How to Succeed in Options Trading? Main Insights into Buying Options.

Contents

- Speed is important

- Traders’ expectations as a factor influencing market prices

- Use short interest as a sentiment indicator

- Press as a factor influencing market prices

- Put/Call ratio is a king

Buying options short-term can be profitable, but all option traders sometimes have losing trades. However, they make profit, since the size of their profitable trades is much higher than the losing ones. Accordingly, it is necessary that profitable trades are substantial.

Successful options trading depends on knowledge of options and option strategies. But if a trader can correctly predict the direction and speed of the underlying asset movement his efficiency will be better. Premium collectors (option sellers) can also trade options efficiently, even if they are not “options wizards”.

Speed Is Important

Here are 3 basic conditions for the underlying asset market required for the option buyer to expect substantial profits:

- The market has to go in the favorable direction.

- The movement has to be strong enough to cover the cost of the premium paid.

- The movement has to happen quickly enough, otherwise the option value will decay earlier.

When buying an option, there is a constant struggle between the option leverage effect and the time decay of the option premium. To win this fight, the underlying asset needs to move quickly and in the right direction. In other words, victory over time decay depends on the speed of the underlying asset movement.

An option trader needs to select the underlying assets that meet these requirements. Most traders use various combinations of technical and fundamental analysis. Actually, these methods are good for predicting market fluctuations, that can help in running most options strategies efficiently.

Although technical analysis is not an absolute method of determining the market movement, it has a definite advantage: changes in prices and volumes reflect the “real” sentiment of market participants. Technical analysis, support and resistance levels help identify trends, but this is not enough to predict the magnitude and speed of market movements.

Traders’ Expectations as a Factor Influencing Market Prices

Although the use of technical and fundamental factors is necessary for market analysis, their synthesis does not guarantee the strength of the market movement. The market needs a push that can lead to the strong directional movement.

This additional component can increase the reliability of technical and fundamental signals. In fact, intuitive analysis based on the faith and assumptions of investors is often the important factor in making trading decisions.

Expectations are critical because they reflect traders’ and investors’ perceptions of the current market situation. Often these expectations are opposite. If expectations are relatively low, there is a good chance of a rally, as purchases may push the prices up.

On the other hand, high expectations usually mean that most investors have already invested their money. The number of new buyers is decreasing, sales prevail in case of negative news. There are several tools that can be used to determine investors’ outlook. Let us consider the most useful of them.

Use Short Interest as a Sentiment Indicator

Short interest shows the number of contracts sold over a certain period of time. Monthly monitoring of short interest allows you to analyze how pessimistic investors are. In most cases, an increase in short interest indicates an overall negative outlook. However, if we observe an increase in short interest within the general upward trend, that may become a bullish signal.

Another factor could be the ratio of short interest to average daily trading volume. A low ratio (2 or less) indicates that short positions can be covered within a few days and can hardly influence the market movement. Higher ratios (6 or more) can lead to a downward rally, especially if the market continues to move down.

Press as a Factor Influencing Market Prices

Analytical press releases are often surprisingly accurate opposite indicators. When investment trends (bullish or bearish) are analyzed in leading newspapers and magazines, it is most likely the market peak.

This is for a very simple reason. A trend appears on the covers of newspapers and magazines when it is already widely known and accepted. As soon as a trend reaches the level when people start writing about it, this is almost certainly its peak, since the public always finds out about everything at the last moment. This indicator works especially effectively when articles include illustrations and appropriate conclusions.

Put/Call Ratio Is a King

Open interest is a very effective indicator of investors’ sentiment. Open interest shows the number of option contracts at the end of each day. To understand how balanced open interest is, you need to pay attention to the analysis of the put/call options ratio.

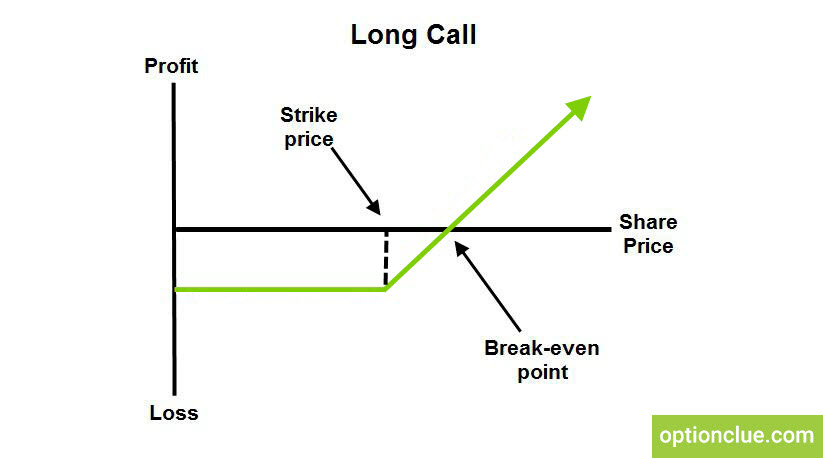

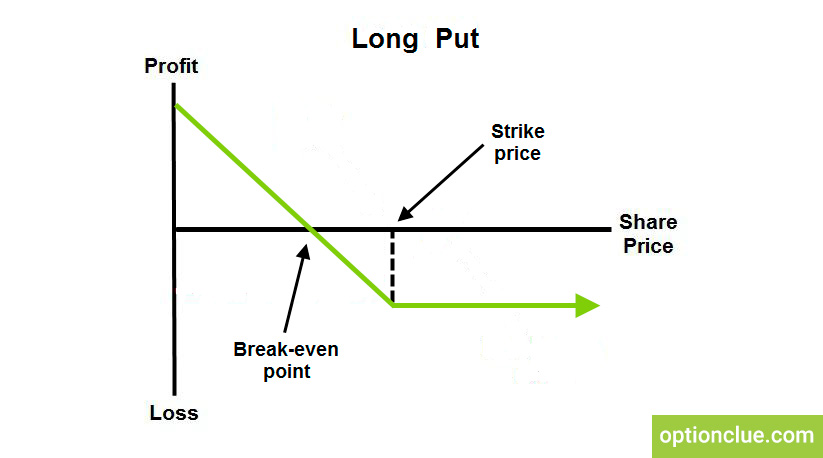

Introduction to options trading usually begins with call and put options.

Buyers of call options hope the underlying price to increase substantially.

Buyers of put options hope the underlying price to go down before expiration.

A high ratio often reflects pessimism, large amounts of money remain outside the market. On the contrary, a low put/call ratio indicates investors’ optimism, there is little money outside the market and that can hardly influence the market.

It is important to note that public opinion often turns out to be a more reliable indicator than market indicators. The market put/call ratios are constantly changing. When comparing and analyzing the current ratio with the previous one, one can clearly track the degree of optimism and pessimism of investors. This is extremely important for understanding the market participants’ sentiment. It is also helpful to compare the current ratio with the extreme one over the past year.

Another way to use open interest is to analyze the put/call ratio for different strikes. It is convenient to use bar graphs of puts and calls. This approach is effective for identifying possible support and resistance levels, especially for the strikes with the highest open interest during the current month.

High open interest in call options usually indicates excessive optimism, which often coincides with a decline in buying power. Accordingly, a small sales volume can change the market movement direction. In addition, those who sold call options and bought the underlying asset can buy back the options and sell the underlying asset. The expiration date is also worth considering. The situation is similar with put options.

Market sentiment analysis is an essential tool for an option trader. The above mentioned methods allow you to better feel the market, that is certainly necessary for effective options trading.