Financial markets weekly overview for August 10 – 14

We make up a weekly medium-term trade list based on CFTC reports and technical analysis.

The overview provides a description of the technical condition of the market on the most popular financial instruments, as well as information on the large speculators’ actions according to the last COT reports and the previous period.

If you want to use CFTC reports in your trading practice, you should understand that for an objective assessment of the situation it’s not enough to have the data of the last report. The dynamic is more important, in other words, comparing the statistics of large speculators’ actions in the current period with the previous one, so we mention both values.

Key topics

- Trade list for the current week

- E-Mini S&P500 (ESU20)

- Dollar Index (DXY)

- Euro (EURUSD)

- Swiss Franc (USDCHF)

- British Pound (GBPUSD)

- Japanese Yen (USDJPY)

- WTI Crude Oil (CLU20)

- Canadian Dollar (USDCAD)

- Gold (XAUUSD)

- Silver(XAGUSD)

- Australian Dollar (AUDUSD)

- New Zealand Dollar (NZDUSD)

- Russian rouble (USDRUB)

- Conclusions

Trade list for the current week

| Assets | Comments | 3. 08 | 7. 08 |

|---|---|---|---|

| **E-Mini S&P500 (ESU20) | The market remains in the uptrend and the impulse wave develops. A pullback buying opportunity will appear after the correction formation on the Daily timeframe. Long positions will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of July 29 - August 3. | ||

| ***Dollar Index (DXU20) | The market remains in the downtrend. The correction came to an end last week and the pullback selling opportunity was formed. Short positions will remain relevant until the market is below the nearest resistance level on the Daily timeframe, the highs of July 31 - August 5. | ||

| ***EUR (E6U20) | EURUSD currency pair remains in the uptrend. The correction came to an end last week and the pullback buying opportunity was formed. Long positions (EURUSD) will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of July 31 - August 5. | ||

| ***CHF (S6U20) | USDCHF currency pair remains in the downtrend. The correction came to an end last week and the pullback selling opportunity was formed. Short positions (USDCHF) will remain relevant until the market is below the nearest resistance level on the Daily timeframe, the highs of July 31 - August 5. | ||

| **GBP (B6U20) | GBPUSD currency pair remains in the uptrend. The correction came to an end last week and the pullback buying opportunity was formed. Long positions (GBPUSD) will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of August 3 - 6. | ||

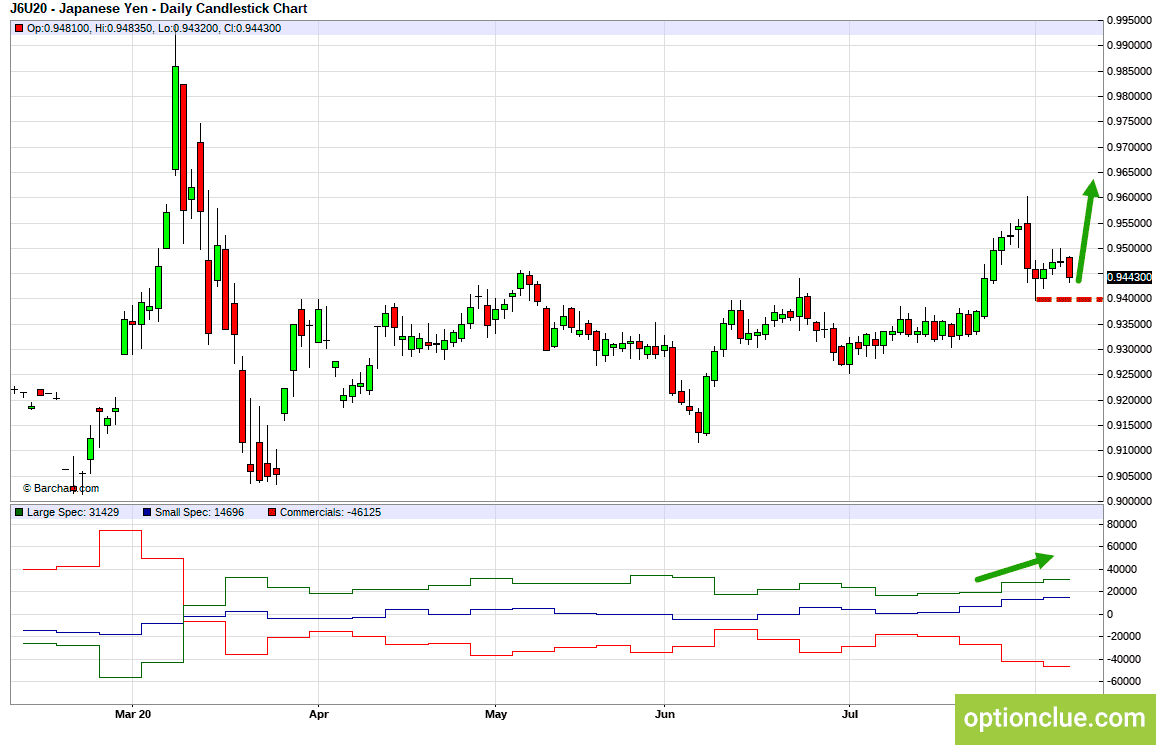

| ***JPY (J6U20) | USDJPY currency pair remains in the downtrend. The correction came to an end last week and the pullback selling opportunity was formed. Short positions (USDJPY) will remain relevant until the market is below the nearest resistance level on the Daily timeframe, the highs of July 31 - August 5. | ||

