Best Stock Options to Trade. Buying Volatility Trading Strategy.

Contents

- The nature of buying volatility.

- What is a delta-neutral hedging? Best option trading strategy.

- Synthetic straddle performance. Best put and call options to buy today

- Volatility trade adjustment. Rehedging.

- Example of a trade plan using buying volatility technique.

The Nature of Buying Volatility

In this article we will discuss one of the most popular options strategies called buying volatility or long volatility trade.

This simple but comprehensive definition potentially includes a range of strategies and it is increasingly used in investment or in identifying a trader’s strategy in the options market. However, there is a need to define transactions such as buying or selling volatility, since they indicate a unified vision. Since it is nothing more than a combination of strategy and its management, it is clear that earlier you may have already considered some examples of this process. Buying and selling volatility are a few more examples of technology trading.

To avoid confusion, let’s remember what affects the option premium. There are five factors, each of which has different origins. One of them comes entirely from the external environment – this is the money market rate. The price of the underlying asset is determined by the situation in that particular market. The strike and the option’s existence can be managed since they are related to the investor’s management decisions. The implied volatility of an option is an unmanageable parameter determined by the options market. This factor can even be considered as an indicator for management decisions since it demonstrates how much the option premium goes above the average value of the theoretical price.

A large number of strategies are based on the fact that management decisions are the link between the selection of appropriate positions and external factors such as the rate, the price of the underlying asset, and volatility. Time and strike are also crucial, but they are entirely related to decision-making. This is where the ability to create a proper configuration comes into play. Management in the development of a market trend is usually based on the use of volatility, as well as on the manipulation of time and strike prices. All of this is reflected in the phrases repeatedly quoted: (1) “Buy pips and sell time” and (2) “Buy low volatility, sell high.”

The issue of risk management can also be solved through the option positions adjustment, mainly short ones. Positions in the underlying assets, as well as long options contracts, are mostly assumed to simply be statically held, doing nothing until the expiration date of the options purchased. The only thing that can inspire earlier actions is some kind of dramatic price movement that creates some new opportunities. Thus, the main focus is on the management of short options.

What is a Delta-neutral Hedging? Best Option Trading Strategy.

The vision currently being considered, called Buying Volatility, is based on static maintenance of options positions and risk management through the underlying asset. This equally relates to both short and long options positions. But at the same time, each of the risk management techniques leads to different results that will be demonstrated further.

Both of these techniques are built on the philosophy of delta-neutral hedging. This is the key point that provides the basis for managing any of these strategies. The second important point stems from the desire to constantly build on immediate success. This is difficult to achieve when trading options. Anyway, an ordinary investor is unlikely to accomplish this, since it requires a large number of option contracts to be put in trading, as well as operations with them. Moreover, the liquidity of the options market often does not allow even a paper gain to be made, since the bid-ask spread plays a significant role here. The solution is to constantly review the portfolio so that we could take the profits regularly, turning them from ‘paper’ into ‘realized’ ones.

Volatility is the King here. The amount of the option premium is related to implied volatility. When it is low, you can expect it to increase. When it goes beyond the highs, one should expect it to fall. This allows us to consider this factor as a common speculative instrument that is subject to be changed. All its difference from other instruments traded on the market is it is not traded on the market independently but is expressed in terms of an option premium. Therefore, “buying volatility,” implies that it is expected to go up. When it comes to “selling volatility”, it is expected to go down.

Synthetic Straddle Performance. Best Put and Call Options to Buy Today

Buying volatility is nothing more than a synthetic straddle. It can be formed in two ways:

- Buying the underlying asset + Buying put options with a rate (ideally equals 2)

- Selling the underlying asset + buying call options with a rate (ideally equals 2)

That is, for every 1 underlying asset, two options are bought (again, ideally). In the stock market, 2 options contracts are required for every 100 securities.

There is nothing unusual about this strategy, and it looks exactly like a straddle. It is clear that the best moment to run it is when the strike price of the option is close to the current price of the asset, and the additional factor that has a positive impact is the decreased volatility. Ideally, when starting this strategy we should have a delta equal to zero, or very close to this value. But this is in a perfect world. In fact, when creating a strategy from stocks and options on them, this is not always possible to achieve.

Moreover, it is mostly totally unrealistic, especially when using long-term options. For example, that have at least 6 – 9 months till expiration. Due to the strong upward skewness of the delta, this strategy will have a positive delta if we use a rate 2. It usually ranges from 10% to 20% of the absolute size of the underlying. That is, with a strategy that includes short 100 shares and 2 call options with 6 months to expiration, delta can be 0.20, or 20%. Volatility also has a strong influence here.

Volatility Trade Adjustment. Rehedging.

To succeed in trading when using the “buying volatility” technique, we need to constantly adjust the strategy. This process is also called rehedging. It lies in maintaining a predetermined balance between positions in the portfolio. The whole point is that this balance is achieved by influencing the number of underlying assets for each option. That is, here the trading process involves a coefficient that shows the ratio of the number of purchased options and bought (or sold) underlying assets, which is nothing more than a hedging ratio. This indicator is the control mechanism that regulates the number of open positions in an underlying asset.

