How to Sell a Call Option? Adjusting Your Covered Call.

Choosing of assets for trading can take a long time, especially when it comes to options trading. Keeping this in mind, we’ve created the options screener that saves your time and helps find new trading ideas based on a simple principle – buying cheap options or selling expensive ones.

In this article we’ll discuss the covered call strategy and look at adjustments we can make regardless of what happens to our strategy whether the stock price goes up, stays the same or goes down.

Contents

- What are covered calls?

- How to trade options? Opening a covered call

- Covered call adjustment. Stock price increases.

- Covered call adjustment. Stock price decreases.

- Covered call adjustment. Stock price stays the same.

- Conclusions on the covered call option adjustment

What Are Covered Calls?

The essence of covered calls lies in the process of simultaneous opening a long position in the stock market and selling the call option on the same asset.

Let’s look at mathematics behind it and calculate our break-even points. To realize profit or loss we’re going to really dive into calculating the required values when we’re rolling a trade.

I show these adjustment strategies because there are a lot of questions about what people can do with certain trades when it comes to strategy and how it all works.

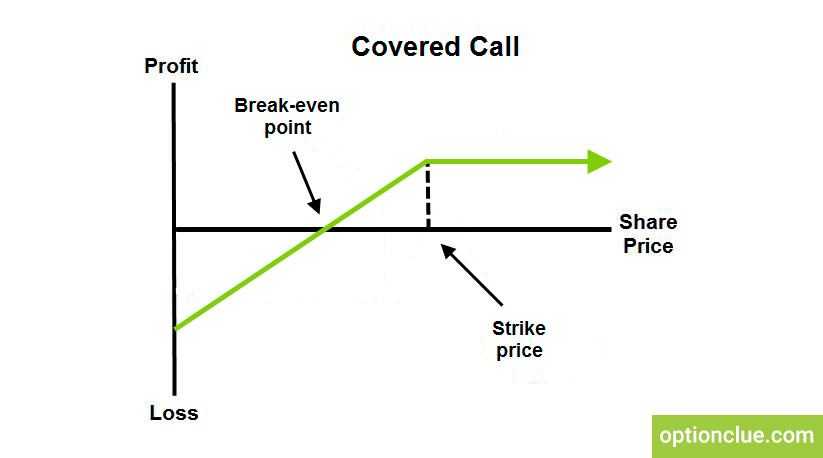

Let’s take a covered call example for visualization (Figure 1).

Figure 1. Covered call

How to Trade Options? Opening a Covered Call.

We have our opening trade and a covered call, in other words, it’s just buying 100 shares at the current stock price and then selling an out-of-the-money call option against it.

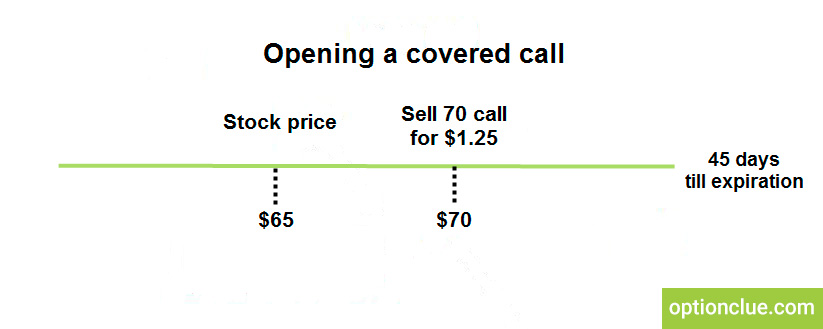

We can take the 70 strike call to sell against our 100 shares at the $65 price point. The 70 call has 45 days until expiration and that’s going to give us a nice premium of $1.25 (Figure 2).

Figure 2. Opening a covered call

When we walk through the different calculations, I’d like to talk first about maximum profit. As you remember, our stock price is $65. For this short call to be covered we need to buy 100 shares. If we buy anything less than 100 shares, our short call would not be fully covered by our shares, every option contract looks like the theoretical equivalent of 100 shares.

