built. That is, the benefit from the strategy applied can be determined through the characteristic indicators, which are a direct consequence of the initial components’ impact. This is just our hypothesis so far, but later it will become clear that in reality, that’s the way it is.

Typically, a single strategy involves the use of multiple benefit-generating parameters. Accordingly, in some cases, but not always, it becomes possible to eliminate the risk caused by individual influences. This largely depends on the extent to which the influence factor, the impact of which must be eliminated (loss generator), is related to the factors that were used as the main benchmarks (income generators).

Options Strategies Management. Risk Assessment.

Thus, the management of an option strategy lies in following the chosen technique, tuned to benefiting from certain factors, and eliminating the emerging risks that are excessive if they were not previously reflected in the strategy. As a rule, excess risk actually arises and is apparent in the fact that income generators enter a critical area, where usually the profit/loss curve is in a negative area and shows the appearance of losses in the future. In some cases, excess risk can be determined in other ways, without using any graphs. For example, it can be the possibility of early exercise of an option (if there are short options). The realization of this opportunity is due to a gradual increase in risk to the value at which it can be considered excessive.

When the excessive risk arises, traders take concrete steps to reduce it to normal levels. It is clear that there is always an ordinary risk. It would be impossible to take a profit without it. It is such because it exceeds the value that was naturally determined by the profit and loss values.

By assessing risk in this way, there is no difficulty in tracking it, just like the entire position as a whole. It is enough to simply determine the cut-off factors when the risk becomes excessive or may become such in the future, and draw up a plan of action that will be carried out when this happens. This plan will not always be implemented exactly as it was originally drawn up. This is especially true for the positions that get excessive risk sooner or later than expected. Therefore, it is necessarily corrected when necessary. But this is quite simple when there are preliminary drafts or a plan of action directing you to base your choice on some specific points.

The presented general theory on the strategies formation and management is not abstract at all. Conversely, everything is quite concrete and of practical importance, you just have to go directly to the analysis of the chosen strategies or option positions. Considering them from various aspects (the underlying price, volatility, time, etc.) makes it possible to assess how successful the form of an option combination can be, and from where you can expect any problems.

Let’s say the above-mentioned approach is applied to identifying and tracking risk. In practice, all this is organized very simply. The first signal is when any factor (for example, the price of the underlying – the most common case) targets the value, where the position has a zero result. These points are called the break-even point. The second signal is usually at the discretion of a trader. The third one is trading at parity or very close to it, which can lead to an early assignment of an option.

For each signal, the actions to be taken are determined. For example, the analysis of the situation and position or its adjustment, which lies in selling some contracts, while others are sold. These are the general management rules that are the basis for creating a money management approach. They define the general principles that trigger market transactions. It is almost impossible to predict in advance what kind of trade will be placed at a given point in time, what and how will need to be done – everything directly depends on the strategies used.

Now, after studying the main factors influencing the option premium, the characteristics by which the profitability and riskiness of a position are determined, as well as approaches to solving practical tasks in the market, one should consider particular options strategies.

LEAPS Options

LEAPS – Long-term Equity Anticipation Securities – listed call and put options, issued with a maturity of two years and more. When time passes and they begin to meet the criterion of “9 months”, they are transformed, renamed into ordinary options.

The most significant feature is the weak theta impact, which puts the LEAPS options very close to the underlying in terms of its characteristics. That is, in terms of the alternative, the difference between investments in security and an option is not so significant if we analyze the profit/loss curve. Naturally, this situation is valid only in the short-term period, but it is nevertheless much longer than the normal lifetime of listed options.

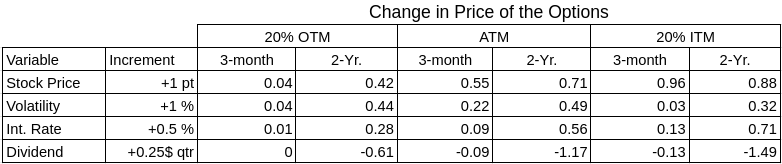

Long-term options have much time value. They also differ significantly in their degree of responsiveness to the main impacts that typically have a strong effect on commonly traded options. The table below gives an idea of how long-term and standard options act.

The table below shows how much the indicators of the main parameters (the price of the underlying instrument, volatility, interest rate, dividend) differ between LEAPS and the standard 3-month call options. The comparison is made for out-of-the-money, at-the-money, and in-the-money options.

Comparison Table. LEAPS vs Short-Term Calls.

These options are used by arbitrageurs, hedgers, as well as investors who use them as a substitute for a position in the underlying, that is, for speculation. Note that these options are especially widely used to form portfolios made up of risky investments, that is, in companies that do not yet have adequate stability and are subject to strong fluctuations. Long-term options find an extremely important application in technologies such as “buying volatility.”

One should bear in mind, however, that the loss of time value for at-the-money (ATM) LEAPS is small. Time value “expiration” begins to progress after 6 months and is especially rapid in the last 3 months. At the same time, out-of-the-money (OTM) options have a more smoothed time value graph. The intervals when this effect begins to change abruptly, are approximately determined by the following periods: 24-18-12-9 months.

The delta of LEAPS options is significantly smoother in comparison with short-term ones.