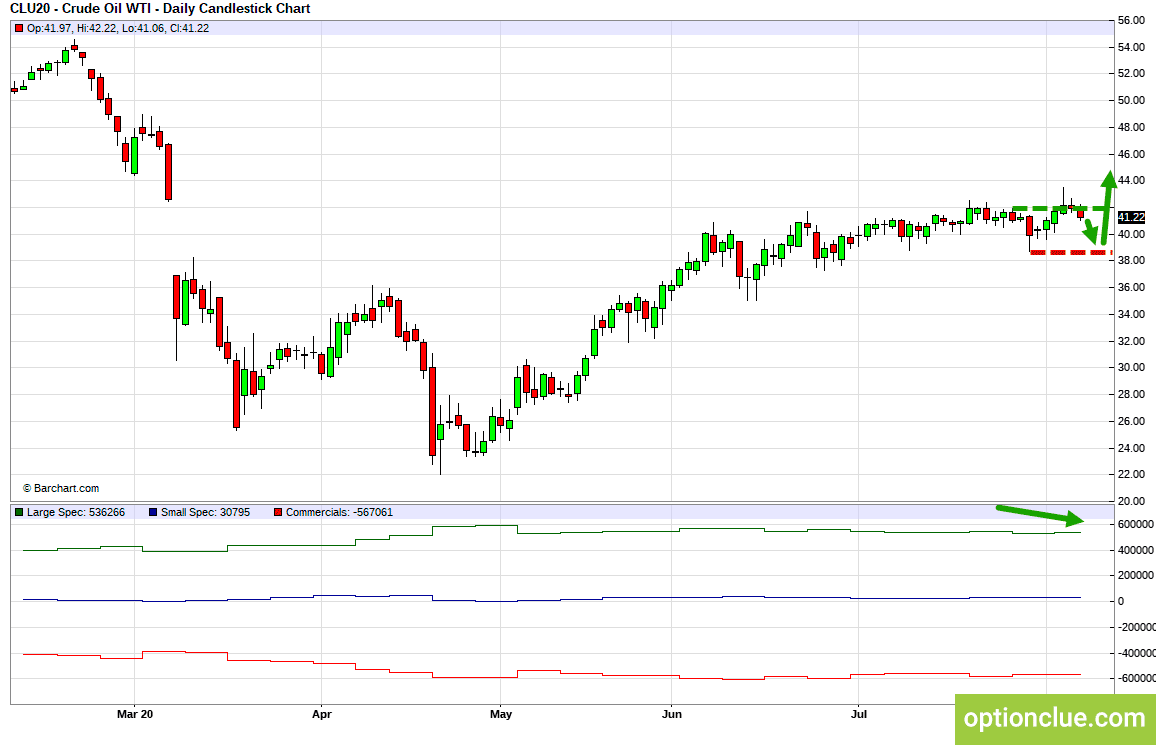

| **WTI (CLU20) | The resistance level was broken on the Daily timeframe on Wednesday, the trend is bullish now and the correction wave develops. A pullback buying opportunity will appear after the correction completion on the Daily timeframe. Long positions will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of July 30 - August 4. | ||

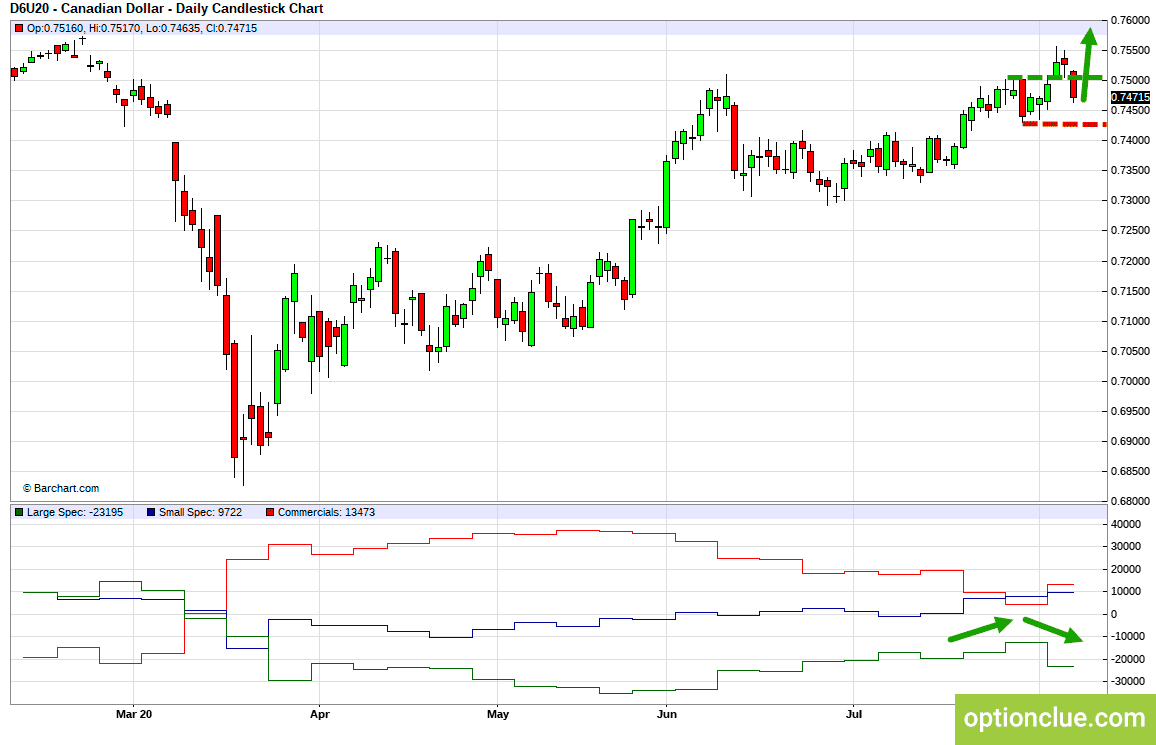

| **CAD (D6U20) | USDCAD currency pair remains in the downtrend and the correction wave develops. A pullback selling opportunity will appear after the correction completion on the Daily timeframe. Short positions (USDCAD) will remain relevant until the market is below the nearest resistance level on the Daily timeframe, the highs of July 30 - August 3. | ||