Suppose, I’m selling the 70 strike call at expiration. If this strike is in-the-money or, in other words, if the stock price is anywhere above $70, this short call is going to turn into 100 short shares. Since I’m long 100 shares at $65, this is considered a covered call.

Let’s calculate the maximum profit. It is realized if the stock price is at $70 or anywhere above $70 at expiration. As you remember I purchased the stock at $65, in other words I paid $6500 for 100 shares. We calculate the difference between our strike price and stock price which is 500 points ($70-$65) or $500 (500 points * $1 per point) and then we take into consideration the credit received that is $1.25. If the stock price at expiration is above $70 I would have long 100 shares at $65, short 100 shares at $70 which would wipe out my position. Since I collected $1.25 in addition to that, my maximum profit is going to be capped at $625 ($125+$500) regardless of where the stock price is above the level of $70.

The maximum loss is going to be $6375. I calculated this by taking 100 shares at $65 and subtracting the cash premium received for selling this call at the 70 strike. Taking $6500 (65$*100) and then subtracting $1.25 or $125 gives me the maximum loss if the stock price ends up going to zero.

In this situation, since I’ve got this basic strategy the maximum loss will be also the break-even price. That’s going to be the case when you’re just opening a trade. The maximum loss in this situation is going to be the break-even point and that’s only going to be realized if the stock price ends up going to zero or going out of business.

Covered Call Adjustment. Stock Price Increases.

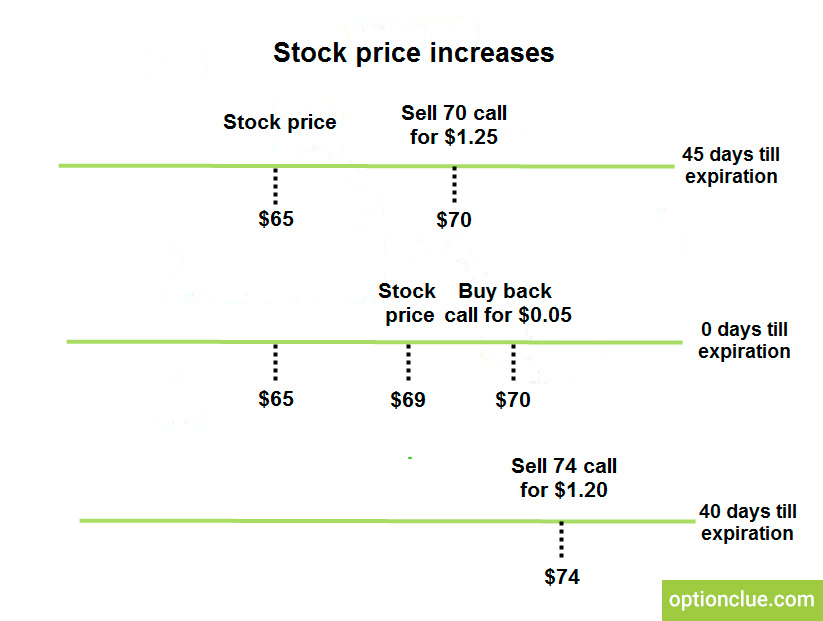

Let’s take a look at some things we can do when the stock price changes. We’ll break down what happens when the stock price increases (Figure 3).

We have the original trade with 45 days to expiration. Suppose we are on expiration day now, we have only a few hours left to trade this position, and we are able to buy back the short call at the 70 strike with the same expiration for 5 cents.

As you can see the stock price has moved from $65 to $69. I still own the shares at the $65 mark but I’m able to close this position out and effectively capture the realized profit on this short call of $1.20 ($1.25-$0.05). I sold it for $1.25, but since I have to buy it back for 5 cents, my net credit received will be $1.20.

Figure 3. Stock price increases

We have $120 from the short call that I originally sold but I bought it back, that’s why it’s considered the closed position and my stock price changed from $65 to $69.

By taking $400 that I benefit from the stock price increasing from $65 to $69, adding this to the net $1.20 credit from the original position and this gives me the profit of $520 ($400+$120).

However, what if I still have the bullish assumption. The thing I’m going to do is to sell a new call at an 74 strike with 40 days until expiration.

