Short-term trading. Entry points on smaller timeframes

Sometimes there are situations where, despite the signal existence, there is no possibility to enter the market because the minimum required risk-reward ratio is not met. The risk is too high or the potential profit is too small.

Often in such situations you can still get an excellent risk-reward ratio and enter the market, but to do this you have to switch to a smaller timeframe. For example, if you mostly trade on the Daily timeframe then the market entry will be determined on the H1 timeframe.

In this article we’ll take this approach as an example.

Contents

- GBPJPY, D1. Breakout trading opportunity

- GBPJPY, D1. Pullback trading opportunity

- Forex. GBPJPY. Point of market entry on smaller timeframes

- Conclusions on short-term trading system

GBPJPY, D1. Breakout trading opportunity

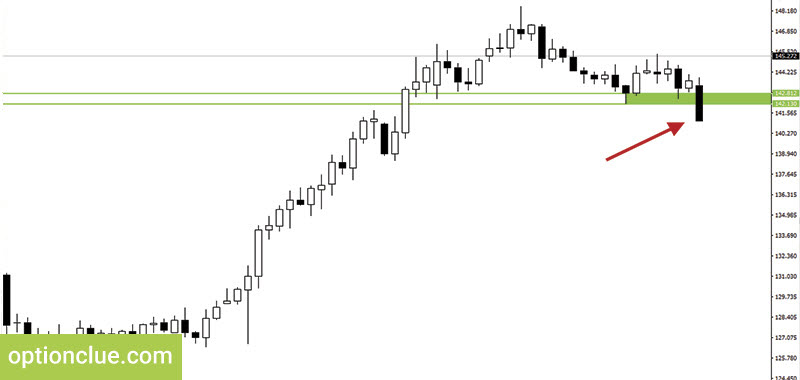

We will analyze the currency chart for GBPJPY since January, the Daily timeframe. Two bear and two bull candles form the support level on the chart with borders of 142.13 and 142.81.

After that the price is at one point for a while, then on the 9th of January the support level has been broken. A bear trend has emerged in the market and a sell breakout signal has been formed (Figure 1).

It is impossible to open the breakout position immediately. First of all, you should estimate the potential risks. When opening a sell position a reliable stop loss is placed around the nearest resistance level. The upper border is 145.36, the lower border is 144.40.

In this example the size of stop loss will be about 450 points (Figure 2). To be able to open this position, the size of the potential profit should be at least 900 points. In this situation this is a too ambitious target even for such active currency pair as GBPJPY. In other words, we cannot open a position based on the Daily timeframe.

GBPJPY, D1. Pullback trading opportunity

What should we do in this situation? The first option is to wait for the correction and search for a pullback trading signal on the Daily timeframe.

The second option is to switch to a smaller timeframe and wait for a market entry point on this timeframe. For this purpose it is necessary to plot horizontal levels of the smaller timeframe on the chart. It should be noted that for the analysis it is important to know where the nearest support and resistance are. They allow you to determine the market entry and exit points.

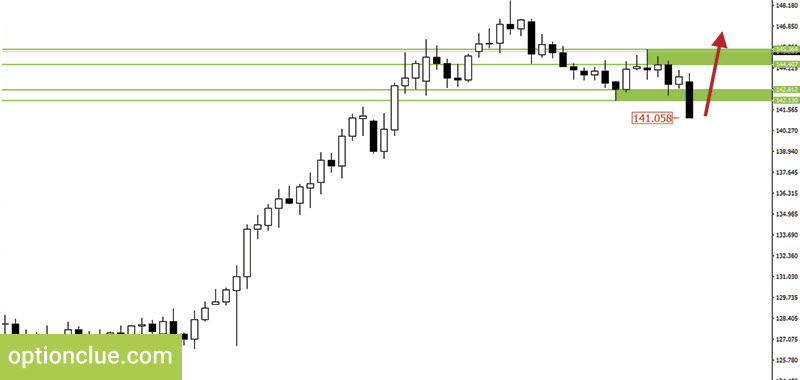

Let’s come back to our example. The resistance level has been formed a few days before the support level breakout. The lower border is 144.40, the upper border is 145.36.

After that the market rapidly moves down and a deep correction starts the length of which is roughly equal to the length of the impulse.

The price comes to the opposite level. Here, if we wait for a bear candle formation, a so-called deep pullback will take place (Figure 3).

Any pullback signal can be called a deep pullback if it occurs at the opposite level. Such signals generate the maximum reward-risk ratio. It is often possible to open a position with a small stop loss and significant profit potential.

Forex. GBPJPY. Point of market entry on smaller timeframes

The second way to find the market entry point in such situation is a market entry on a smaller timeframe.

