Planning in Trading. Two Strategies for Achieving Goals

Before starting to study the basic methods of market analysis, principles of opening and closing positions, each trader should answer the following questions:

- What trading tactics to follow, why it’s noteworthy?

- What is a trading plan you will follow?

- What trading timeframe is better to use for searching market entry points?

- What position size to open?

- For how long positions should be open?

It is critical to find the answers to these questions before you open your first trade. If you start trading without having a clear plan of actions, according to which trades will be opened and closed, then, in my experience, most likely you won’t succeed.trading

You should also pay particular attention to strategic planning, especially if you are being conscious of trading and setting ambitious goals. All of this must be considered before starting studying technical or fundamental analysis.

In a separate article, we have considered the principles of building a trading plan, discussed the points it should include and which elements of the trading plan can be changed, and which can not. In this article, we’ll discuss planning issues in terms of strategy. What targets does a trader set at the beginning of his career? And what are the strategies for achieving these goals?

Trading as a type of business. Goals of beginner traders

Communicating with traders, I concluded that most beginners, starting this type of business, don’t have clear goals and consequently don’t know how exactly these goals to achieve.

Most often, beginners form goals in a really weird way. For example, they want to get some money when trading in the financial markets. This is a healthy desire, but in most cases, a novice trader has no idea how he is going to achieve this goal and acts at random. Even if a trader has chosen the trading tactics and, for example, decided to trade important levels breakouts, that’s not enough. The main reason for loss of capital in the market is emotion, and planning is one of the powerful tools to minimize its impact on trading results.

Trading is a business. And now we’re going to talk about trading particularly as a type of business you should run as seriously and mindfully as possible. In this case, the first thing to do is to realize what you want to reach in the end.

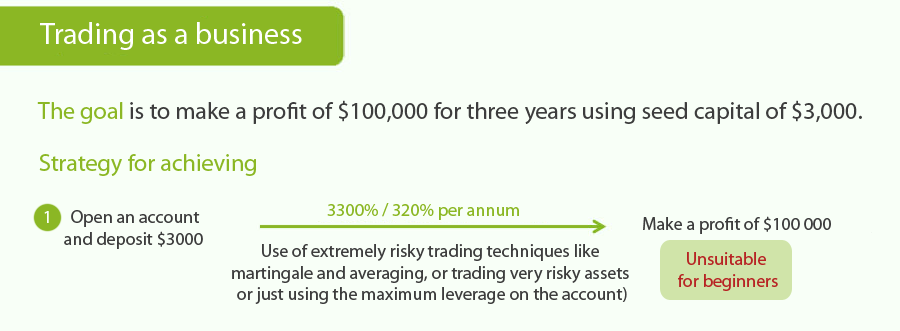

Suppose that the trader’s goal is to make a profit of $100,000 for three years using the seed capital of $3,000. I’ve defined this goal according to the most beginners’ aims. That is, profit potential relates to investments ratio, as a rule, just like that.

How do traders achieve their goals?

Strategy #1 – the way of majority

Most often, a beginner takes the wrong path that results in destroying of the trading capital, replenishing their trading account and its repeated loss.

In short, such strategy looks like this:

1. To open an account and deposit, for example, for 3 thousand dollars.

2. To earn 100 thousand US dollars when trading on this account.

I’d like to notice that such situations have been happening. I’ve seen traders reaching that result not for 3 years, but much faster. Unfortunately, out of thousands, only a few traders were able to do this, and that was about good fortune but not about extremely efficient trading tactics.

Such strategy of achieving the goal has nothing to do with trading as a type of business. If you try to trade this way (that is, you open a trading account and try to increase it by 10, 20, or 30 times), then in terms of statistics you won’t succeed. Because, even if we increase time for achieving the desired profit to 3 years, then we have to receive at least 320% per annum and reinvest all the profits.

Although it may happen, such strategy of achieving the goal isn’t good for majority. Professional traders, who have been trading in the financial markets for a long time and are aware of risks they take and start trading with specific account settings, may probably act this way. And as you know, with such appetite for profit potential, the risks must be enormous. Most often, a beginner, coming to financial markets and following this strategy of achieving the goal, tries to “accelerate” the growth of his trading account.

