Why Do Options Prices Not Go up When Company Reports Are Released? What is IV Crush?

Trading stock options has its own characteristics, which at first glance, may seem illogical for beginners. In this article we will discuss the phenomenon of options implied volatility crush after positive earnings. Let’s look at some examples.

Suppose, a stock is trading at $360 and we buy a $400 strike call option for a premium of $10. The next day, the company releases good earnings, but, nevertheless, the option premium decreases. What happened?

Actually, this situation is quite common for stock market traders who have little experience in options trading but want to use leverage provided by options for speculation. However, they soon figure out that in most cases they fail to make a profit when buying call options during the reporting period, even if the company’s earnings report was good. This may be for two reasons.

First of all, the obvious reason for this may be that some stocks do not go up even after the promising company earnings are released. Though this situation is not common, this possibility should be considered. The main reason why options prices do not rise during the company’s earnings announcement, even if it is encouraging, relates to such a specific phenomenon in the options market as “volatility crush”.

First, I would like to explain it in a simple non-technical language. Options premiums are rapidly rising in the run-up to important news releases such as earnings reports. That means options prices start going up even if the stock price has not moved.

In other words, to correctly estimate an option using the Black-Scholes Model, the expected stock movement is included in the option premium price. The logic is that an option that gives you access to the expected strong movement of the underlying asset will cost more than an option that is not related to such expectations. It is reflected in an increase in premiums, which usually peaks on the day prior to the company’s earnings announcement. That’s when inexperienced traders often buy call options, that is, they buy a contract at the highest price. And this is when the so-called volatility crunch is happening.

