How to Protect Floating Profit? Put Options – Best Time to Buy.

Choosing of assets for trading can take a long time, especially when it comes to options trading. Keeping this in mind, we’ve created the options screener that saves your time and helps find new trading ideas based on a simple principle – buying cheap options or selling expensive ones.

In this article we will discuss the principle of protecting floating profit using options*. This need arises when the market reaches intermediate targets or an important price level, when it is early to close the whole position, but the risk of unfavorable price movement is high.

We will analyze basics of an option hedging which, despite simplicity, can be an excellent addition to your trading strategy.

Contents

- Trade position maintenance

- Buying option to protect the floating profit

- When option hedging has no sense

- Conclusions on trade position support

Trade Position Maintenance

Along with the correct entry and exit from the market, any trader often faces the need to adjust the position between these points.

This happens when the direction of the main trend in the market has not changed, but the risk of undesirable price movement may take place. For example:

- the market moves in the right direction, but reaches a predetermined intermediate target and can start to correct;

- the price starts to fluctuate around the important price level, in the near future the market can stop, go to a flat or even reverse;

- an important event is coming that can significantly affect the market condition (statistics of the company activity, important political or economic speech, elections, referendum, etc.)

In such situations, you often do not want to lose your position and at the same time the prospect of leaving it unprotected also isn’t attractive. The market can start moving rapidly against the position and the floating profit will be destroyed. At the same time, the price, breaking through the nearest targets, any time can rush further in the trend direction.

The most straightforward options for actions in such situations:

- Liquidation of the position – we protect the floating profit against a possible correction or a market reversal, but we lose our position. If the price continues to move in the right direction, there will not be any opportunities to participate in this movement. This is bad since it isn’t always possible to enter the market again – the movement may be too active and a trader may not always be near the trading terminal.

- Partial liquidation of the position – is often the most sensible solution without the possibility to use options. In this case you can fix a part of the floating profit, and at the same time, participate in the further market movement through the remaining position in the market.

- Purchasing stock options – defends the floating profit and gives the opportunity to maximize it if the price movement continues in the right direction.

Buying Option to Protect the Floating Profit

Let’s take an example of an option hedging to protect a position. There is the long pullback position in the gold market (GLD). GLD is a financial instrument with a plenty of liquid options, the chart of which duplicates the conduct of the gold market. It’s excellent for this example.

