Financial markets weekly overview for January 14 – 18

We make up a weekly medium-term trade list based on technical analysis. The overview provides a description of the technical condition of the market on the most popular financial instruments.

During the shutdown of the federal government, CFTC reports will not be published and one should analyze just the chart.

Key topics

- E-Mini S&P500 (ESH19)

- Dollar Index (DXY)

- Euro (EURUSD)

- Swiss Franc (USDCHF)

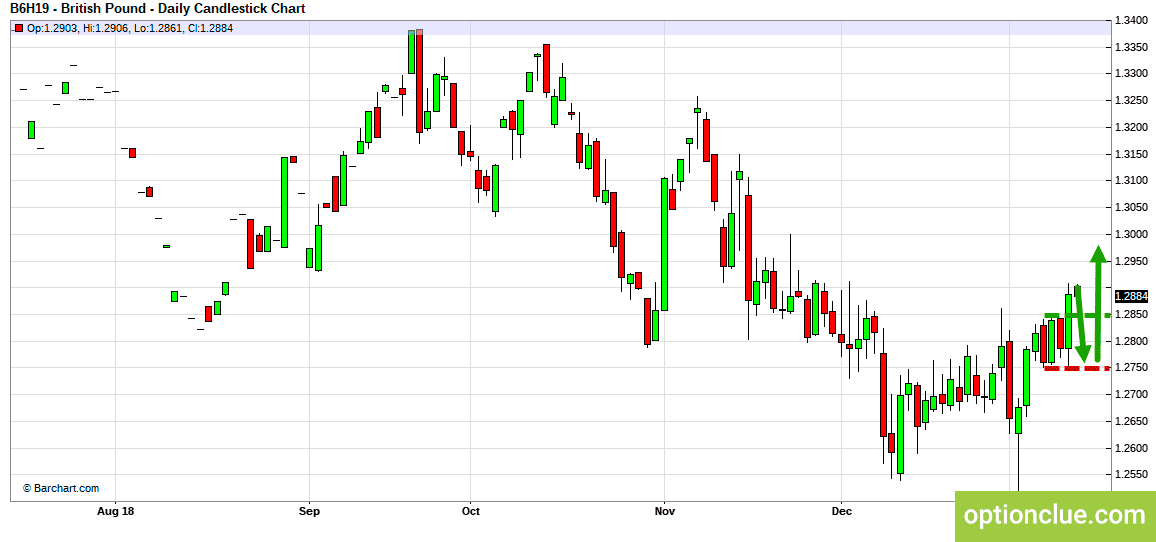

- British Pound (GBPUSD)

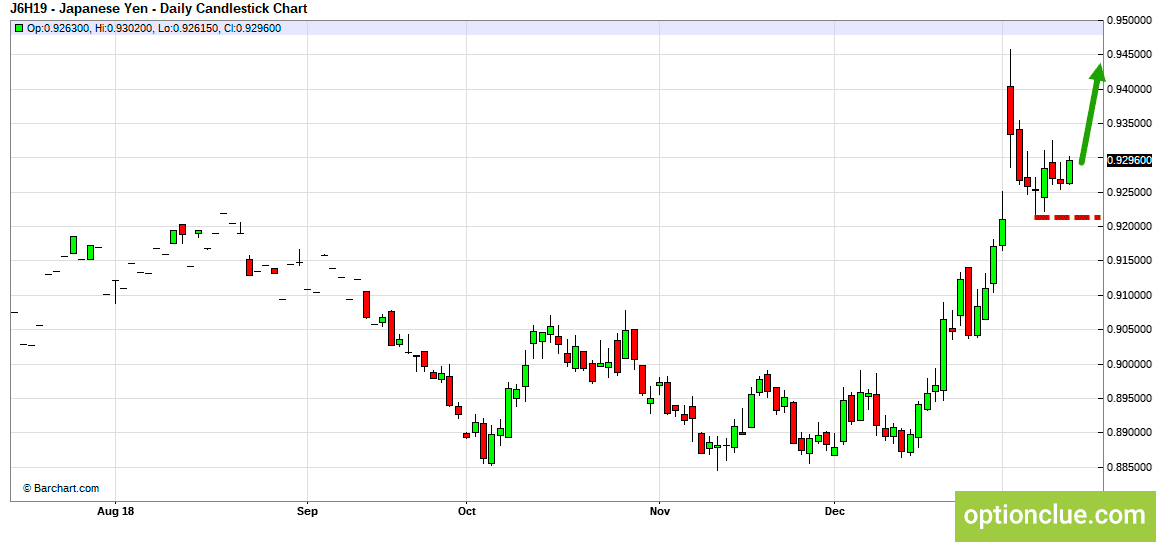

- Japanese Yen (USDJPY)

