Grail and Ignorance. How to Lose Money in Trading Quickly

Who destroys trading accounts faster – traders who do not use risk and money management rules or a trading robot that determines market entry points at random?

Contents

My first trading account

I destroyed the first trading account after several trades although I believed I was doing everything right. Like the vast majority of newcomers, I supposed that the most important thing in trading was to determine the ideal market entry and exit points.

By that moment I knew about money and risk management rules and I was warned of their importance. However, I did not use them in my trading practice. Apart from this, I did not have a trading plan. I used several popular indicators to find the market entry point, but I did not have a clearly specified trading system. This is the beginner’s classic way and such attitude to trading leads to the predictable result. It’s a loss of funds.

Ironically, at that time I used the risk management concept which necessarily leads to the destruction of the trading account. It’s the so-called «lock». I read the article that described the advantages of this method and, in view of ignorance, I immediately adopted it.

Quote on the topic

A good approach could be sabotaged by a few mistakes. You never want that. You never want to be at the mercy of having a few mistakes knock you out of the game. Virtually every trader I ever interviewed said the risk management part is more important than the method.

Jack Schwager, an author, fund manager

Moreover, I traded in Forex without knowing about the principles of calculating the optimal risk per trade which worsened the situation even more. The combination of huge leverage and misunderstanding the importance of money and risk management principles is perhaps the most popular reason of capital loss among new traders.

The example described above is a classic manifestation of the Dunning-Krueger effect in trading – the lower the competence, the higher the person’s confidence that he is competent. Ignorance in the financial markets leads to a rapid loss of funds. The less a trader knows about financial markets, the more confidence he has that trading is simple and that his own trading strategy will directly bring him thousands of percent per annum.

Quote from «The Willpower Instinkt»

This bias is not unique to willpower — for example, people who think they are the best at multitasking are actually the most distractible. Known as the Dunning-Kruger effect, this phenomenon was first reported by two Cornell University psychologists who found that people overestimate their abilities in all sorts of areas, including sense of humor, grammar, and reasoning skills. The effect is most pronounced among people who have the least skill; for example, those with a test score in the 12th percentile would, on average, estimate themselves to be in the 62nd percentile. This explains, among other things, a large percentage of American Idol auditions.

Kelly McGonigal, an author, PhD, psychologist teaching at Stanford University

Due to a combination of these factors, I destroyed a trading account after several trades. The speed of losing funds genuinely surprised me and it’s time to analyze my mistakes. As a result, it became obvious that the key reason was the disregard of risk and money management rules. The cost of this knowledge was several thousand dollars. I had to invest these funds in the important fact awareness. The main thing in trading is not the search for an ideal entry point, but the use of risk and money management rules.

Later, when dealing with traders, studying the trade statistics of beginners, literature and useful interviews, I was always convinced that when a trader uses money and risk management rules, he has a chance to succeed in the market, to become a professional and to manage the investors’ capital. Otherwise, the long-term result of his trades will most likely be the average one, that is, negative. If a trader is willing to learn from his mistakes and adjust his trading principles, the sum of future losses can become an investment in experience and knowledge, as well as in understanding the value of risk management and money management.

Your Competitive Advantage

Among all traders I communicated with, at least 30% of them believe that their main task is to find the ideal trading concept. Risk and money management is considered as an option that does not particularly affect the result. But such traders are often in constant search. They open accounts one after another, test dozens of indicators and are gradually disappointed with them. This process is endless since the ideal trading concept (the Grail) does not exist.

Most traders lose money in the market, at the same time most traders believe that trading with the risk-reward ratio of 1:1 or more is quite normal. These two tendencies, in my opinion, have a strong correlation.

Quote on the topic

My strength is I never make a trade that doesn’t offer an excellent risk-reward ratio: downside one, upside five.

Mike Bellafiore, a trader, co-founder of a prop trading firm SMB Capital

Often a trader, having studied the key principles of trading in the markets, directly starts trading using real money. He is aware of risk management rules importance and starts looking for trades with the reward-risk ratio of 2:1 or higher and suddenly faces the need to skip most of the trades. When searching for such entry points, you will have to skip up to 70% of trades since they will not meet the requirements of the 4-th point of the trading plan which says about risk management rules.

Quote on the topic

There’s no reason to take substantial amounts of financial risk ever, because you should always be able to find something where you can skew the reward risk relationship so greatly in your favor that you can take a variety of small investments with great reward risk opportunities that should give you minimum draw down pain and maximum upside opportunities.

Paul Tudor Jones, a founder of hedge fund Tudor Investment Corporation

If a trader looks for ideal trades, for example, when risk-reward ratio is equal to 1:5 and less, he will have to skip about 90% of entry opportunities.

