Comparison of Stocks and Options Trading

In this article we’ll discuss the basis of option trading, consider pros and cons of their usage over stock trading. This material can be valuable for beginners since it contains simple examples of stocks and options trading.

Contents

- The essence of stock trading

- Stock movement directions

- Features of shorting stocks

- Why do option traders have an unique advantage over stock traders? Call and put options

- Why trading stocks is more risky than trading options?

- Using put options to buy as income protection

- Summary

The Essence of Stock Trading

Before analyzing option trading, we should understand how stock traders make money in the medium term. This is important because options are derivatives and they are traded in the market depending on the underlying asset price movement.

Stock traders basically buy low and sell high. So if you’re a stock trader the only thing you know you ought to do is to buy something at $5 and then sell it for instance for $15 someday down the road, but that just means you only know how to make money if the stock market goes up.

Most novice stock traders expect every trade to go to the moon (Figure 1) and they suppose this is the one trade that can take care of their families for the rest of their lives.

But what is the stock traders’ reality? Sometimes they end up holding those stocks driving them into the ground because we all know stocks do not always go up and what goes up at some point usually ends up coming down. In addition, most people just end up driving their stocks all the way down into the ground so that’s the true reality of the stock market. But stocks can move in three ways.

Stock Movement Directions

As we mentioned earlier, stocks can move up and that’s no surprise to anybody. Stocks can also move sideways. If you buy a stock for example at $5 and it moves all the way up to $10 then it falls to $7 then it falls to $6, $4 and it rises to $5 again, 5 years later that stock essentially just moves sideways because you bought it at $5 in 2012 and in 2017 it’s back at $5, so you didn’t make any money and wasted time.

So, stocks can move up, down and sideways and you can make money during the upward movement. You don’t have to be a rocket scientist to know that if you only make money one out of three possible ways, the odds are not in your favor, the odds are against you now.

Features of Shorting Stocks

You should know that shorting stock has the unlimited risk. Now let’s analyze why it’s true. When it comes to opening a short position, it means that you are going to sell something that you don’t have to someone and you’ll hope you can buy it back at a lower price.

For example, if I tell that you can buy my Apple stock today at $140 provided that I don’t own the Apple stock, it is short. I’m short because I don’t have the stock but hope Apple falls down below $140 where I can buy it. So if it falls down to $130 then I would actually buy the stock back.

But what can happen if Apple never falls below $140? What if Apple comes out with a new phone and it goes up to $150, $170, what if the new device is a big hit and the stock goes up to $200, I still have to buy that stock at $200 and give it back at $140 because I agreed to sell it at $140 whether I owned it or not. So, that’s where the unlimited risk comes in with the shortened stock. You’re selling to somebody something you don’t own. That contains the unlimited risk. So again, I’m trying to prove the point that stock traders can primarily make money one way and that’s if the stock goes up.

Why Do Option Traders Have an Unique Advantage over Stock Traders? Call and Put Options

After considering the features of stock trading we can examine why option traders have an unique advantage over stock traders.

Option traders have more tools to build their house than a stock trader has. A stock trader has one tool – to buy low and sell high. Option traders can make money in the sideways and down market so they can apply two more tools when trading in the market.

These tools are simply two types of options called calls and puts that enable trading in the market in different directions – up and down.

Many different combinations stem from just these two options. When you mix these options together, you can probably get many different combinations. So, I mean you can buy a call and a put, you can sell a call and a put, you can buy a call and then sell a call on top, you can buy a put and sell a put on the bottom etc.