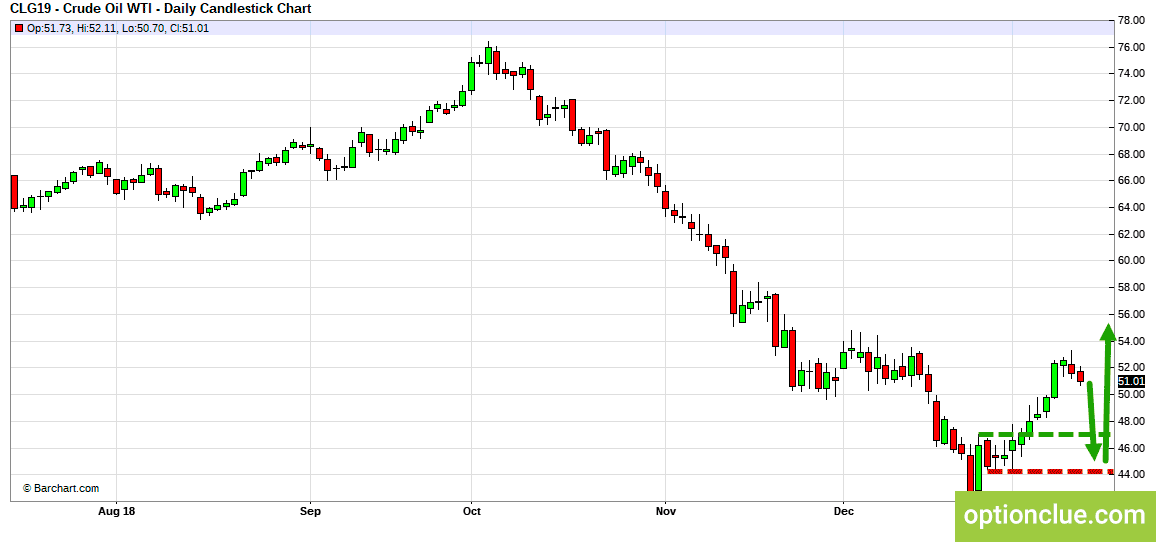

- WTI Crude Oil (CLG19)

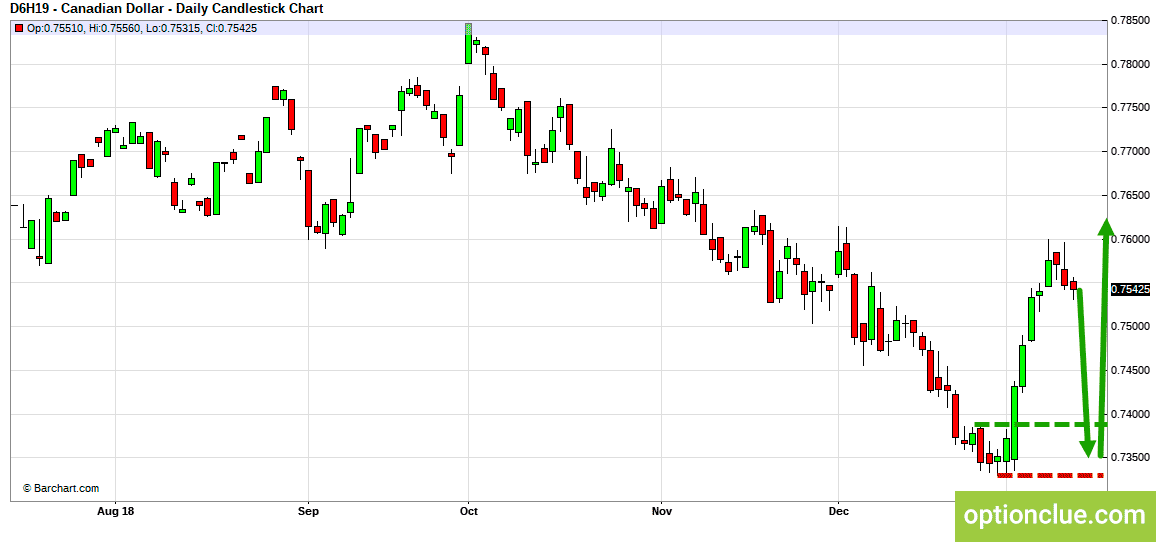

- Canadian Dollar (USDCAD)