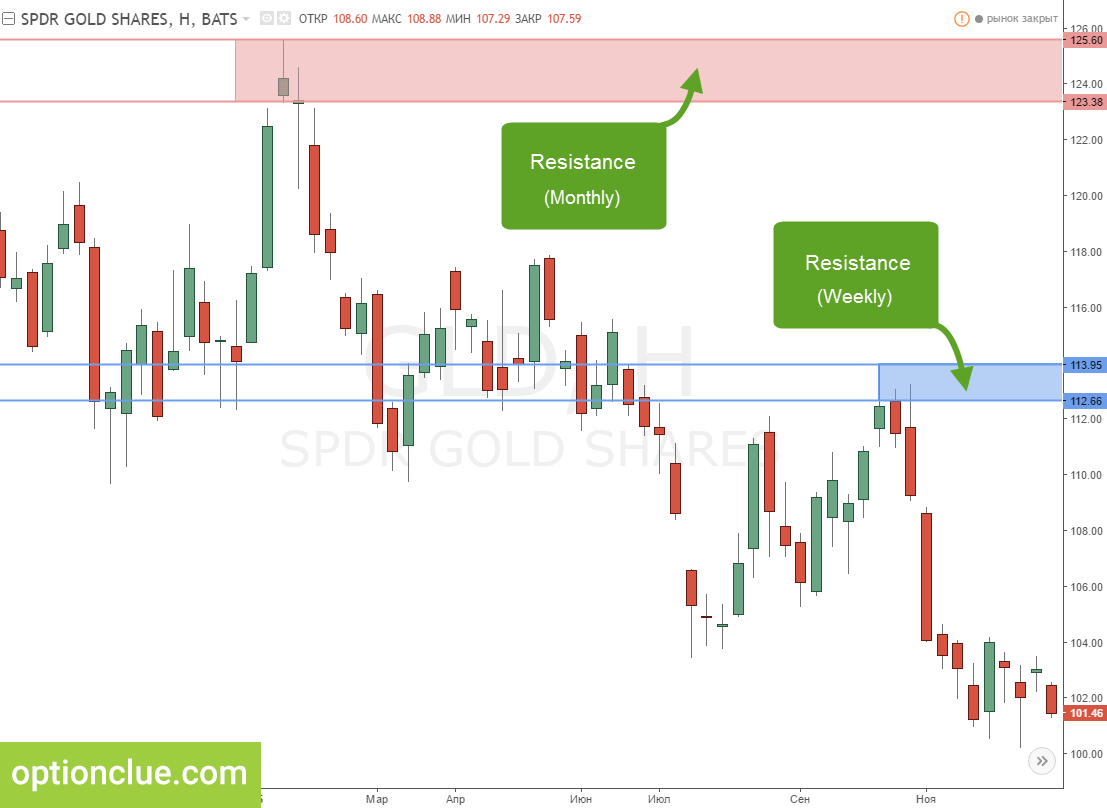

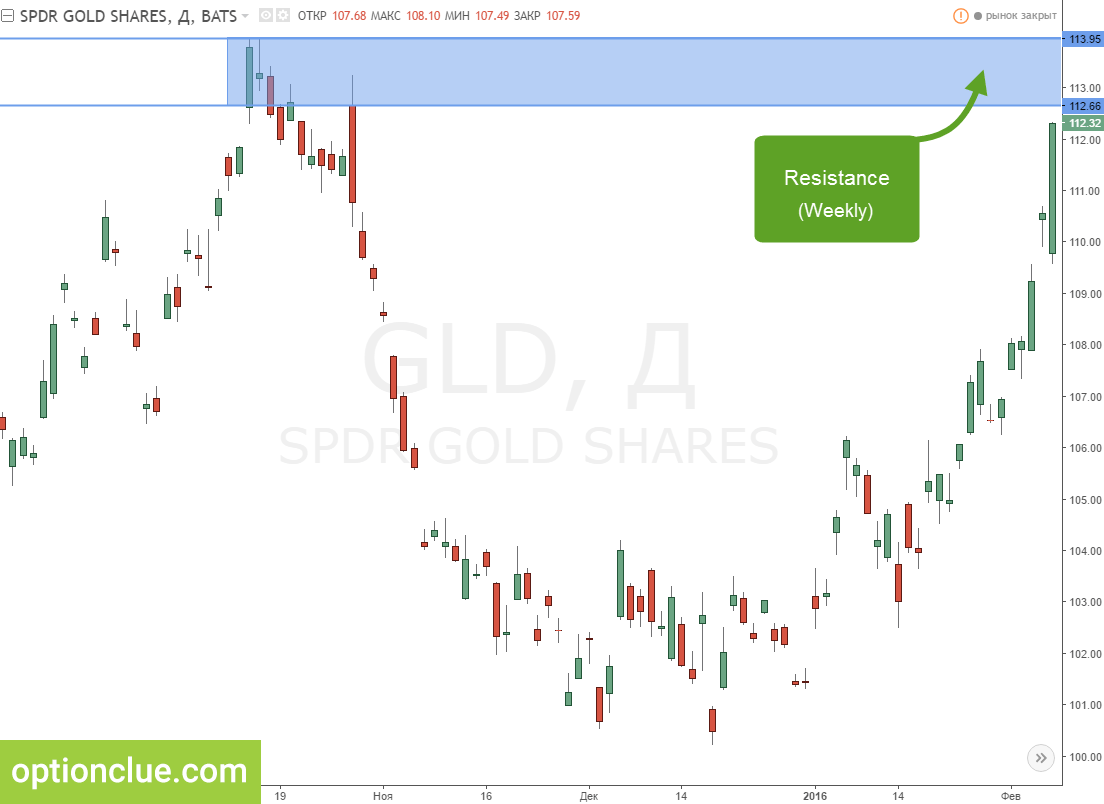

By the time of the entry two targets were relevant: timeframe of the weekly resistance level (highlighted in blue, the highs of October 12-25th) and the monthly resistance level (highlighted in red, January-February 2015 highs).

The first target is the nearest one, the second is more optimistic, but also quite acceptable, because a new trend started on the Daily timeframe and January is the beginning of one of the most active trading periods of the year.