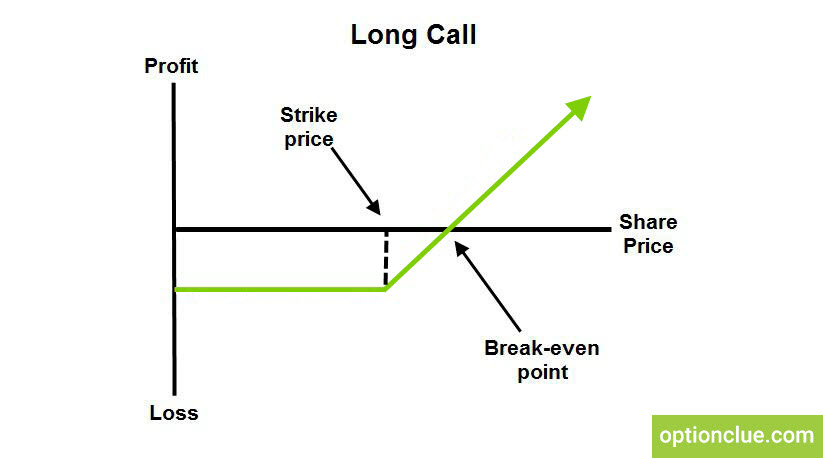

Calls are used for bullish strategies. A call option provides the holder just the right to buy an underlying asset at an agreed-to price at a particular date in the future while the seller, receiving the option premium, assumes the obligation to sell these underlying assets at the strike price if the latter exercises his right. So if you are buying a call, you are assuming the stock is going up therefore that is a bullish strategy.

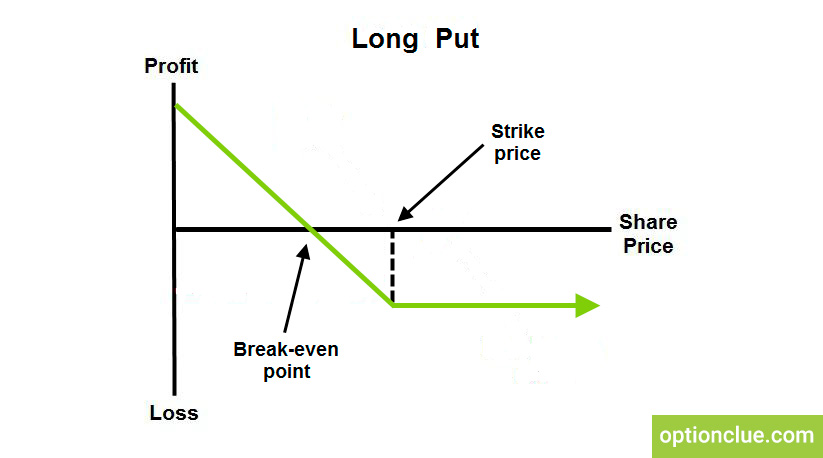

On the other end there is something called put, which is used for bearish strategies. So if you’re buying a put you’re basically saying I believe this stock is going lower and that’s where my put starts to make money.

Once you get even more sophisticated, you can flip both of these options around and do some weird stuff with them to change the meaning of the strategies, but on the surface, if you’re buying a call option you’re bullish, if you’re buying a put option you’re bearish and you believe the stock is likely to go down.

As soon as you understand these two types of options, you have everything you need in my opinion to build the financial freedom for yourself, and moreover, simultaneous options and stocks trading can improve the investor’s financial results.

Why Trading Stocks Is More Risky than Trading Options?

Many people mistakenly think that options are risky and that is why without studying them they start trading penny stocks, Forex or binary options. I would like to prove that trading options primarily requires less money and involves less risk.

