How to Buy and Sell Top Stock Options? Short Vertical Spread.

Choosing of assets for trading can take a long time, especially when it comes to options trading. Keeping this in mind, we’ve created the options screener that saves your time and helps find new trading ideas based on a simple principle – buying cheap options or selling expensive ones.

In this article we’ll learn how to trade stock options and discuss one of the vertical spread options trading strategy. The vertical spread is the most basic spread we’ll talk about and it’s the building block of the majority of more complex option spreads. Understanding vertical spreads is going to be key to getting a powerful tool when trading options.

Contents

- What is a vertical spread option?

- How to trade stock options? Short vertical spread trading strategy

- Scenarios of vertical spread realization

- Vertical spread break-even point

- Short vertical spread example

What Is a Vertical Spread Option?

A vertical spread is simply the combination of a long option and a short option at different strikes but with the same expiration date. So, when you trade a vertical spread you’re simply trading two options at once. However, we like to think of it as one trade and the trade is collectively called a vertical spread.

How to Trade Stock Options? Short Vertical Spread Trading Strategy

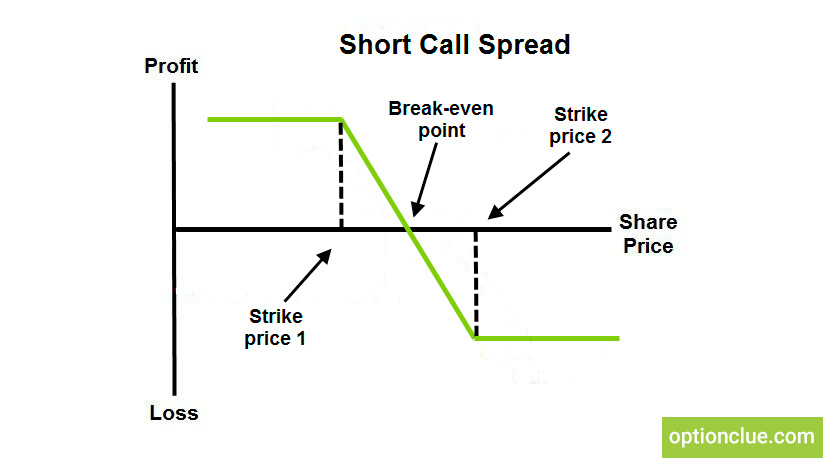

We can buy a vertical spread or sell it. Let’s talk about selling a vertical spread (Figure 1). Earlier we talked about how you can sell options to collect time premium because we know that if an option is out-of-the-money at the expiration date it will be worthless.

Let’s take an example. XYZ stock is trading at 98 dollars per share and we don’t know where the stock will go but we would like to bet that it won’t go over 100 dollars per share. You could sell the 110 strike call option for let’s say $3.5 and if this option remains out-of-the-money until the expiration date meaning that the stock stays anywhere below 110, then we would get to keep this entire credit received as profit.

It makes a lot of sense. However, there are a few problems with this that keeps the majority of traders away from selling premium:

- Undefined risk: We don’t know our maximum risk since XYZ could skyrocket and blew right through the 110 strike price

- Large capital requirement: The capital requirement to sell this option could be very large

What can we do to combat these two problems? In addition to selling the 110 strike call for $3.5 we could also simultaneously buy the 115 strike call for let’s say $1.30. This is called a short vertical spread. By trading a vertical spread rather than selling just a naked option we are able to get time value but with very little capital and also with defined risk.

Scenarios of Vertical Spread Realization

Let’s look at how exactly this trade works. For better financial results you can’t do without real options analysis.

Scenario 1. XYZ stays below $110 per share. As you know, if an option is out-of-the-money at the expiration date it will have no value. And if the stock is below 110 then it means both of our options that make up our vertical spread (Sell 110 Call and Buy 115 Call) would be classified as out-of-the-money and are worthless. That means we made $350 (100*$3.5) on the short strike call but we lost $130 (100*$1.30) on the long 115 strike call. So our net profit is $220 ($350-$130).

We don’t really care about each individual leg of the trade. All we care about is our net profit of the vertical spread as a whole. Once you understand vertical spreads and start trading them you probably won’t even look at the prices of each individual option. You can simply monitor the price of the entire spread itself in the trading platform.

Scenario 2. Let’s check out another scenario. Suppose XYZ stock decides to rise and ends up at $140 per share. Our short 110-strike call that we sold for $3.5 is now $30 ($140-$110) in-the-money. If we sold this call naked that means we would lose $2,650 ($350-$3,000). Fortunately, we traded a vertical spread instead of selling the naked call. Our 115 strike call we bought for $1.30 is now $2.5 ($140-$115) in-the-money. Even though we lost $2,650 on the short call, we get $2370 ($2500-$130) on the long call. So our net loss is just $280 ($2370-$2650).

Now again we aren’t really concerned about each individual leg of the trade. The loss of $280 will be the same whether the stock is at $140 or $190 or any other number above $115 per share. If we are above $115 per share the net price of the vertical spread will be worth the difference between the strike prices we chose when we open the position.

The difference between the strikes on this example is $5 ($115-$110). The difference between entry prices is $2.2 ($3.5-$1.3) So in any situation, when the stock is above the discussed marks we sell the spread at $220 and close it at $500, then we lose the amount of $280, that is the maximum loss for us.

Scenario 3. What if the stock ends up between our short and long strikes of 110 and 115? In this case the 115 strike call will be out-of-the-money and the 110 strike call will be in-the-money. So the 115 call will be worthless and the 110 strike call will be worth the difference between the stock price and the strike price. If the stock rises to $111, for example, then the vertical spread as a whole will be worth $1 ($111-$110). And, for instance, if we sold at $2.20 ($3.5-$1.3) and closed it at $1 then we made $120 ($220-$100).

Vertical Spread Break-Even Point

Where is the break-even point? We sold this vertical spread for $2.20.

Our breakeven point is $112.20 ($2.20 + short strike of $110). So if the stock is anywhere below $112.20 it will make money and if it’s anywhere above $112.20 we’re going to lose money.

When selling a vertical spread our maximum profit is simply the net price that we sell the vertical spread. In this case, we sold the vertical spread for a net price of $220 so our maximum potential profit is $220. As you remember our maximum loss in the example is $280.

This option strategy has the disadvantage, which lies in the low reward-risk that forces an investor to be right in more than 50% of trades.

Short Vertical Spread Example

Let’s take a few real examples in thinkorswim trading platform. The cool thing about trading spreads is that the technology is advanced enough to allow us to enter the multiple options that make up the spread as one order. So we’re looking at the option chain of Apple and to construct this option combination we should click sell vertical and choose the out-of-the-money call option (Figure 2). We sell vertical spread with strikes 165 and 170.

Our example involves selling a vertical call spread where we would want the stock to stay below our short call, that is the price at 165 (Figure 3) so we can keep the credit we received for the trade.

We could also do this with the put. So we would sell the put and then buy further out-of-the-money put as protection. In this case we would want the stock to stay above our short put strike so a short put vertical would be a bullish to neutral trade and a short call vertical would be a bearish to neutral trade.

The key here to remember is that when selling a vertical spread whether it’s calls or puts we want to make sure that we are selling the closer to the money more expensive option and we are buying the further out-of-the-money cheaper option.

I hope you know now how to choose best stock options to buy today and any other day!

Good luck in trading!