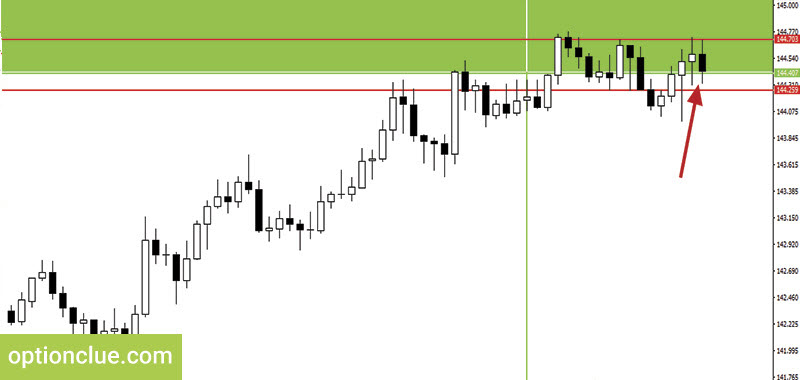

On January the 27th the market touches the opposite level (Figure 4). As soon as the touch occurs, we can switch to a smaller timeframe to search for a market entry point. We trade a trend and should search for bearish signals.

The touch of the level occurs on the 27th. Then we switch to the smaller timeframe and see that the price has approached the resistance level and started to bounce off it.

The support level is formed further on the H1 timeframe. The level has appeared after the bull candle closing at 9 o’clock in the morning. The lower border of this level is 144.25.

The level breakout occurs a few hours later. This indicates that the trend on the H1 timeframe has changed and now we can see a bear trend. And a sell signal has appeared (Figure 5).

Let me remind you that we can also see a bear trend on the Daily timeframe. When, before the signal formation on the Daily timeframe, a trend on smaller timeframe reverses and the market movement direction both on the H1 and the Daily timeframe coincides, this means that a very attractive signal can appear.

This is exactly what’s happened. After the candle closing, we can determine the potential risk in points and calculate the size of stop loss. When trading on the H1 timeframe, stop loss is placed according to the level that is formed on the H1 timeframe. In this example, this level has appeared 6 hours ago and stop loss is approximately 65 points (Figure 6). I recommend to place stop loss with a small gap to the upper border of the resistance level (the price is 144.70).

At the same time, when the market entry point occurs at the point of the potential reversal of the Daily trend the take profit order can be set in accordance with a larger timeframe. In our example it’s the Daily timeframe.

These are ambitious targets which the market does not always reach. Therefore, we can fix a part of profit around the levels plotted on the current timeframe or hold the position orienting at more distant targets.

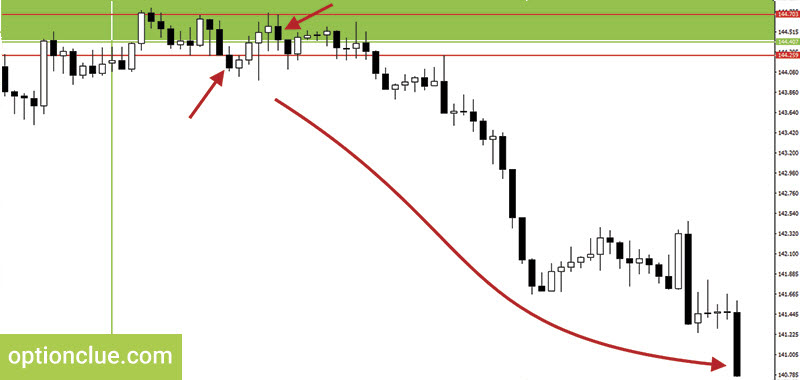

As a result, the risk-reward ratio is one to two on the Daily timeframe and versus one to four on the H1 timeframe.

A deep correction is formed in the market and a pullback signal has appeared (Figure 7).

Actually, both the breakout and pullback entry points were possible to enter the market. Both signals were carried out. The market was at one point for a while, then it dropped down (Figure 8).

Conclusions on short-term trading system

Let’s summarize. In the points of potential market reversal on large timeframes you can search for entry signals on smaller ones. For instance, you can analyze the levels on the Daily timeframe but search for entry points in the direction of the main trend on the H1 timeframe. Targets can be determined both on the Daily and on the H1 timeframe. This approach allows you to obtain the best possible risk-reward ratio. But in this case, it requires more attention and time for market analysis.

Traders often make the process of plotting horizontal support and resistance levels much more difficult than it needs to be. Some of them tend to complicate this task by plotting unnecessary levels confusing them in determining further price movements in directed trading. After getting the Levels indicator you won’t have any difficulty in this due to the simplicity of its use. It can help not only identify price zones where the market movement can slow down or price reversal is likely to occur but also find entry signals that appear during a deep market correction or calculate stop-loss and take-profit.