What Stock Options to Buy? Long Options Management. Rolling.

Contents

Introduction to Options Management

The general principles for managing long option positions are the same for both put and call options and are determined by the purpose of using these options – for speculative trading or to hedge the price risk on the underlying instrument.

Speculative trading in options is mainly carried out according to two scenarios. The first one implies complete exit from a position on all contracts after receiving the required rate of profit. The second one makes it possible to cover all costs incurred at purchase and try to get even more profits. For this purpose the technique of the so-called “rolling” is used, which is often used on the options market in one modification or another.

In this case it looks like this: part or all of the option contracts are closed and simultaneously new contracts are opened, which have a higher/lower strike price of call/put than the previously used. At the same time, new investments are made only from income. Trading operations are made so as to get not only a full cost recovery, but also some profit, which is invested in the purchase of new option contracts. In other words, investments in the “rolling” technique do not use new investment resources.

Let’s take an example. Suppose the initial position of 10 2-month 65 call options on ХYZ is worth $1.5, while ХYZ was trading at $50. After the underlying increased to $60, the call option price became $5. At the same time, as you can see, a 70 call of the same series is worth $2.5. Expecting a further rise in the price of ХYZ, which makes it possible to expect, reaching, say, 65-67 price levels, it is logical to hope to make more profits with the same instruments. However, there are concerns that this may not happen.

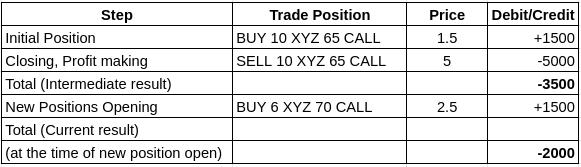

To eliminate uncertainty regarding the return of investments which are currently profitable, it is possible to sell (close) some or all of the contracts and buy new contracts at a different strike price. For example, adjusting the position on options on ХYZ (we are talking about benefiting from the price change of ХYZ through options, not from the options trading itself) may be as follows (the minus sign indicates the operation is credited, which indicates the inflow of funds, and if they remain in the account, it is a profit):

Options management. Example.

In the example above, $1,500 was returned in full, plus $3,500 in revenue (excluding commissions). By investing $ 1,500 of the received profit (exactly the same amount as was invested initially) again in the option positions of the same security, we thereby get one of the classic ways of “rolling”. The result is obvious – the paper profit is received in the account and becomes real, and the original amount is reinvested. The overall result cannot be negative, since in any case, 2,000 will still be in the form of profits deposited into the account. This allows you to stay in position more safely and not make impulsive, unproductive actions.

Options in terms of the number of closed as well as newly opened positions may be different. It all depends on the assessment of future price movements, as well as on what policy the investor is inclined to pursue. For example, not all option contracts can be closed, but only some of them. Let’s say 3 or 4, which is enough to ensure the return on investment. In this case, new positions may no longer be opened if the investor tends to use previously opened contracts to generate profit if the trend continues to develop.

Sometimes such actions (“rolling”) are called adjustment of option positions. But this term is most often used regarding operations with short positions.

Ratio Reverse Technique

Covering price risks using long option contracts implies more pragmatic actions with options after the combination reaches those parameters that are target for it. The combination is not able to generate a profit greater than that which is observed at the moment and can actually be obtained if all positions are closed immediately. Alternatively, the rate of profit growth has decreased and does not meet the requirements that the investor has for the combination.

The simplest thing to do now is to close all positions that form a combination. All option contracts are closed and the investor proceeds to create new positions. Often these actions can be the most effective, as it is not always possible to get more positive results in addition to those already achieved.

Remaining an option position in the hope of a price reversal is not always wise, although it is quite possible. Here, the investor should be aware that if, for example, coverage was carried out by buying a short position in a stock, then leaving a long call option can lead to incurring additional losses if the stock falls even lower. The same applies to the use of put options in trading with long positions in the underlying.

We should note that other options are sometimes possible. Usually they are associated with some kind of activities that provide additional benefits. True, most often it is only assumed and unattainable in reality. Thus, using a long option position as a hedge, an investor may find that it is promising to transform it into a spread. The spread can be vertical, horizontal or diagonal. In other words, if an option remains in the portfolio, the use of which has already made it possible to achieve the target, then it can be used in other option strategies.

Managing a long option position in case of false prediction is simple enough. It must be held exactly as long as there is a need for it as a hedging tool. To close the option position with a profit when there is a loss on the stock or futures may be a very bad decision. This is usually done in the hope that the underlying price trend will change its direction and the position will be closed at an affordable price. Generally, this is not forbidden and may well be justified, but in real trading you can hardly be sure that the price will definitely move in the expected direction.

If we follow the idea of using deep-in-the-money options, then the maximum loss we can suffer in the combination is exactly equal to the time value, plus the commission costs. The profit, however, is theoretically unlimited. It is especially pleasant that such combinations allow an investor to tolerate short-term price fluctuations more calmly and have more time to make decisions. Deep-in-the-money options sometimes provide significant benefits, especially in cases where the investor has concluded that he was wrong and that he should have taken an oppositely directed position. Thus, the use of ITM options has a number of advantages that cannot be reached with other options. Anyway, the effect of the latter will be weaker.

The technique presented here is so simple and accessible that it is difficult to declare it an innovation in investment management. Nevertheless, the technique is so important that it makes sense to discuss it as a separate, independent element of trading on the options market, giving it a definition and its own name. According to the possibilities it offers, this trading technique is called Ratio reverse. The description below will make it clear.

