Short Call

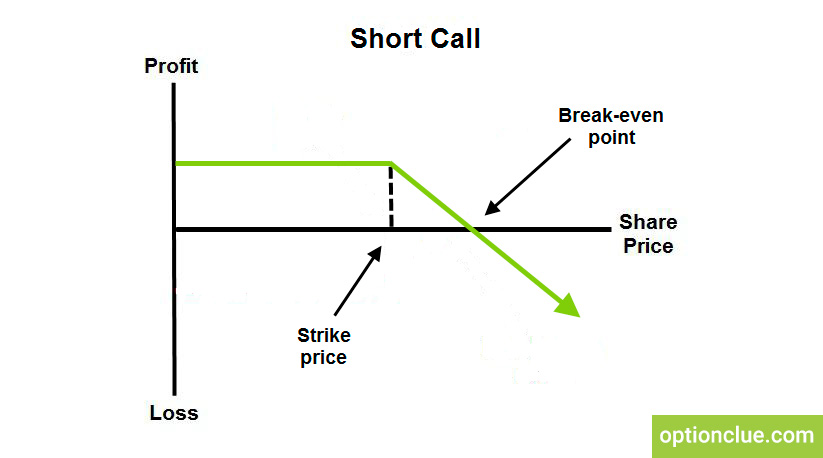

Short call: The potential profit for call option sellers is fixed and equal to the option premium. When the option is exercised, a seller is obliged to sell the asset to the buyer at the strike price. In this case, a seller doesn’t have to own shares to sell the call option, such selling is called «uncovered»

If the asset price exceeds the strike price, a buyer may exercise his option on the seller and the latter starts losing money as the asset price increases. The higher the asset price, the more losses a seller suffers. The option seller’s losses are unlimited but the profit potential is limited.

Suppose, we sell the call option for $20 when the strike price is $100. After a while, the asset price starts rising and the call option is in-the-money. Until the breakeven point is reached ($100 + $20 = $120), our position doesn’t incur any losses. After that, the market moves down and the call option expires at the stock price below $100, that is, below the strike price. The seller’s profit is limited and equal to the premium: $20 * 100 = $2000.