For any cases of falling of the underlying prices, the delta of the whole combination decreases, tending to the negative area to “-1”. When prices rise, it increases, striving to reach “+1”. This makes it necessary to buy when prices fall and sell when prices rise. Thus, as the underlying price goes down, the number of open positions on it decreases, and when they go up, it increases. This is equally true for both short and long positions in the underlying asset.

Now let’s consider the main question: “When should you trade?” The answer is simple: “Actions to rebalancing (the same as rehedging) must be performed when the delta is changed accordingly.” Theoretically, they can be performed with a very high degree of discreteness, almost continuously, which will be demonstrated soon with an example. But this, unfortunately, requires significant resources. Otherwise, when using small trading volumes, it is possible to get a problem in the form of a strong increase in management costs. If to act in a more relaxed mode and, suppose, determine the fragmentation of the trade in the amount of 10%, then each trade should start when the delta of the portfolio (containing the underlying and options) changes by 0.10.

To determine how many assets you need to buy or sell, you just need to know the delta of the option used in the strategy. Volatility and time contribute to the delta’s functioning. Therefore, it is not constant and changes over time regarding the underlying price. In other words, the delta of an option, which is observed today at a certain price level the underlying is traded, will not be the same tomorrow. This indicator does not change so quickly if we compare days close to each other, especially when the expiration date is still far away, but, this process continues nonstop.

Example of a Trade Plan Using Buying Volatility Technique

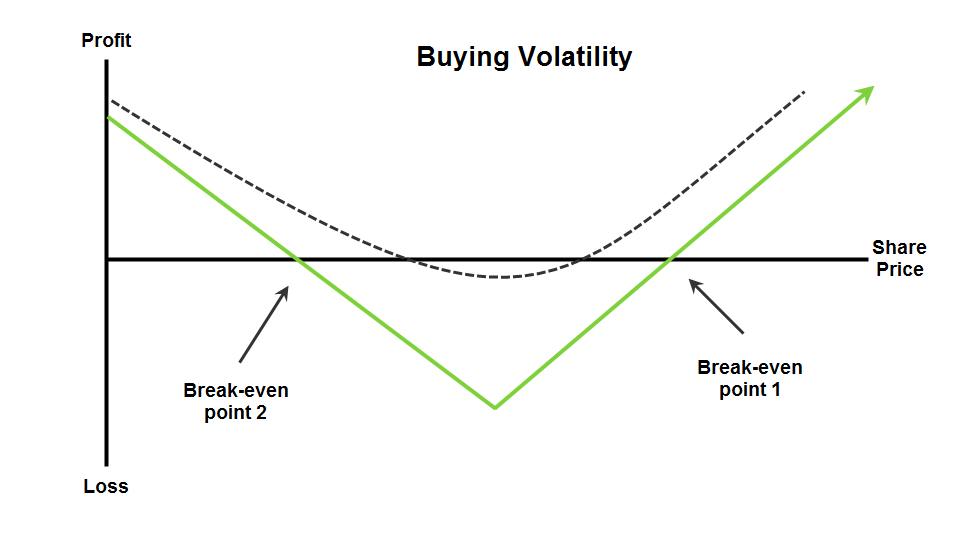

To understand how this happens, let’s take AEM stocks traded at $57.05 as an example. Suppose we start the trade at this point by selling 100 shares and buying 2 55-call options with expiration in January, for the premium of $8.5 (delta 0.596). Its profit/loss curve is shown in the image below.

This is the typical picture. It shows that, although any changes in the share price have a positive effect on the strategy’s outcome, nevertheless, if at expiration the price remains within the break-even points (40.05 and 69.95), the strategy will result in direct losses. Closing the strategy before the expiration date is another matter. In this case to benefit from this strategy the investor expects rapid price movement in any direction.

Note, here, at the very initial stage, there is a problem with delta. What about its excessive value, which causes the skewness of the strategy towards the bullish side? Since the total delta of the combination turns out to be equal to + 0.32, or 32 shares. In other words, this synthetic straddle is equivalent to 32 securities in a long position. There is no definite answer to this question yet. Rather, it is necessary to be guided by common sense and a real view of the specific market.

Abstracting from the problem with delta, that is, assuming that its initial value will be maintained further, it is possible to determine the price levels where we should start trading by selling and buying the corresponding number of securities.

Anything above our current price at the moment of establishing the strategy is considered as the level where one should sell using limit orders. In our case, go “short”. And below this level we should buy. When the price changes its direction, the reversal point becomes our starting point which is important for us in terms of managing our position and starting placing new series of limit orders. So, in our case, if we strictly follow this strategy, then we should place sell limit orders at the levels that are higher than the current one, and place buy limit orders below our current level. The image below shows how it looks when using 0.1 delta move or 10 stocks.

The buying volatility strategy based on put options is basically no different from the strategy based on call options. Even the prices will be the same, since “delta of a put = 1 – delta of a call”. However, there is always room for manipulation and choice of solution, because this strategy may not behave exactly as it should do in theory.

Here is the dilemma. On the one hand, the volatility should not be too high, as this can lead to a high cost of options, which must be bought strictly.