Long Strangle

Long strangle is the option strategy with limited risk based on volatility. The market entry is carried out when the price is in a flat or a triangle and the active market movement may start in the near future and / or implied volatility (IV) is extremely low. Long strangle strategy lies in the simultaneous buying call and put options on one asset with different strikes.

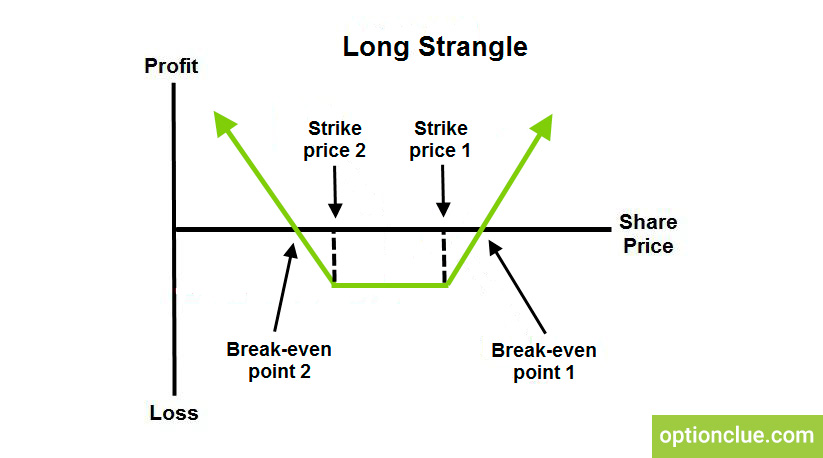

Long strangle has 2 break-even points (above the higher and below the lower strikes) therefore the buyer expects the stock price to move rapidly in any direction after long-term market flats and triangles. This is a more aggressive strategy than long straddle, but it needs less capital, since when buying a strangle, options are out-of-the money. This strategy has conditionally unlimited profit potential and limited risk equal to the premium of the purchased call and put options.

Suppose, we buy a strangle. Call option premium is $15 when the strike is $100. Put option premium is $10 when the strike is $90. Break-even point # 1 is $125 ($100 + $25) and break-even point # 2 is $65 ($90 — $25). We make profit in case of the rapid asset movement beginning from the price of $125 and higher or $65 and lower. The strategy results in losses when the price remains between strikes of options. The loss is limited to premiums.