How to Make Options Trading Easier? Cash-Secured Puts Screener.

Choosing assets to trade takes much time, especially when trading stock options. It is necessary to take into account not only the stock market situation but also the options prices and volatility. To deal with this and save time, you can use option screeners. They automate most of the work. In this article, we will discuss how to use option screeners. We will also examine the cash-secured put screener by 5Greeks as an example.

Contents

- What is an options screener?

- Cash-secured puts screener

- What is a cash-secured put?

- How to use the CSP screener

- Example of using the CSP screener

- Bottom line

What is an Options Screener?

Options screeners are designed to find market entry points. Before they appeared, traders used various and unrelated sources of information. They read analytics, forums, and also gathered information from many sites at the same time.

They had to analyze a lot of stocks and options, taking into account several characteristics of each asset. It took much time, making it difficult to find market entry points. A large number of sources of information is distracting, especially if a trader has no trading plan. In this case, it is easy to fail to understand what is happening in the market and, as a result, start trading based on emotions. The option screener solves all these problems.

A screener is a sample of options based on particular parameters, for example, potential return or volatility.

Screeners are different and can be used:

- to trade covered calls,

- to trade cash-secured puts,

- to trade straddles,

- to trade directionally.

Screeners significantly reduce the time spent on market analysis. Moreover, they greatly complement a trading plan, as they are based on data, not opinions or emotions.

Cash-Secured Puts Screener

Now let us talk about the cash-secured puts screener by 5Greeks. The screener will be of interest to traders and investors who:

- sell options to generate additional income from their portfolios;

- trade the options wheel strategy;

- hold stocks for the long term and are interested in making extra profits from selling puts;

- strive to reduce time spent on analyzing options and quickly select those with particular parameters;

- want to learn how to trade vanilla options.

What is a Cash-Secured Put?

The cash-secured puts strategy is a simple and popular options strategy in which a trader regularly sells put options and immediately collects an option premium, which generates a stable cash flow. The position requires cash to be maintained in the account. Therefore the strategy is called cash-secured puts.

Let us examine an example where the strike price is equal to the stock price:

- Suppose the stock is trading at $30. In this case, we need $3000 since an option contract represents 100 shares. This amount must be in the account when opening a position.

- The option can be sold for $6. It means that after its selling, the premium collected will be $600 ($6 * 100).

- We sell the option and get $600, which we can immediately use as we want: buy shares, withdraw profits, or sell cash-secured puts on another stock.

The risks are limited. If the stock price falls, then after the expiration of the option we get the stock at the strike price, which can give us additional income. At any time, we can sell the stock, wait for the price to go up, or trade the wheel strategy and sell the covered calls on that asset. It is an options strategy, in which we sell call options on the stock we already own.

The wheel strategy allows you to make a profit from the stock, even if it is flat or goes down. If you choose dividend stocks when trading cash-secured puts, then if a price decreases, you will find stocks on your account. And they will generate additional cash flow in the form of dividends. This strategy compares favorably with margin trading when you suffer losses when the price goes against you.

Moreover, selling cash-secured puts allows an investor to buy shares below the market if the price falls and get an extra profit in the form of an option premium. However, most often, the main goal of a trader is to sell ‘expensive’ puts, get high returns with limited risks, and at the same time avoid buying a stock.

To find puts that are suitable for this strategy, use the CSP screener, which is free from emotions, and therefore it is a reliable tool when preparing for trading.

How to Use the CSP Screener

The CSP screener is a table with put options and their main characteristics. It allows you to analyze more than 600k options so that you can quickly identify the best ones to sell cash-secured puts.

