Basic methods of money management. Their weaknesses and strengths

In the previous articles of the cycle «Axioms of Trading» we discussed risk management, the fourth point of the trading plan at which a lot of low-quality trades will be passed.

This time we will talk about money-management rules that complement risk management rules and are the basis of any worthy trading strategy.

While risk management is used to determine a sufficient risk-reward ratio in each trade, then money management is used to calculate the optimal position size.

At the same time, the more global goals of applying these principles in trading are identical, that is minimizing the «drawdowns» of the trading account and maximizing profits.

In this article, we will discuss minimization of risks. Just money-management and the correct position sizing will protect your trading capital from default and safeguard you from the uncertainties about the future (nobody knows how many unprofitable trades can be next quarter).

This may be not obvious at first glance, but the competent position size calculation can create «miracles» with trade statistics. I think this word is appropriate as due to money-management your trading result can be much better than statistics of traders who don’t know or don’t use these methods.

This is another competitive advantage, an important difference between a professional and a beginner.

Money management rules include the optimal position size calculation in each trade. We can emphasize several basic approaches of solving this issue. I will talk about those that are used most often and start with the methods of money management that are low-efficiency.

Contents

- Trading. Fixed position size

- Fixed risk per trade in the account currency

- Money management example 1. Three traders

- Fixing risk as a percentage of capital

- Money management example 2. Is it possible to lose money in the market?

- Conclusions on how not to lose money in the market

Trading. Fixed position size

The first method implies trading the same position size in each transaction. In this case a trader, opening a position in the market, does not determine the risk in the account currency or percentage of capital. These values vary chaotically from position to position.

This is the worst way to determine the position size since a trader cannot predict in advance how much money or a share of capital he risks. This is the way the vast majority of beginners act and for the trading account this approach most often ends up fatal. Money-management is absent since there is no «management» of capital.

If you apply this approach, I recommend to finish reading the article to the end since applying a fixed size in each trade affects your trading more negatively than positively.

If a trader always trades the same position size, then most often the logic of opening a position will be as follows:

- market entry and exit points are determined;

- the risk-reward ratio is calculated and if it is small enough then a position is opened.

The position size when entering the market does not change. For example, a trader always trades one contract. This can be a futures contract, one lot in the spot market or one option contract. The main thing is that the position size from trade to trade does not change.

This option of determining the position size does not give any flexibility or advantages over other traders. If risks in each trade vary chaotically and are not under control, then this approach is difficult to attribute to money-management. These are the axioms of money management. For these reasons, we will not come back to it.

Fixed risk per trade in the account currency

The next way to determine the position size can be attributed to money-management as, unlike the example above, it implies money-management in each trade. The risk is determined in advance and fixed in the account currency. When a trader applies this approach he always knows the risk per trade before opening a position.

The sequence of actions when entering the market will be the following: first of all the risk per trade is determined, for example, $50. Then the risk in points (stop-loss in points) is determined, for example, 300. After that, the point value for one contract is determined, for example, $1. Only after this, in the final, the position size is determined.

Using this approach, the position size can be calculated according to the following formula:

S — position size,

R — desired risk in the account currency,

S — stop-loss size in points,

P – point value for a contract.

Let’s calculate the position size in our example:

This means that at a risk of $50 the position size must be 0.16 contracts. Unlike the fixed position size per trade, a trader determines the amount he is prepared to risk and according to this knowledge, he calculates the optimal position size.

This is a sensible approach. Please note that in this case, the position size will change in each trade. The risk in the account currency will remain unchanged. Naturally, when calculating the position size, there will be an error due to which the risk per trade will rarely be exactly equal to the desired value. Nevertheless, this approach has a number of benefits that we’ll analyze now in detail.

Money management example 1. Three traders

Suppose we observe three traders who risk a predetermined amount in each trade and the risk is fixed in the account currency.