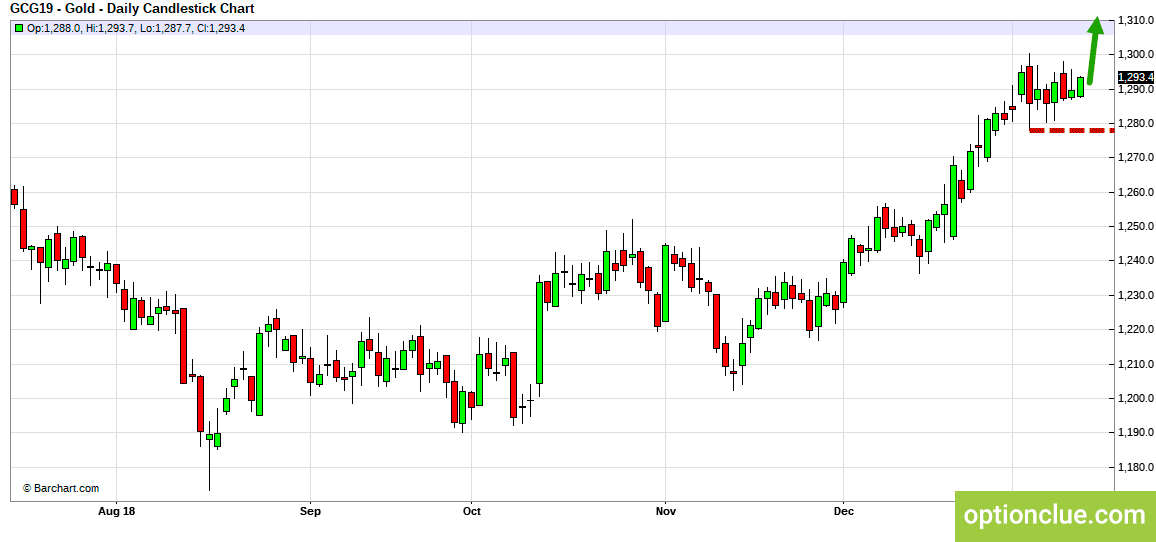

- Gold (XAUUSD)

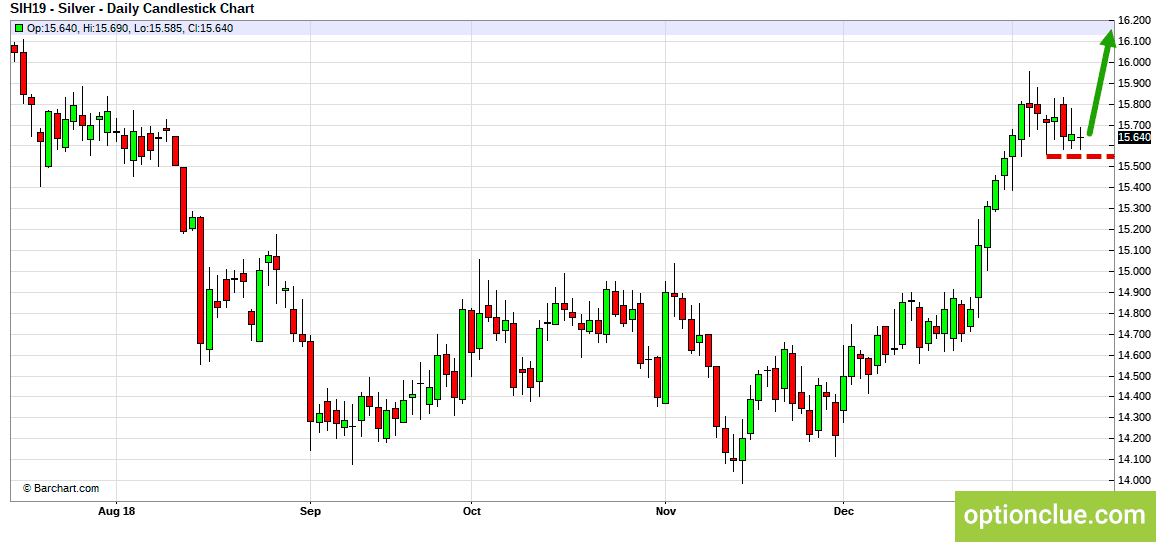

- Silver(XAGUSD)

