Stop-loss or Buying a Call Option? Position Size Calculation when Trading Options.

Choosing of assets for trading can take a long time, especially when it comes to options trading. Keeping this in mind, we’ve created the options screener that saves your time and helps find new trading ideas based on a simple principle – buying cheap options or selling expensive ones.

We analyzed earlier the principle of calculating the optimal position size in a classic directed trading.

Today we will discuss the application of the formula for calculating the position size when trading in the options market and we will also take an example in which risk management rules do not allow you to open a position with a stop-loss order, but you can enter the market using options.

Contents

- The formula for calculating the position size

- When risk management does not allow to buy

- Options as an alternative to trading with a stop-loss (SL)

- The optimal position sizing in the options market

- Conclusions on the use of stop loss and options trading

The Formula for Calculating the Position Size

The purchase of an option is a worthy alternative to trading with a stop-loss order. In this case, risk is strictly limited to the option premium and there is no slippage in its classical form.

In comparison with directed trading with a stop-loss order, the calculation of the optimal position size becomes even easier. At the same time, the formula works also efficiently and lets increase the profit potential and reduce trading risks.

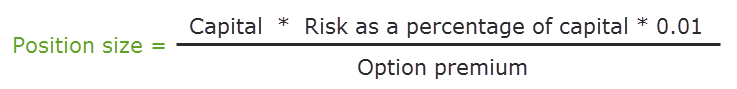

In the denominator of the formula instead of risk in points and the point value for a lot the option price (the option premium) occurs. (Figure 1).

Fig. 1. The formula for calculating the position size in a directed trading in the options market

Then our example will clarify the specifics of situations in which buying an option is a more attractive solution in comparison with a stop-loss order placement.

When Risk Management Does Not Allow to Buy

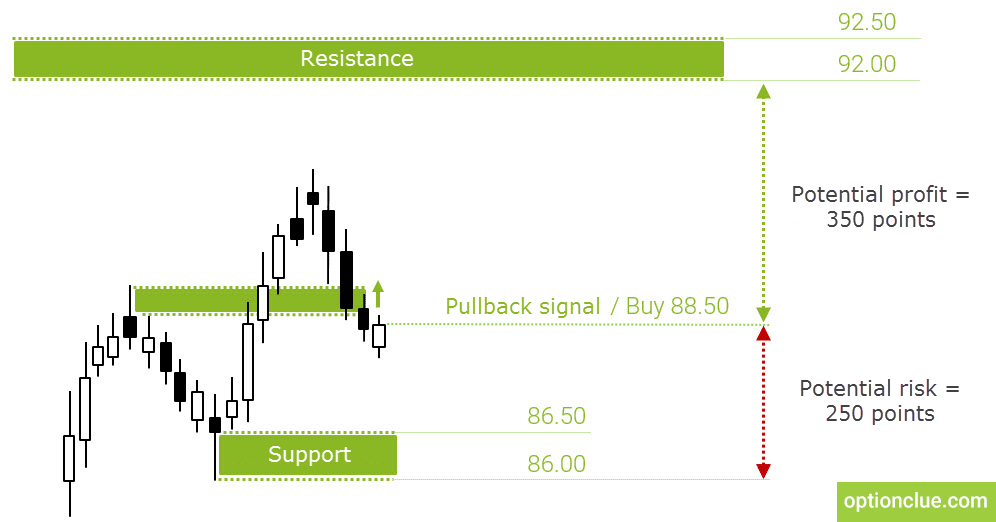

The Japanese yen market is an uptrend and after another bullish jump, a completed correction is being formed on the daily timeframe. At the time of the most possible continuation of the price increase, a buying opportunity appears for the medium-term trading, in other words, a pullback signal from the last broken horizontal level (Figure 2).

When placing the stop-loss order around the nearest support level of the current timeframe risk per trade is approximately 250 points. The profit potential is 350 points.

The reward-risk ratio can be calculated as follows: 350/250 = 1.4 (Figure 2). In the current example, we are talking about the pullback trading – entering the market at the time of the market correction completion. When using these trading tactics, it is quite real to get a reward-risk ratio equal to 2:1 or higher even on the Daily timeframe.

The minimum acceptable reward-risk ratio is 2:1. It makes no sense to break the trading plan. You can’t enter the market since one of the key points of the trading plan (risk management) is not met.

If breaking risk-management rules becomes frequent, a trader will lose one of the important competitive advantages – the opportunity to increase his capital, making mistakes in more than 50% of cases.

Options as an Alternative to Trading with a Stop-Loss (SL)

In such situations, it makes sense to pay attention to the options market. This is an alternative option for the entry with known beforehand and limited risk.

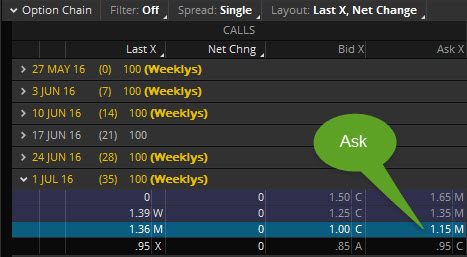

Fig. 3. The prices of the nearest options (trading platform thinkorswim)

The option price that is appropriate for us is $1.15 (Figure 3). This is a call option and its purchase will make it possible to make profit in case of the market rising. Its lifetime is 35 days which in the current example is more than enough to reach price targets or a market reversal.

