Wheel Options. Management Tree in the Option Wheel Strategy.

Contents

- Step 1. Start with a put

- Out-of-the-money scenario when running the option wheel

- In-the-money scenario when running the option wheel

- Position size and time adjustment in the covered strangle

- Assignment scenario in the covered strangle

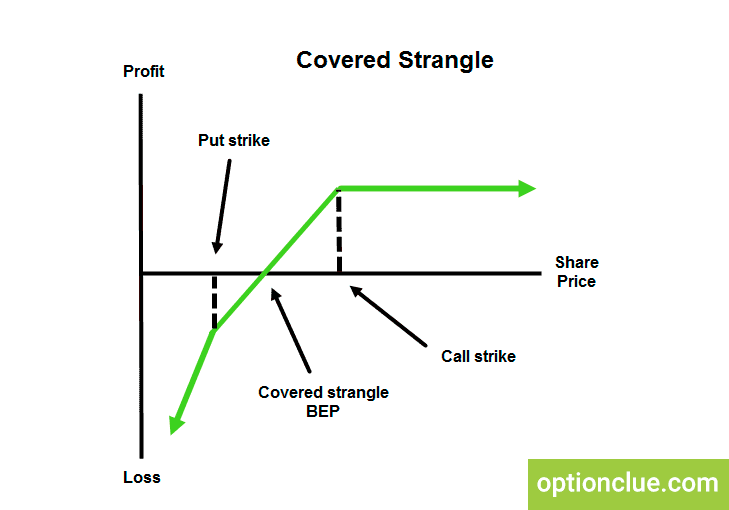

In this article we will discuss how to manage the option wheel strategy (it is also called the covered strangle) depending on the time left to expiration and intrinsic value of the options opened when running this strategy.

Step 1. Start with a Put

First I am going to sell to open a put of some sort and then one of two things is going to happen:

- the put is either going to remain out-of-the-money in which case I will close for a profit and then sell another put and continue to do this circle

- the other scenario is we can end up in-the-money

If we end up in-the-money there again is a branch of two possibilities:

- we can roll for some time

- or we can choose to allow assignment

If we allow assignment, this essentially means we own shares of whatever we sold the put.

So now there is another kind of two lane approach. What will happen is we are going to create a covered call for the long shares, so this is where were long shares and then we sell a call against these shares and then in this scenario one of two things will happen:

- this will fall out-of-the-money and if the calls remain out-of-the-money we just sell another one and then continue that loop

- or the calls will fall in-the-money, in which case we will be assigned

Then what will happen is the call will fall off, we will keep that profit and then the long stock is sold. And we are going to sell the stock or sell the underlying at the strike price.

Now let us go back to the moment of assignment. We are also going to sell another put and then this put here follows the structure of the first put explained above.

One of two things will happen – out-of-the-money or in-the-money cases may occur and we follow the same algorithm.

Out-of-the-Money Scenario When Running the Option Wheel

First let us talk about this out-of-the-money position. If we are out-of-the-money the very first thing is if at any point in the trade I have a 60% profit I am going to look to take it down.

It does not mean I always do well but I am going to look at it. I want to consider it very strongly.

Now if I ever have a scenario where I have 80% of my max profit with greater than 50 percent to expiration on the original trade left, I will take that down.

Let us say, if I am in the trade with 40 days to expiration and then at 21 days to expiration we have 80% or higher max profit, I am going to take that trade down.

The other scenario that can happen is if I make 30 to 40% of the trade in less than 2 days, I potentially will take that trade off.

Now the way that I provide the out-of-the-money management depends a lot on the current market conditions, how I feel about the market at that point in time. If I feel that the market is stable, continuing to climb etc., very likely I would just leave a position for longer.

But if we are in a market that is not so stable, I am less inclined to do that, I manage positions a little more regularly. I can continue to realize profits and lower my outstanding risk.

In-the-Money Scenario When Running the Option Wheel

Let us talk about the in-the-money case when selling a put. And what I want to specifically talk about is rolling.

Now we are assuming we are in-the-money and I am not going to take the assignment, I want to roll.

I always know that the best rolling opportunity is going to take place when the strike price equals my short strike.

If I sell a put at a 10 strike when the stock or when the underlying is trading around $10 is my best time to roll.