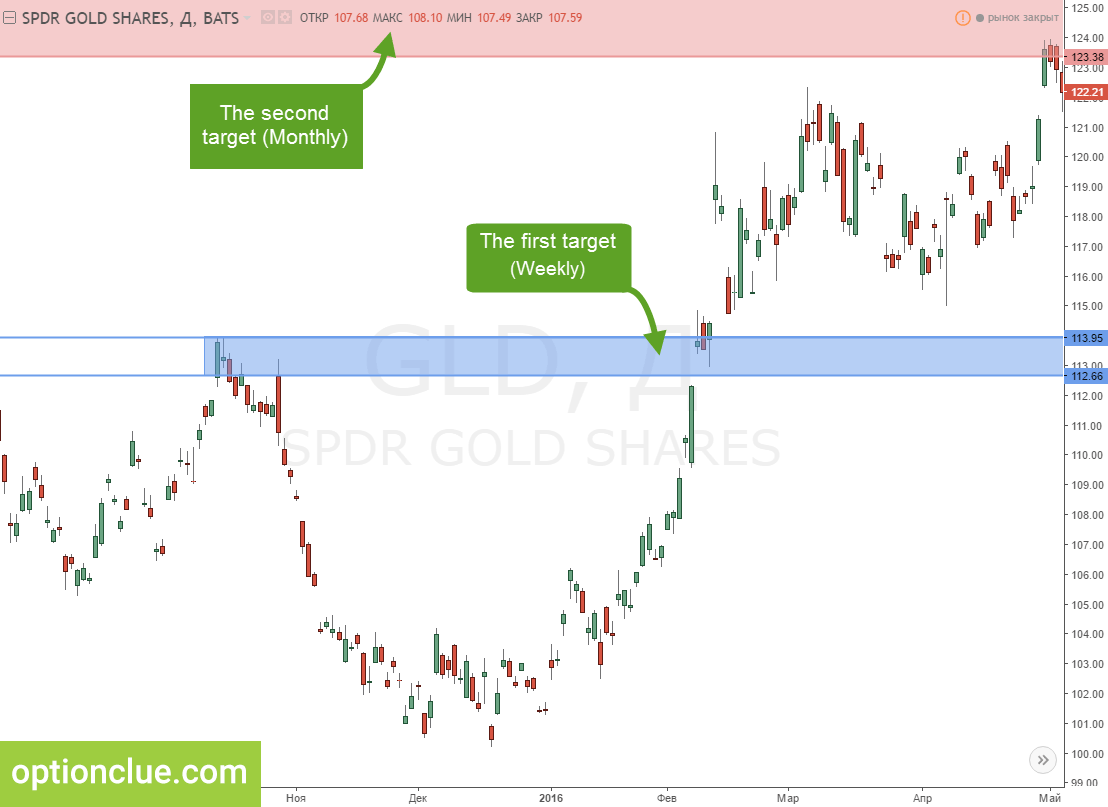

GLD. Bullish pullback signal on the Daily timeframe.