- Australian Dollar (AUDUSD)

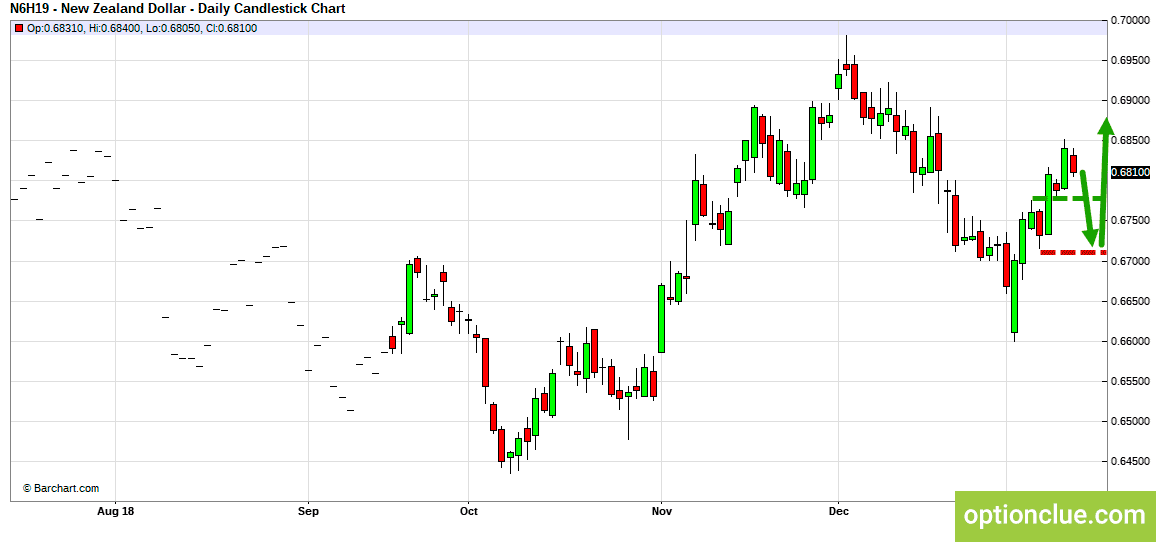

- New Zealand Dollar (NZDUSD)

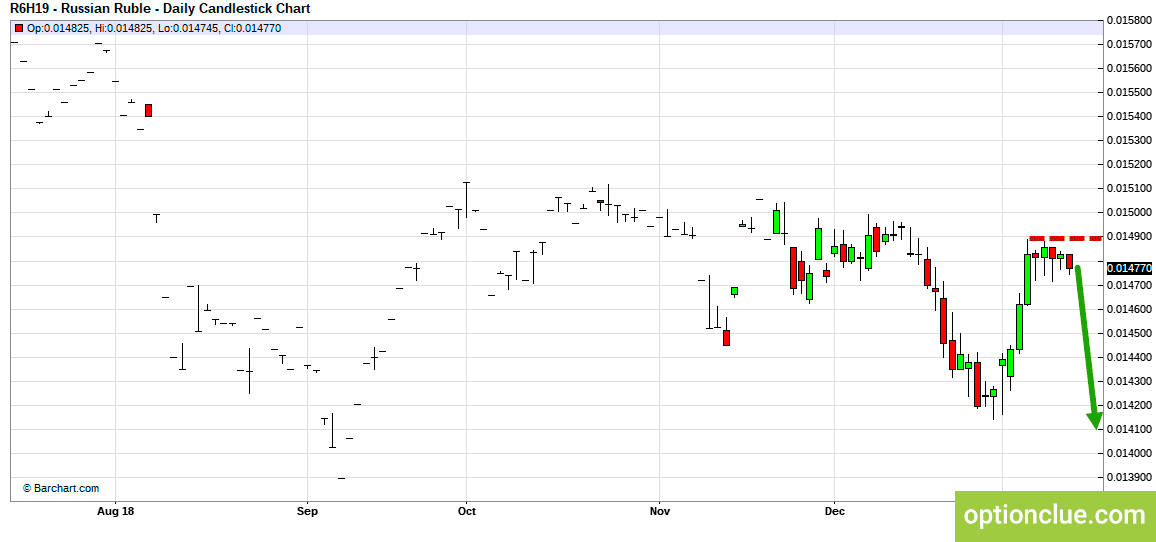

- Russian rouble (USDRUB)