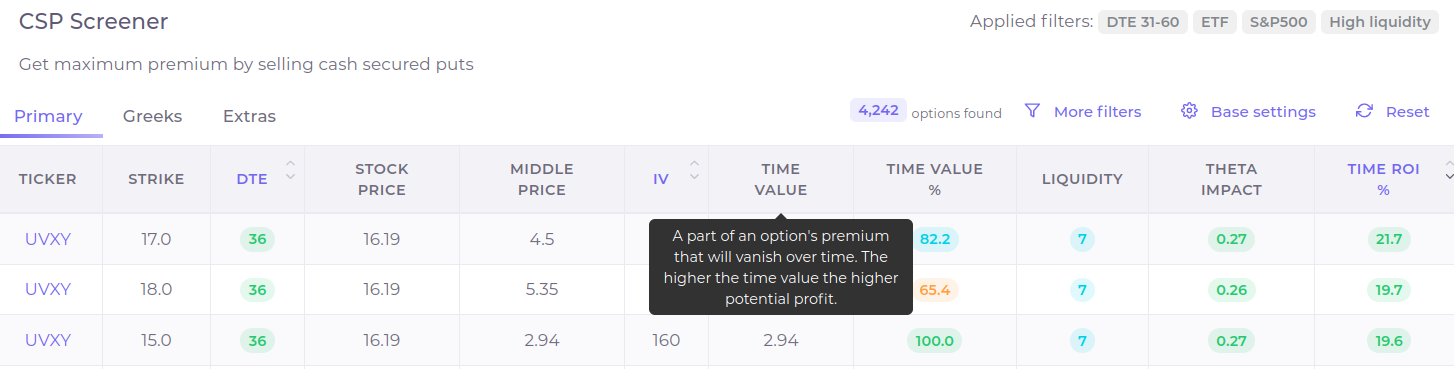

The table in the screener shows the main characteristics of options, for example, DTE, strike, IV, etc.

In the screenshot above, filtering by default is applied to the table. Options are displayed that match filters shown in the upper right corner:

- high liquidity options,

- options with 31 to 60 days till expiration (DTE 31-60),

- options from the list of S&P500 companies and ETFs

We should note the criteria for sorting options. By default, in this screener, they are sorted by Time ROI%, which reflects the potential rate of return. The higher the value, the more desirable selling a put is.

These Base settings are used by most options traders when trading the wheel strategy to find high liquid options with high profit potential.

The first ten options are usually of the most interest to us. We should prioritize checking them if we want to sell puts.

Figure 2. The first ten options from the screener should be analyzed in detail. When hovering over the ticker, we see the Daily chart of the stock.

It might happen that options on the same stock appear in the Top 10. This can happen if options on a particular stock become too ‘expensive’ and significantly ‘break’ into the ranking in terms of Time ROI% or IV. However, even this sample can become very valuable for us.

Depending on the tactics for options trading, you can change the sorting of the table and get a new sample of options. For that, click on any other column, for example, IV or DTE.

The Reset button allows you to reset all settings and apply new ones later, and the Base settings button returns default settings.