The need to skip low-quality trades often raises such problem: a trader, filtering most of the trades, simultaneously sees that some positions with a reward-risk ratio of 1:1 and lower would often be closed with profit.

This can lead to the desire to ignore risk management and to trade all market opportunities without exception. This is an unfortunate mistake which in the long term leads at least to a worsening of trade statistics and, as a maximum, leads to the loss of a trading account. In this case a trader loses an important competitive advantage – the ability to focus on high quality trades and the ability to be wrong more often than to be right.

Experiment

Beginners focus on market entry and exit points, ignore risk management and money management and are in the constant search for Grail. Usually this approach is used by 95% of traders who regularly lose their trading accounts.

Risk management and money management are primary and the search for entry points is of secondary importance. To illustrate this idea we will make a small experiment.

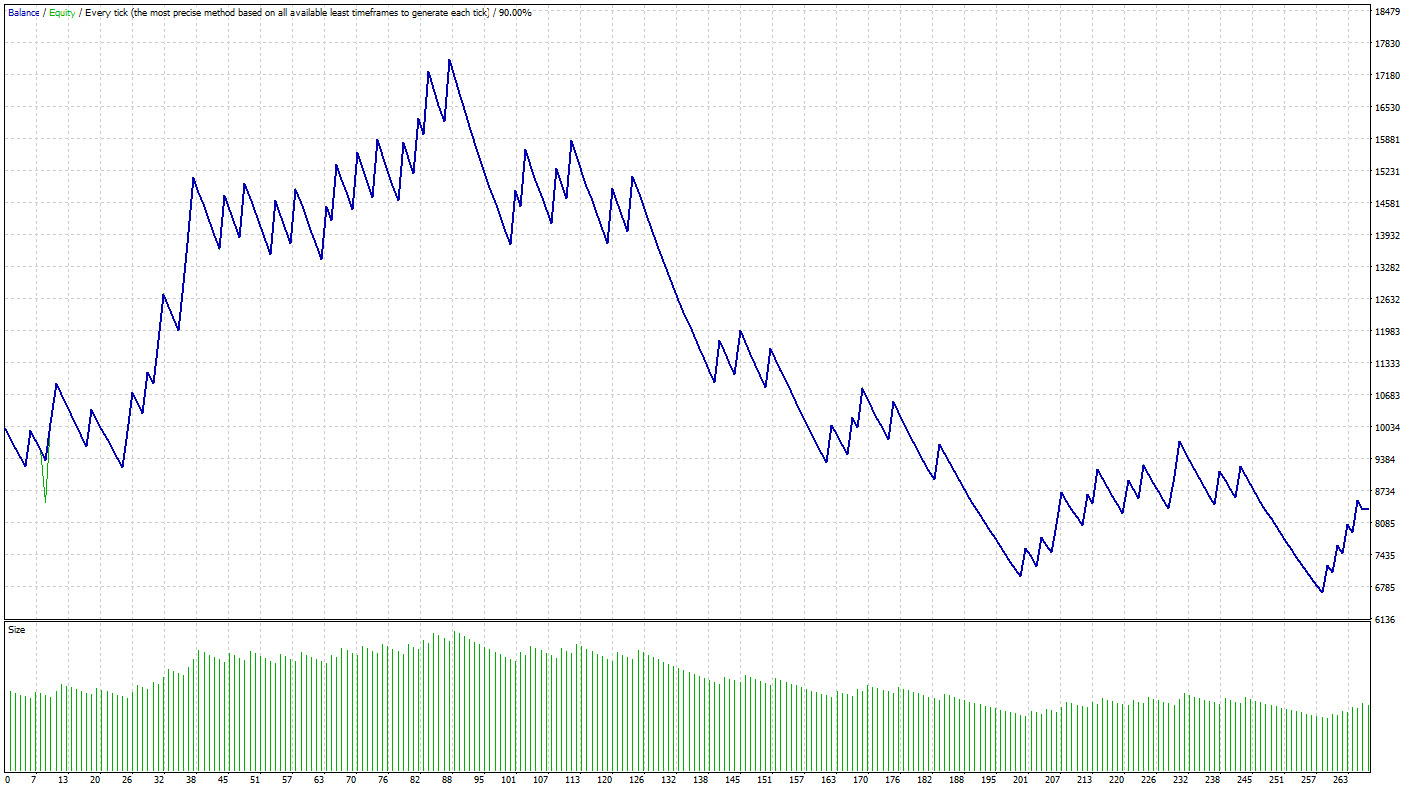

Random trades. EURUSD. The risk-reward ratio is 1:4. Stop-loss is 10 points. Take-profit is 40 points. Risk per trade is 2% of capital.

The goal is to demonstrate that even in case of using the obviously absurd method of determining market entry points it will be extremely difficult to lose money in the market using risk management and money management.