- Conclusions

If you want to get more information on the pullback trading tactics and other aspects of trading in the market, watch the «Horizontal levels in trading» video course.

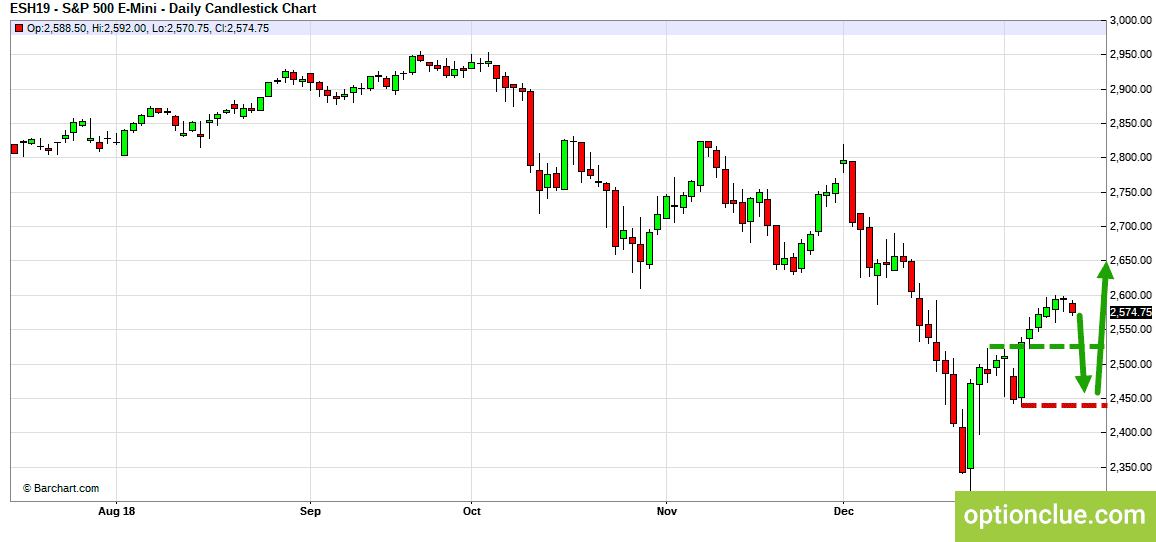

E-Mini S&P500 (ESH19)

The market remains in the uptrend and the impulse wave develops. A pullback buying opportunity will appear after the correction formation on the Daily timeframe. Long positions will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of January 3 – 4.

