Trading Styles. How to Choose Your Style?

In the previous article, we discussed strategic planning in trading and two main ways of achieving goals when trading in different markets. If you have already decided on your strategy, then it’s time to think about choosing the trading style that will be best for you.

The choice of trading style

Starting to study financial markets, most traders make the same mistake: they follow the trading strategy that another trader uses, without analyzing whether such strategy or trading style suits them or not.

What is it about?

Let’s say, you’re aware that your friend has been successfully trading, following short-term trading. That is, he opens and closes positions within one trading week. You enthusiastically begin to study this concept, trading on a demo account and only when it comes to trading on a real account, you realize that it’s not good for you, since it makes you spend much time to trade – for example, 1-3 hours a day.

Such real money trading implies having free time during the day when you can focus on the market and not get distracted by minor tasks. And if you are not ready to spend much working time on trading, then the trading strategy that your friend uses will be hardly good for you.

On the other hand, for example, this trading style is associated with higher risks than you could expect earlier or requires more seed capital that is available.

I recommend starting from the time you want to spend on trading and capital available, and not the reverse.

How much time are you ready to spend on trading?

For example, if your goal is to make trading an additional source of income, then it is unlikely that you will be ready to spend 3-5 hours a day on market analysis and trading. Therefore, you can immediately discard dozens of trading approaches that require so much time.

On the other hand, if you are trying to make trading the main source of income, then you will plan your time and priorities another way. Each trader is free to choose a trading style that is best for them and, as a result, it will most likely allow them to achieve their goals.

What are the types of trading styles?

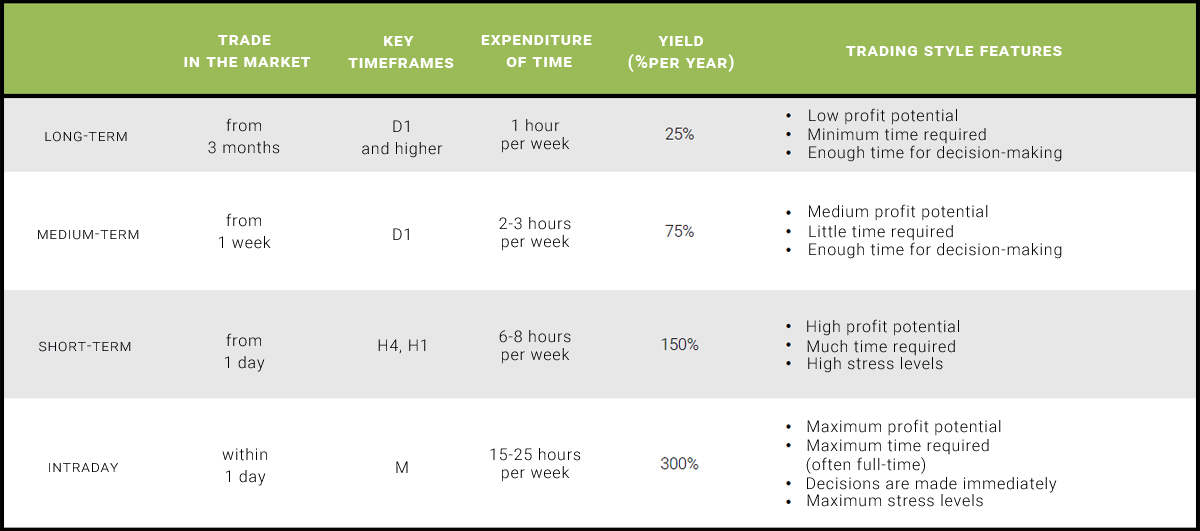

The slide below shows the main trading styles and their specific features.

Long-term trading

Long-term trading implies trading when a position is held for 3 months or more. The key timeframe used to determine entry and exit points is Daily or higher timeframes (Weekly and Monthly).

Most often, this kind of trading is carried out in the stock market, as well as in options trading. In this case, the time required will be minimal. One or two hours a week can be quite enough to control opened positions and find new trading opportunities.

The slide shows the relative value of the expected return. In this example, I indicated 25%, but this number is very hypothetical. It is needed to compare roughly the profit potentials that are adequate for different trading styles. Obviously, you can trade long-term and get 100% per annum, while in another situation you can trade short-term and get 5% per annum. These numbers are relative so that you can compare them with each other.

When trading long-term, the expected average return will be the lowest. Moreover, the risks in comparison with medium-term, short-term and intraday trading, will be often lower.

In comparison with other trading styles, this one is of the least profitable. At the same time, its competitive advantage lies in the minimum expenditure of time. Moreover, you have plenty of time to make a trading decision.

If you trade long-term then you have time to analyze the market and channels of information you consider useful, and to think carefully whether to open, close or modify a position or not. It can take several days to think over one trade. That’s why this option will not require much time and will give a wide room for maneuver, maximum time for decision-making. As mentioned earlier, trading is carried out on the Daily and higher timeframes.

Medium-term trading

The next trading style is the golden mean. We’re talking about medium-term trading.

Medium-term trading requires not much time – usually 2-3 hours a week. In this case, a position can be held for a week or more. The key timeframe, in this case, is Daily. The search for entry points can be carried out on smaller timeframes, but the Daily timeframe will be still the most important. The average expected return can be slightly higher in comparison with long-term trading.

This approach can’t be called the most profitable. However, in my experience, it’s getting chosen by most traders, especially those who consider trading as an additional source of income. After all, in this case, you shouldn’t always stare at your computer. You just have to look what’s going on in the market once or several times a day.