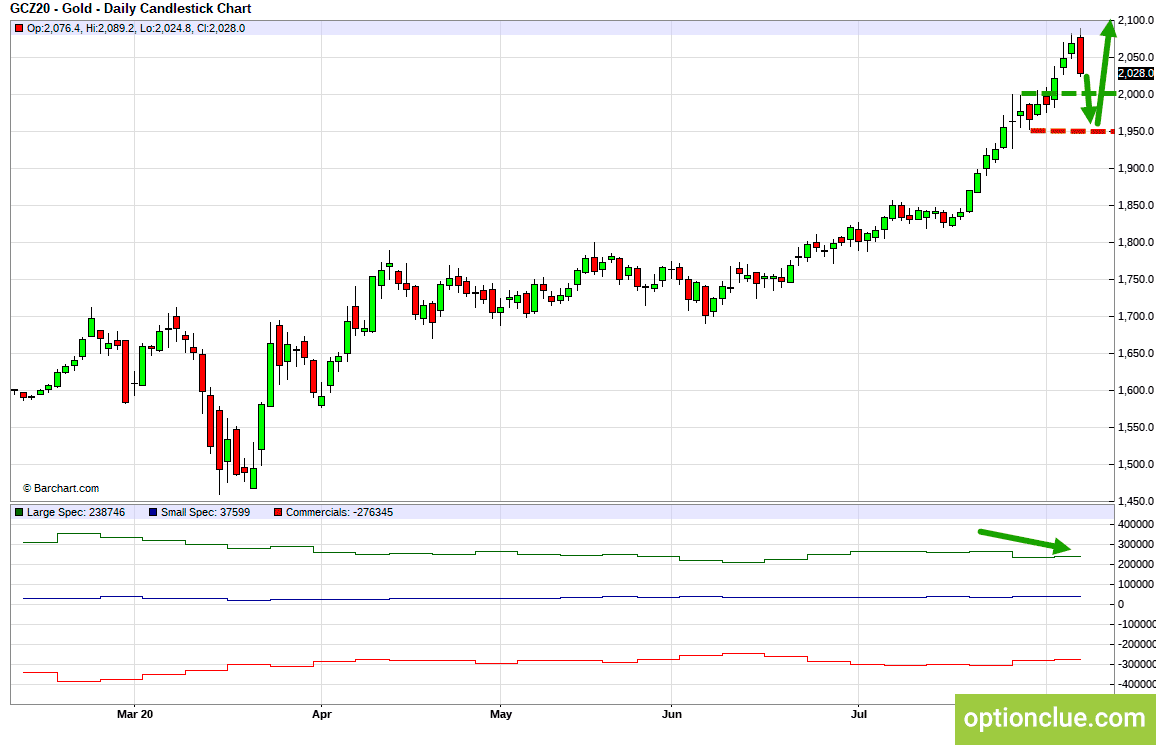

| **XAU (GCZ20) | The market remains in the uptrend and the correction wave develops. A pullback buying opportunity will appear after the correction completion on the Daily timeframe. Long positions will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of July 30 - 31. | ||

| ***XAG (SIU20) | The market remains in the uptrend and the correction wave develops. A pullback buying opportunity will appear after the correction completion on the Daily timeframe. Long positions will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of July 30 - August 4. | ||

| **AUD (A6U20) | The market remains in the uptrend and the correction wave develops. A pullback buying opportunity will appear after the correction completion on the Daily timeframe. Long positions (AUDUSD) will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of July 31 - August 5. | ||

| ***NZD (N6U20) | The market remains in the downtrend. The correction came to an end last week and the pullback selling opportunity was formed. Short positions (NZDUSD) will remain relevant until the market is below the nearest resistance level on the Daily timeframe, the highs of August 5 - 7. | ||

| ***RUB (R6U20) | USDRUB currency pair remains in the uptrend. The correction came to an end last week and the pullback buying opportunity was formed. Long positions (USDRUB) will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of August 3 - 7. |

| The notation that determines the quality of possible trades during the new week are profit potential, the risk-reward ratio, the opinion of major market players, other factors: | |

| **** | Excellent |

| *** | Good |

| ** | Ordinary |

| * | Uninteresting (sideways trends, etc.) |

| The notation that determines the change in the opinion of large speculators, the direction of COT net position indicator in the reporting and prior periods are: | |

| large speculators are buying the asset specified in the first column | |

| large speculators are selling the asset specified in the first column | |

| the green color of the arrows means that the Daily trend direction corresponds to the opinion of large speculators | |

| the blue color of the arrows means that the Daily trend direction doesn’t correspond to the opinion of large speculators |

If you want to get more information on the pullback trading tactics and other aspects of trading in the market, watch the «Horizontal levels in trading» video course.