The acceleration of the trading account is a process when a trader is constantly increasing the risks in trading, that is, he’s seeking to increase the account substantially in one or two trades, simultaneously risking a significant share of the capital, often all of his capital. After making some profit, a trader is risking almost all of his money again, trying to drastically increase his account for several times in a row.

Often such trader uses especially risky strategies – martingale or averaging down. In such cases, the risk is limited to the total amount of the trader’s capital. And as a rule, this risk can be realized in one or two trades.

Alternatively, in the third option, a trader simply tries to achieve this goal by maximizing the risk in each trade that often also leads to the trivial blowing up of his account. Acting this way, a trader fails and doesn’t achieve his goal.

The growth of the trading account in such proportions is possible, but I strongly encourage you not to follow this strategy if you just start trading and the sum of money you’re going to use for such experiments is significant for you.

None of the principles presented on the slide above are good for beginners: the acceleration of the trading account, usage of martingale, averaging or other super aggressive trading concepts, the maximum leverage used on the account.

What is good for beginners then?

The strategies for achieving the goal don’t consider trading as a business. In my opinion, when a trader risks everything in a couple of trades is the attitude to trading as gambling. In the following, we’ll discuss how we can achieve our goal considering trading specifically as a business.

Strategy #2 – the way of a professional

The second strategy for achieving the goal is good not only for beginners but for all traders who:

- are ready to consider trading consciously;

- want trading to become the most likely source of their income;

- intend to become professional traders in the future.

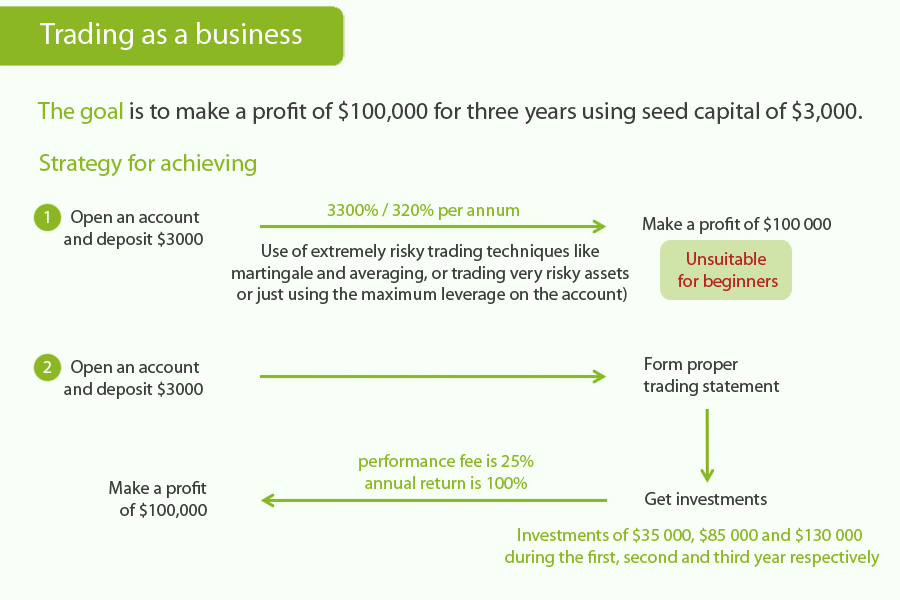

To implement the strategy, three steps are needed to be done:

1. Opening a trading account.

2. System trading to create a positive trading statement.

3. Attracting investments or publishing trading signals.

Now let’s talk about the key points of this strategy.

System trading to create positive trading statement

Let’s say you trade, carefully following your trading plan and act according to the complete trading strategy you’ve tested on historical data.

We’ve already written earlier about how properly to build a trading plan – a set of rules according to which you open and close positions. So, following your trading plan, you trade and build your trading statement.

The most important trader’s asset is a trading statement. If a trader focuses on creation of worthy trading statistics, his trading is highly predictable, he doesn’t open trades with unjustifiably high levels of risk, follows his trading plan and the profit and risk potential in each trade is predictable, then the further result will not be long in coming.

