Principles of setting targets when entering the market

Money and risk management – is a broad subject, which, in my opinion, is one of the key ones. In this article, we will discuss the principles of setting targets when entering the market. They along with the calculation of profit potential and determination of risk/reward ratio are related to the fourth point of the trading plan.

Contents

- How to define targets when entering the market?

- Trading. Greed as a principle of the market exit points determination

- Setting targets when entering the market at the beginning of a trend

- Trading advice. Protection of floating profit near the interim targets

- Determination of targets when entering in the middle of the trend

- Conclusions on setting targets for reaching take profit

How to define targets when entering the market

Market entry points are based on the properties of the support and resistance levels. Targets and market exit points, if the price is moving against the position, are also set on price levels.

Suppose, the market was falling for some time, each new high on the chart was lower than previous one, and the price was closed above the next resistance level. That is there was the resistance level breakout from the bottom up.

The fact of the level breakout has been recorded therefore a buy signal, a breakout signal is being formed. The question is: what levels should be considered as the most favorable market exit points if the price keeps on moving in the desired direction.

To receive an adequate answer it is necessary to think over the point other traders will exit the market if the price is still moving up if the bullish trend continues and the market is rising.

Traders close their positions somewhere about the same horizontal levels. There is no need to have supernatural market sense, secret signals or market analysis tools to determine optimum exit points. It is enough to be aware of the logic of the market exit by different groups of participants, preferably the logic of the majority.

At what point will most likely the balance between buyers and sellers change? One of the simplest ways for getting an answer to this question is based on the search for the nearest support and resistance levels on the price chart.

If you see the market was moving in any direction for a long time and then has reversed, you may expect you are at the beginning of a new trend. If you are at a point that could potentially be a new trend starting point, you can be more optimistic in making predictions about setting targets on the market.

I believe the very best money is made at the market turns. Everyone says you get killed trying to pick tops and bottoms and you make all your money by playing the trend in the middle. Well for twelve years I have been missing the meat in the middle but I have made a lot of money at tops and bottoms.

Paul Tudor Jones — investor, hedge fund manager

Analyzing client statements I often come across situations when traders open positions on the market, guided not by cautious optimism but the desire to get a sum equal to X (this value varies). This is probably the worst possible approach to setting market targets. It is important that optimism in setting targets is a consequence of balanced analysis of the market situation, rather than greed.

Trading. Greed as a principle of the market exit points determination

Let us take an example of such false optimism. In this case, a trader says to himself: «I’d like to make a profit equal, for instance, $1000». Afterward, he opens a position and determines the price target, based on his appetite for profits that he wants to earn in a particular trade.

This target is not associated with market realities and is biased, most likely it will not be consistent with targets that other market participants set, and key support and resistance levels on the chart.

If a trader guided by this principle sets targets too far, the market may reverse before hitting it. Even if the trade is profitable, the result will be most often much worse than expected. Apart from this, a profit will be much lower than a trader could make in case of defining a target based on its objective criteria settings. Namely, based on the support and resistance levels, the market marking.

the quote from «Market wizards»

I would say that risk management is the most important thing to be well understood. Undertrade, undertrade, undertrade is my second piece of advice. Whatever you think your position ought to be, cut it at least in half. My experience with novice traders is that they trade three to five times too big.

Bruce Kovner — investor, hedge fund manager

For that reason, it is necessary to analyze the price chart for setting the targets. This could help determine where traders will likely close their positions. This will be enough to figure out where market reversal or correction can start and determine the qualitative target based on market realities.

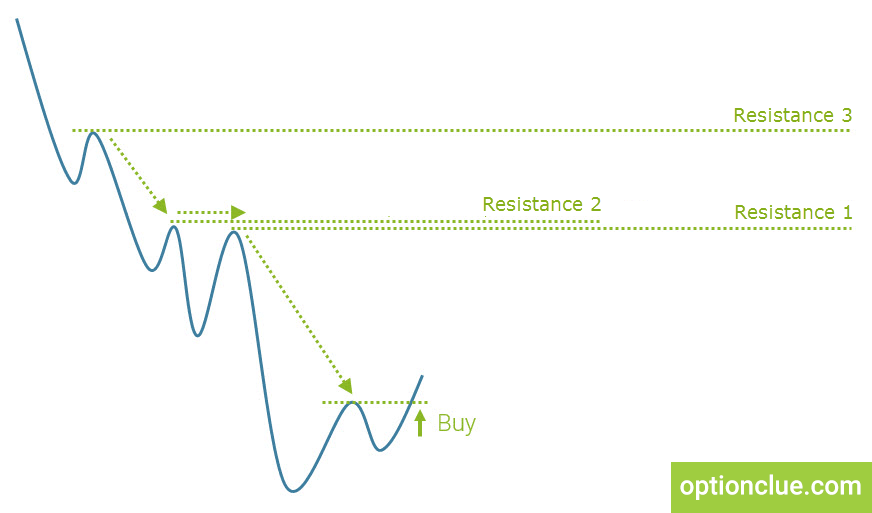

The graph below shows 3 plotted nearest resistance levels. In most cases, it is a sufficient number for determining qualitative targets that market can really reach if it is moving in the right direction.