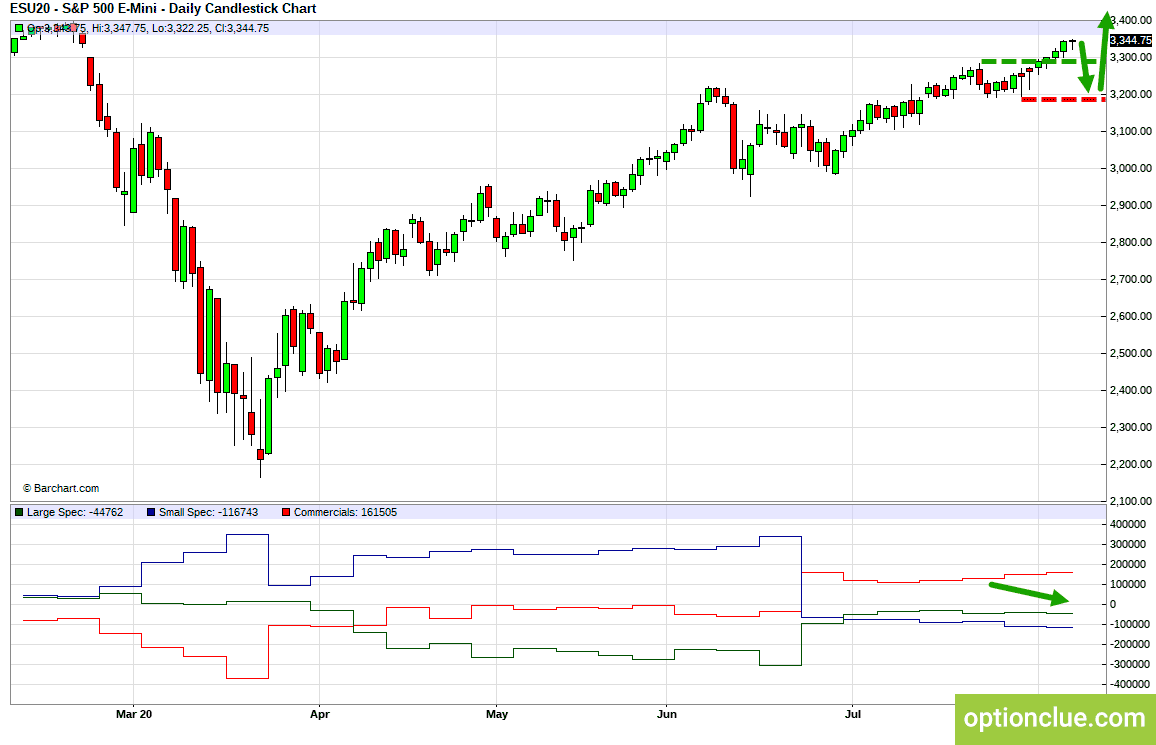

E-Mini S&P500 (ESU20)

The market remains in the uptrend and the impulse wave develops. A pullback buying opportunity will appear after the correction formation on the Daily timeframe. Long positions will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of July 29 – August 3.

COT indicator decreases. CFTC reports indicate that large speculators are selling and the professionals’ opinion doesn’t correspond to the market technical picture and it makes sense to reduce the position size when an entry point appears in the trend direction.

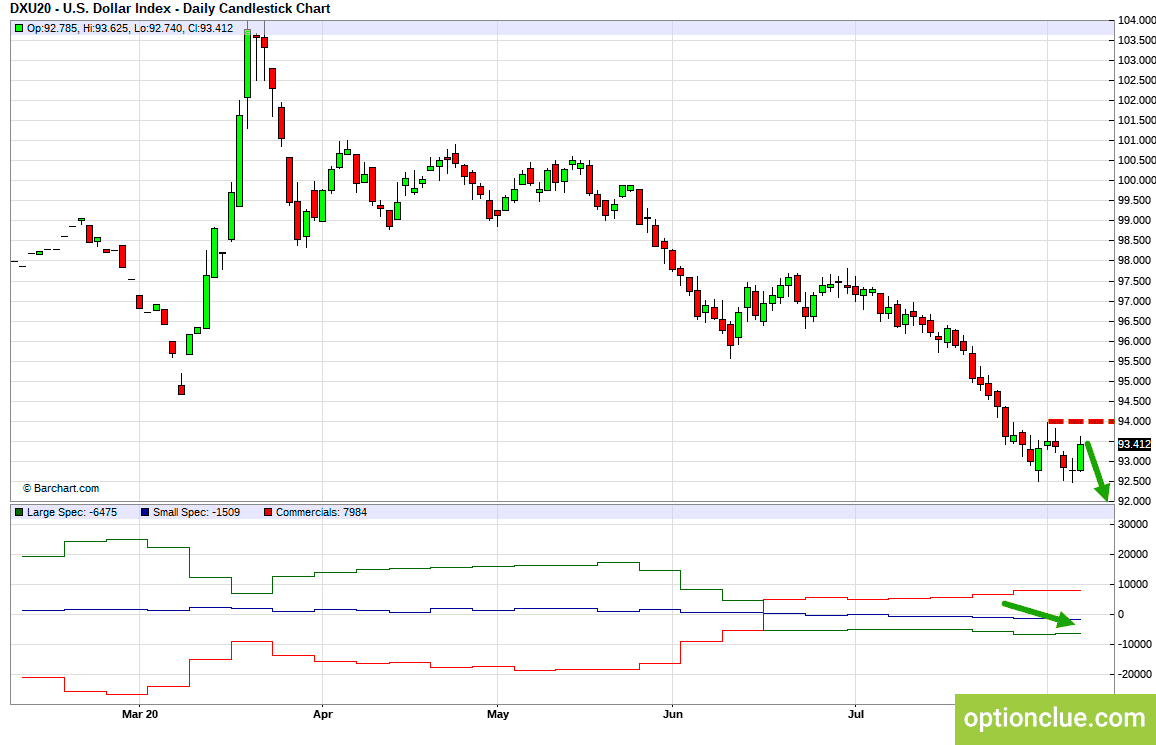

Dollar Index (DXY)

The market remains in the downtrend. The correction came to an end last week and the pullback selling opportunity was formed. Short positions will remain relevant until the market is below the nearest resistance level on the Daily timeframe, the highs of July 31 – August 5.

