Selling a Call Option. Insights into Short Call Strategy.

Contents

- The nature of selling call options

- Company news as a factor influencing call options management

- Conclusions on writing a call option

The Nature of Selling Call Options

In this article we will discuss the option strategy of selling a call option. Short calls can be used both as a single options strategy and as an element of more complex strategies, such as the covered calls or even covered strangles.

Selling or writing a call option, if considered as a separate, independent position, is usually called an uncovered call writing strategy. It can also be called a ‘naked call’, although more often the definition of ‘naked’ is applied to put options, and in relation to calls it is called ‘uncovered’.

This is typically a more advanced level of options trading since there are greater risks.

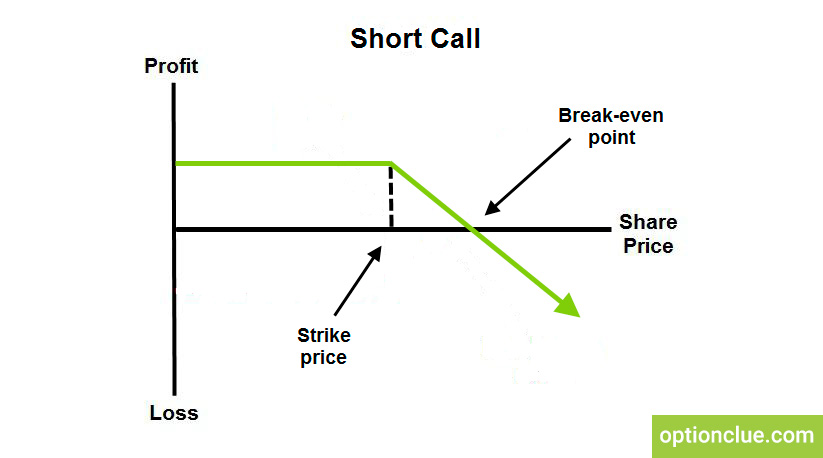

Selling a call option is the mirror image of its purchase: this strategy generates a limited gain when the underlying asset falls and an unlimited loss when it rises.

The image below shows the payoff diagram of the naked call.

If this position is held until the expiration date of the option contract, it brings unconditional benefit only if the option expires worthless. That is if the option holder will not exercise it.

As long as there is uncertainty in this issue, there is a risk of loss, which can always be realized. If the price of the underlying asset exceeds the strike price of the option and its holder exercises the rights, the seller has a chance to win if the asset is in the price range between the strike and the strike + premium received from selling the option.

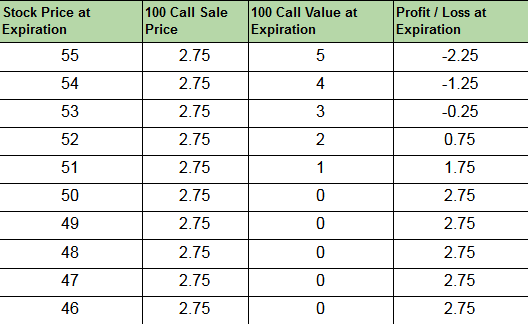

Let us take an example. Suppose, we assume short-term neutral-to-bearish price movement of XYZ stock, which is trading at $45 at the moment. So, to make some money we sell the call option with 90 days till expiration for $2.75 with the strike price of $50.

As we mentioned earlier, the seller of the call option is likely to stay in the positive territory even if the share price rises to a certain price level. In our example, this value is $ 52.75. This price is our break-even point. It is determined by adding the premium received when the option is sold to the strike price. The table below demonstrates what the profits/losses can be from selling an option contract by the time the option expires in 90 days.

Writing Call option. Profit / Loss table.

That is, if the XYZ stock price is out-of-the-money at expiration, for example, $46 or lower, we receive the maximum profit equal to the premium received. If the stock price is in-the-money at expiration, and at the same time the price already exceeds the break-even point, for example, is above $53, then we begin to incur losses that can theoretically be unlimited since the price of the underlying stock can rise indefinitely.

Moving on, there is one market conduct strategy that many do not consider too risky, but, nevertheless, it can cause significant losses. Its concept is based on mathematical statistics, which suggests that the probability of reaching a certain price level during a specified period of time is very low. The point is, when the expiration date of the options contracts approaches, the followers of this concept start selling out-of-the-money options. Moreover, some options traders prefer to use deep out-of-the-money options. Then they simply wait for the option’s expiration date when their premium is zero. Based solely on statistical calculations, these actions can succeed, but we should never forget that one event can blow up a trading account, causing large losses. This is what happens most often in the options market.

Therefore, to minimize risks, this option strategy is often used with a simultaneous opening of a long position in the stock market. In this case, it is the option strategy called the covered call.

Company News as a Factor Influencing Call Options Management

Company news and announcements are one of the most sudden and powerful market drivers, often motivating investors to exercise the options that are even out-of-the-money. This is greatly facilitated by the fact that option holders can give their broker an order to exercise options contracts before 8-00 PM NY.

So, if after the market closes, news comes out that allows market participants to predict the subsequent price movement direction, the profitability of exercising the option becomes apparent, even out-of-the-money options are likely to be exercised.

For example, you have call options with a strike price of $50. The close price of the stock on the third Friday of the month was $48, but after the market closed, news came out that indicates that the market will open much higher on Monday, say, at least at the level of $50. Naturally, under these circumstances, you will exercise options with a strike price of $50. Because when the market opens with a large gap, it may lead to its further rise. Some traders may even exercise call options with higher strikes.

What has the option seller to do now? When the option is exercised, the asset is sold at the strike, and since the seller does not own shares, in other words, there is no offsetting long stock position, he will be in a short position.

It is good if he sold the options with a premium of more than $ 2-3 because then he has a chance to buy the shares and exit from the market at least without losses (with a $50 strike and $3 premium, the break-even point will be at $53). What if this seller is following the concept of ‘an unlikely 10-15% price change within a day’? In other words, if he sold the options most recently and received just 25 cents for it, that is, $25 for 1 contract? These situations do not happen often, but they bring bad luck, so they should always be remembered.

Conclusions on Writing a Call Option

Basically, one should be quite cautious about selling call options, especially in the stock market, which has a historical upward trend. Since there are alternatives to writing call options, for example, buying put options or creating a more complex options wheel strategy, one should consider whether to use them. Undoubtedly, the apparent advantage of selling an option is that we are credited, so that provides a cash flow to the account. Many brokerage companies have the opportunity (or rather the right) to use this money in the money market instruments, or by buying other financial instruments with it, for example stocks. Thus, those investors who work with such companies can receive certain benefits.