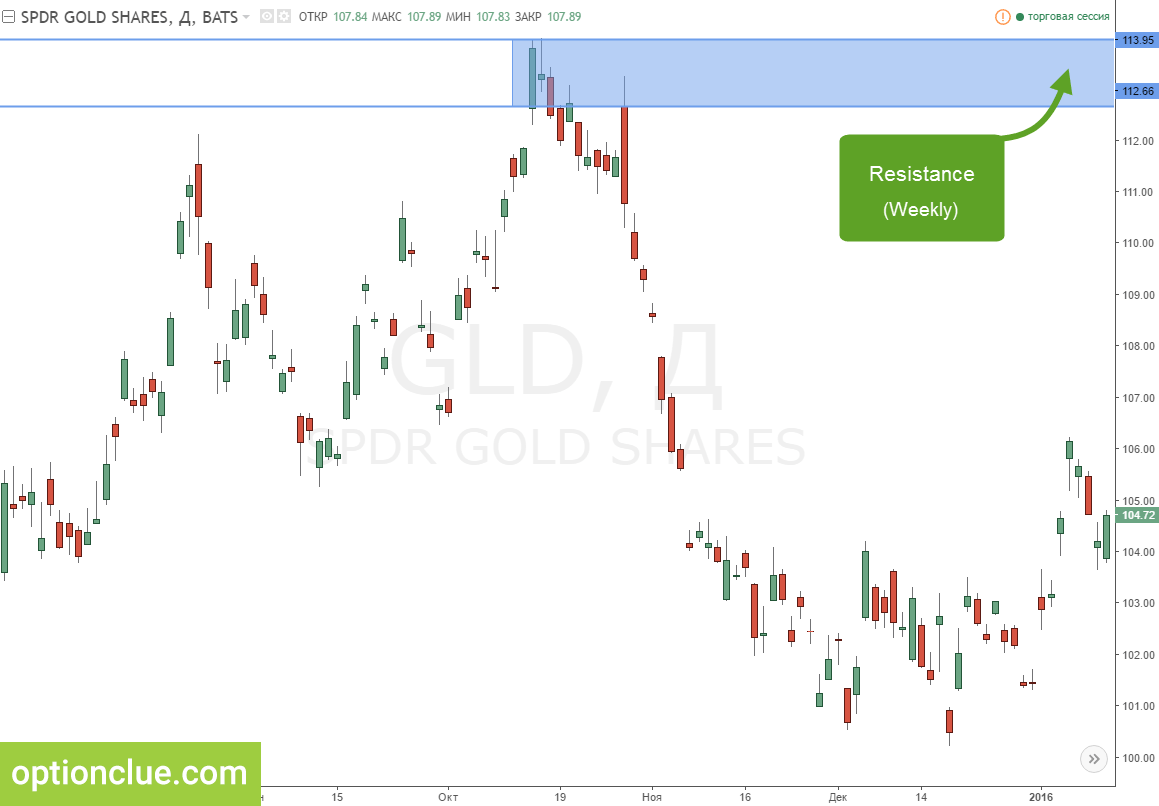

The pullback trading signal was formed on January the 12-th, after which the market during three weeks came close to the first target, that is to the resistance level of the weekly timeframe. When this happens, the market can easily start to correct, reverse or go to a flat.

GLD. The first target is the resistance of the weekly timeframe.

Suppose we don’t want to close the position, but we want to protect it if these unfavorable scenarios take place. In this case to assess the rationality of the options use, you should find out their current prices. To do this you have to open an option desk.

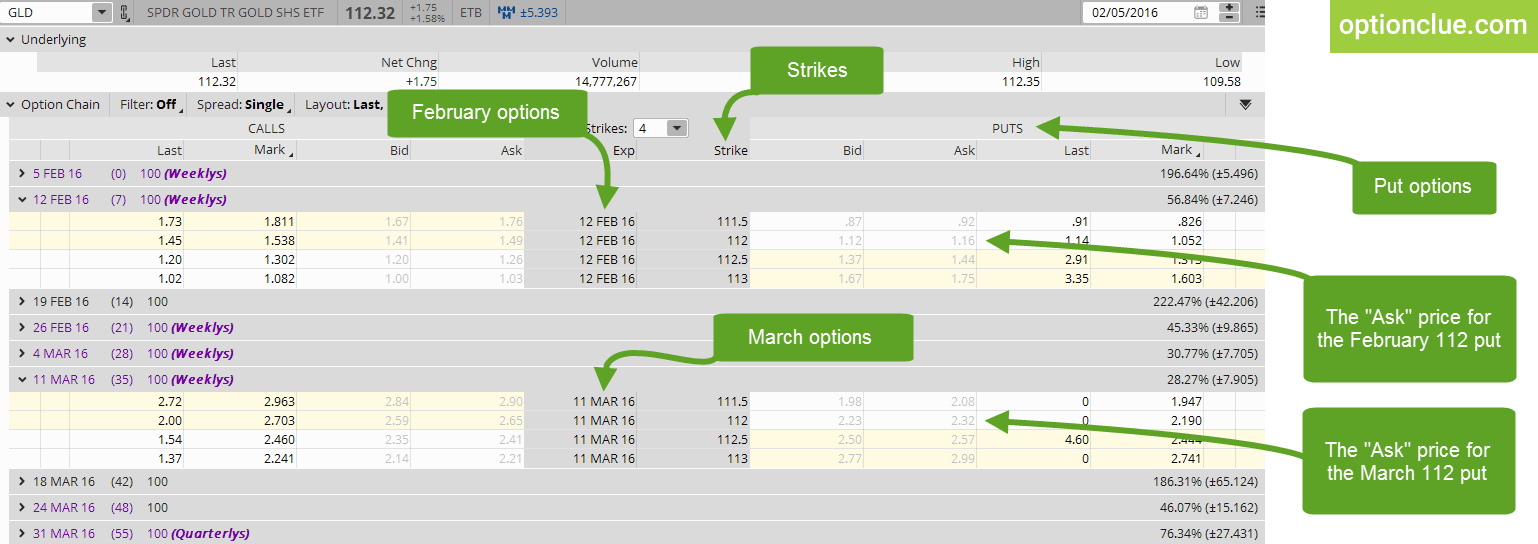

The long position is opened on the trading account, therefore, for hedging purposes, we are interested in put option (Protective put protects from the unfavorable bearish market movement).