COT indicator increased but didn’t reverse. CFTC reports indicate that large speculators are selling the dollar, hedgers are buying and the professionals’ opinion corresponds to the Daily trend direction.

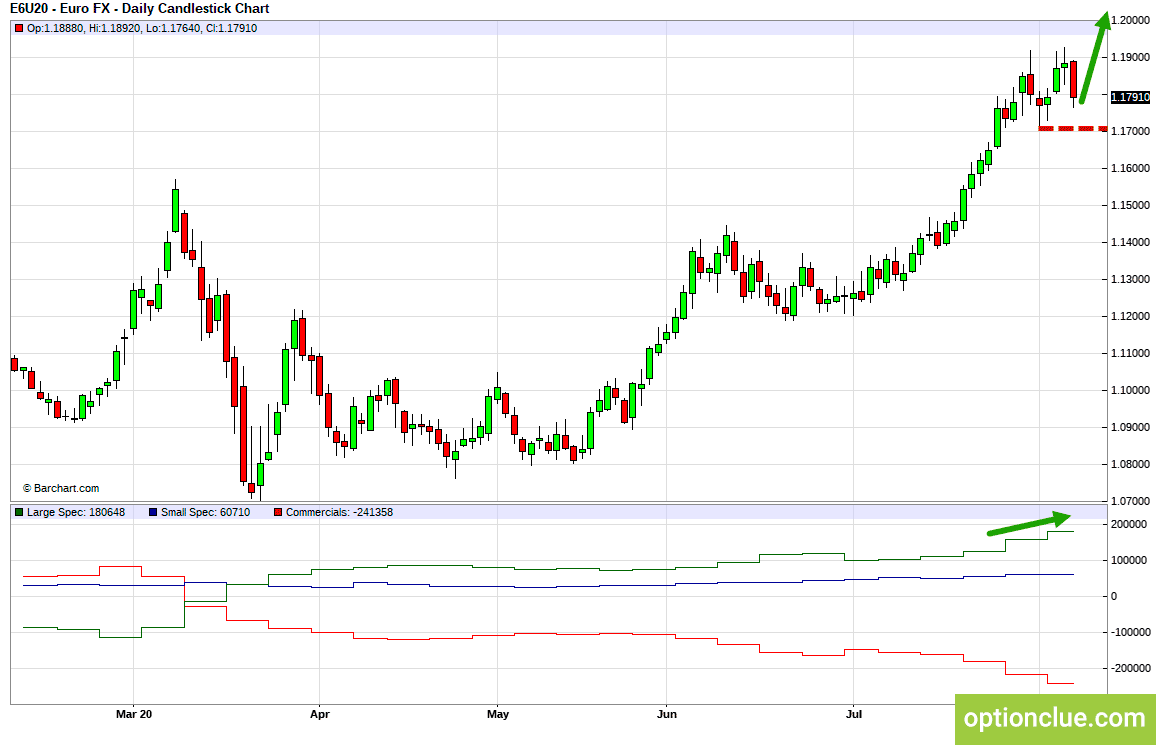

Euro (EURUSD)

EURUSD currency pair remains in the uptrend. The correction came to an end last week and the pullback buying opportunity was formed. Long positions (EURUSD) will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of July 31 – August 5.

COT indicator increases. Large speculators are buying Euro and the professionals’ opinion corresponds to the market technical picture.

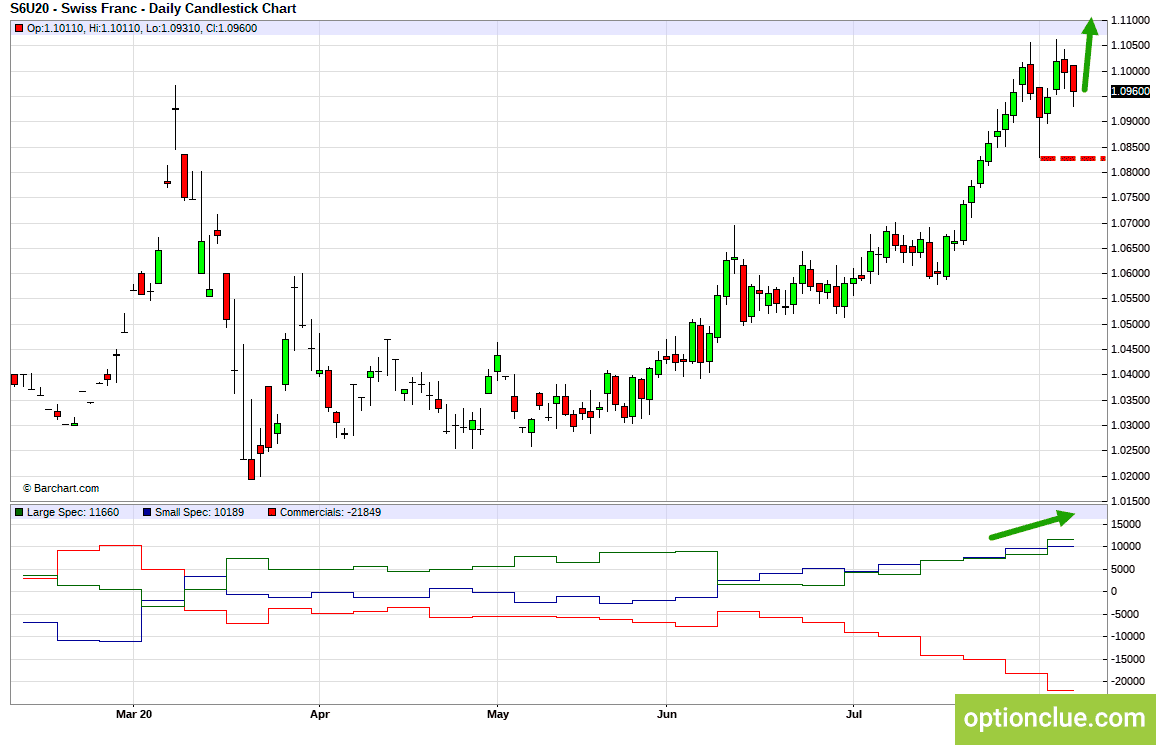

Swiss Franc (USDCHF)

