Calendar Spread

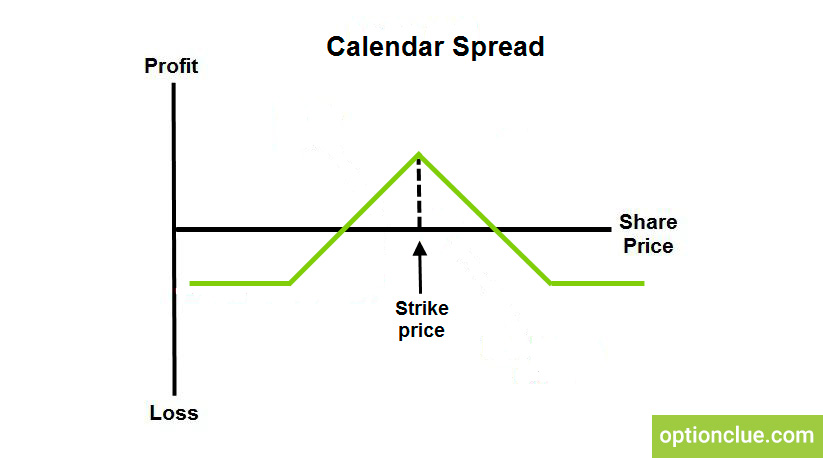

Calendar spread (horizontal, or time spread) is the option strategy with limited risk and profit potential, which lies in the simultaneous buying and selling one kind of options (calls or puts) with the same strike price and different expiration dates.

For call options: buying the option, which has more distant expiration date called «back-month» and selling another call with closer expiration date called «front-month».

For put options: buying the option, which has more distant expiration date, that is «back-month» and selling another put with closer series, called «front-month».

When running the time spread, an investor is looking forward to the stock price to be first around the strike when the short-term contract is exercised and then start moving in the favorable direction. This strategy is rather conservative since it implies price movement first in one direction, then in another one. Due to the great opportunities in the selection of options prices it’s possible to benefit from the underlying asset movements in any direction. In case of sharp market movements, the calendar spread may lead to a negative result, but the use of this strategy is justified since it often provides a considerable risk-reward ratio.

Suppose, we open the calendar spread by buying the Call 90, September 2017 for $5 and selling the Call 90, August 2017 for $3. If the price fluctuates around $85 till August and then increases to $95 in September, it results in making profit from the increased intrinsic value of the long-term option and receiving the premium from the short-term one.

The result will be as follows: (3$ — 5$ + 5$) * 100 = $300.