Long Straddle

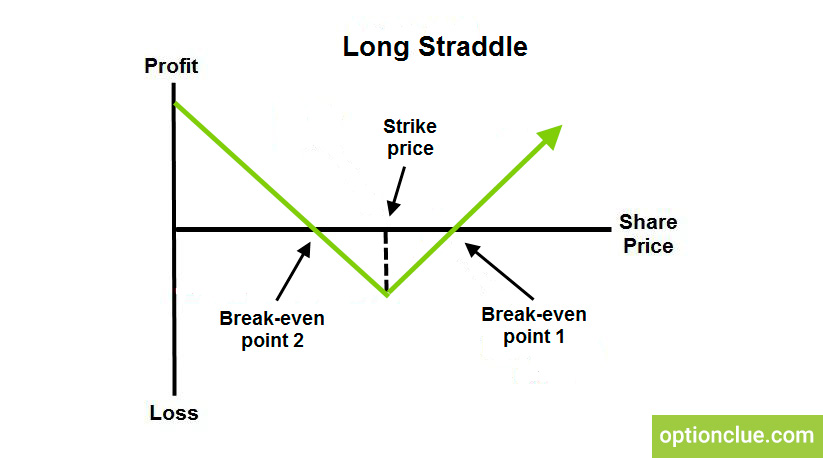

Long straddle is the option strategy with limited risk based on profiting from extremely low volatility. Its essence lies in the simultaneous buying call and put options on one asset with same strikes.

Long straddle has 2 break-even points – above and below the strike price. Therefore the buyer expects the stock price to push up rapidly in any direction after long-term market flats and triangles, that is he is looking forward to the increased volatility in the underlying stock after buying options. This strategy has conditionally unlimited profit whereas risk is limited to the premium.

Suppose, we open the long straddle by buying the call option for $14.5 and the put option for $10.5. Suppose, the strike price is $100. The total premium is ($14.5 + $10.5)*100 = $2500. Break-even point #1 is $125 ($100 + $25) and break-even point #2 is $75 ($100 – $25). Thus, we’ll make profit in case of the rapid asset movement beginning from the price of $125 and higher and $75 and lower and we’ll lose money if the price remains in this prcie range. The loss is limited to premiums.