USDCHF currency pair remains in the downtrend. The correction came to an end last week and the pullback selling opportunity was formed. Short positions (USDCHF) will remain relevant until the market is below the nearest resistance level on the Daily timeframe, the highs of July 31 – August 5.

COT indicator increases. Large speculators are buying franc and the professionals’ opinion corresponds to the Daily trend direction.

British Pound (GBPUSD)

GBPUSD currency pair remains in the uptrend. The correction came to an end last week and the pullback buying opportunity was formed. Long positions (GBPUSD) will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of August 3 – 6.

COT indicator increased but didn’t reverse. CFTC reports indicate that large speculators are selling Pound and the professionals’ opinion doesn’t correspond to the Daily trend direction and it makes sense to reduce the position size when an entry point appears in the trend direction.

Japanese Yen (USDJPY)

USDJPY currency pair remains in the downtrend. The correction came to an end last week and the pullback selling opportunity was formed. Short positions (USDJPY) will remain relevant until the market is below the nearest resistance level on the Daily timeframe, the highs of July 31 – August 5.

COT indicator increases. Large speculators are buying Yen and the professionals’ opinion corresponds to the Daily trend direction.

WTI Crude Oil (CLU20)

The resistance level was broken on the Daily timeframe on Wednesday, the trend is bullish now and the correction wave develops. A pullback buying opportunity will appear after the correction completion on the Daily timeframe. Long positions will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of July 30 – August 4.

COT net position indicator decreases. Large speculators are selling oil. Professionals’ opinion doesn’t correspond to the Daily trend direction and it makes sense to reduce the position size when an entry point appears in the trend direction.

Canadian Dollar (USDCAD)

USDCAD currency pair remains in the downtrend and the correction wave develops. A pullback selling opportunity will appear after the correction completion on the Daily timeframe. Short positions (USDCAD) will remain relevant until the market is below the nearest resistance level on the Daily timeframe, the highs of July 30 – August 3.

COT indicator reversed. CFTC reports indicate that large speculators are selling the Canadian dollar and hedgers are buying and the professionals’ opinion doesn’t correspond to the market technical picture and it makes sense to reduce the position size when an entry point appears in the trend direction.

Gold (XAUUSD)

The market remains in the uptrend and the correction wave develops. A pullback buying opportunity will appear after the correction completion on the Daily timeframe. Long positions will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of July 30 – 31.

COT indicator increased but didn’t reverse. Large speculators are selling gold and the professionals’ opinion doesn’t correspond to the market technical picture and it makes sense to reduce the position size when an entry point appears in the trend direction.

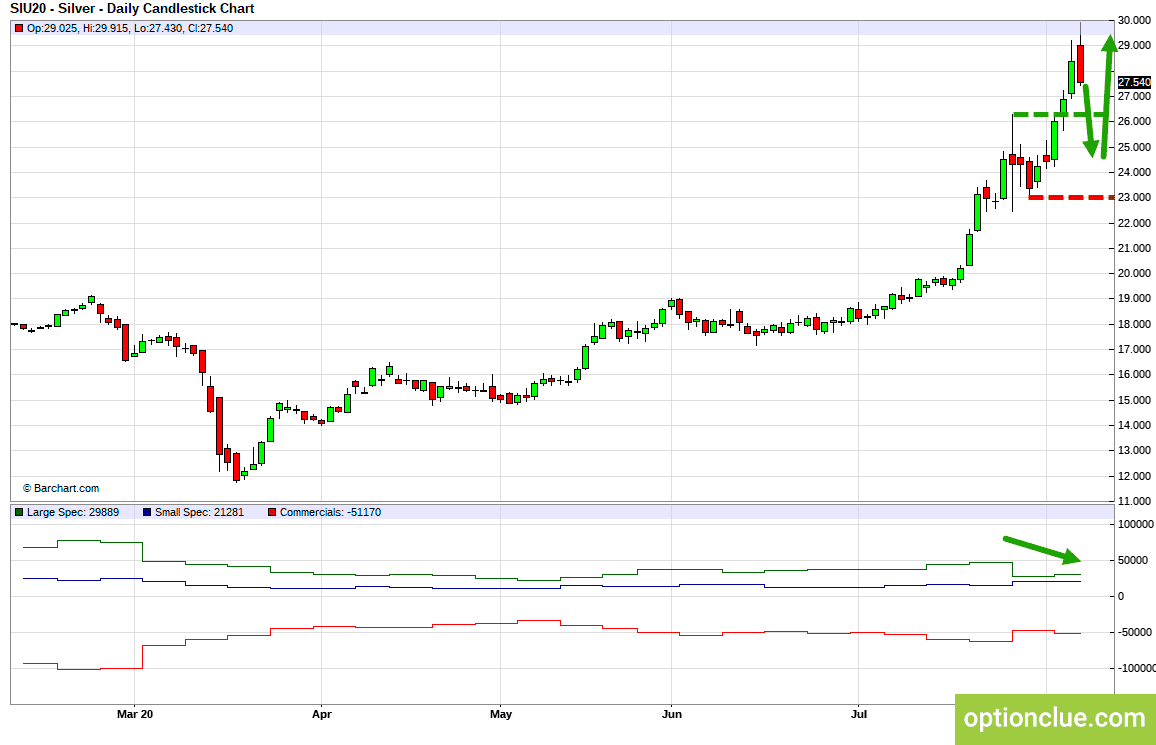

Silver (XAGUSD)

The market remains in the uptrend and the correction wave develops. A pullback buying opportunity will appear after the correction completion on the Daily timeframe. Long positions will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of July 30 – August 4.