The experiment is simple:

- Open a demo account;

- open trades by flipping a coin: the buy position is «heads», the sell position is «tails» and no more than one position at a time;

- risk per trade is 2% of capital (it’s calculated using the formula for determining the optimal position size);

- the risk-reward ratio is 1:2 and lower (for example, stop loss is 15 points and take-profit is 30 points).

To simplify and speed up this experiment it is useful to use the expert you can get by filling out the form below. In its settings you can choose risk per trade, size of stop-loss and take-profit. One month of market data is sufficient for the experiment.

Random trades. EURUSD. The risk-reward ratio is 1:4. Stop-loss is 10 points. Take-profit is 40 points. Risk per trade is 2% of capital.

Please make at least 10-20 of such experiments, compare the test results with ignoring (the ratio of TP:SL in points is equal to 1 or lower) and exact following risk management principles (TP:SL ratio is 2:1 and higher). Comparison of the extremely low risk-reward ratios (for example 0.2:1) with extremely high ones (for example 6:1 and higher) perfectly illustrates the idea described above.

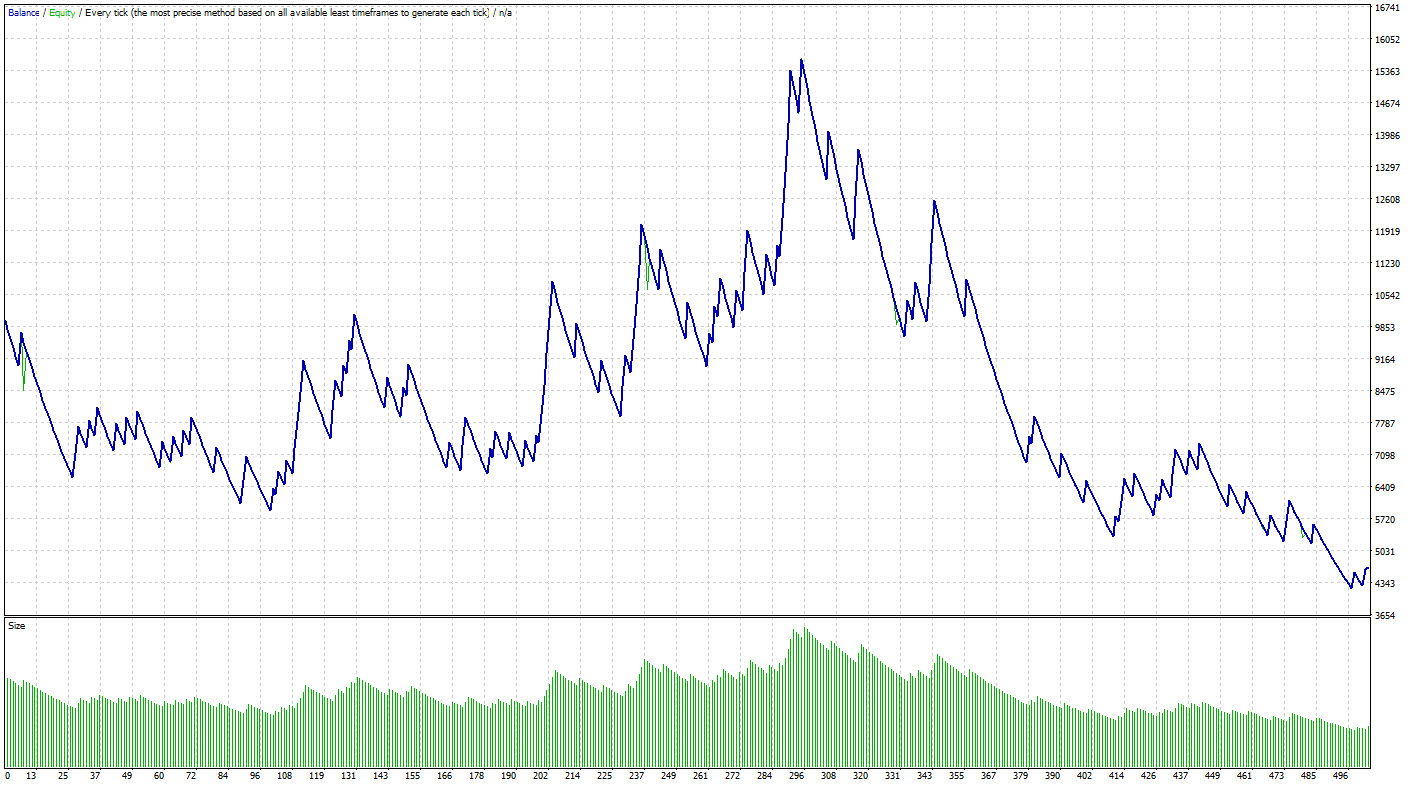

Random trades. EURUSD. The risk-reward ratio is 1:0.5. Stop-loss is 10 points. Take-profit is 5 points. Risk per trade is 2% of capital.

