Short Strangle

Short strangle is the option strategy with limited profit potential and conditionally unlimited risk, based on the sale of volatility. Market entry is carried out when the market movement is about to slow down and the price may go into a sideways trend and / or implied volatility (IV) is extremely high. Short strangle strategy lies in the simultaneous selling call and put options on one asset with different strikes.

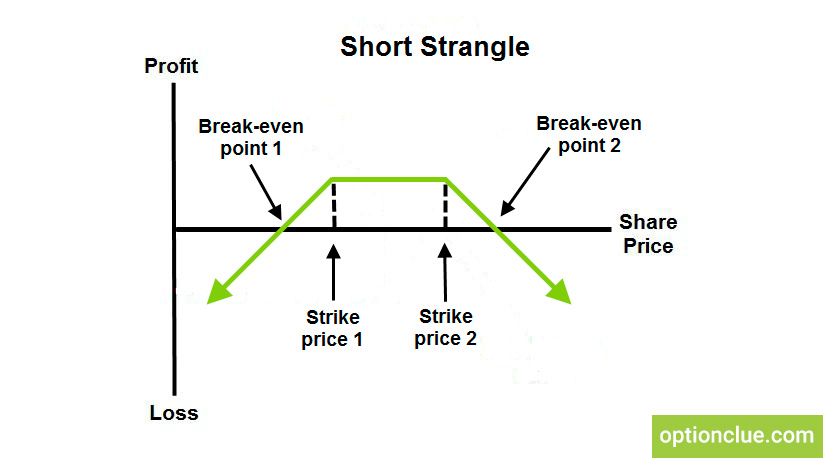

Short strangle has 2 break-even points – above the higher and below the lower strikes. Therefore, a seller expects the share price to stay in the narrow price range during required period of time, that is he is looking forward to low volatility in the underlying asset. This strategy has unlimited risk whereas profit potential is limited to the total premium received.

Suppose, we open the short strangle. The call option premium is $25 and the strike price is $100. The put option premium is $15, and its strike price is $90. The total premium is $40 ($25 + $15). The break-even point #1 is $140 ($100 + $40) and the break-even point #2 is $50 ($90 – $40). Thus, we’ll make profit that is equal to $4000 ($40 * 100) if the asset price remains in the price range from $50 to $140 and we’ll lose money if the price goes outside this area.