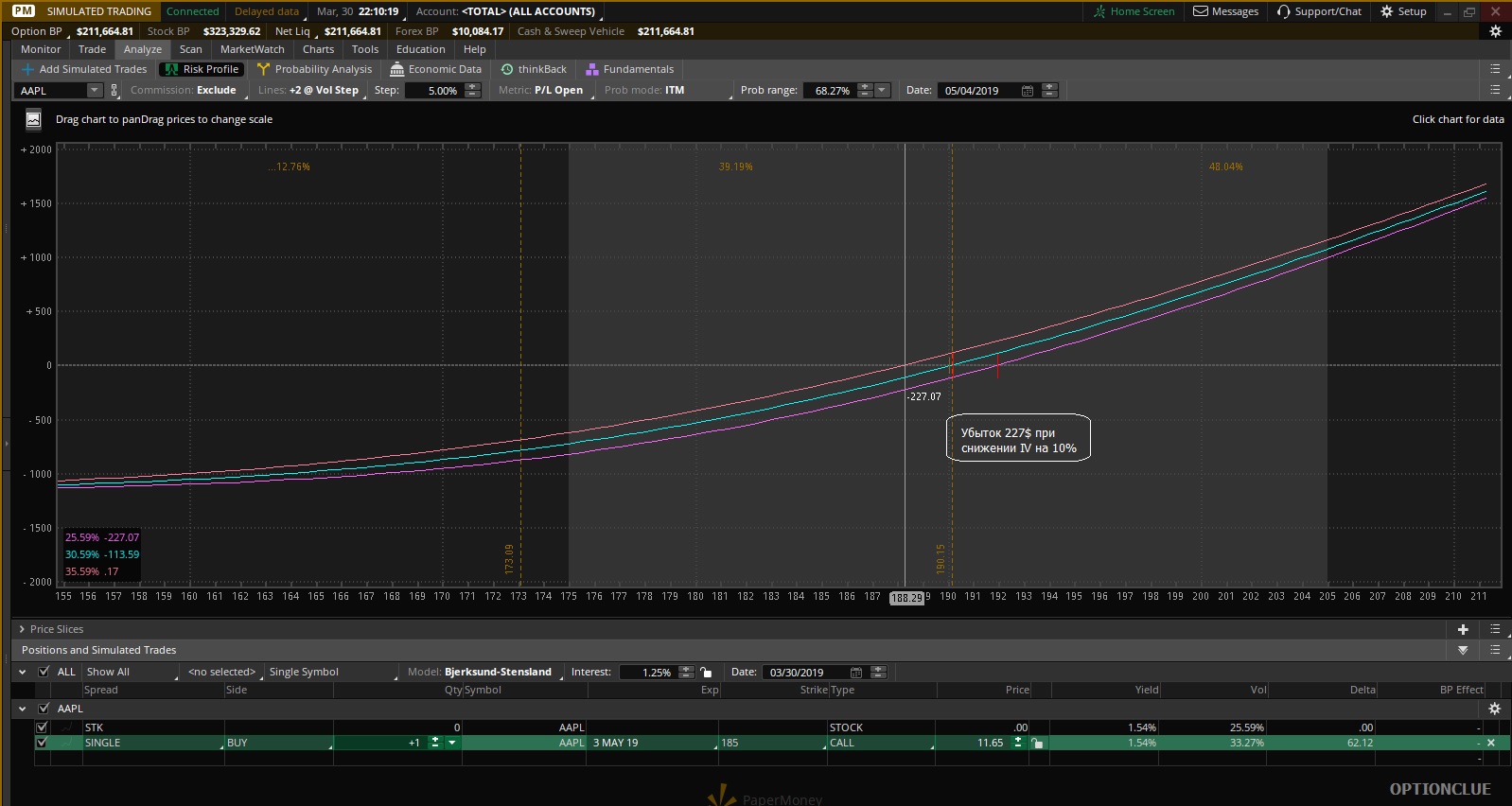

Figure 1. Decrease in implied volatility (over 10%) after AAPL earnings reports are released (thinkorswim trading platform).

However, an enormous increase in the option premium often instantly disappears at the moment of the earnings report release. This is because a volatile move is no longer expected since a potentially important event has already occurred. This part of value that disappears from your call options can be significant, that’s why if the stock price remained practically unchanged or increased insignificantly, then you will actually have a loss.

This situation is quite common for out-of-the-money call options. This is how most newbies lose money trying to speculate on corporate reports by buying call options prior to earnings reports. If the stock does not move very actively, you are unlikely to make a profit.

Actually, most professional options traders usually do exactly the opposite – the day before the report is released, they sell calls and puts (or sell straddles) that have extremely high extrinsic (time) value, and close the position when implied volatility crushes. Naturally, they sell these options to those traders who try to speculate by buying call or put options before the upcoming earnings announcement. Professional traders can speculate on the earnings reports by buying call options before their premium rises.

These options are recommended to buy at least 3 weeks before the release day of the report so that you can profit from the premium increase in anticipation of the earnings announcement. Alternatively, if you buy deep-in-the-money options with very low extrinsic value and very high delta, you will also have a good chance of profiting from good earnings. But since most novice traders use options as an analogue of leverage, very few are willing to buy expensive options deep in the money.

Thus, buying call options one day prior to earnings announcement, especially out-of-the-money options, is more likely to result in losses. The chances of making a profit are slim and it can happen only when the stock is moving very actively.

Reasons for Implied Volatility Crunch

As shown above, the collapse of option premiums after company earnings are released, is caused by a sudden and rapid decrease in Implied Volatility.

Any events that cause uncertainty in the market as a whole or regarding certain stocks increase Implied Volatility. These events include earnings reports, corporate news, judicial decisions, etc.

An increase in implied volatility often occurs before the expected event as speculators start investing in options, and thereby increasing demand. Options are also bought to hedge the risks of possible sharp stock movements. Thus, one day prior to this event, we usually observe the highest levels of implied volatility that results in high extrinsic value as well. And all that greatly reduces the ability for option buyers to make any profit.

Figure 2. Change in call option P/L depending on Implied Volatility (AAPL stock). Thinkorswim trading platform.

Basically, an increase and decrease in implied volatility is due to market demand and expectations. If there is an absolute certainty that a stock price will be actively moving, market makers, reacting to this expectation, will include implied volatility in the price and thus increase extrinsic value.

This re-pricing is needed to maintain the fair value and balance between the stocks and their derivatives, reducing arbitrage opportunities. These actions form an opinion among newcomers to options trading that option prices are not sensitive and vulnerable to market makers manipulations, thus damaging the reputation of such an important market participant. Even without big expectations of an important event, a sudden increase in demand for certain options affects implied volatility through the asking price raise caused by the increased purchases in the market. Once this event has occurred, market expectations become the same as they were before, and market makers appropriately include this in implied volatility, causing its sharp decline.