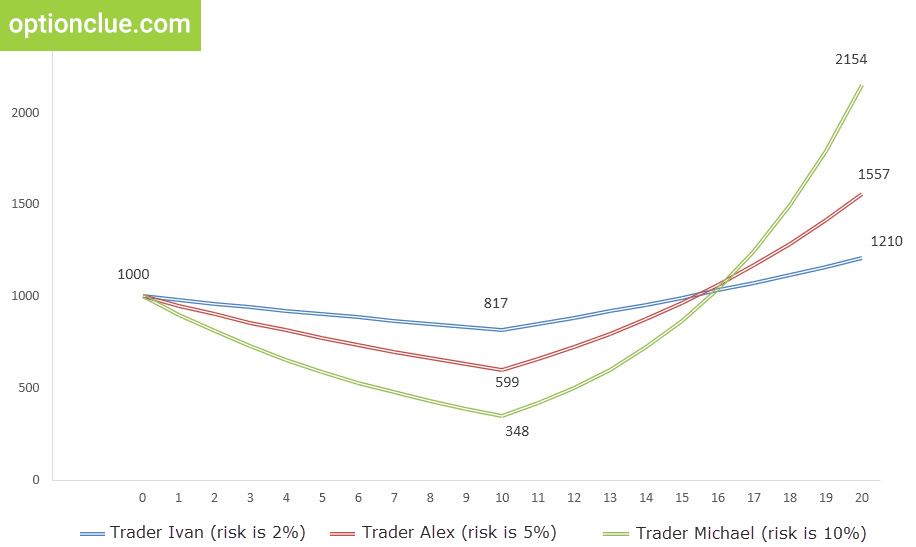

They start trading having capital equal to $1000, but are characterized by a different appetite for the risk. Trader Ivan is the most conservative as the risk per trade is $20 (blue chart in Figure 1), trader Alex risks $50 in each trade (red chart in Figure 1), trader Michael uses the most aggressive approach and risks $100 in each position (green chart in Figure 1).

One of the key reasons for using money and risk management rules in trading is to protect the capital from uncertain future and to minimize drawdowns in case of several unprofitable trades in a row. Let’s carry out stress testing of various money management options, assuming that as a result of trading, three traders get ten loss-making trades and then ten profitable trades. At the same time, all participants strictly follow risk management rules, that is the risk-reward ratio is 1:2 in each trade.

How will yield graphs of these traders look like?

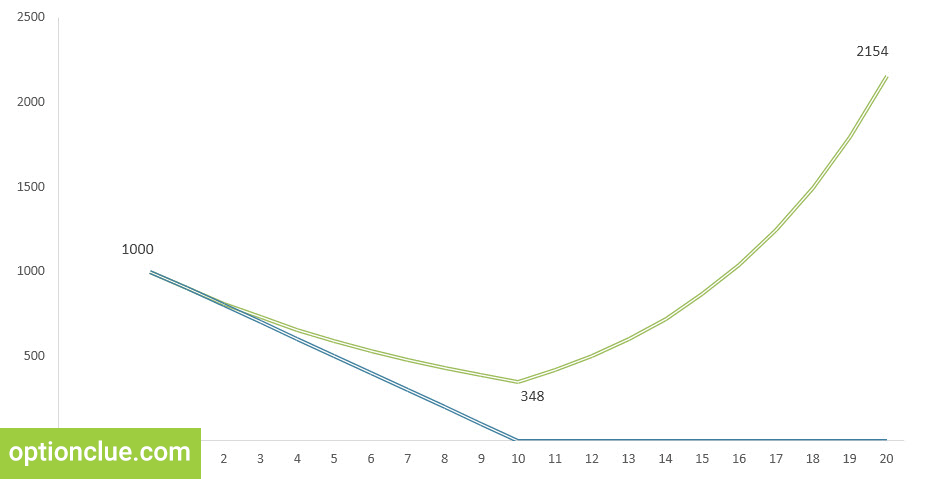

Fig. 1. Stress test. The risk per trade is fixed in the account currency. The vertical axis is capital. The horizontal axis is trades.

Trader Ivan risked $20 per trade and lost $200 after ten losing trades. Thanks to the use of risk management rules, the next ten trades allowed him to increase capital up to $1200. The trader restores the trading account and takes it to a new high.

Trader Alex loses half of the trading account after ten losing trades, but due to the use of risk management rules, he manages to «pull out» the trading account into a plus and gets 50% of profit in relation to the starting amount and about 200% of the profit in relation to the amount when there was the maximum drawdown of the account.