COT indicator increased but didn’t reverse. At the same time, CFTC reports indicate that large speculators are selling and hedgers are buying and the professionals’ opinion doesn’t correspond to the technical picture and it makes sense to reduce the position size when an entry point appears in the trend direction.

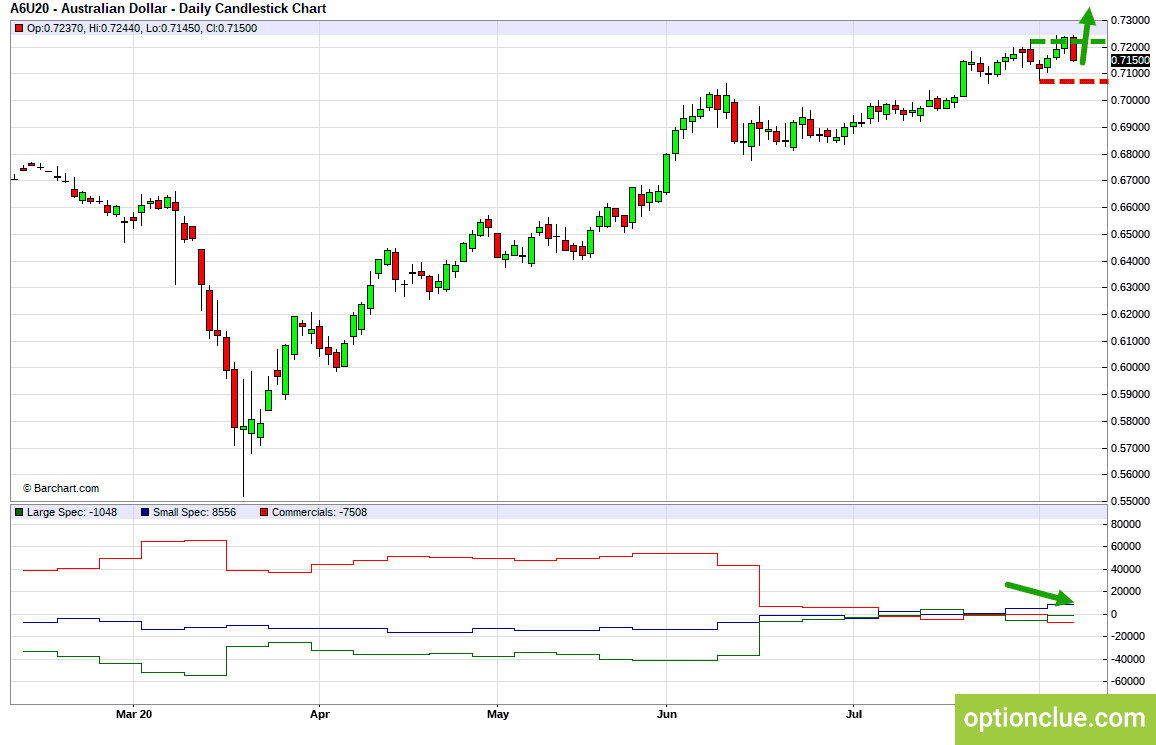

Australian Dollar (AUDUSD)

The market remains in the uptrend and the correction wave develops. A pullback buying opportunity will appear after the correction completion on the Daily timeframe. Long positions (AUDUSD) will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of July 31 – August 5.

COT net position indicator increased but didn’t reverse. Large speculators are selling and hedgers are buying. Professionals’ opinion doesn’t correspond to the Daily trend direction and it makes sense to reduce the position size when an entry point appears in the trend direction.