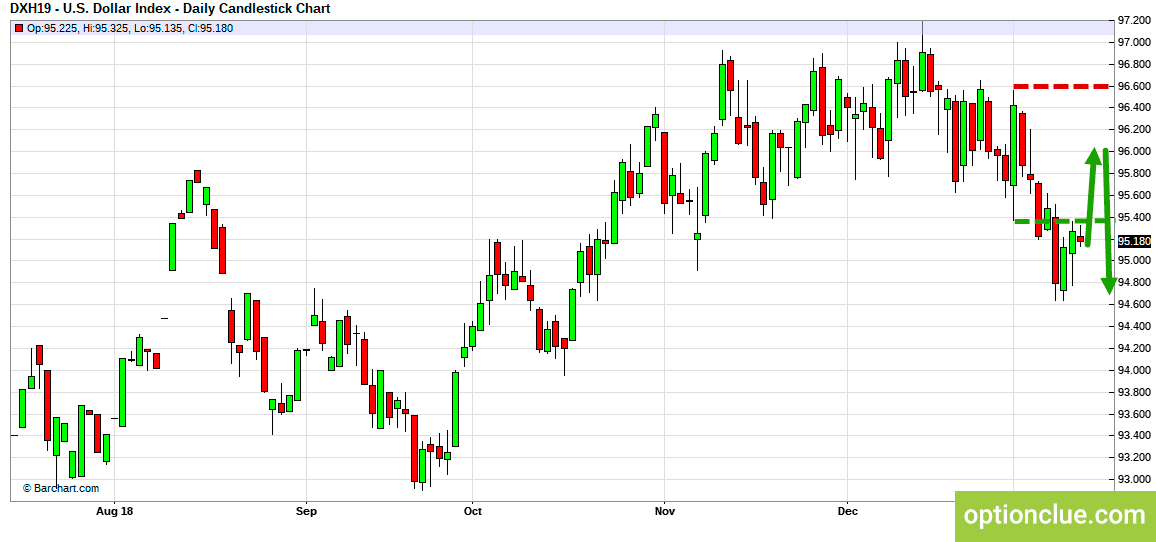

Dollar Index (DXY)

The market remains in the downtrend and the correction wave develops. A pullback selling opportunity will appear after the correction completion on the Daily timeframe. Short positions will remain relevant until the market is below the nearest resistance level on the Daily timeframe, the highs of January 2 – 4.

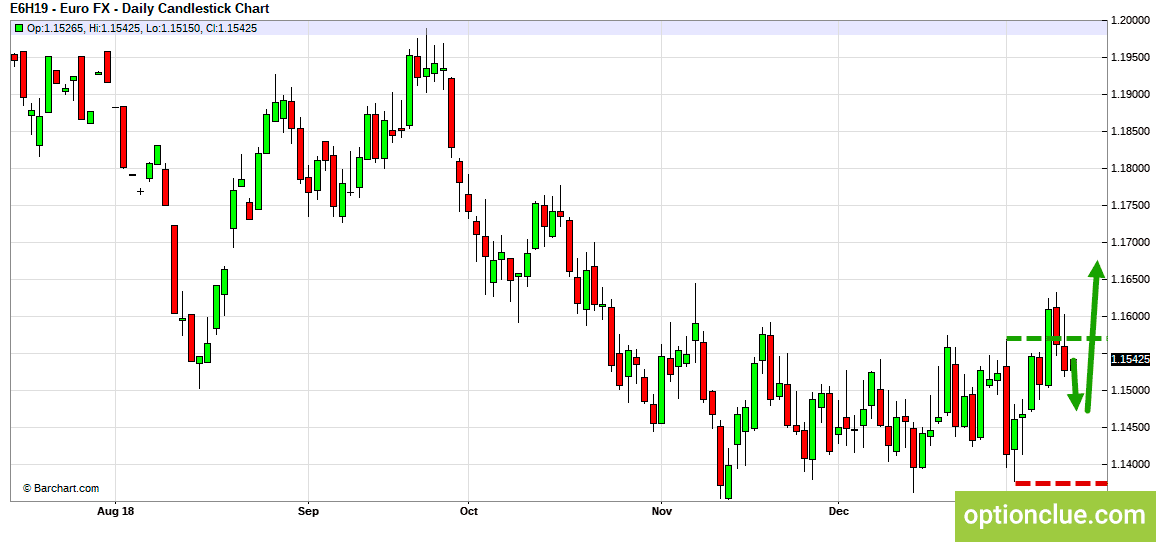

Euro (EURUSD)

The resistance level was broken on the Daily timeframe on Wednesday, the trend is bullish now and the correction wave develops. A pullback buying opportunity will appear after the correction completion on the Daily timeframe. Long positions will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of January 2 – 4.