In the figure below these are the resistance levels #1, #2 and #3. If all three levels overlap they are almost at the same price zone, then further targets may be considered. Anyway, the optimism has to be based on the objective price marks that you can make in accordance with the existing support and resistance levels.

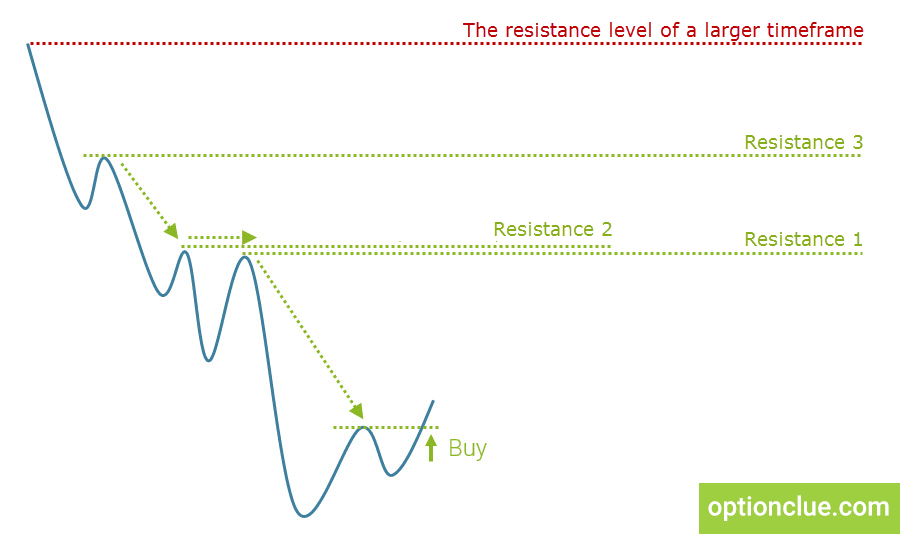

Apart from this, levels of larger timeframes will be always plotted on the chart.

In the illustration above, the resistance level of a larger timeframe is far enough in comparison with the levels we have plotted on the current timeframe. Therefore, as a target, you can choose the first, second, or third resistance level of a current timeframe or the resistance level of a larger one.

Setting targets when entering the market at the beginning of a trend

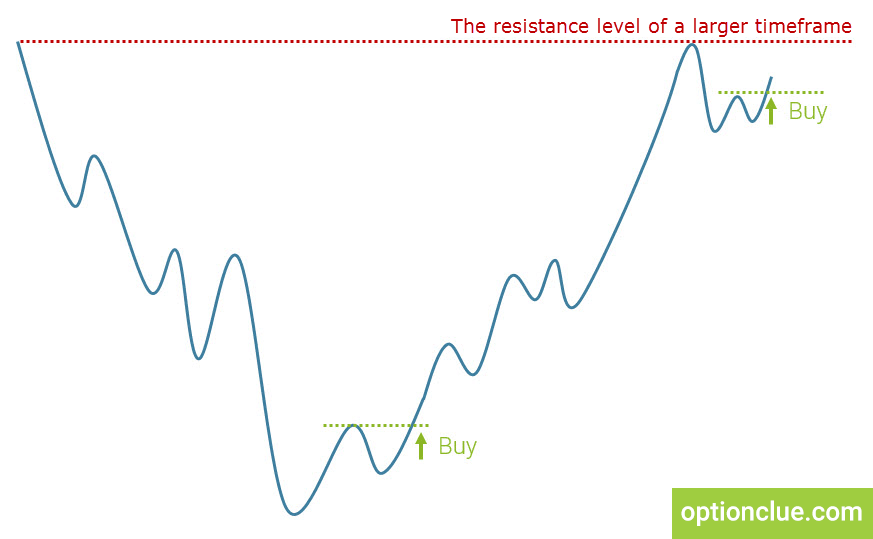

If the trend on the marked evolved for a long time and after that, the tendency changed – an attractive entry point is being formed. If the price moves in the direction of the reversal, the entry point near the current price zones will make it possible to get the maximum profit-loss ratio.

Entry points at the time of the market reversal after a long growth or decline generate the maximum profit-loss ratio

Entry points during the market reversal after long-term growth or decline, allow entering the market with low risk and significant profit potential.

How strong the trend will be, how rapidly will the market move within this trend – it is the question, that will never have the definite answer. You had better focus on the market realities and profit-loss ratio (risk-management).

When opening a position in the potential beginning of a new trend, you can determine a target based on the cautious optimism, for example, choose a target #2, #3 or the resistance level of a larger timeframe.

Trading advice. Protection of floating profit near the interim targets

When opening a buy position as a target you choose resistance level of a larger timeframe or the second, third level of a current one, and then after entering the market, we should not expect it to rise linearly directly and reach the target in a few candles.

This desire is fully justified – when opening a position, you want to close it with a profit and as soon as possible. However, generally movements on the financial markets are not linear and the market may slow down or correct near the most support and resistance levels. Moreover, if the target is set far enough from current prices, you have to prepare for such market reaction to the horizontal levels – the market often starts fluctuating around next support and resistance levels.