The reason is because you can still typically roll out-of-the-money at that point but I have some rules on how I approach this:

- First and foremost, I always make sure I get a credit for the roll. If you do not get a credit, you are going to make this a very difficult trade to manage for the long term

- The second thing is I monitor the size of my trade because when we roll we know we are closing the front position and we are establishing a further position that should cover the cost of closing this front position.

Position Size and Time Adjustment in the Covered Strangle

Based on my assessment of the market, my current thoughts I will look and adjust my size accordingly. For example, if I have a position that I put on with 40 days to expiration and with 35 days left to go it falls in-the-money, I am not going to do anything.

The reason for that is I like to wait until it is about 20 days to expiration, so that I am able to maximize my use of weekly contracts and not have to roll out an entire month. I typically try to roll out as little in distance as possible.

Based on the trade management, if my strike is slightly in-the-money and there are 20 days left to go, or something like that, I likely will roll that out to reestablish a new position with 40-45 days to expiration.

However, instead of selling 5 lots I might only sell 4 lots, but keep it at the same strike. I might take some of my position off removing some risk from the trade.

Let us say (we are in the same scenario) I sold a 40 day to expiration option and we are at 22 days left to go and all of a sudden my option is deep-in-the-money. So, if I roll out in time, I am collecting a very small credit.

In that scenario I might add some of the allocation I set aside for the trade, so that I can add additional short puts and allow myself to roll closer to the money.

In that example let us say if I sold 5 puts at a 10 strike, and with the new position I establish, I might have six puts at a 9 strike or an 8 strike – the goal is to move closer or out-of-the-money.

Size can be adjusted to add risk or reduce risk depending on what the objectives are at that point in time.

The duration for the rolls I hit on a little bit to start. If I am wary of the market and concern that it might come down, I try to let it get as close to expiration as I can, so that I am leeching all of the theta out, so I am not buying back a whole bunch of theta when I roll the position.

Once I get 14-15 days to expiration, I am going to try to roll out time as little as I need to, in order to roll down as well.

So, if I want to roll out and down I might have to go two weeks or three weeks instead of just one.

If I suppose that the position is on the lows, I might just roll out to the same strike a week later.

And then the last kind of broad scenario is if I want to roll and I want to make sure I get out-of-the-money, I might have to go further out in time, I might have to reestablish a new position in order to collect a new credit all the way at 40 to 45 days till expiration or something like that.

Let us jump over to kind of if we are going to allow the assignment.

Once we get to the 20 day window, we sell to open 5 puts at the 10 strike and we are at the 20 days till expiration, we choose we want to allow assignment.

We are going to let the underlying continue to move towards its expiration.

Now the week of expiration or whenever I see the extrinsic value < .05, I am always going to reevaluate one more time.

I am going to say do I really want to let this go to expiration and be assigned or do I want to potentially roll this now?

That is kind of my last evaluation.

Assignment Scenario in the Covered Strangle

Let us say I want to own the underlying. Once we own the stock I like to sell a covered call.

That means I will take the assignment. I am now with shares and I will always sell a call above my basis.

If I am assigned at 10, I am always going to sell at strike 10 or above.

There may be times where I cannot sell and collect a premium above my basis, that is fine, I will wait because as you already know, I pick something I like to own, and I will definitely wait.

And then at the same time I will always outlay an additional put below my strike.

If I am at a short strike of 10, I might sell at strike 8, or 6, or 5 or 7 whatever something below my basis.

What this does, it allows me to scale into the trade, still collect a premium and then if I am assigned again, if I choose to allow assignment, then my cost basis will reduce as my size increases.

If we sold that 5 lot and then now we are long 500 shares, and then if we sell 3 lots cheaper, now we are going to be long 800 shares but at a lower price.

That is why I like to sell the additional put.

We are just going to repeat the put management until it is assigned again or we are rolling, or out-of-the-money, or we are going to keep going until that covered call is called away.

Whenever the covered call expires worthless or is very close to expiring worthless, I might take it down and sell another one and just keep doing that over and over again.

This is my favorite strategy: the cash secured strangle. It is easy to manage, but it is not frequent.

I might put a trade on that has 40 days to expiration and adjust it once every 2 weeks, so there is a lot of thought that goes into the management but it makes the execution very easy and systematic.