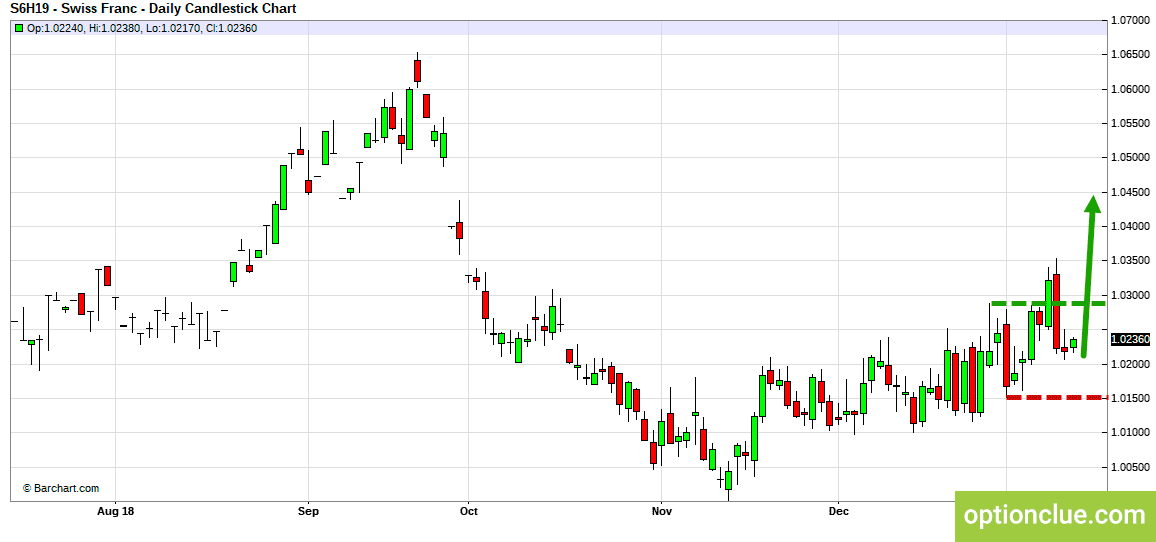

Swiss Franc (USDCHF)

USDCHF currency pair remains in the downtrend and the correction wave develops. A pullback selling opportunity will appear after the correction completion on the Daily timeframe. Short positions (USDCHF) will remain relevant until the market is below the nearest resistance level on the Daily timeframe, the highs of January 2 – 7.

British Pound (GBPUSD)

The resistance level was broken on the Daily timeframe on Friday, the trend is bullish now and the impulse wave develops. A pullback buying opportunity will appear after the correction formation on the Daily timeframe. Long positions will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of January 8 – 9.

Japanese Yen (USDJPY)

USDJPY currency pair remains in the bear trend. The correction came to an end last week and the pullback selling opportunity was formed. Short positions (USDJPY) will remain relevant until the market is below the nearest resistance level on the Daily timeframe, the highs of January 8 – 9.

WTI Crude Oil (CLG19)

The market remains in the uptrend and the correction wave develops. A pullback buying opportunity will appear after the correction completion on the Daily timeframe. Long positions will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of December 28 – January 2.

Canadian Dollar (USDCAD)

USDCAD currency pair remains in the downtrend and the correction wave develops. A pullback selling opportunity will appear after the correction completion on the Daily timeframe. Short positions (USDCAD) will remain relevant until the market is below the nearest resistance level on the Daily timeframe, the highs of December 31 – January 2.

Gold (XAUUSD)

The market remains in the uptrend. The correction came to an end last week and the pullback buying opportunity was formed. Long positions will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of January 4 – 9.

Silver (XAGUSD)

The market remains in the uptrend. The correction came to an end last week and the pullback buying opportunity was formed. Long positions will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of January 8 – 9.

Australian Dollar (AUDUSD)

The market remains in the uptrend and the impulse wave develops. A pullback buying opportunity will appear after the correction formation on the Daily timeframe. Long positions (AUDUSD) will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of January 2 – 4.

New Zealand Dollar (NZDUSD)

The resistance level was broken on the Daily timeframe on Wednesday, the trend is bullish now and the impulse wave develops. A pullback buying opportunity will appear after the correction formation on the Daily timeframe. Long positions (NZDUSD) will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of January 8 – 9.

Russian rouble (USDRUB)

USDRUB currency pair remains in the uptrend. The correction came to an end last week and the pullback buying opportunity was formed. Long positions (USDRUB) will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of January 9 – 10.

Conclusions

In terms of medium-term trading, financial instruments with the correction close to completion on the Daily timeframe and with potentially the most promising risk-reward ratio are EURUSD, USDCHF and USDRUB.

In the near future, AUDUSD and Dollar Index can become noteworthy depending on the market correction depth.

Other financial instruments in the trade list may be also interesting, but in these markets pullback signals on the Daily timeframe are likely to occur no earlier than a week.

More information on the topic:

- The role of support and resistance levels in the trading plan

- Trading tactics. Breakout trading and pullback trading

- How to use CFTC reports in trading. General concepts

- How to use CFTC reports in trading. The logic of large speculators

Good luck in trading!