The illustration below shows that on the hedge date (February the 5-th) various option series were available, that differ in the options lifetime from 1 to 714 days. If the position is opened on the Daily timeframe and is considered as a medium-term one, which can easily exist for 1-3 months, then for hedging we can use options that will exist for 1 more month. During this time movement continuation, a market correction or a reversal will certainly take place, so it will be clear what to do further with the position.

The question of a detailed analysis of the principles of selecting option series and strikes for hedging goes beyond this article. Therefore, let’s suppose that we consider the simplest way of hedging – the purchase of a put option at the money (ATM – At The Money) which will exist for another 35 days.

The put option with an expiration date of March the 11th and the strike price of $112 corresponds to this criteria. The purchase price of such option is $2.32, that is $232 per standard contract.

Is it much or little? Is such price appropriate for hedging this position? To answer these questions, let’s calculate the floating profit size on the open position.

The entry price is $104.50, the market was around these marks on January the 12th and 13th. On February the 5th, at the time of approaching the first target, the price fluctuated around 112$ – the market opened at $109.97 and closed at $112.32.

The floating profit can be calculated as follows:

112$ (current price) – 104.50$ (entry price) = 7.5$.

Ask price of put option is $ 2.32. Having purchased this contract, we will fix the floating profit in the amount of:

7.5$ (Floating profit) – 2.32$ (Option price) = 5.18$,

which is $518 (per 100 shares) when hedging by put option.

If we just close the position, then the profit will be $7.5 per share, that is $750.

Does this hedging make sense? May it be enough just to close the position? To answer these questions, it is necessary to assess the potential for further market movement in the right direction. It is necessary to understand how much profit will grow if the trend develops and the following targets are reached. It is necessary to compare the possible profit potential with the cost of hedging (in this example it’s with Ask price of put option).

The key target in our example is the resistance on the Monthly timeframe. The position can be closed around the marks of 122 – 123$. In this case, the maximum profit potential when reaching these goals can be calculated as follows:

122$ (target) – 104.50$ (entry price) – 2.32$ (put option price) = 15.18$

Let’s compare the available options for maintaining the position:

- without hedging – when you exit around the first target you can earn 7.5$ per share;

- with hedging – if the market starts to move against us, reverses or deeply corrects, the profit will be $5.18 per share. At the same time, if the price continues to move in the right direction, even after a correction or a flat on the Daily timeframe, and the target number two is reached, the profit will be $15.18 per share.

In this example, hedging with a put option is an attractive solution since it allows you to fix part of profit and protect the position against corrections or even a market reversal. At the same time, we are able to participate in the further market movement in the direction of the trend and increase profit if such scenario is realized. The profit potential when reaching the second target makes hedging a noteworthy way of the position maintenance.

When Option Hedging Has No Sense

If the key target were close to the first one, for example, around the mark of $114, then buying the selected put option would not be an interesting solution, because when achieving this target, the profit would be the following:

114$ (target) – 104.50$ (entry price) – 2.32$ (put option price) = 7.18$.

This is less than $7.5 per share, that is the profit we can earn by simply closing the position around current prices.

In similar situations, such hedging does not make any sense or requires greater attention when choosing option series and strikes.

Conclusions on Trade Position Support

We have analyzed the example of a simple option hedging for protecting the floating profit. This method of the position support can be an excellent addition to any medium- and long-term trading or investment strategy.

Options are not the only right solution to protect profit or enter the market, but if you know about their existence and know how to use them, you get a powerful tool to hold positions in the financial markets.

Options are a broad topic, so in this article, we haven’t analyzed the market entry using options or hedging a position with option combinations (call + put) and the differences between various option series (dates) and strikes (in the money, out of the money options).

We have not also examined the implied volatility, which is directly related to the option price, the spread size in the options market and the broker’s commissions.

In detail, these issues will be examined in the following articles on optionclue.com.

Good luck in trading!

* Classic (vanilla) options are discussed in the article. Only the name unites them with binary options. Classic options are traded on real markets and are used both by private and large traders. They allow to fix trading risks rigidly without limiting profit potential.

Binary options are analogous to a casino. They are not traded on stock exchanges and they are not used by large traders. They are adjusted so that expected value can always shift against a trader (in casinos the expected value should be less than zero, otherwise the organization will go bankrupt). Trader’s losses become the profit of the casino in this case – the supplier of binary options.