Short Strangle. Best Options Trading Strategies.

Contents

- How to sell put and call options for income? The nature of short strangle.

- ITM and OTM options when running a short strangle

- Conclusions on selling strangle performance

How to Sell Put and Call Options for Income? The Nature of Short Strangle.

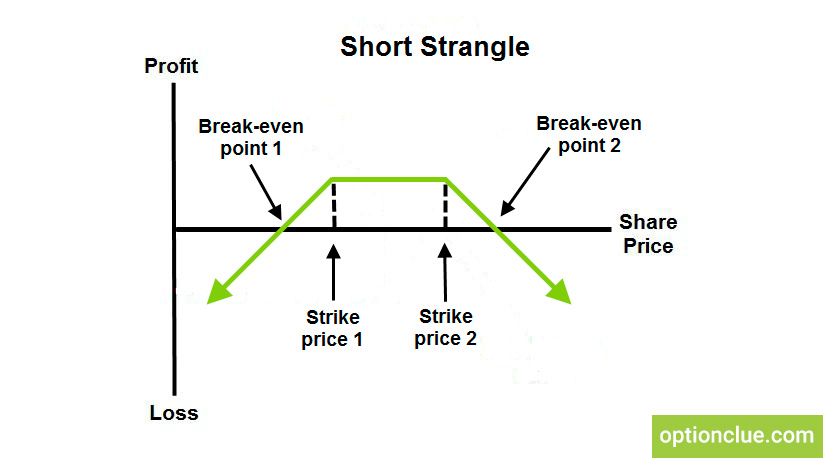

In this article we will discuss one of the most popular options strategies called strangle write or short strangle. The P/L curve of the short strangle, consisting of short calls and puts that have different strike prices, is the opposite of the P/L curve of the long strangle.

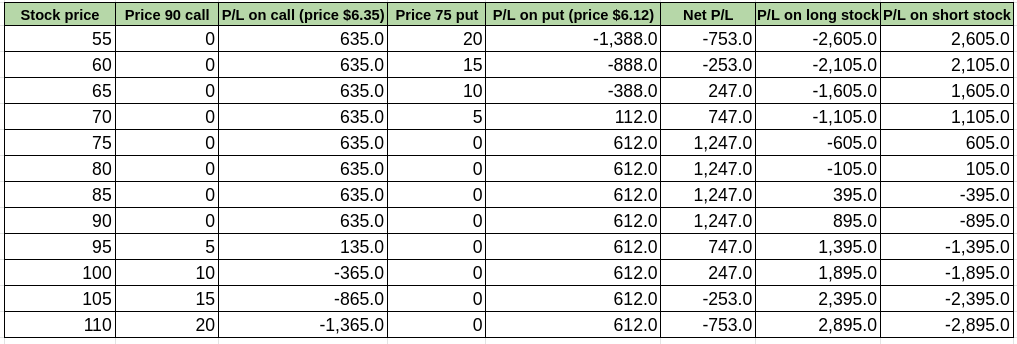

Let us take XYZ stock which is traded at $81.05 as an example. Below is a short strangle formed by options that have 87 DTE (days till expiration). To run this strategy we use a 75 put option for $6.12 and a 90 call option for $6.35. Thus, the total premium received from selling the strangle consisting of one short call and one short put is $12.47 ($6.12 + $6.35), or $1,247 per one lot. This strategy is shown in the figure below.

The table below demonstrates the values of gains and losses at the expiration date. The last two columns show the P/L of short and long stock positions of one standard lot (represents 100 shares) as an alternative to options.

A big difference between a short strangle and a straddle is that the first has significantly less risk. There is no mandatory need for an early getting rid of the strategy before the option contracts expiration date. If the underlying remains within the bounds defined by the strike prices of the options, then the best way is to do nothing. Certainly, if we observe dangerous signs indicating that one of the options may be at risk of exercise, then we should take the necessary proactive action.

Time and lower volatility compared to the moment of strategy creation are the best friends of strangle sellers. Just as with the strangle buying, its selling provides significantly more room for managing this strategy when compared with a straddle.

Bearing in mind that there is a large group of traders using single options that are deep out-of-the-money for selling, it is easy to understand that they are also active in selling strangles.

ITM and OTM Options when Running a Short Strangle

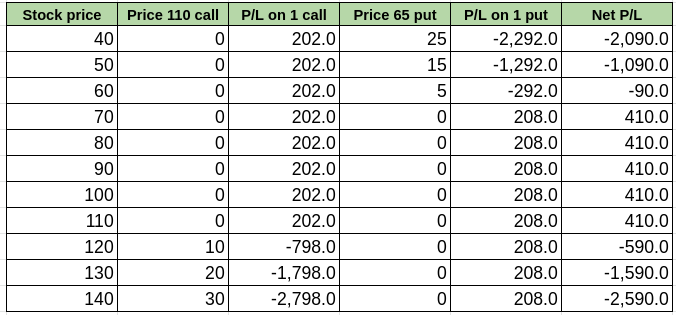

Focusing on the probability, which in mathematical calculus often shows good performance (whether this approach can be used, everyone usually decides for himself, since this question is very rhetorical), option traders are happy to sell deep out-of-the-money options. A similar approach, used in relation to our example during the given period, when XYZ stock was traded at $81.05, could probably give the following scenario when sampling among options that have 87 days till expiration: 110 calls for $2.02 and 65 put for $2.08. The results are shown in the table below.