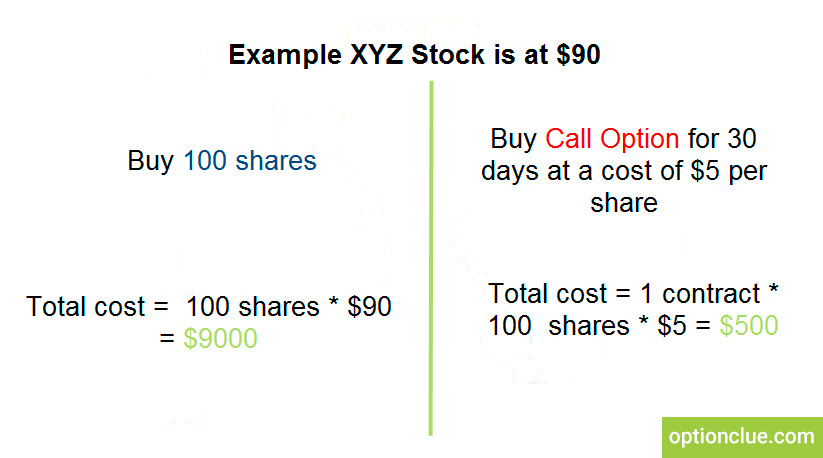

For example, you’re looking at stock XYZ and its price is $90 you could buy 100 shares of the stock and that would cost you $9,000. However, this sum is rather large for the majority of beginners to get started trading. On the other hand, you can buy a 90-dollar strike price call option (Figure 4). This option contract controls 100 stocks of the underlying asset within, for instance, 30 days and its cost is just $500. Would you rather control XYZ stock for $9,000 or would you rather control a hundred shares for $500 for 30 days expecting the stock is going to move within 30 days? The answer should be definite since options give you the greater point to start in the medium term that you don’t have with the stock.

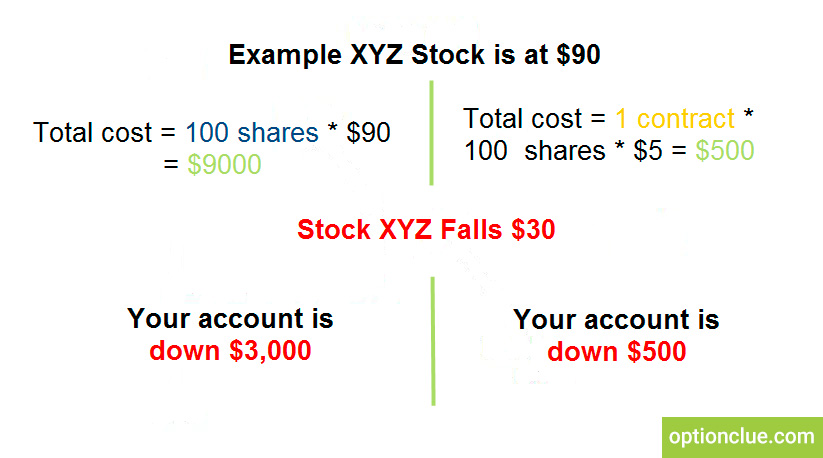

Using our example, what if XYZ stock tomorrow falls $30 overnight on the left hand side you’re going to be down at $3,000, because if it fell $30 you got a hundred shares you just lost 30, times 100 shares that’s $3,000. On the right side, if that option expires worthless in 30 days you lose only $500 (Figure 5).

So, the stock may be more risky in case of some force majeure whereas with options we can lose just the amount of money we pay for the option. In this case we bought option for $500 and that is the absolute maximum we can lose.

Using Put Options to Buy as Income Protection

Options can also be used as income protection. If you’re in the trade and you’re making money, one of the worst things that you can do at the time when it comes to earnings season is to hold the trade all the way up to earnings, and when the company may come out announced bad earnings or something like that, and then you can lose most of money you’ve made over the last period.

Now let’s take an example of how you can protect that income with options. You can do it by using put options. Put options give you the right to put the stock to someone else at a specific price. It actually allows you to profit from the fall of the stock now and you couldn’t do that when you were just buying the stock itself if the stock fell.

In the example below you got a hundred shares still, but this time the stock falls $30, on the right hand side you own the $80 strike put contract at two dollars so the cost for one contract times 100 shares is $200 (Figure 6).

Suppose you bought the $80 strike price put, what happens if the stock still falls down to $60, you have the right to go to someone else and make them buy it from you at $80 because you have the $80 put. So if a stock is trading at $60 and you have the right to sell it to them for $80 that’s a $20 price difference. So, the stock fell $30, you can make 20 of it back because due to put option feature you can force somebody to buy it from you at $80 even though it’s trading at $60. So you really lost only $10. Therefore, if the stock XYZ falls $30, your account is down only $1000.

Summary

Options trading gives an investor great opportunities to participate in all market movements because it does not depend on the price direction and can make money in the market in upward, downward and sideways market conditions, using call and put options and their combinations.

A predetermined and relatively small level of risk will help seek for the market entry points with the best risk-reward ratio. The simultaneous application of classical bullish directed trading and put options will enable to fix a part of the profit before the strong market correction and even the market reversal.

Thus, in this case, put options act as a kind of insurance that protects income that has already been received.