Its nature, as mentioned before, is simple. When the price of a protective option that was bought to cover the price risk increases due to the directly opposite market expectations (losses on the underlying asset occur), it is sold, and new options are purchased with the money gained, but their strike price is closest to the current price of the underlying asset. Buying more option contracts provides the ability to close previously open positions in the underlying and open oppositely directed options through execution.

The loss from this long option position adjustment is exactly equal to the balance of time value (included in the premium), the cost of the bid ask spread, and commissions. It is clear that the more deep-in-the-money the option contracts involved in trading, the less inevitable losses and the greater the effect of actions according to this algorithm. In other words, the closer the options used are to parity, the greater the effect.

When can this technique give better results than simply closing all positions? When there are reasons for a complete change of opinion about the market, the only right thing to do is to take a position in the opposite direction.

Selling an option at a profit and then buying new option contracts with the money gained is successful only if all options used in trading are in-the-money and are traded at or close to parity. Otherwise, unjustified losses will inevitably occur, which are associated with the payment of an excess amount of time value included in the premium of options purchased. However, the contracts to be purchased may not necessarily be of the same series. It often makes sense to start new options that have less time to expiration.

It is also extremely important to expect the situation to develop in a direction completely opposite to earlier predictions. That is, in a direction that brings gains on hedging option positions, which are now considered protective options, and losses on underlying.

Thus, basically everything is determined by the parity of the option contracts. For this reason, actions are possible only in two cases: all options used in trading are deep-in-the-money or there are just a few days till the expiration date of the purchased options, when the losses associated with the need to pay the time value become minimal. In this case, the basic rule applies: debit and credit must be equivalent, that is, the amount received from selling options should not be less than the costs associated with the purchase.

Usually, this technique becomes profitable if previously purchased deep-in-the-money options have risen in price by at least 2 times, and at-the-money options – by 2.5 – 3 times.

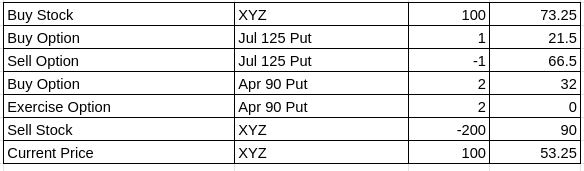

The example below demonstrates quite well all the actions when the ratio reverse technique is applied. Let’s consider it.

Suppose we buy 100 XYZ stocks for $73.25 Then, when its price increased (at first, for some reasons, the options were not used), 125 put was purchased for $21.5. Other options were also used in the combination, but in this case it does not matter. After the price decreased, it became clear that there would be no rapid upward movement, and the perspective of effective cash management can be reached if we take a short position in the stock. The put option was bought when prices were at the top.

So, what are our actions when the next option series are about to expire and what makes it possible to buy options with minimal costs? The put option was sold in the market (at 125 strike), and with the money made from the sale, at the same time twice as many April put options were bought with a strike price of $90. These options were exercised, which ensured short positions at $90. One lot closed the long position on XYZ, and 100 shares were in shorts. The list of trades is given below. The last line is not a deal, but shows the current situation.

Ratio reverse example.

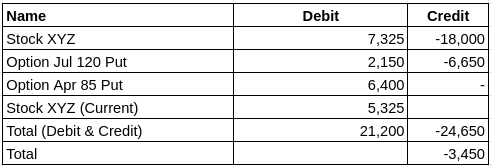

After restructuring the strategy for hedging a long stock position with a long deep-in-the-money put, you can analyze the results. Calculating debit and credit balances with the intention to liquidate recently opened short positions in stocks gives the following picture.

Ratio reverse. Debit / Credit calculations.

All actions related to the ratio reverse technique were performed around the price indicated as the current one. Now the current profit is $3,450 ($24,650-$21,200). However, in some cases, such actions make a lot of sense, since the deliberate refusal to make some of the profits is recovered from other sources. For example, through options writing, which provides a transformation of the existing position into one of the strategies aimed at benefiting from the sale of volatility.

The reversal principle, which involves the execution of a number of new option contracts in order to close a pre-existing short position and go long through the exercise of options or creating a bullish combination, is quite simple. It is fully identical to the way it is done with regard to the initial long position in the underlying asset, which is transformed into a short one. All of this is shown in the example above for a long XYZ position.

We have explored how the ratio reverse technique is applied to short stock positions, but its use can be expanded. It can not only provide a reversal, but also contribute to an increase in the volume of credit transactions without investing new funds.

Rolling. Follow Up and Follow Down

The ratio reverse technique is very close to the approach to managing reverse strategies, which involve a larger number of option contracts compared to the underlying assets. It is quite simple: sell options that have made enough profit in the account. After that, the funds gained from the sale are invested in new option positions. This technique is sometimes called rolling, which reflects its nature: to adjust the option position so as to move to other strikes without worsening its performance.

The motive in this case is that a change in the movement direction, which is always probable, can lead to the loss of the received gain. By using the rolling technique, a trader thereby receives a real profit to the account, without missing the opportunity to benefit from continuation of movement in the same direction. Naturally, there is a loss in time value, since options that have moved deeper in-the-money are sold, and at-the-money or closer to that state options are bought. Such actions conflict with the basic rule of option trading: sell time and buy points.

Sometimes the technique of rolling is called “Follow Up” or “Follow Down”, identifying and emphasizing the direction of the option position adjustment. In the first case, instead of the sold option, an option with a higher-placed strike price is bought. In the second case, the strike of the option, which replaces the previous one, is lower. That is, through the “Follow Down” technique, a decrease in the option’s strike is achieved, and the “follow-up” technique leads to its rise.