The option value varies non-linearly and it is affected by a number of factors the description of which is worthy of separate articles.

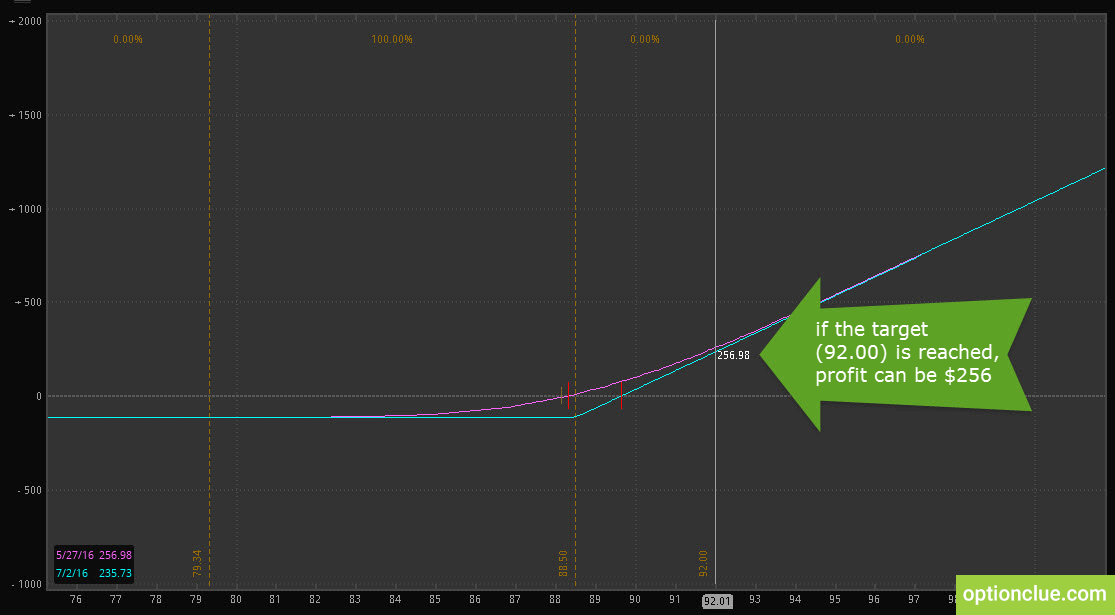

You can simulate the purchase of an option in some trading platforms (thinkorswim has no competitors in this regard). This will make it possible to evaluate the profit and risk potential as simply and objectively as possible.

Fig. 4. The profit potential determination when buying an option if the target is reached at the point of $92 (thinkorswim trading platform)

Figure 4 indicates that if a previously determined target (92.00) is reached, profit can be $256 at a risk of $115 for each purchased option. The reward-risk ratio is 2.2 (256/115 = 2.2), whereas this value was 1.4 when entering the market with the stop loss order.

As mentioned before, it’s impossible to enter the market with a reliable stop-loss order, therefore, other things being equal, buying an option in this example looks much more attractive.

The Optimal Position Sizing in the Options Market

Let’s calculate the optimal size for entering the market. Suppose capital is $9000 and the acceptable risk for this account is 3% per trade.

The input data for the formula (Figure 1):

- Capital is $9000

- Risk as a percentage of capital is 3

- Option premium is $115 (Ask price)

Position size = ($9000 * 3 * 0.01) / 115 = 270/115 = 2.34 of the contract

You can buy only standard contract in the options market, so we’ll round off the received value downwards to two contracts. If you open a position of this size, the risk will be $230 which is the closest to the target of 3% risk per trade of capital.

If option price is too high and you can’t meet the required level of risk per trade, you can look for a similar asset with a smaller option premium in another market.

It’s difficult to find a cheaper option for a security, whereas such opportunity can be found in the metals, currencies or energy markets. Options for these financial instruments are traded everywhere, while their market price and contract size vary in each market.

For example, when writing the article, an option for silver in the Russian market can be bought for $136, in the US market, a similar contract of a smaller size is traded for $93. The lower the option price (premium), the more accurate you can calculate the position size.

If the optimal position size is less than one contract and there are no alternative options for the entry, then according to the trading plan it’s impossible to open a position since money-management rules are not met.

Conclusions on the use of stop loss and options trading

Options are an excellent addition to the classic directed medium-term trading with a stop-loss order. They give a trader the flexibility that can’t be obtained in any other way and also allows to strictly limit trading risks.

The formula for calculating the optimal position size can be used in directed trading in any market. Today options are the most effective tool to limit trading risks and together with the dynamic risk per trade calculation, they allow you to use capital as efficiently as possible.

We have considered only one of the many ways to apply options in trading. There are many opportunities to improve trading and investment decisions using options and best option trading strategy and we will certainly analyze them in the following articles.

P.S. Classic (vanilla) options are discussed in the article. Only the name unites them with binary options. Classic options are traded on exchanges and are used both by private and large traders. They allow to fix trading risks without limiting profit potential.

Binary options are analogous to a casino. They are not traded on stock exchanges and they are not used by large traders. They are adjusted so that the expected value can always shift against a trader (in casinos the expected value should be less than zero, otherwise the organization will go bankrupt).

Good luck in trading!