Trader Michael having got ten losing trades in a row and due to the aggressiveness of the trading style, simply leaves this experiment. He has lost money and in order to continue trading, he needs to add funds into the trading account.

The quote from «The New Market Wizards»

Almost every person I interviewed felt that money management was even more important than the trading method. Many potentially successful systems or trading approaches have led to disaster because the trader applying the strategy lacked a method of controlling risk.

Jack D. Schwager — author, fund manager

As you could see, while using a fixed risk per trade in the account currency, a trader can lose all the trading capital. If the risk per trade is significant and the trading account falls into a series of unprofitable trades, then the trading capital can be completely destroyed.

This is extremely annoying since it is not possible to lose all capital and «crash» a trading account using the correct principles of money-management.

Let’s discuss the third option for calculating the optimal position size when the loss of a trading account becomes an impossible task. This principle is widely used in professional trading and can considerably improve the results of any trading system.

Fixing risk as a percentage of capital

This is a simple and efficient way to determine the optimal position size. The risk per trade is fixed as a percentage of capital. In this case, the first thing a trader thinks about when planning a trade is what share of capital is worth risking.

How does this principle work and what are its pros and cons?

Initially, the risk is fixed as a percentage of the trading account, for example, 2% of capital (the principle of calculating the optimal position size is described in detail in the article «The formula for calculating the position size»). Afterwards, it is necessary to determine the stop-loss size in points and the point value for a standard contract. Based on this information, you can easily determine the optimal position size.

If your trading account has sufficient capitalization, the position size will always change. The lower the minimum possible position size and the larger the trading capital, the more accurate you can calculate the position size.

Why is this principle of money management more effective in comparison with the previously described options?

To answer this question we’ll modify the example we discussed earlier. Suppose that three traders take part in the experiment, seed capital of who is $1000. Traders make ten losing and ten profitable trades in a row.

Risk management rules are met, the risk-reward ratio in each trade is 1:2. In addition, unlike the previous example, traders use the principle of dynamic risk per trade, when the calculation begins not with a specific amount, but with a share of capital, which is worth risking.

Let the first trader (Ivan) risk 2% of capital in each trade. The second (Alex) trades more aggressively and risks in each trade 5% of the trading account. The third trader (Michael) risks 10% of the trading account.

Please note that when opening the first trade, the given values are combined with the risk levels that we considered in the previous example ($20, $50 and $100).

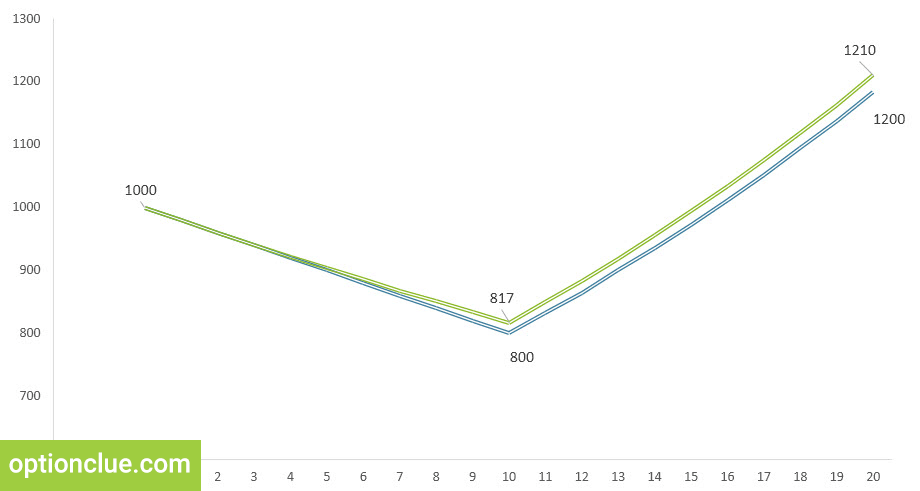

After ten losing trades in a row the first trader’s account is reduced to $817 against $800 with the fixed risk per trade in the account currency (Figure 3). The next ten trades increase the account up to $1210 (versus $1200 in the previous example).

Fig. 3. Comparison of money management methods. Green chart. The risk is determined as a share of capital (2%). Blue chart. The risk is fixed in the account currency ($20).

