Bitcoin Overview and Crypto Markets Analysis for August 17

We make up a crypto markets overview containing the detailed technical analysis on Bitcoin and top altcoins. The market analysis is performed on the Daily timeframe.

Key topics

- Bitcoin (BTC/USDT)

- Ethereum (ETH/USDT)

- Binance Coin (BNB/USDT)

- Axie Infinity (AXS/USDT)

- Solana (SOL/USDT)

- Bottom Line

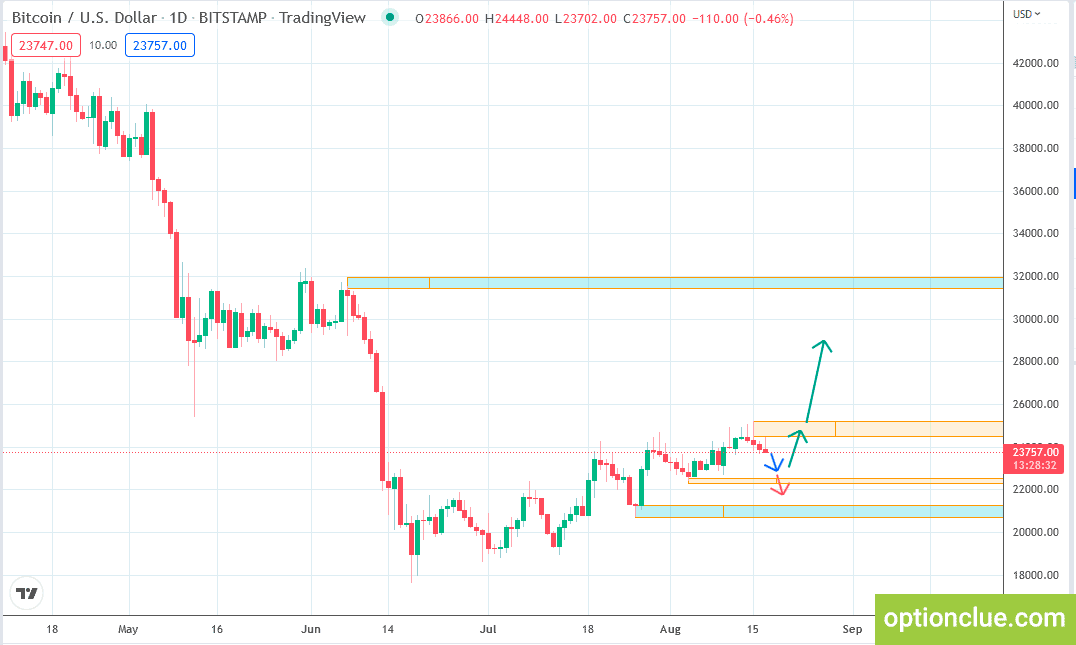

Bitcoin (BTC/USDT)

The market is in the uptrend on the Daily timeframe starting from July 19, after breaking through the upper border of the resistance level – $21,955.

The market has been in the correction wave for the last few days. This correction has already formed the new resistance. Its borders are $24,460 – $25,210

This price zone will be the target for the bullish movement continuation after the correction is finished.

In case of successful development of the trend, a more distant target will be on the highs of June 6 – 8, where the next resistance is located with the borders of $31,965 – $31,400.

Signals to buy will be relevant until the market is above the nearest support level on the Daily timeframe, the lows of August 3 – 5. The borders of this support are $22,254 – $22,512.

Bitcoin / U.S. Dollar. Daily price chart. Technical analysis.

