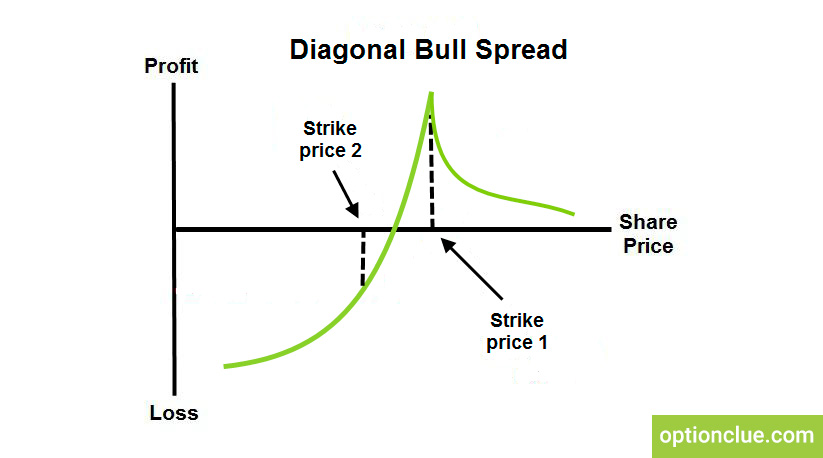

Diagonal Bull Spread

Diagonal bull spread is the option strategy with limited risk and profit potential, which lies in the simultaneous buying and selling call options on one asset with different strikes and expiration dates.

Diagonal bull spread is usually used when an investor is bullish on the market in the long-term but has neutral outlook in the near term. For this purpose, he buys a call to earn profit from the upward movement and sells another call with a closer expiration date. Therefore, an investor wants at first the underlying asset price to stay around front-month strike and then when the short-term call expires worthless he is going to profit from the purchased call option when the market is rising. After the expiration of the first option sold, an investor can write another one and then repeat this process until the back-month option expires to earn additional profits from selling front-month options.

Suppose, the underlying asset price is $120. We run the diagonal call spread by buying the Nov $120 call for $250 and selling the Aug $130 call for $100. The debit is $150. If the price increases to $125 and stays at this mark till November, this long-term option has $500 in intrinsic value and the Aug call expires out-of-the-money.

Suppose, after the Aug call option expiration, we sell Sep $130 call and when it expires, we sell the call option with the expiration date in October. Thus, we make additional profit by selling short-term options and at the same time, we hedge our position with the help of long-term call option bought earlier. That means we have the opportunity to develop a position and respond flexibly to changes in market realities.

Extra profit from selling these options is $200 ($100 * 2) and total profit is $550 ($500 + $200 – $150). If the price falls to $90 and stays at this mark till November, we will suffer losses which equal $150 (entire investment).