Knowing this, my new profit potential on my current trade will be $620. I calculate it by just taking the current stock price that is $69 and my short strike of $74, which have a 500-point difference ($74-$69), and take into account the credit of $1.20. When adding these two values together we get the new potential profit of $620.

My new breakeven is actually going to be $62.60. I take my original $65 stock price that I’ve purchased and I take $1.20 net credit that I received from my previous position and I add another $1.20 credit with my new position. So I take $1.20, subtract this value from $65 and subtract another $1.20 from my new position which gives me a new breakeven of $62.60 ($65-$1.20-$1.20).

So this is a great way to continually reduce cost basis especially when we’re in winning positions like in the first example and we got lucky with the second one because we were right on the brink of the 70 strike, but the stock was at $69, I was able to buy back that call on the expiration day, so we got lucky with this situation.

Covered Call Adjustment. Stock Price Decreases.

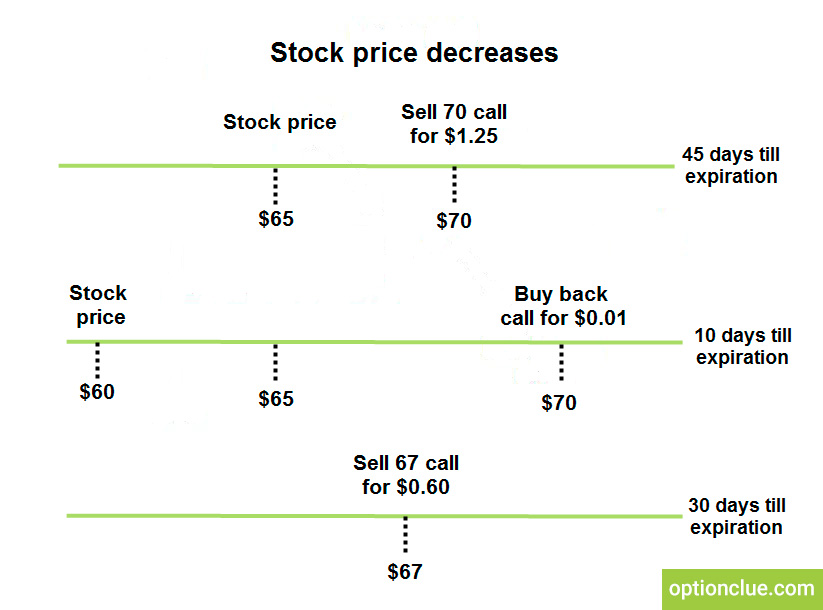

Let’s take another example and talk about a situation that would go against us. Suppose the stock price actually goes down (Figure 4). Let’s look at the same values despite it becomes a little bit more difficult to calculate them.

Figure 4. Stock price decreases

Let’s say I have the same position but in a different simulation – the stock price went down to $60. We originally purchased the shares at $65, stock price now is at $60 and I have 10 days until expiration.

The stock price is 10 points away from my short call that I sold and I’m able to buy it back for one penny. This is the lowest price I can possibly buy it back. Knowing this I want to hedge my position even further. Since I’ve purchased the shares at $65 and if I move my new call down to $67 as opposed to $70 I can still reduce my cost basis a little bit further, give myself some profit potential and it’s going to reduce my maximum loss overall.

If we move the strike down to $67, it will be still above the $65 purchase price of the shares and I have 30 days to go for this one. Let’s calculate the desired values.

As you remember, the original break-even point is $63.75 ($65-$1.25). If I buy back the option that I sold for one penny, my break-even point would be $63.76.

However, I’m selling this new call for 60 cents which gives me my new breakeven of $63.16. I take $63.76, subtract the short call I’m selling against my shares and it gives me the breakeven of $63.16 ($63.76-$0.6), which means that if my breakeven is $63.16 my current loss is $316 because the stock price is trading at $60.

But if the stock price ends up coming all the way back up above $67, the profit would be capped at this point. My new profit potential in this trade would be $384 because I would be able to wipe out this current loss of $316 and it would give me this new profit potential of $384 ($700-$316), which is what I would receive above my break-even point if the stock price did go up.