Attracting investments or publishing trading signals

The last point of the strategy for achieving the goal is attracting investments. Professional traders are people who most often manage not only their own but mainly other people’s money.

In fact, in my experience, each good trader (who follows the trading plan, disciplined and considers trading as a business) three are at least ten investors. In addition, it doesn’t matter which market you choose for trading – stock market, FOREX, futures market or options trading. If you create excellent trading statement, the question of funding won’t be a problem for you.

Many services allow traders to attract investments in their trading. And if trading statistics is good, then a trader can easily attract additional capital to his trading account.

If you look at statistics of attracting investments into trading accounts which generate high-quality trades and the worthy return, then the amount of investment attraction you see on the slide (about $35,000) is quite adequate. I took these values from statistics of investments into trading accounts which work according to trading plans and generate statistics and return that can be called competitive (at least for FOREX traders).

At the time of writing this, such yield varies significantly, but it’ll be more interesting when it’s several times higher than the banking one – from 25% per annum. In most FOREX and cryptocurrency related PAMM- and trading signals services, private investors are interested in the accounts with the return of 50-100% per annum and higher.

Not only return, but also the risk-reward ratio plays a crucial role. The higher it is, the more interesting a trading account will be. For example, a trader whose account yield is 100% per year with drawdowns of 50-60% will be much less interesting in comparison with a trader who generates the same yield with drawdowns of 10-20%. I’d like to note that trading tactics, such as martingale, can create the deceptive illusion of low levels of risk until the trading account is blown up.

Traders who trade professionally in the PAMM service make a part of the profits on investors’ accounts. It can be different percentage of remuneration – 25-50%. For example, let’s take 25% per year. If a trader is going to make such return for 3 years, he will finally yield 100 thousand US dollars due to his money management and investors’ capital management.

Sometimes traders feel uncomfortable while the sum on the trading account is increasing, they begin to open more emotional trades, they can lose sleep and get nervous. Therefore, the PAMM-service is not good for everyone. In this case, a trader can publish his trading statistics in the form of trading signals.

Most often, that solves the problem described above. At the same time, the trader’s profit potential can be equal or even higher than it can be obtained in the PAMM-service. The standard trader’s fee in this case is around $30 per month, which is collected from each subscriber (for MQL5), or commission fee from each trade on subscribers’ accounts (for Zulutrade).

Moreover, signals can be published from the PAMM-account, that is, a trader can make profit from both sources – trust management in the PAMM-service and remuneration from subscribers in signal services.

The way described above allows a trader to call himself a professional, avoiding the need to use super risky trading strategies. In my opinion, this way is most suitable for all who want to consider trading as a business and deal with this type of activity deliberately.

Summary

Once again, let’s look at two strategies for achieving the same goal. The first strategy is an attempt to increase the capital by accepting extraordinary risks. This is often chaotic and emotional trading and in fact, this is ordinary gambling.

The second strategy considers trading as a business when a trader realizes that the main thing is to generate positive trading statistics striving to have predictable drawdowns and maximum risk-reward ratio in each trading period.

Each trader may have unprofitable trades – one, two, five or more trades in a row – it can happen. And it’s important not the number of losses or profitable trades, but the result a trader reaches in the reporting period.

Depending on the trading concept, a trader can assess the financial result on his trading account once a week, month, quarter or longer period. It’s important that the trading account predictably increases in the reporting period, and certain trades can be both profitable and unprofitable.

The increase of the trading account by two or three times is excellent, but such result forces a trader to take high risks, and it’s unsuitable for beginner traders.

Keep in mind that the main asset of a trader, who considers trading as a business, is positive trading statistics. It add credibility to the trader, attracts investors or signal subscribers, and increase a chance to become a professional private trader. Creating such statistics should be your main goal.

Articles by the topic

- Planning in trading. Two strategies for achieving goals.

- Goal setting in trading. What are your goals?

- Trading plan and its role in trading.

- What unites 95% of beginner traders.

- Trading styles. How to choose your style?

- What is trader’s one hour worth? A conscious choice of the trading style.

- The best books from the trader’s library.

- What will be the role of trading in your life?