Best Options Trading Strategy. Introduction to Options Spreads.

Choosing of assets for trading can take a long time, especially when it comes to options trading. Keeping this in mind, we’ve created the options screener that saves your time and helps find new trading ideas based on a simple principle – buying cheap options or selling expensive ones.

In this article we will introduce the option spreads, consider their application in different option combinations, discuss their pros and cons and take simple examples with the help of thinkorswim trading platform.

Contents

What Are Option Spreads?

You already know what options are and maybe you’ve even traded some options and know what options to buy in different situations but now it’s time to learn about option spreads. Albert Einstein once said: «keep things simple, but not simpler». What he means is it’s good to keep things simple but you can’t make everything simpler than it actually is.

Sometimes there may be doubts about the feasibility of studying option spreads because they seem to be complicated at first sight.

I’m just going to keep it simple and stick to buying calls and puts. The more option strategies you know the more opportunities you can find while trading.

Let’s figure out what exactly an option spread is. It’s simply the combination of two or more options. Instead of trading one option, you’re trading a combination of options.

Buying Vertical Spread Option

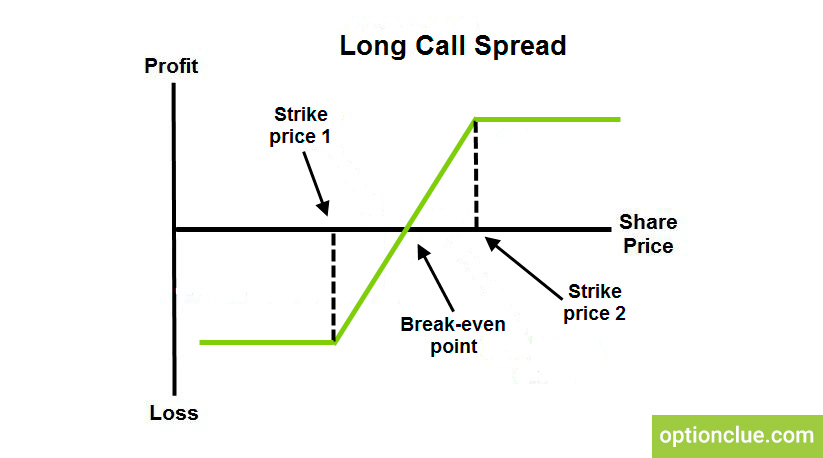

Let’s take the simplest type of option spread, for example, the vertical spread (Figure 1). This is a spread where you might buy one call and then you sell another call at a different strike price and you can also do this on the put side but we’re going to stick to calls for this example.

Figure 1. Long call spread

You might be asking if you’re buying one call and selling another call won’t they just cancel each other out. And the answer is no, they won’t cancel each other out because options at different strike prices behave differently.

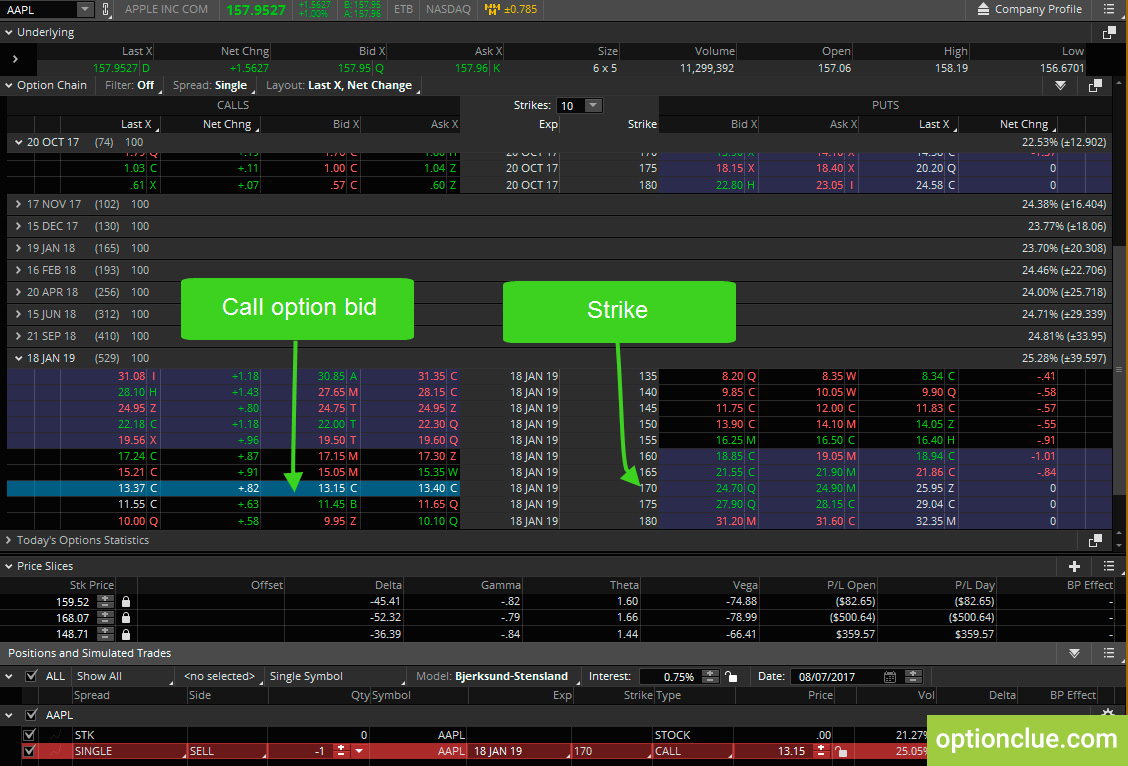

Suppose you want to make a bullish trade on Apple stock where you will profit if the stock price goes up. Most traders would simply look for best call options to buy (Figure 2) and in this case you not only need the stock to go up you need it to go up a certain amount to even break-even point.