On the other hand, this trading style (just like next two options) can allow a trader to become a professional, that is, to consider trading as his own business and the main source of income. In my experience, medium-term trading will generate a greater number of profitable trades and will give you more time to think about the feasibility of each trade than short-term or intraday trading.

For that reason, even if you have decided that you want to trade short-term or intraday at the moment, I strongly recommend starting to study trading by building a trading plan for medium-term trading.

After that, you can adjust the existing trading plan for short-term trading. Moreover, it’s not only possible, but it’s one of the most logical ways to study short-term trading, to move “top-down”. You will be able to better understand the larger timeframes, and your further trading on smaller timeframes will be more effective.

In addition, trading causes a certain level of psychological abuse, but medium-term trading makes it to a lesser extent.

Short-term trading

Short-term trading means trading within a week when a position is held for 1 – 5 trading days. In this case, the key timeframes for making a trading decision are H1 and H4, nevertheless, the search for the most optimal market entry point can be carried out on smaller timeframes. In this case, generally, the expenditure of time will be approximately twice as high as compared with medium-term trading.

If you are trading on smaller timeframes, get ready that you will always need to have a tablet or smartphone with access to the trading platform. You will often have to quickly close a trade within a day or in a different way respond to the changed situation in the market.

Following this trading style, you should keep your eye on the ball and monitor the market situation much more often in comparison with medium-term trading. It will not require much time, but you have to understand that you will spend on this process for at least 1-2 hours a day.

At the same time, if you have short-term positions in the market, be ready that you can be less effective in your non-market affairs. Initially, you will be willing to constantly look into the trading platform, switch between timeframes. Psychological stress is usually several times higher in comparison with medium and long-term trading. Thus, short-term and especially intraday trading is not for everyone.

The expected return may be higher in comparison with medium-term trading – often significantly higher, but not always (in the next article we will discuss trader’s time worth in each of the categories considered).

On the slide above, I indicated a high psychological stress in the properties of the trading style. This is true since if you hold a trade on smaller timeframes, your transactions can be closed more often at a loss in comparison with medium-term and especially long-term trading. However, the profit potential in each trade, in other words, the risk-reward ratio may be higher here.

It causes high psychological stress to which, to be honest, most new traders are not ready. Many novice traders “jump” over the medium-term trading, and immediately begin to trade short-term or intraday. In this case, beginners simply waste their vitality, often can’t sleep at night, become irritable and defocused.

I do not want to frighten you at all. And I will not say that this will happen exactly to you. However, I know dozens of cases when traders tried to quickly leave medium-term trading, aiming to start more active trading as quickly as possible. As a result, they faced an increased psychological stress, being not ready for it. Emotional stress did not let them engage in their main activities. It was difficult for them to concentrate.

Thus, trading automatically became their main activity, without being their main source of income. Naturally, that resulted in major challenges: trading still provides no benefit, but it is a source of stress. It also makes a person more irritable and distracts from work. The result is obvious – in this case, trading causes just frustration and naturally can’t become either the main or additional source of income.

Therefore, in order to minimize such psychological stress straight from the start, I recommend starting to study trading with medium-term trading.

Intraday trading

The next trading style implies that you spend most of the time on trading. I would like to dwell on it in detail. Day trading, intraday trading means trading within a day. And as far as I know, a huge number of traders want to become intraday traders.

Intraday trading is the most active trading style, which theoretically can generate the maximum profit, but at the same time, it is associated with many specific features.

First, if you are trading intraday, then you spend most of the time on the analysis and trading, as well as on preparation for a trading day. If you work full-time in addition to trading, you will obviously have to quit your job. In most cases, it will not be possible to combine intraday trading with your main job. You simply won’t be able to sufficiently focus on both processes at the same time. Intraday trading requires maximum concentration, much time and maximum involvement.

At the same time, such trading causes the highest psychological stress due to the reasons I mentioned earlier. You will often have to make trading decisions at lightning speed. You will have almost no time for reflection, at least in comparison with medium – and short-term trading. You should also have a perfect trading plan, tested on history and on a demo account. It’s a plan you really follow and each point of which you can analyze in the blink of an eye.

You are trading at this level without having time for long-term reflection on whether to break your trading plan or not and how to find the optimal risk-reward ratio. All calculations and situation analysis must be rapid and effective. To master such skill, you obviously have to train a lot.

Summary

Each of these trading styles has its pros and cons. You’ll be able to understand which style is good for you after starting trading in financial markets. However, in my experience and according to the reviews among the students who passed the course “Trading. Successful start”, at least 30% of them were able to draw such a conclusion just after starting the course.

If you want to trade short-term or intraday, I urge you to examine primarily medium-term trading in the market. In this case, you will save much time and effort and will be better prepared for the difficulties of trading on smaller timeframes.

After studying the medium-term trading, you will build your trading plan, which can be modified in order to trade short-term or intraday. It will be a trading plan that is good for you, taking into account the time, capital and expectations you have. After all, not everyone wants to make trading the main source of income, and not everyone dreams of staring at the monitor for 5 hours a day.

You will realize which elements of your trading plan are the most important, what you can and need to adjust, and what in no way shouldn’t be adjusted. You will study the principles of entering the market and master them, and that will give you a chance to become a perfect trader.

Articles by the topic

- Planning in trading. Two strategies for achieving goals.

- Goal setting in trading. What are your goals?

- Trading plan and its role in trading.

- What unites 95% of beginner traders.

- Trading styles. How to choose your style?

- What is trader’s one hour worth? A conscious choice of the trading style.

- The best books from the trader’s library

- What will be the role of trading in your life?