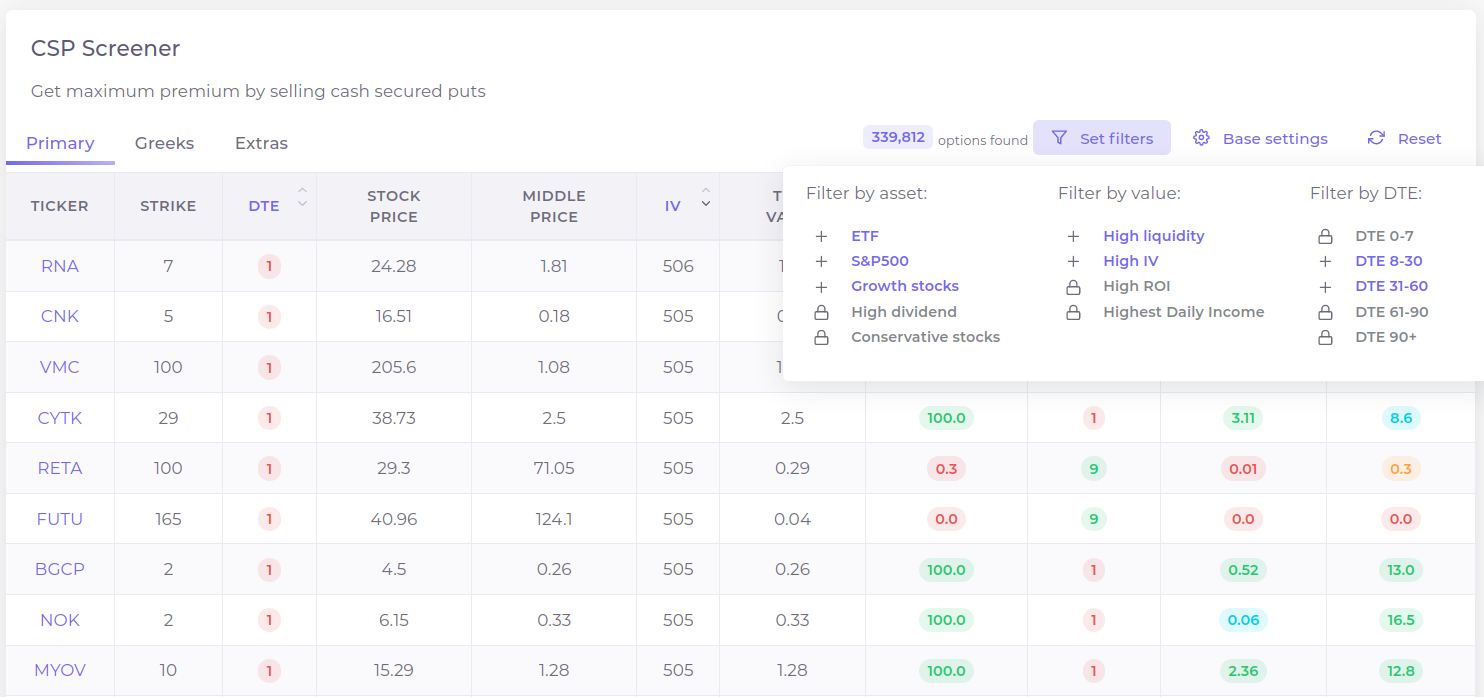

The Set filters button above the table enables additional filters.

As you can see in the screenshot above, we can apply different filters:

- by asset — ETFs, S&P500 stocks, high dividend stocks, etc

- by value — liquidity, implied volatility, etc

- by days till expiration

Base settings, sorting by several parameters, and some other filters are available for free. You can sign up on the 5Greeks website and get a sample that best suits your trading style.

There is also a paid subscription. It makes it possible to use more filters and sort options and get more than ten options for each selection.