Let’s take a look at Apple’s option chain. You can see Apple is trading at $157.8 and you think the stock is going to go up. Suppose you buy the 155 call for $7.50 that means Apple has to go to $162.50 per share just for you to breakeven (Figure 3).

There is an option strategy according to which you could buy the 155 call just like in the last example for $7.50 but this time you’ll also sell the 165 call for $3.05. So the net price you pay for the spread is $4.45 per contract (Figure 4).

You just knock $3.05 off your break-even point. Your break-even price is now $159.45 ($155+$4.45) (Figure 5).

But Apple is trading at $158.04. So you actually have shorter distance than in case of a single call option to start making money.

So you bought this call spread at $4.45 and the maximum amount you can lose on the trade is $4.45 per contract, and the maximum profit is less than loss in our case. This is why most people are reluctant to trade spreads because you cap your profit potential.

However, sometimes capping your gains in exchange for a higher probability of success will allow you to take many smaller profits that far outweigh that one home run that you hope you’ll hit. If you want higher profit potential you can simply trade more contracts and now the technology is advanced enough to allow you to trade these spreads with one order, so you don’t have to use multiple orders to trade the multiple options that make up your spread.

Selling Vertical Spread

There is another way you can use a vertical spread and in my opinion, it’s even more powerful than the first example.

Suppose, you want to sell premium to collect time decay, but you don’t have a large account and you don’t want to have undefined risk. There is a way you can do this. This time let’s go to Apple.

And we don’t know where Apple is going but we like to bet that it isn’t going to go above $170. We could place a trade where we sell the 170 strike call (Figure 6) because we know that all out-of-the-money options expire worthless, if we just sell the naked 170 call we can make $1315, but we don’t know exactly how much we can lose because the stock can go up to whatever price it wants to.

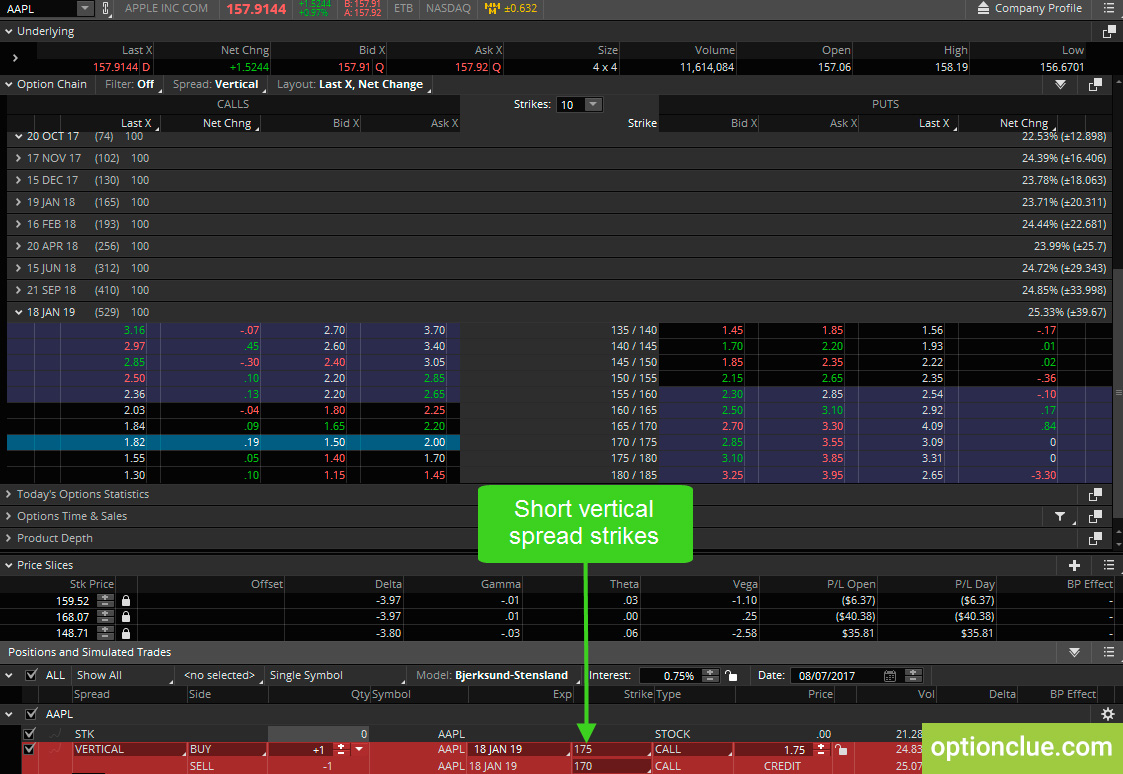

Now let’s use a vertical spread to fix this issue. In addition to selling the 170 call we’re also going to buy the 175 call. Now let’s take options with another series as an example (Figure 7).

What this does is caps our potential losses in case apple decides to fly to let’s say $190 per share. You can see we make maximum profit if Apple stays below 170 and we will lose the most if Apple goes above 175 (Figure 8).

The maximum profit is just $175, at the same time the maximum loss is $330 so the return on capital equals only 58%. But the great thing about this trade is that instead of betting where the stock will go you’re betting where the stock won’t go which is so much more consistent. Apple can go down, it can trade sideways, it can even go up a little bit, but we will still keep the entire credit if Apple is stable at $170 per share. Also you can choose whatever strikes you like to adjust your risk/reward.

After reading this article you’ll be able to find best options to trade and use them when running options spreadsd