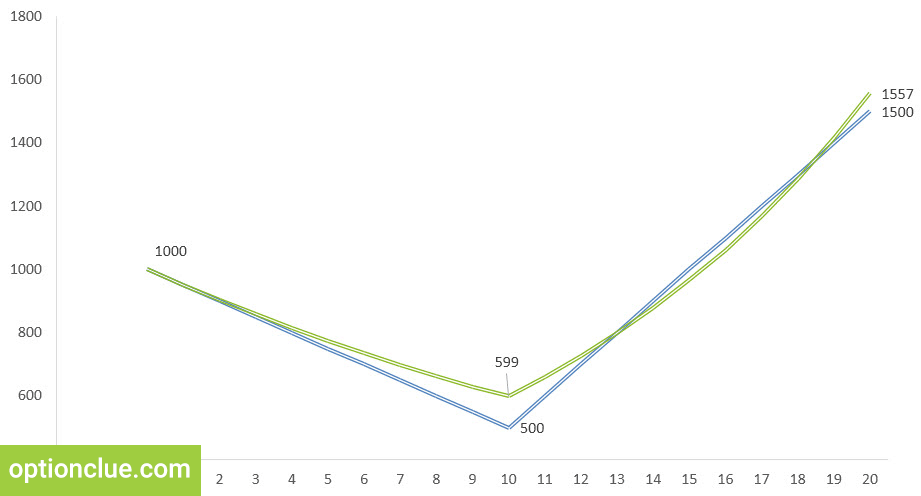

The second trader risks a more substantial amount and the first ten unprofitable trades reduce the capital to $599 (versus $500 when using the fixed risk per trade in the account currency).

The advantages that a trader gets using the money management rules become apparent.

A trader who risks 5% per trade, after making 10 losing trades in a row, loses 41% of the trading account (Figure 4). The difference in the drawdown of the account when using different methods is significant. This is 41% versus 50%.

Fig. 4. Comparison of money management methods. Green chart. The risk is determined as a share of capital (5%). Blue chart. The risk is fixed in the account currency ($50).

If you use dynamic risk per trade the yield curve is reduced smoothly since the loss in the account currency in each trade will get lower and lower.

Simultaneously the account grows rapidly in case of several successful trades in a row, that is trader Alex increases his capital to $1557 versus $1500 in the previous example.

The most interesting situation is observed on account No. 3 (Figure 5). Previously trader Michael risked a sum equal to $100 in each trade and quickly destroyed his capital. Then he had to either give up trading or add funds into the trading account.

If he had fixed the risk as a percentage of capital, he wouldn’t have made such choice. Moreover, his next step could be the withdrawal of profits from the trading account.

Fig. 5. Comparison of money management methods. Green chart. The risk is determined as a share of capital (10%). Blue chart. The risk is fixed in the account currency ($100).

The account of trader Michael after ten lose-making trades in a row with a risk of 10% of the capital per trade is reduced to $348. His capital is not crashed and the trader gets the opportunity to continue trading.

Having $348 on the account, trader Michael continues to use the money management rules and having made ten profitable trades in a row, he increases his account 7 times, up to $2154.

Please note, that losing money in case of using money and risk management rules becomes a challenge. If a trader uses the principle of dynamic risk per trade, his account becomes more resistant to drawdowns and grows rapidly when the market goes in the right direction during several trades in a row.

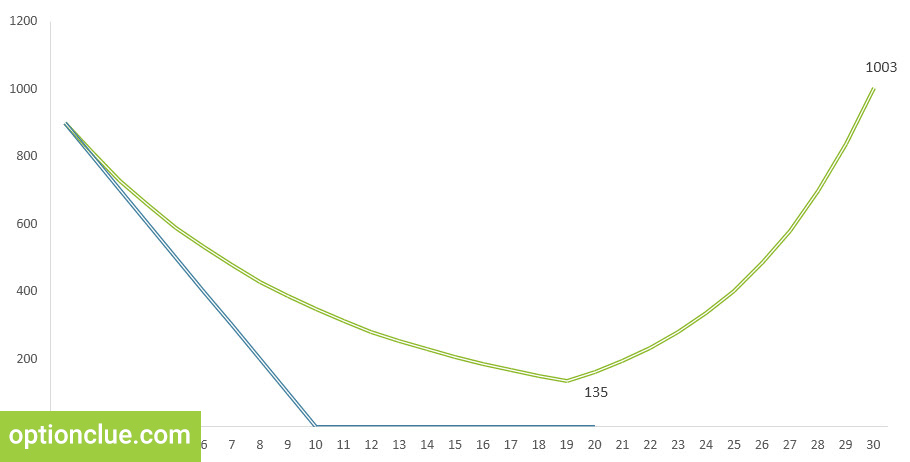

Money management example 2. Is it possible to lose money in the market?