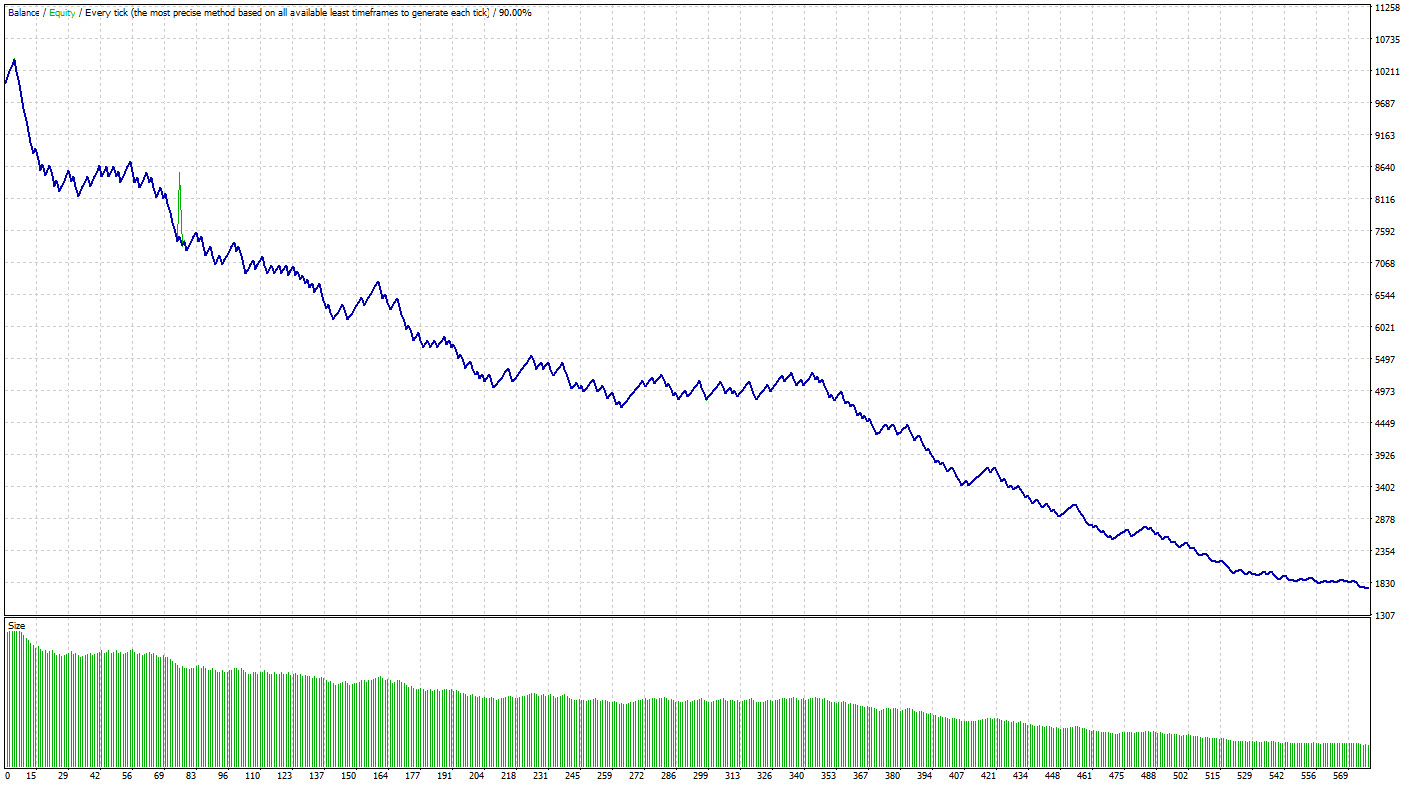

Having made this experiment, you’ll see that it is difficult to destroy a trading account even if the market entry points are determined according to absurd methods. A trader is more likely to be bored with trading than he will lose all his capital. Naturally, an expert that makes trading decisions at random can’t generate a steadily growing equity curve. Even so, when using the basic principles of risk management there will be sometimes periods of growth, capital will decline slowly and hundreds of trades will be needed to destroy the trading account.

Summary

The ideal trading strategy implies the use of money and risk management rules in each trade and a rigid filter of low-quality entry points. The fact of determining the market entry point is definitely important, but it is of secondary importance in comparison with risk and money management.

If you realize this fact, you will save a lot of money which otherwise you will have to invest in practical experience. The market is an excellent teacher, but its lessons are extremely expensive.

Good luck in trading!

The trading bot has been created to illustrate the importance of using the principles of risk management and money management in trading and it is not intended to be used in the real market.