Best Option Strategy for Day Trading. Long Vertical Spread.

Choosing of assets for trading can take a long time, especially when it comes to options trading. Keeping this in mind, we’ve created the options screener that saves your time and helps find new trading ideas based on a simple principle – buying cheap options or selling expensive ones.

In this article we’ll discuss one of the vertical spread options trading strategy. The vertical spread is the most basic spread we’ll talk about and it’s the building block of the majority of more complex option spreads. Understanding vertical spreads is going to be key to getting a powerful tool when trading options.

Contents

- The basis for a long vertical spread. Call option example

- What is a call vertical spread?

- Comparison of a call vertical spread and single option position

- Conclusions on a long vertical spread

The Basis for a Long Vertical Spread. Call Option Example

Most option traders start out buying options because it’s simple. If you think Facebook stock will go up you could buy a call and if you think Facebook stock will go down you could choose best put options to buy. This sounds great because you can trade the options with much less capital than if you were to simply trade the stock.

Let’s take an example of top option stocks. First, let’s look at the option chain on Apple stock which is currently trading at $156 per share. Suppose you are bullish on the stock and you’re looking to buy a call option. If you, for example, were to buy the 150 strike call option this would cost you 850 dollars (100*$8.50) and you’re hoping that the price of Apple will rise, so you can make money (Figure 1).

But this is not a very good trading strategy because it puts time decay against you and not only does the price of Apple has to move up a significant amount for you to break-even point.

In this case your breakeven point is at $158.50 ($150 + $8.50) (Figure 2) that is a $2.5 above the current stock price and if Apple sits still and trades sideways you’re screwed because the option you’ve just bought will decay every day.

What Is a Call Vertical Spread?

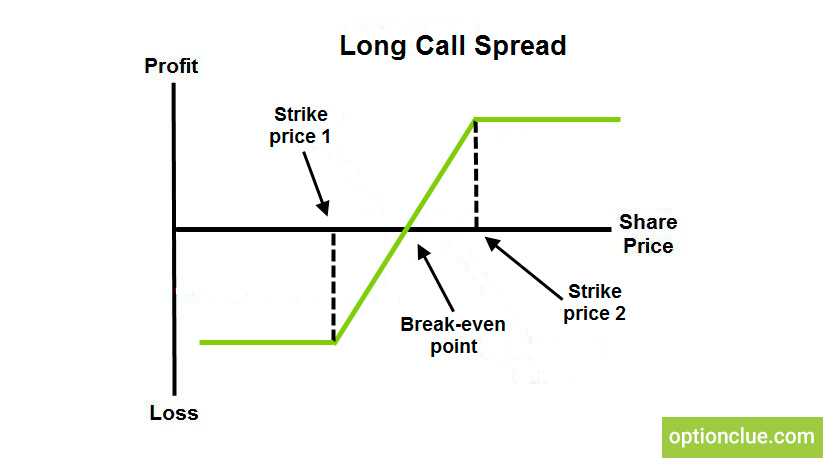

There is a better way that allows you to make a directional bet on the stock but without having to buy a naked option or put up tons of capital to trade the stock itself. Moreover, we’re actually going to eliminate time decay altogether.

Instead of just buying the 150 strike call option we’re going to do something a little bit different. We’re going to buy this option but we’re also going to simultaneously sell a cheaper out-of-the-money option to reduce our cost. So in this case we’re going to buy the 150 strike call for $850 but we’re also going to sell the 160 strike call for $314. This is called buying a vertical spread (Figure 3). This knocks our cost down and our net price is now just $536.

I’d like to show you how to pull up in order to buy a vertical spread in the thinkorswim trading platform. All you’re going to do is to go to the option chain, choose the option you want to buy and then click buy vertical.

All you have to do further is to adjust your strike selection. I personally prefer to buy one strike in-the-money and sell one strike out-of-the-money when trading this strategy (Figure 4).

By trading a vertical spread rather than simply buying a single option we’re able to significantly reduce the cost of our trade which improves our breakeven (Figure 5) on the trade and our probability of success. The net price we pay for this vertical spread is $5.36, so our breakeven point is at $155.36 per share.

Comparison of a Call Vertical Spread and Single Option Position

To better understand how this works let’s compare two strategies in three different scenarios. For better financial results you can’t do without real options analysis.

Scenario 1. Apple stock price has moved up and at the expiration date it’s at $159.50 per share. First let’s look at the vertical spread. The short 160 call that you sold for $314 would now be worthless because it’s out-of-the-money. So you made $314 on the short call. And the long 150 call you bought for $850 is now $9.50 ($159.50-$150.0) in-the-money, so it’s worth $9.50. So you made $100 ($950-$850) on the long 150 call. So your net profit is $414 ($314 + $100). As you remember, the net price we paid for the vertical spread was $536, so our return on capital was 77% ($414/$536). Our maximum risk was simply the net price we bought the spread that is $536.

Now let’s compare this to if we simply bought the 150 call for $8.50. With the stock at $159.50 our long call would be at $9.50 providing us with a profit of $100 so our return on capital was only 11.7% ($100/$850). Our maximum risk was $850 we paid for purchasing this stock option.

Scenario 2. Apple has mostly traded sideways and at the expiration date, the price is still at $156 per share. Looking at the vertical spread our long 150 call will now be worth $6 resulting in a loss of $250 ($850-$600) on that leg of the trade. But our short 160 call will again be worthless resulting in a profit of $314 on that leg (100*$3.14). So, our net profit is $64 ($314-$250).

Now compare that to if we simply bought the 150 call at $850 we would now be sitting on a $250 loss ($850-$600). So in the case of the vertical spread time decay was not an issue whatsoever, however, if you just bought the 150 call rather than trading the vertical spread you’re sitting on a 29% ($250/$850) loss due to time decay.

Scenario 3. We are completely wrong about the direction of Apple and the stock tanks down to $110 per share. Both of the options that make up our vertical spread are out-of-the-money and are worthless. We lost $850 on the long 150 call but we made $314 on the short call so our net loss is $562 ($850 – $314) much less than losing $850 like we would have if we were to simply buy the 150 strike call. Buying the vertical was better than buying the naked option in all three of these scenarios, but there is another scenario.

Scenario 4. Buying the naked call would have worked out better if let’s say the stock rips higher and is now at $165 per share at the expiration date.

For the vertical the 150 call we bought for $850 would now be worth $15 providing us with a profit of $650 ($1500-$850) on that leg. The short 160 call we sold at $314 would now be worth $5 resulting in a loss of $186 ($500-$314) on this leg of the trade. So our net profit is only $464 ($650-$186) as opposed to $650 ($1500-$850) if we would have just bought the call.

Conclusions on a Long Vertical Spread

So, that’s the only downfall with the vertical spread is that it has limited profit potential whereas buying the naked option allows us unlimited profit potential. But is the profit potential really unlimited? Of course not. That’s just theoretical because theoretically, a stock can go to infinity. However, look you still made a 100% return on capital on the vertical spread so what is there to be upset about.

I’m sure these three scenarios are going to happen way more often and the vertical spread will pay far more in the long run than the few times you might eventually hit a homerun with buying the naked option. In addition to the mentioned benefits, this option strategy has also the disadvantage, which lies in the low reward-risk that forces an investor to be right in more than 50% of trades.

Now to run a long vertical spread you are aware of what option to buy depending on stock price movements and you can trade no worse than an options analyst.