What Is Trader’s One Hour Worth? A Conscious Choice of the Trading Style

In the previous article, we discussed different types of trading styles, determined how they differ and what style is best for beginners. In this article, we will continue with the topic of choosing a trading style, but in terms of efficiency, including a trader’s time worth.

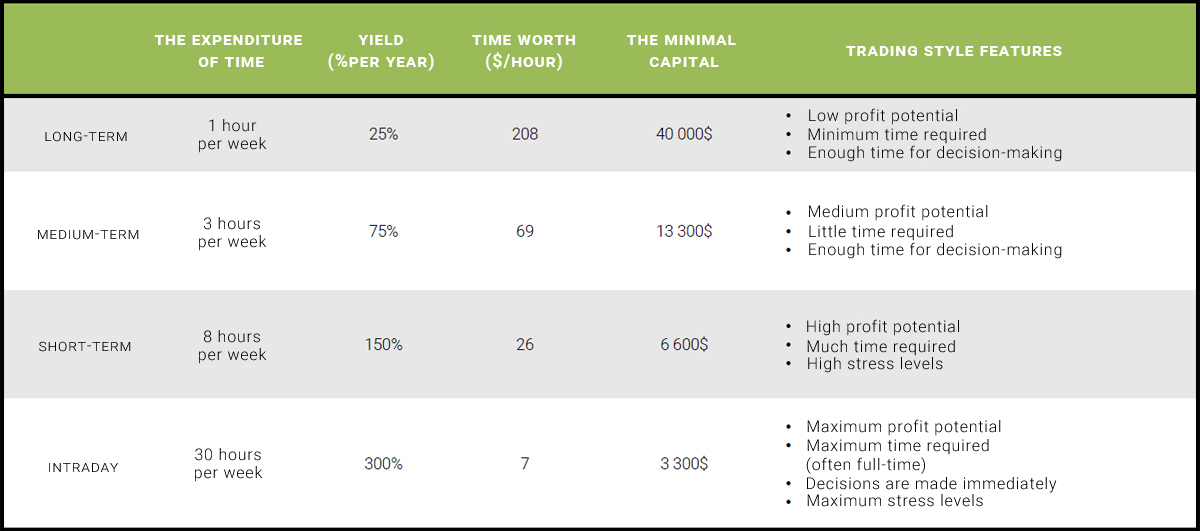

Comparison of trading styles. This example shows how much time and investment is required to make $10,000 a year following different trading styles.

Our slide shows the comparative table of the trading styles, which already appeared in the article “Trading styles in trading. How to choose your style?“. However, I added a column «time worth» to the table. What is worth one hour of your time as a trader?

Let’s take a small example. Suppose, we want to make $10,000/year. We will analyze how much time, capital and effort you should put into this in terms of those profit potentials and trading styles we considered earlier.

If we trade long-term and spend 1 hour a week on trading and our yield is 25% per annum, then the capital needed to make such profit will be about $40,000. Is that much? – It’s a matter in question. At the same time, you should understand that if you want to trade long-term and expect to make the above-mentioned profit, then the capital needed for such trading style will range from 40 to 50 thousand US dollars. With a small seed money of 1-2 thousand, you will have to choose another style or reduce the desired profit to make.

If we trade long-term and spend 1 hour a week, profiting 25% per year, that is 10 000$, your time is worth $208/hour. This is a very good result.

If you trade medium-term and spend about 3 hours a week on market analysis and trading, and earn, for example, 75% per annum, then the minimum capital needed to trade medium-term is $13,300. The sum of about $10,000 and higher will really allow you to trade comfortably in the medium-term ranges. In this case, your time is worth $70/hour.

If we are talking about short-term trading, then in comparison with medium-term trading, the time needed will be higher and the yield can also be higher. With a return of 150% per annum, equal to $10,000, the minimum capital will be about $6,000. The time will worth $26/hour that is slightly lower in comparison with the trading styles we considered earlier.

Intraday trading is associated with a maximum time spending, when a trader spends almost all his time on market analysis devoting at least 30 hours a week on market analysis and trading in the financial markets. The goal of such trader is maximizing the profit, above the levels discussed earlier – say, 300% per annum. In this case, the minimum capital required to make a profit equal to $10,000 is $3,000. Thus, the value of time is the lowest (in comparison with short-, medium-, and of course, long-term trading).

Once again, I would like to draw your attention to the fact that annual profit rates, naturally, can and will vary. But in relative terms, comparing these methods with each other, they will differ almost as much as they differ on the given slide.

The same is true for the optimal capital required for easy trading under each trading style – each trader will use different values, but it will decrease from long-term trading to intraday trading.

That is, to trade long-term, maximum money is needed to get sufficient profit potentials satisfying trader’s appetites. Medium-term and short-term trading require less capital. In addition, intraday trading requires the minimal capital.

However, pay attention that intraday trading with such amount of capital can imply the minimum hour worth. Most traders misjudge this extremely important thing because they start trading short-term or intraday and expect a huge return on their capital. In the early stages, when a trader manages solely his money, does not attract investment and does not share signals to investors, the hour worth will be especially low.

So, you have to ask yourself – does it make sense to consider trading as the main source of income when you are just starting to study trading in the market? I believe that for most traders the answer to this question is negative.

Summary

The question of the value of your time is a key question.

In most cases, at first, it is necessary to consider trading as an additional source of income, focus on the qualitative statement building, aiming to form worthy trade statistics, and then start trading as the main activity (if it is your goal).

I hope that the table above has thrown light on the questions that might not have been obvious. At the same time, I’d like to note once again that I do not discourage you from short-term or intraday trading. I just want to show you the realities you will most likely face if you decide to trade following these trading styles.

I urge you to proceed to active trading and consider trading as the main source of income only after studying the medium-term trading in the market. Medium-term trading is the middle ground after mastering which, you can consciously and effectively move towards long-term or short-term trading.

Such decision will be much more informed than, say, quitting your main job with the aim of increasing your trading capital by 10-15 times after reading the inspiring book on trading.

Study all the details associated with medium-term trading in the market, risk and money management rules. After that, you will be able to decide to move towards another trading style extremely consciously, knowing everything needed for this and understanding if this trading style is good for you or not, taking into account your lifestyle, line of thought, seed money, free time, stress resistance and other factors.

Articles by the topic

- Planning in trading. Two strategies for achieving goals.

- Goal setting in trading. What are your goals?

- Trading plan and its role in trading.

- What unites 95% of beginner traders.

- Trading styles. How to choose your style?

- What is trader’s one hour worth? A conscious choice of the trading style.

- The best books from the trader’s library

- What will be the role of trading in your life?