If a trader risks a fixed share of capital in each trade, then he has the opportunity to trade even if the price goes in the unfavorable direction during several trades. Until there is money on the account, the trader remains in business and can correct this unfortunate situation.

Let’s analyze even more bright illustration of this idea.

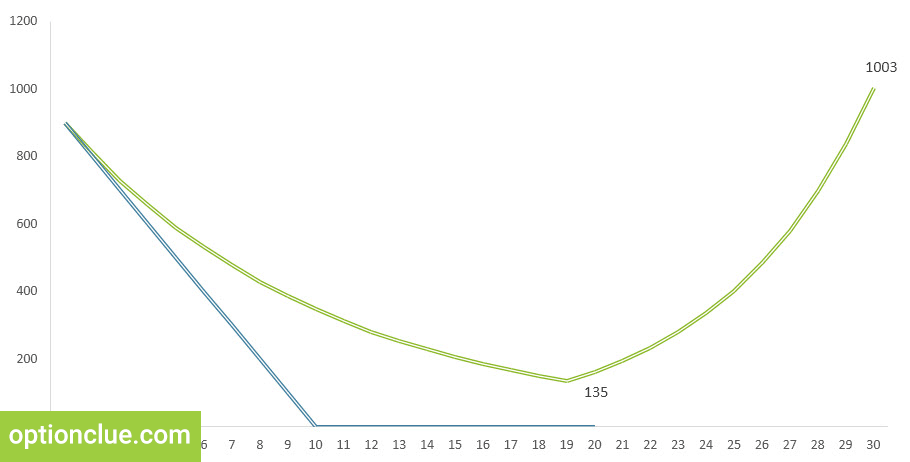

A trading results model of trader Michael who is familiar to us from the previous examples is presented in Fig. 6. Suppose that the streak of bad luck is delayed significantly and 19 losing trades appear in a row. With a risk per trade in the account currency (blue chart), the trader, risking $100 in each position, makes ten losing trades and destroys the trading account. Drawdown is equal to 100% of the starting capital.

Fig. 6. Stress test. 20 losing and 10 profitable trades. Green chart. The risk is determined as a share of capital (10%). Blue chart. The risk is fixed in the account currency ($100).

Suppose that in a parallel reality there is another trader Michael, who, unlike his doppelganger, knows the importance of using money management rules in trading and calculates the risk per trade as a percentage of capital, that is 10% per trade (green chart).

Having made 10 losing trades in a row, the trader has the capital for further trading. The market moves against him again and as a result, 19 unprofitable trades are made on the account in total. The risk in each trade is 10% of capital but the trader still remains in business as he has funds in his account (about 13% of the starting amount) and he can trade.

The drawdown on the account is approximately 87%. Nevertheless, if a trader subsequently closes ten profitable trades in a row and uses risk management rules (risk-reward ratio is 1:2), then he increases his capital about 7 times.

Using the principle of dynamic risk per trade, a trader has the opportunity to trade after unthinkably unsuccessful periods whereas using a fixed risk per trade in the currency account, a trader would lose his capital almost 2 (!) times in a row.

Conclusions on how not to lose money in the market

If you begin to think in terms of percentage of capital when calculating the position size and determining the profit potential, then you get the opportunity not to crash your trading account at the time when other traders do it. This is a powerful competitive advantage and one of the facets of the «Grail» which lays in the use of money and risk management rules.

The question of losing money in the market is a matter of choice. If you want to increase the stability of the trading account, smooth the drawdowns and get a powerful competitive advantage, then I strongly recommend to use money management rules and to calculate the risk per trade as a percentage of capital.

Good luck in trading!