Short Put

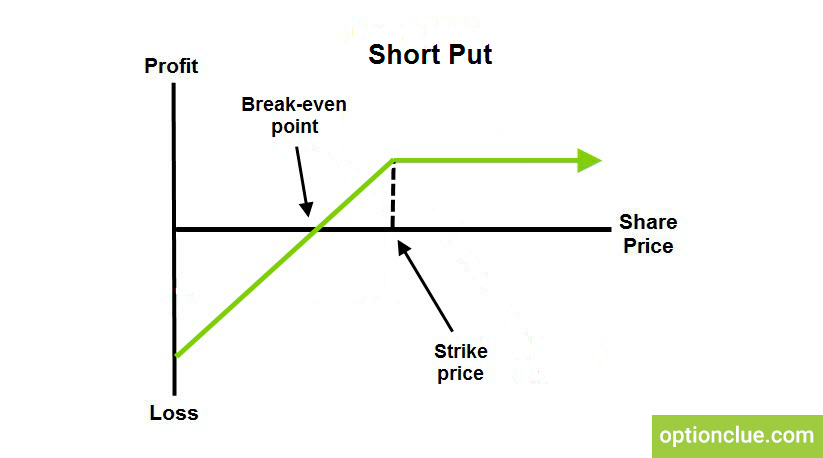

Short put: sellers of put options hope the stock price to go up or stay around current levels. If the asset price decreases, options sellers are obliged to buy shares at a predetermined price (strike). A seller of a put option receives a premium, that is, the profit potential is limited and known in advance, while risks are conditionally unlimited.

Selling put options is often interesting when you want to buy stocks at a more attractive price and when the market is about to fall slightly or consolidate. Large investors often use the strategy during periods of uncertainty when the market is overheated and a seller of the put option doesn’t mind buying the underlying asset but believes that the market may decline, or wants to make additional profits from the increased implied volatility.

In this case, a seller receives a premium, but runs the risk of losing a position if the underlying asset price actively rises. The worst scenario for the put option seller is a sharp fall in prices below the strike, and the maximum profit is limited to the premium and can be received if the underlying asset price is higher than the strike price of the put option sold.

Suppose, we sell the put option for $20 when the strike price is $100 and then the asset price starts falling and reaches the price mark of $81. The option is in-the-money and our position is losing money but the break-even point hasn’t been reached yet, it’s around $80 that’s why there’s nothing to worry about.

After that, the market starts rising and it’s around $95 on the expiration date. As a result, the option is $5 in-the-money, and the financial result will be equal to: $20 (premium) – $5 (intrinsic value of the option) = $15*100 = $1500.