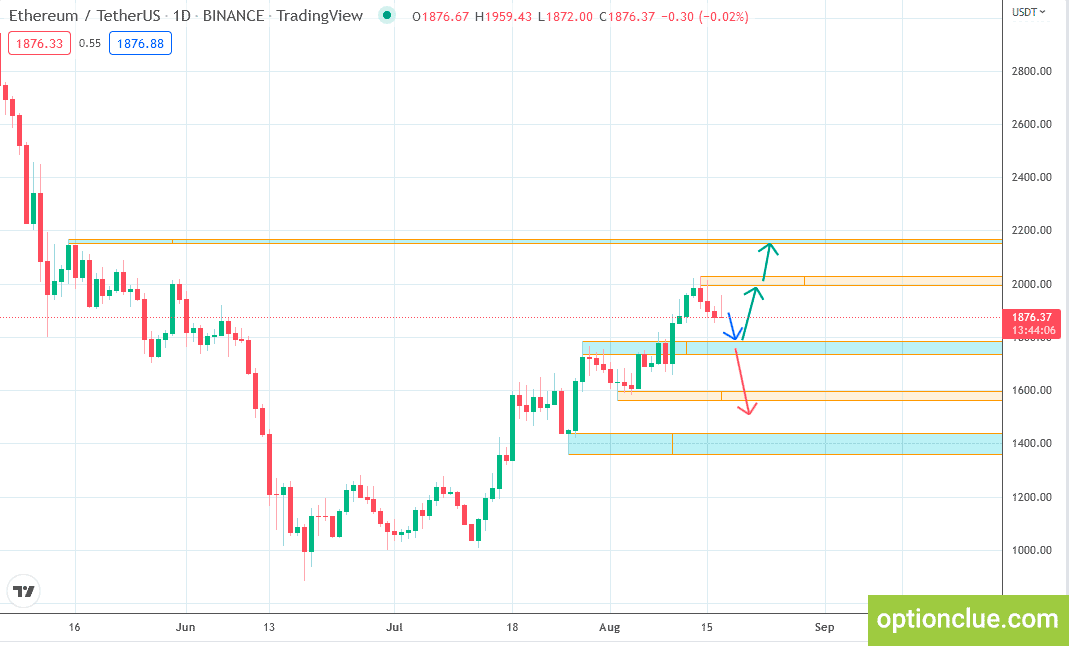

Ethereum (ETH/USDT)

The market remains in the uptrend on the Daily timeframe. Another resistance with the borders of $1784 – $1731 was broken on August 10. Now we see the correction wave after the bullish impulse formation, but the trend is still bullish on the Daily price chart.

A pullback buying opportunity will appear after the correction completion on the Daily timeframe. When the upward movement continues the resistance level with the borders of $1992 – $2030 formed on August 12 – 15 will become the next target.

Long positions will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of August 1 – 5. The borders of this support are $1596 – $1559.

Ethereum / U.S. Dollar. Daily price chart. Technical analysis.