If this happens, you can partly close a position or protect the floating profit by buying an option * (put – for a bull market, call – for a bear market). Using options to protect the position from possible negative market movement is often the excellent solution and the classic of their application. In this case, if the options are cheap enough you get an opportunity to earn maximum profit from the market growth and simultaneously protect unrealized floating profit.

Meanwhile, if you are worried about the market reaction to the support and resistance levels, you find it difficult to hold the position and suffer emotional torments during every correction I highly recommend that you reduce the position size. Position size reduction in most cases allows traders to reduce emotional tension and exercise their right to a good night’s sleep.

Another solution to the problem – revise your concept of setting targets. The liquidation of a position in an area of closer targets may also allow avoiding unnecessary stress. Remember that the optimal profit-loss ratio should be satisfied in each trade. Risking large capital and closing tiny profits, you lead your trading account to the predictable average result.

Determination of targets when entering in the middle of the trend

If the trend only starts forming, you could choose rather optimistic targets. But how to act if by the time of signal appearance the market has already been moving for a long time in the direction of the trend.

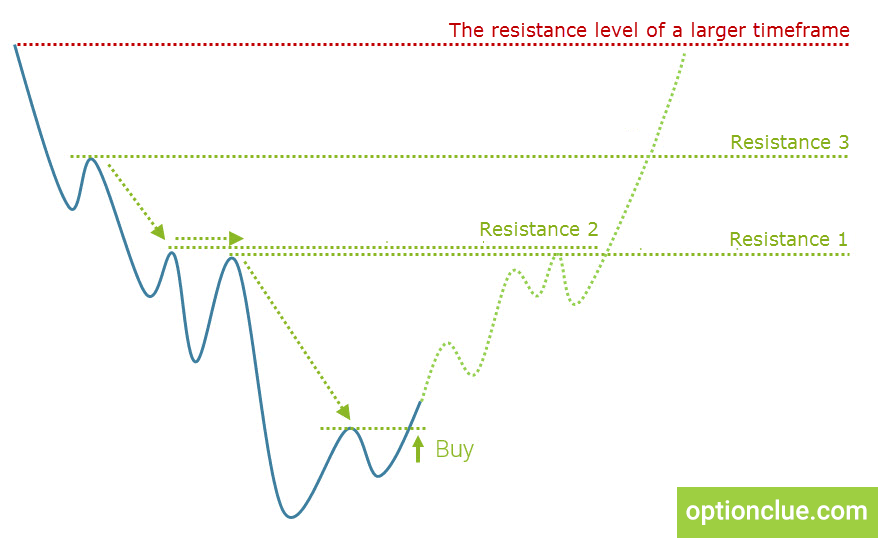

What period of time can be considered to be long? The answer to this question will depend on the timeframe and the financial instrument and along with this, in my opinion, as a reference value of the maturity of the trend you can use a value equal to 3-5 breakouts in the direction of the trend.

Let’s say, you see a breakout signal #5, which occurs around the resistance level of a larger timeframe. This raises the question of what target can be considered to be objective.

Most often, this is the nearest resistance level (for the bear market – support level). If you get into the market in the direction of the main trend and see that it is far from the beginning of the trend, excessive optimism is inappropriate because you may pay dearly for it. Objective target settings in this example are possible at the nearest resistance level. Pay attention to the example above, this is the resistance level of a larger timeframe.

As mentioned earlier, flats, triangles, market reversals may start forming around such levels. When the price is below the level, it’s impossible to say for sure whether it’ll be broken or not. Therefore, the objective target will be the nearest resistance level. If such a target doesn’t satisfy you, the profit potential is too small, you should back out of a deal.

Conclusions on setting targets for reaching take profit

When opening a position optimism should be maximally justified. Trying to trade with setting unreasonably distant targets, the market just will not reach them. Moreover, even if you close a position with the profit, more often it’ll be much lower than you could make in case setting a target around the nearest support and resistance levels.

Therefore, when setting targets you should ask yourself: «How objective am I in setting this target?» It’s necessary to figure out how this target allows you to answer the question: «At what point will most of traders likely close their positions?», rather than answering the question: «How much would I like to earn in this trade?»

Traders often make the process of plotting horizontal support and resistance levels much more difficult than it needs to be. Some of them tend to complicate this task by plotting unnecessary levels confusing them in determining further price movements in directed trading. After getting the Levels indicator you won’t have any difficulty in this due to the simplicity of its use. It can help not only identify price zones where the market movement can slow down or price reversal is likely to occur but also find entry signals that appear during a deep market correction or calculate stop-loss and take-profit.

Good luck in trading!

* Classic (vanilla) options are discussed in the article. Only the name unites them with binary options. Classic options are traded on real markets and are used both by private and large traders. They allow to fix trading risks rigidly without limiting profit potential.

Binary options are analogous to a casino. They are not traded on stock exchanges and they are not used by large traders. They are adjusted so that expected value can always shift against a trader (in casinos the expected value should be less than zero, otherwise the organization will go bankrupt). Trader’s losses become the profit of the casino in this case – the supplier of binary options.