Example of Using the CSP Screener

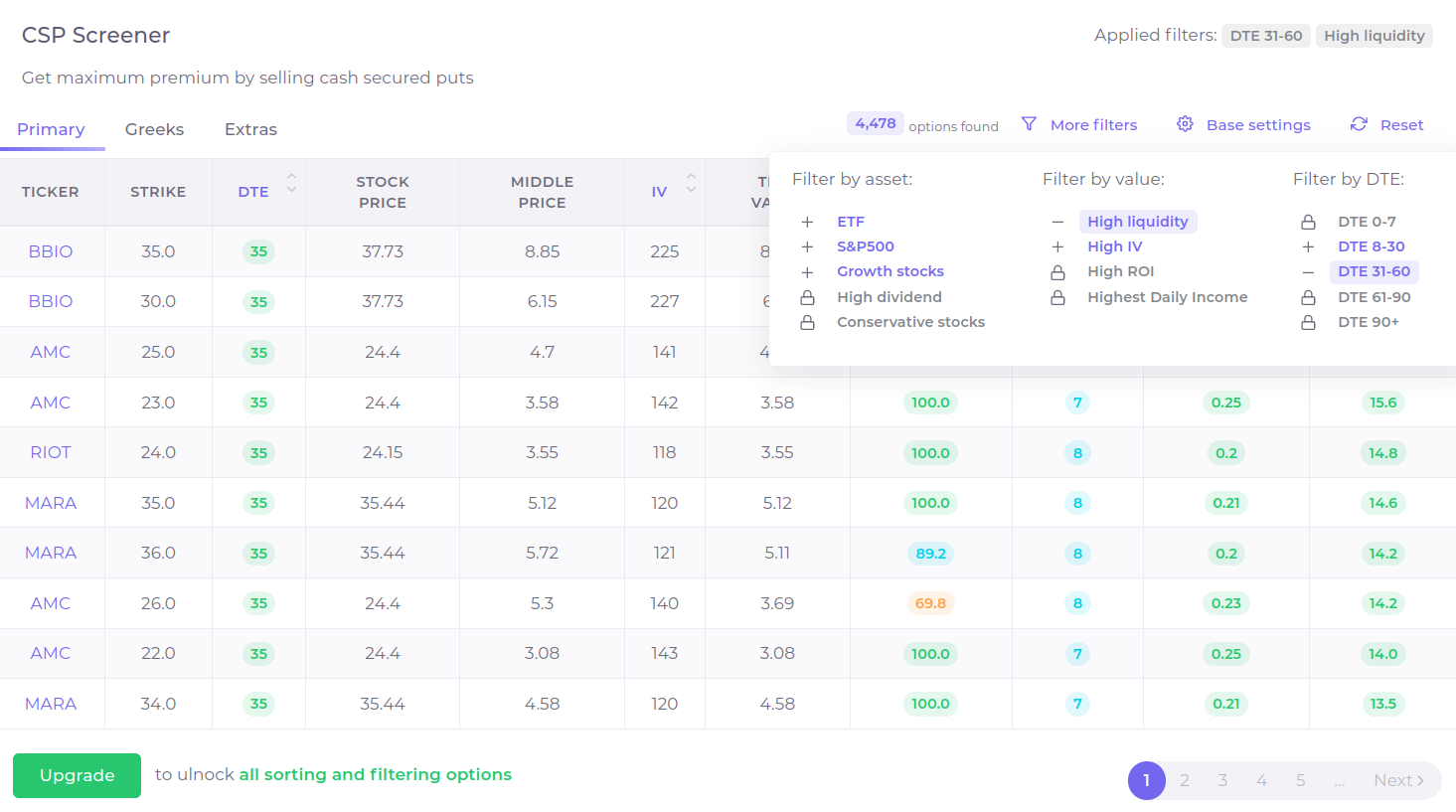

Let us take an example of how the screener works. To find the most promising trading opportunities, I often use the following filters:

- DTE 31-60 to show puts in the sample that are best to trade the options wheel strategy,

- High IV, to find options with high implied volatility.

High ROI means a lot to me as it selects options that have potentially high returns. This parameter is available with a paid subscription. Alternatively, you can choose a descending order for the Time ROI% column. Thus, we will see options with the highest potential return in the Top 10. To do this, click on the Time ROI% column.

We set these parameters via the More filters menu:

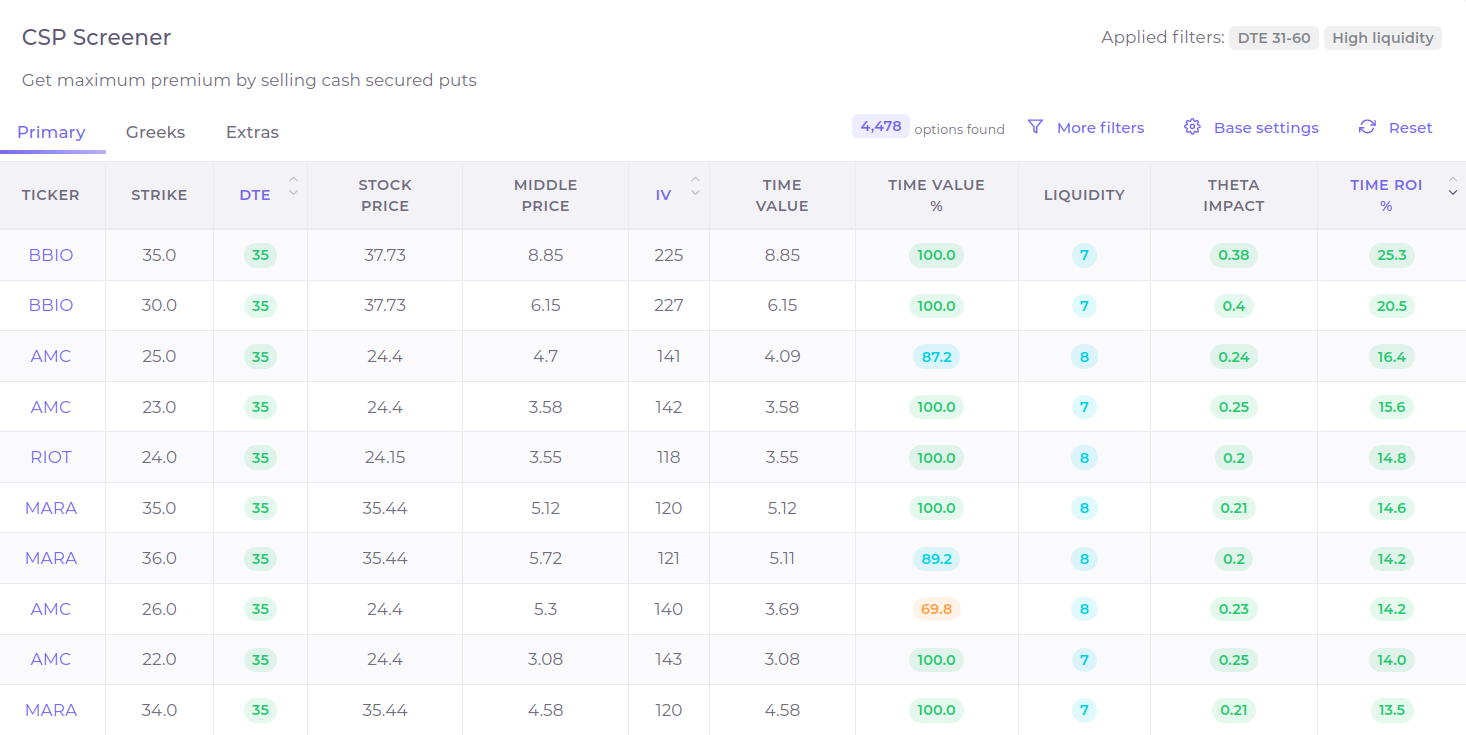

At the time of writing almost 4.5k options have been found using these parameters. From the given sample, a 35 put on BBIO, which expires in 35 days stands out. The put option is promising thanks to the following parameters:

- pretty high Time ROI – 25.3%, which implies a potential annual yield of 260%,

- 35 days till expiration, which is optimal when trading cash-secured puts,

- pretty high liquidity, that is, we can close the position with ease,

- the option is out-of-the-money as its strike is below the current stock price.

Figure 5. Pay attention to options with high Time ROI%, which are out-of-the-money at the moment. Screenshot of the screener for December 16, 2021.

Thus, selling a put option on BBIO with a strike of $35.0 for $8.85 (middle price), we get 25.3% in 35 days if the stock price is above $35 at expiration. If successful, we get 260% annually and avoid buying the stock.

In this example, the yield is good, but there may be options with even higher returns.

If the stock price is below the strike at expiration, the put will expire in the money, and we will buy the stock at the strike price. In this case, we start owning the stock while receiving a bonus (premium collected from selling puts). The next steps depend on our strategy:

- we can hold a stock, receive dividends and sell it at a higher price in the future,

- or sell covered calls on this stock and also get premiums.

Any approach can be profitable. Read more about the wheel strategy in another article.

Bottom Line

The CSP screener by 5Greeks is a powerful tool for those who trade options and strive to be more efficient traders or investors.

The CSP screener will be especially useful for those who trade:

- cash-secured puts – use the default settings for that,

- aggressively – apply Growth stocks filters sorted by Time ROI%,

- conservatively – S&P500, ETF, and Conservative Stocks filters may be helpful.

The puts screener is updated every hour. It selects the best puts from over 600k options traded in the US market. You only have to monitor the updates and not miss profitable trade ideas.