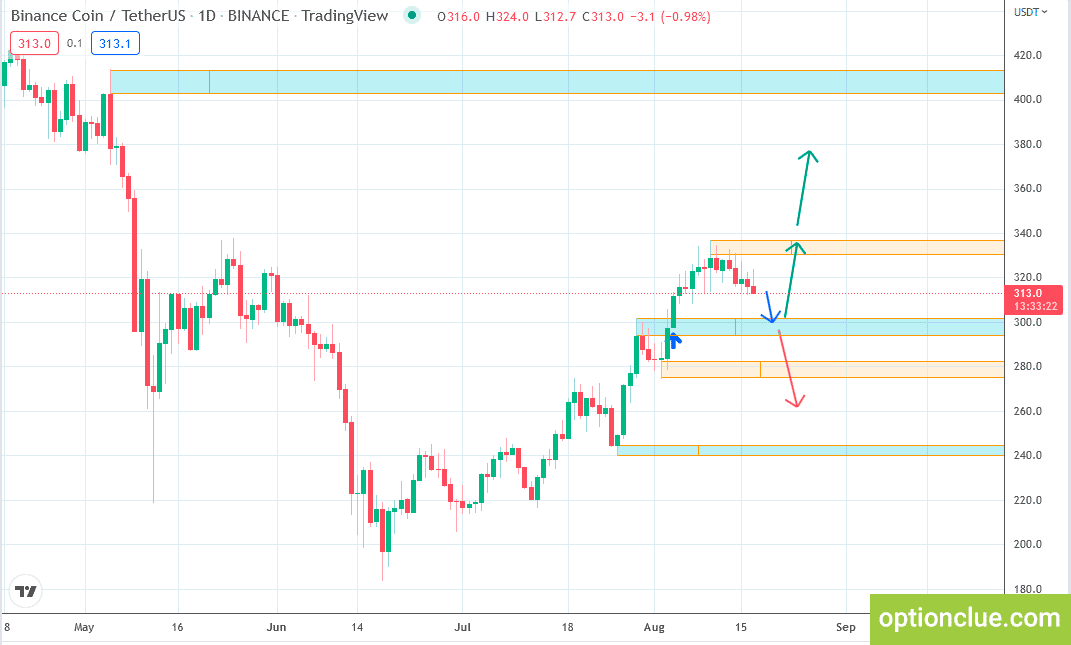

Binance Coin (BNB/USDT)

The market is in the uptrend on the Daily timeframe. The market reached intermediate targets a few days ago and a the correction wave is now developing.

A pullback buying opportunity will appear after the correction completion on the Daily chart.

This correction formed another resistance with the borders of $330 – $337.

When the correction is finished and we see the pullback, this price zone will become the target for the bullish movement.

If the market is closed above this resistance successfully, the price is likely to move forward to the target #2 – it is the resistance level with the borders of $402 – $413 formed on May 4 – 5.

Long positions will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of July 31 – August 2. The borders of this support are $275 – $282.5.

BNB / U.S. Dollar. Daily price chart. Technical analysis.

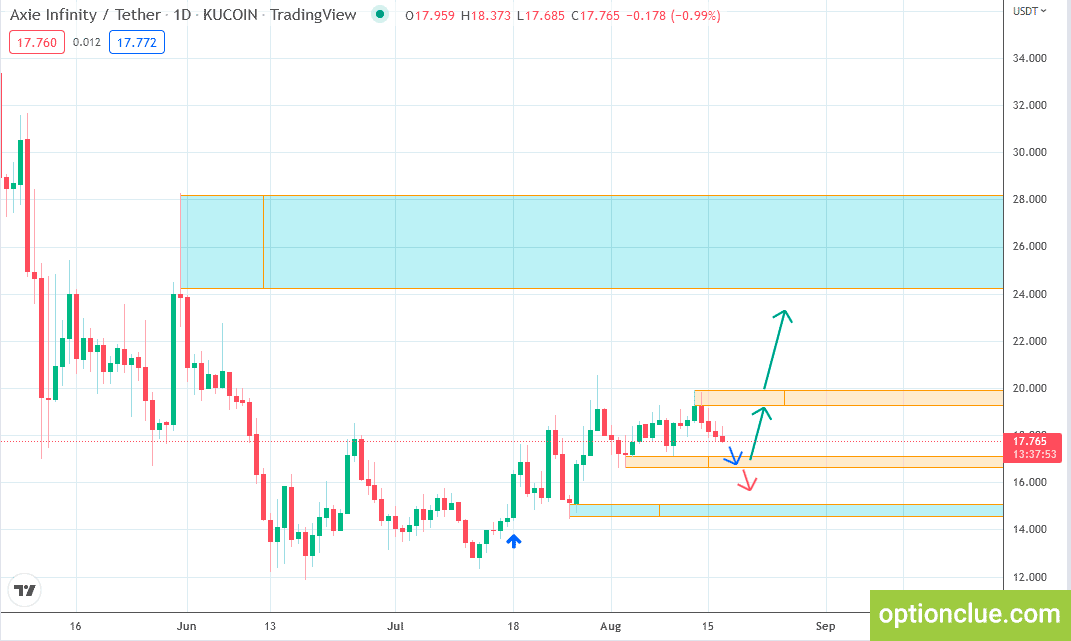

Axie Infinity (AXS/USDT)

Axie Infinity is in the bullish trend on the Daily timeframe and the correction wave develops.