It is clear that on one side of the scale we have a profit of $410, and on the other side, we have an unlimited loss if the price goes far beyond the price range.

A strangle can be designed either with out-of-the-money or in-the-money options. It is clear that in the second case, the premium received is more in absolute terms, since, in addition to time value, it also contains an intrinsic value. But out-of-the-money options tend to provide more time value. It is easy to see by reviewing the options for creating a strangle on any asset.

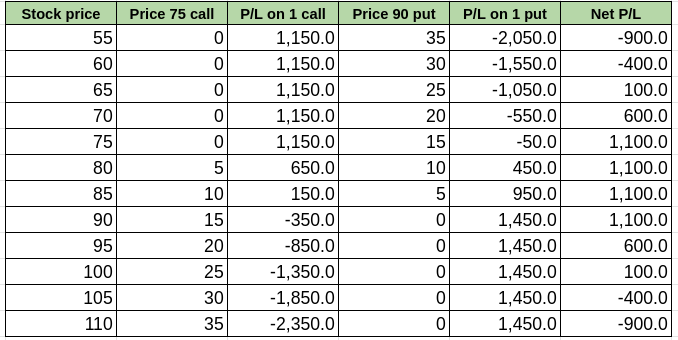

For example, for our XYZ stock which is traded at $81.05, a short strangle formed by a 90 put for $14.50 and a 75 call for $11.50 provides the account with a premium of $26.00 for a standard lot or $2,600 for each short strangle.

For in-the-money options, these calculations will differ.

It should be noted that when using in-the-money options, the motivation and expectations for future market behavior do not change. An investor still expects the underlying asset price to not leave the price range and to remain in it until the option expiration date. In our case, the stock must remain between $75 and $90, which would lead to exercise notices on both options at expiration, resulting in offsetting positions (short position at $75 and long position at $90).

This will result in a loss of $1,500 per lot, but the final result will be positive, with a maximum of $1,100 ($2,600 – $1,500) per strangle lot, that is, based on one short call and one short put. Thus, the inevitable losses in this combination are fully covered by the intrinsic value received on the trading account when selling options. You can see it from the table above.

Basically, if there are no other reasons than getting the maximum profit directly from the strategy, then using in-the-money options makes no sense, but since there are certain aspects that are of interest, we should briefly touch on them.

The first positive point with regard to benefiting extra funds from the use of in-the-money options implies the possibility of investing the premium received in the money market instruments. This is not available to everyone and largely depends on the broker, as well as on the terms of work with it. The second point is related to the possibility of giving the illusion of a large amount of cash in the account.

Managers can use this method to hide losses on a client’s trading account or to show “good results”. Since a large amount of cash on the account with the help of these or similar manipulations can be maintained for quite some time, a manager thereby gets the opportunity to obtain for himself some “delay” in identifying the real situation if his client has no deep understanding of the account reports. This gives him hope to remedy the situation without embarrassing the client. In this regard (keeping a client calm), the manager’s actions are correct. But as to how good they are in general, we should not consider them here.

Whichever way a short strangle is created, it is a strategy that generates limited gains with potentially unlimited losses. The maximum profit for the seller of the combination is exactly equal to the maximum risk of the buyer.

- Max profit OTM = put option premium + call option premium

- Max profit ITM = put option premium + call option premium – (put strike – call strike)

The break-even points are also calculated quite simply:

- Upper break-even point OTM = call strike price + call premium + put premium = call strike price + max profit OTM

- Lower break-even point OTM = put strike price – call premium – put premium = put strike price – max profit OTM

For a short strangle based on the in-the-money options, calculations look like this:

- Upper break-even point ITM = call strike price + call premium + put premium = put strike price + max profit ITM

- Lower break-even point ITM = put strike price – call premium – put premium = call strike price – max profit ITM

As well as for a long strangle, you can use any formula for the calculations. It depends entirely on your preferences.

Conclusions on Selling Strangle Performance

Analyzing the prospects of using a short strangle, it should be noted that it is necessary to manage the positions that are part of the strategy. Very often this is the key to success with the short strangle, which ultimately can be a very effective strategy. After all, it is designed to benefit from the market that is not in the upward or downward trend, and since very often prices are fluctuating in a certain price range, this strategy may seem the best.

Despite all the advantages of the short strangle, we should remember that its nature indicates that we are playing against the market. The delta performance of the options combination with 87 days till expiration formed by 90 short call and 75 short put traded on XYZ is a good way to understand this aspect.

It should be noted that as the share price goes up, delta is becoming increasingly negative, and as the price decreases, it moves to the positive area, showing an increase in the indicator under consideration. In other words, we can say figuratively that the more the price falls, the more purchases are made. And vice versa: the more the price rises, the more sales are made.