Covered Call Adjustment. Stock Price Stays the Same.

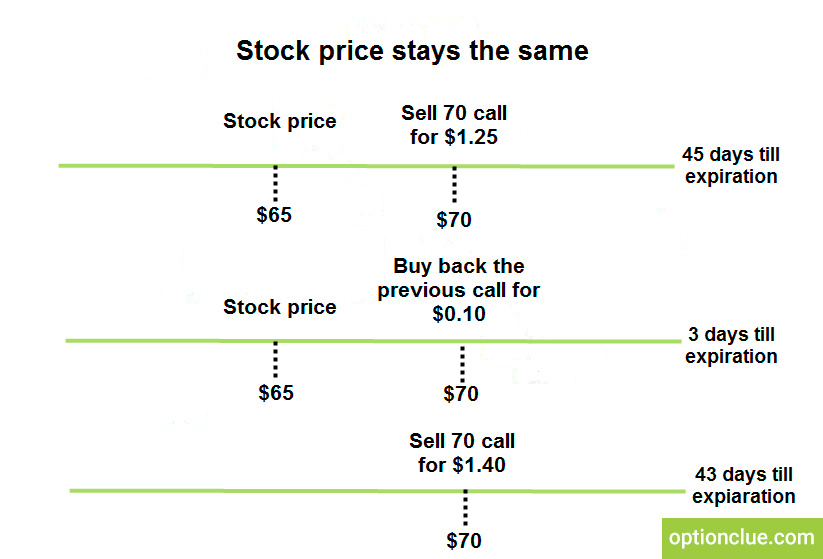

Let’s look at another scenario when the stock price doesn’t move at all (Figure 5). This one is the easiest to calculate in my opinion. Suppose, the stock price stays the same for that matter.

Figure 5. Stock price stays the same

We have 3 days until expiration and I’m able to buy back this call for 10 cents. I can continue to reduce my cost basis. I’ll sell the same exact strike that with for 43 days until expiration and as you can see implied volatility has increased a little bit because this call is sold for $1.40 as opposed to $1.25.

Let’s walk through how we can calculate our realized profit and break-even point.

Having bought shares for $65 and sold the call for $1.25 gave me the break-even point of $63.75 originally. However, I bought back the call for 10 cents. The break-even point shifts now to $63.85. However, I’m going to sell a new call for a $1.40. $63.85 minus $1.40 is $62.45 and it means that my realized profit is $1.15.

Essentially the stock price didn’t change that’s why I did not receive any profit or loss on the stock position, it’s exactly where it was when I originally put the trade on. But I was able to sell that call and buy it back for 10 cents and I got a net profit of $1.15 ($1.25-$0.1)

It means that my new potential is going to be $640 and that’s easily calculated since the stock price did not change at all and is still at $65 as it was when I open the trade, but now I can sell another call for $1.40, therefore my new profit potential is simply the difference between the stock price and strike price that is five points ($70-$65) plus $1.40 as credit which gives me $640 ($500+$l40).

Conclusions on the Covered Call Option Adjustment

Let’s wrap all this together with some conclusions:

- Selling premium helps us weather the storm

As you can see regardless of whether the stock price goes up which is good for us in a covered call position, stays the same, which is also good or it can go down. Really, we’re able to reduce our cost basis in all three scenarios which gives us a higher probability of being successful in the long run.

- When it comes to adjustments it’s all about cost basis reduction

We never really know whether a stock is going to rise, stay the same or go down but we can have our assumptions. If we reduce our cost basis that’s really what gives us success in the long run when it comes to just generating a number of occurrences and continually reducing our cost basis. If I continue to do that and I can hold these shares for a very long time I could own these shares for $0 because I would have reduced my cost basis all the way to zero.

- When maneuvering keep in mind probability of profit and break-even price

We always want to choose best stock options to buy, decrease our break-even point or make it better for us for any options strategy. But we’re also going to keep in mind the probability of profit on our new trade and keeping all these things together is really what’s going to make us successful traders in the long run.