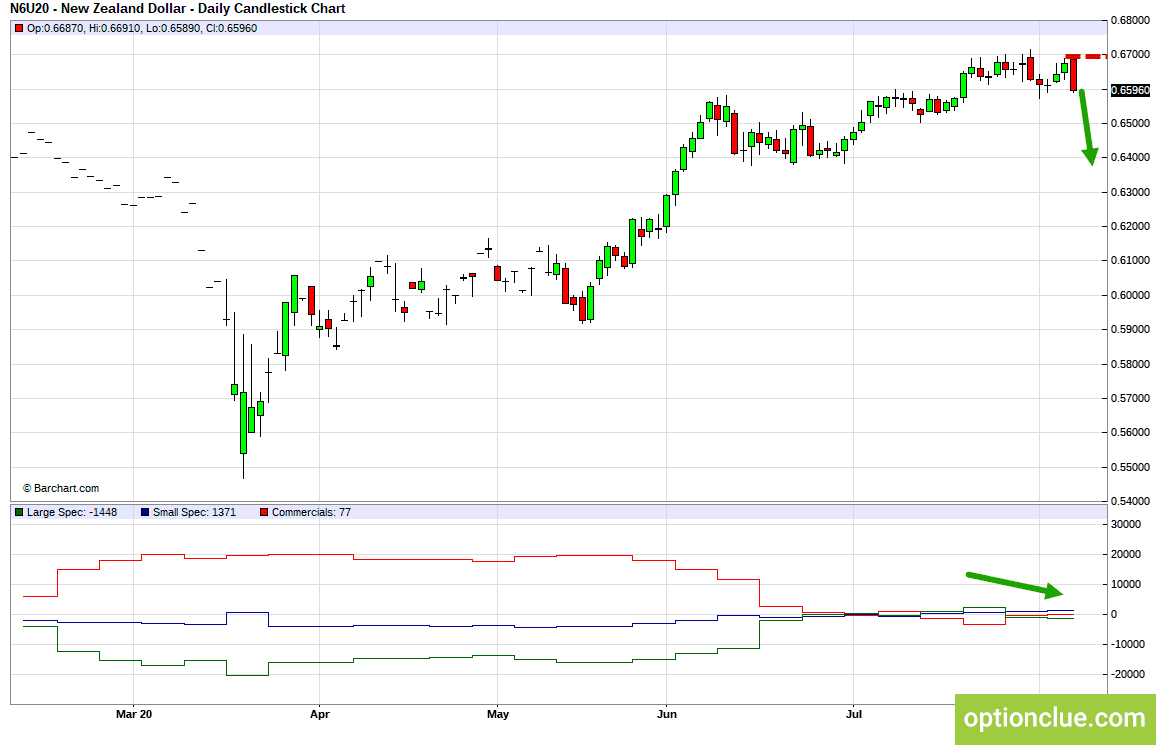

New Zealand Dollar (NZDUSD)

The market remains in the downtrend. The correction came to an end last week and the pullback selling opportunity was formed. Short positions (NZDUSD) will remain relevant until the market is below the nearest resistance level on the Daily timeframe, the highs of August 5 – 7.

COT indicator decreases. CFTC reports indicate that large speculators are selling and the professionals’ opinion corresponds to the market technical picture.

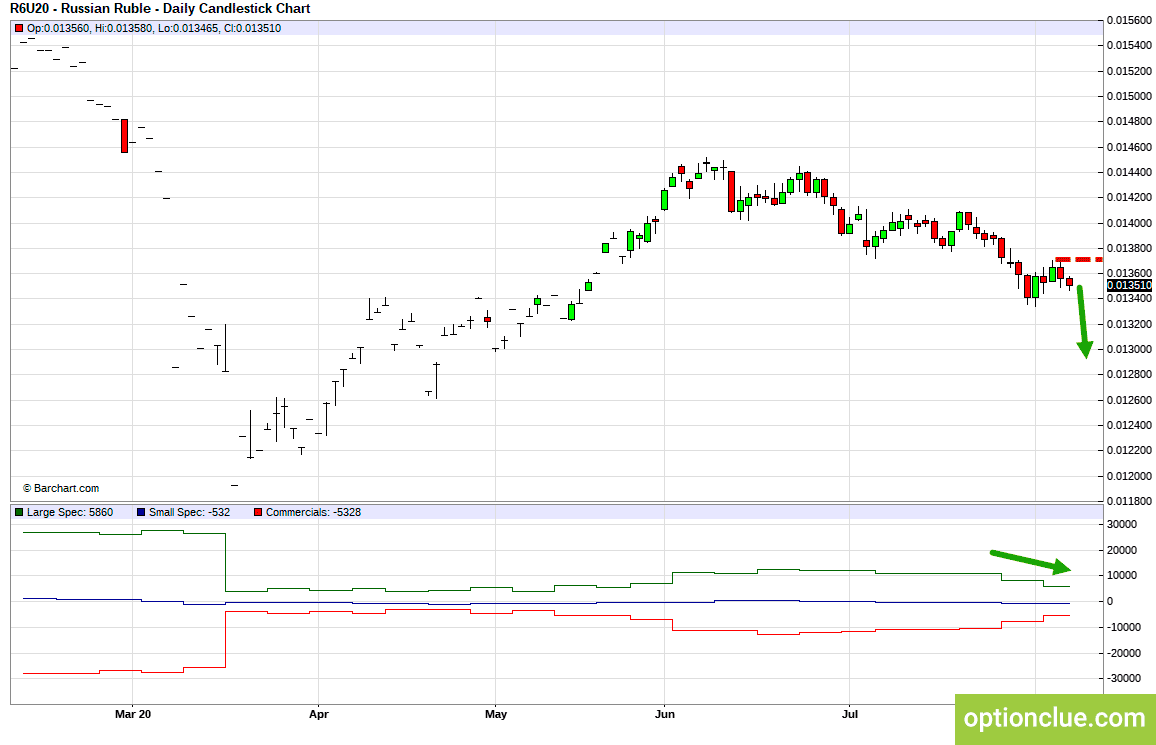

Russian rouble (USDRUB)

USDRUB currency pair remains in the uptrend. The correction came to an end last week and the pullback buying opportunity was formed. Long positions (USDRUB) will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of August 3 – 7.

COT indicator decreases. Large speculators are selling rouble and the professionals’ opinion corresponds to the Daily trend direction.

Conclusions

In terms of medium-term trading, financial instruments with the correction close to completion on the Daily timeframe and with potentially the most promising risk-reward ratio are USDCHF, WTI Crude Oil, EURUSD, GBPUSD, USDJPY, USDRUB.

In the near future USDCAD, gold and silver can become noteworthy depending on the market correction depth.

Other financial instruments in the trade list may be also interesting, but in these markets pullback signals on the Daily timeframe are likely to occur no earlier than a week.

More information on the topic:

- The role of support and resistance levels in the trading plan

- Trading tactics. Breakout trading and pullback trading

- How to use CFTC reports in trading. General concepts

- How to use CFTC reports in trading. The logic of large speculators

Good luck in trading!