A pullback buying opportunity will appear after the correction completion on the Daily timeframe. The correction which has just started has already formed another resistance with the borders of $19.23 – $19.90. After the pullback is formed this price zone will become the target for the bullish movement.

The main target for the bullish movement is the resistance level formed on May 30 – June 1. Its borders are $24.21 – $28.20.

Long positions will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of August 1 – 5. The borders of this support are $17.12 – $16.62.

When breaking through the support, the trend will reverse and we should look for selling opportunities.

AXS / U.S. Dollar. Daily price chart. Technical analysis.

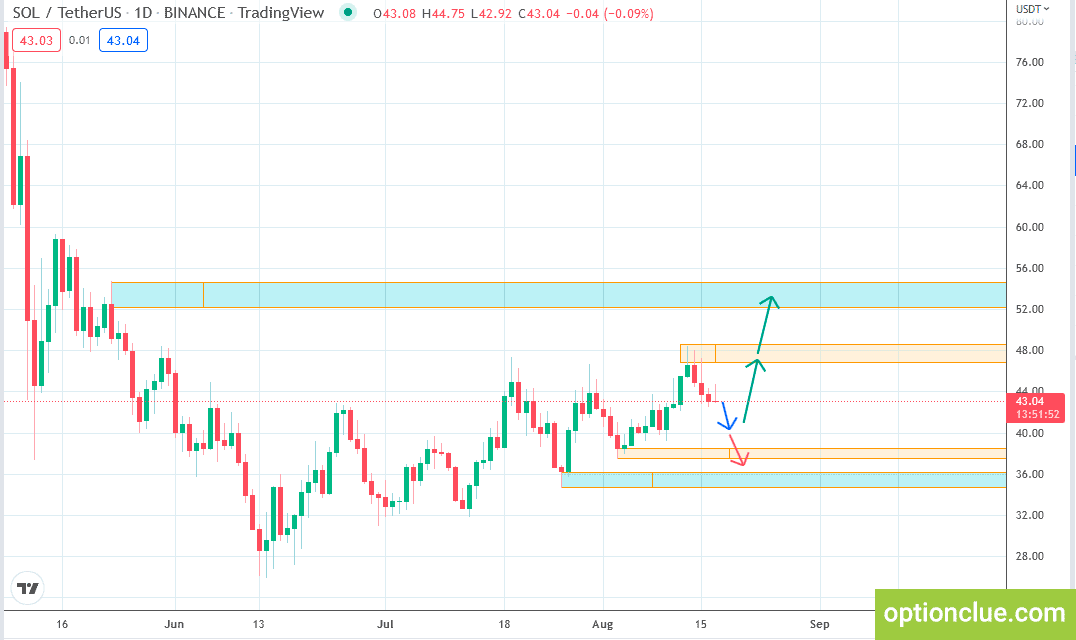

Solana (SOL/USDT)

The market is in the uptrend on the Daily timeframe and the correction wave develops.

A pullback buying opportunity will appear after the correction is finished and a bullish candle is formed on the Daily timeframe.

If the upward movement continues, then the price can move towards target #1. It is the resistance level formed on August 12 – 15. Its borders are $46.74 – $48.56. A more ambitious target is around $52.

SOL / U.S. Dollar. Daily price chart. Technical analysis.

Bottom Line

In terms of medium-term trading, tokens with the correction close to completion on the Daily timeframe and with potentially the most promising risk-reward ratio are Axie Infinity, Solana and Ethereum.

Many tokens have already broken the bearish trend and are moving up. Some of them have reached the first targets.

In the near future, many tokens will provide excellent opportunities to enter the market with a huge reward / risk ratio.

We used support and resistance levels for the analysis in this market overview.

FYI. We are building an indicator that will automatically plot key levels on all timeframes on all popular tokens..

Subscribe to our Telegram channel, dedicated to cryptocurrencies.

Subscribe to our Telegram channel, dedicated to cryptocurrencies.